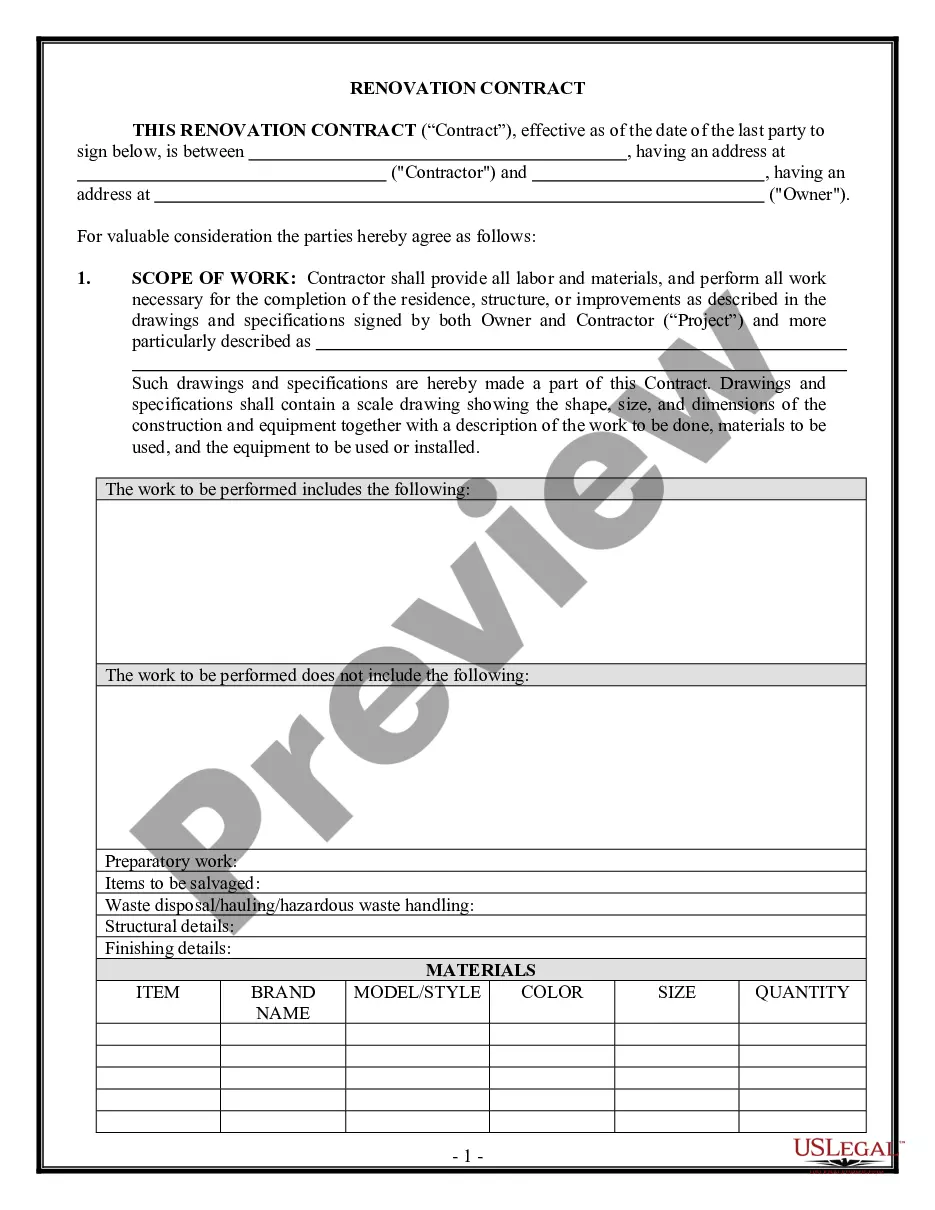

This special or limited power of attorney is for your agent to handle bank account matters for you, including, making deposits, writing checks, opening accounts, etc. A limited power of attorney allows the principal to give only specific powers to the agent. The limited power of attorney is used to allow the agent to handle specific matters when the principal is unavailable or unable to do so.

Concord California Special Durable Power of Attorney for Bank Account Matters is a legal document that grants a trusted individual or agent the authority to act on behalf of the principal (the person granting the power of attorney) specifically for bank account-related matters. It is crucial to understand the specifics of this type of power of attorney to ensure appropriate handling of financial affairs. The Special Durable Power of Attorney for Bank Account Matters in Concord, California, enables the agent to make decisions and take actions concerning the principal's bank accounts. This could include managing deposits, withdrawals, transfers, online banking activities, and other financial transactions related to the represented individual's bank accounts. It grants the agent the power to handle all account-related matters, including checking, savings, money market, certificate of deposit (CD), and other types of accounts held by the principal. There might be variations or additional designations specific to Concord, California, when it comes to Special Durable Power of Attorney for Bank Account Matters. Some possible types include: 1. Limited Special Durable Power of Attorney for Bank Account Matters: This type of power of attorney provides a limited scope of authority to the agent. It restricts the agent's powers to specific bank account matters or a particular bank or financial institution. 2. General Special Durable Power of Attorney for Bank Account Matters: Unlike a limited power of attorney, a general power of attorney grants the agent broader authority to manage all the principal's bank accounts across multiple banks or financial institutions. 3. Springing Special Durable Power of Attorney for Bank Account Matters: This type of power of attorney becomes effective only upon the occurrence of a specific event or condition, which could be the incapacity or disability of the principal. Once the triggering event occurs, the agent can assume control over the principal's bank accounts. It is essential to consult with a qualified attorney experienced in estate planning or power of attorney matters to understand the specific requirements, limitations, and legalities of a Concord California Special Durable Power of Attorney for Bank Account Matters.Concord California Special Durable Power of Attorney for Bank Account Matters is a legal document that grants a trusted individual or agent the authority to act on behalf of the principal (the person granting the power of attorney) specifically for bank account-related matters. It is crucial to understand the specifics of this type of power of attorney to ensure appropriate handling of financial affairs. The Special Durable Power of Attorney for Bank Account Matters in Concord, California, enables the agent to make decisions and take actions concerning the principal's bank accounts. This could include managing deposits, withdrawals, transfers, online banking activities, and other financial transactions related to the represented individual's bank accounts. It grants the agent the power to handle all account-related matters, including checking, savings, money market, certificate of deposit (CD), and other types of accounts held by the principal. There might be variations or additional designations specific to Concord, California, when it comes to Special Durable Power of Attorney for Bank Account Matters. Some possible types include: 1. Limited Special Durable Power of Attorney for Bank Account Matters: This type of power of attorney provides a limited scope of authority to the agent. It restricts the agent's powers to specific bank account matters or a particular bank or financial institution. 2. General Special Durable Power of Attorney for Bank Account Matters: Unlike a limited power of attorney, a general power of attorney grants the agent broader authority to manage all the principal's bank accounts across multiple banks or financial institutions. 3. Springing Special Durable Power of Attorney for Bank Account Matters: This type of power of attorney becomes effective only upon the occurrence of a specific event or condition, which could be the incapacity or disability of the principal. Once the triggering event occurs, the agent can assume control over the principal's bank accounts. It is essential to consult with a qualified attorney experienced in estate planning or power of attorney matters to understand the specific requirements, limitations, and legalities of a Concord California Special Durable Power of Attorney for Bank Account Matters.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.