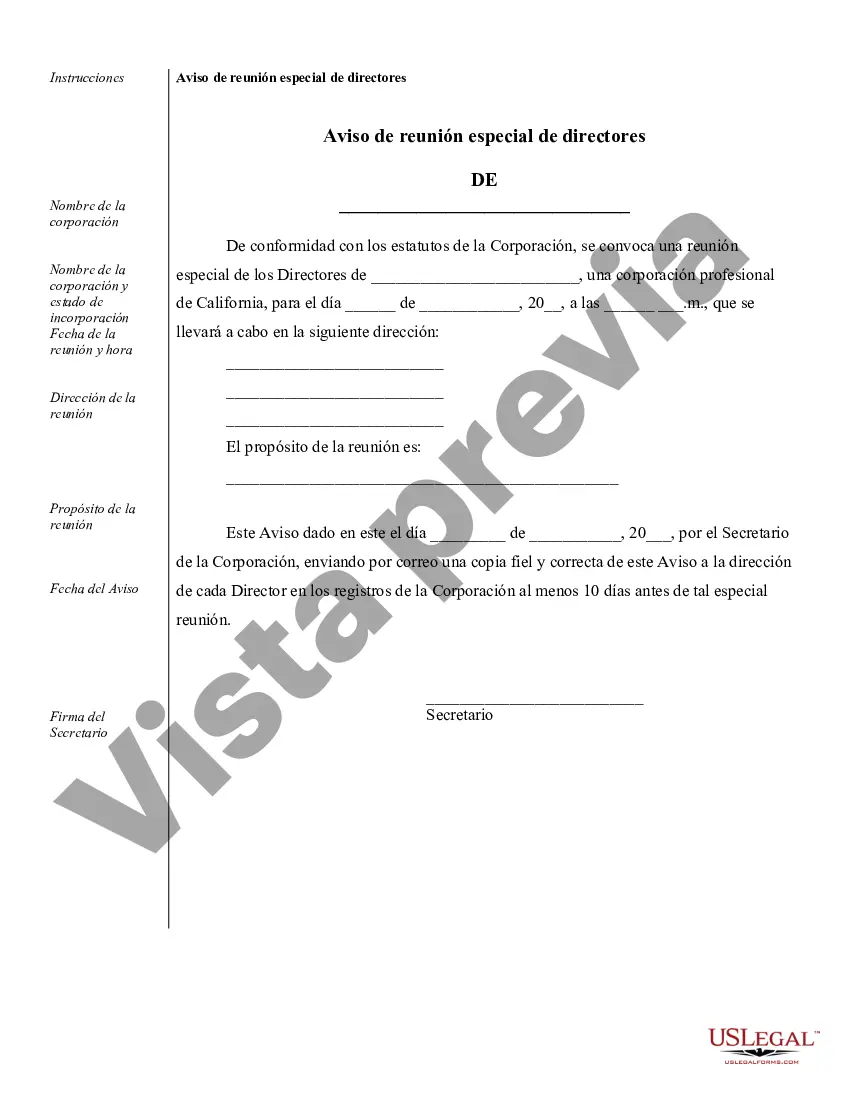

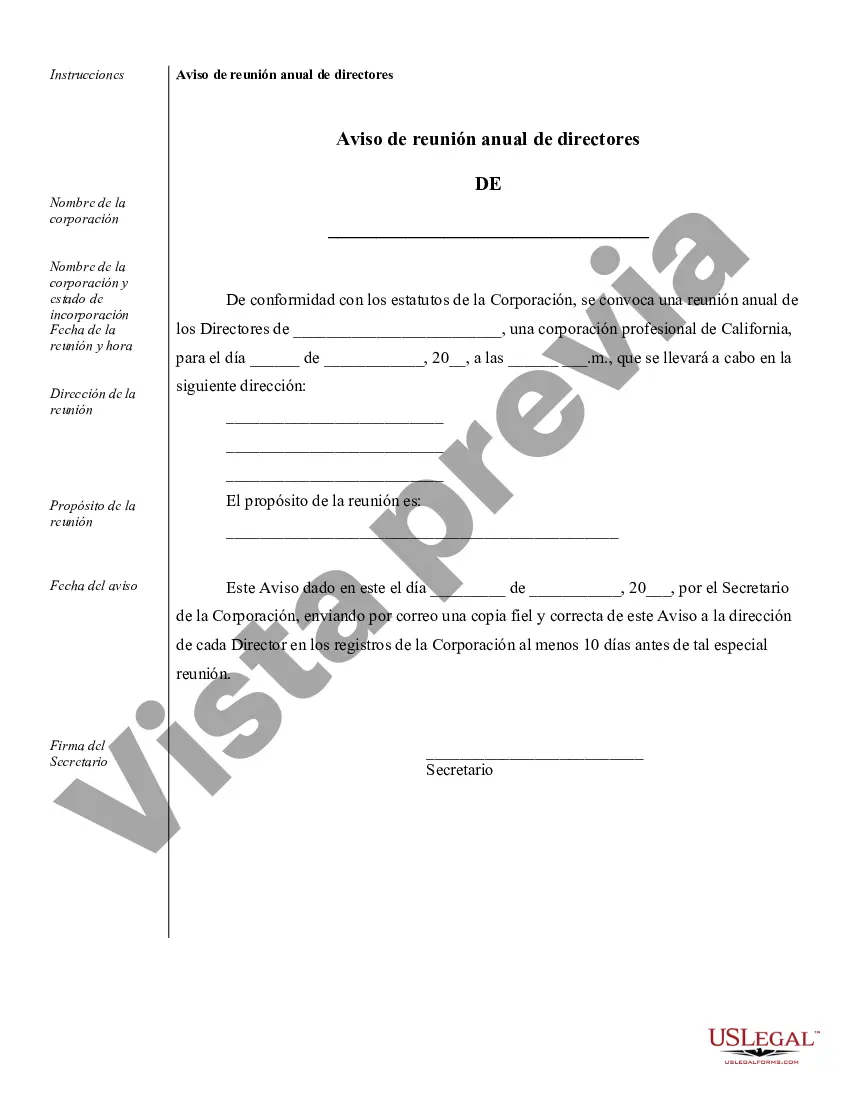

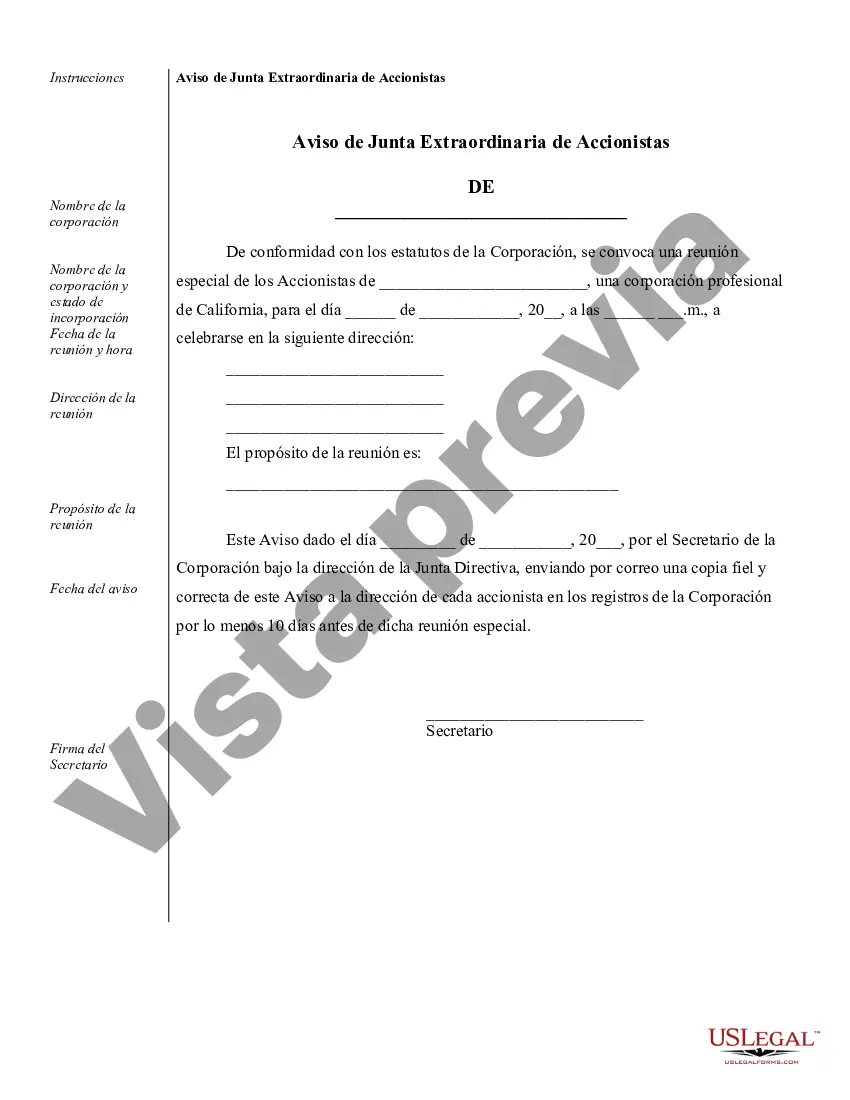

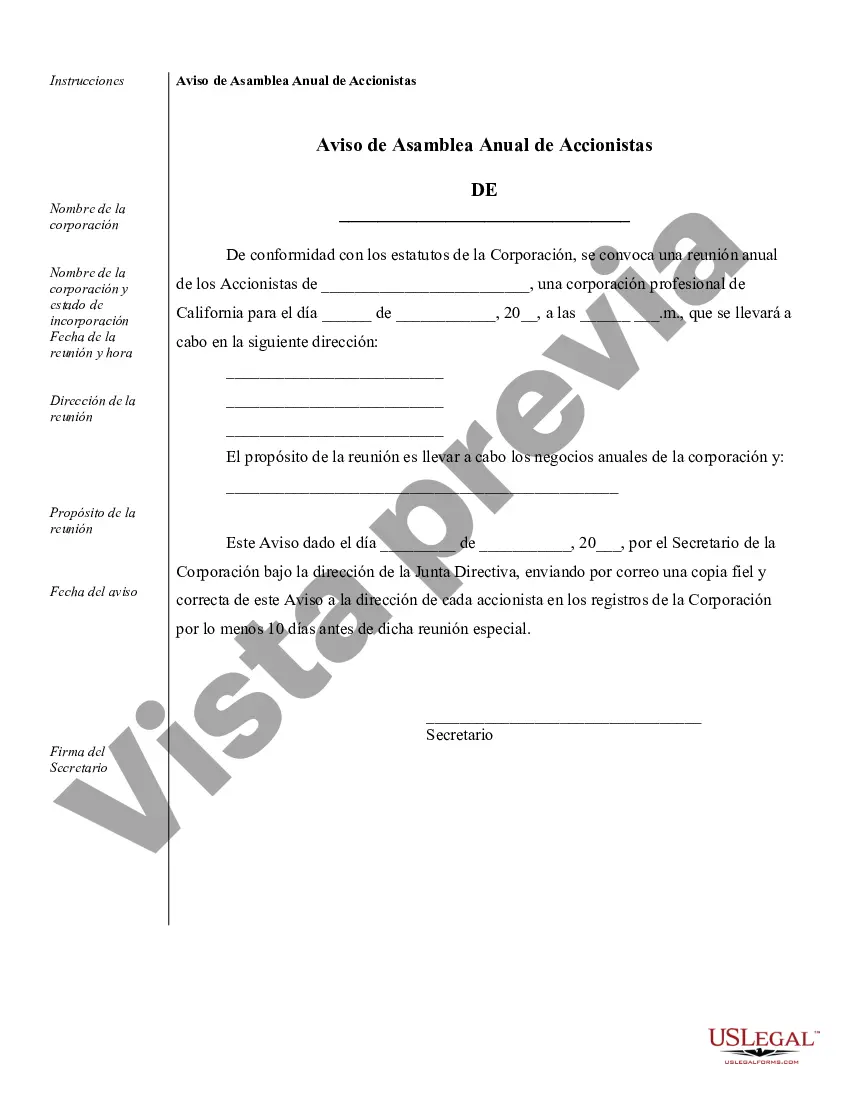

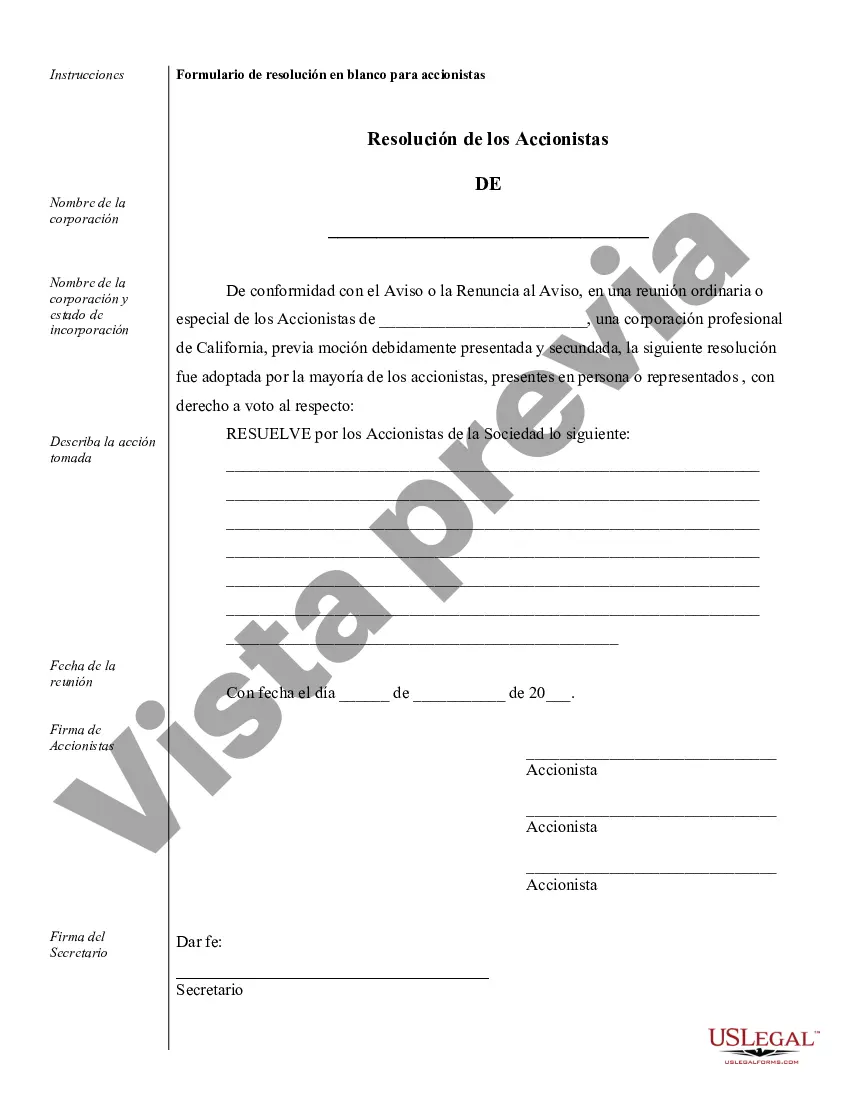

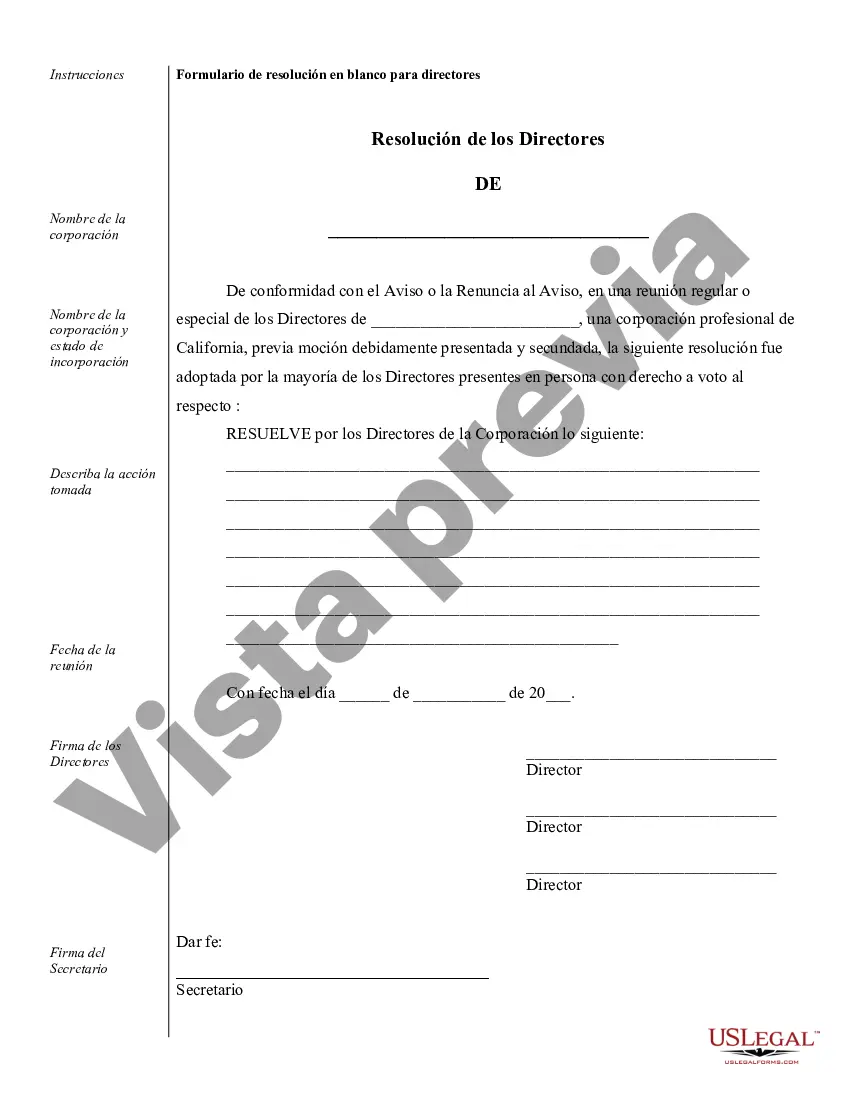

Elk Grove Sample Corporate Records for a California Professional Corporation are essential documents that outline the various administrative, legal, and financial activities of a professional corporation based in Elk Grove, California. These records function as a historical and legal reference for the corporation and assist in ensuring compliance with state laws and regulations. Some crucial Elk Grove Sample Corporate Records for a California Professional Corporation may include: 1. Articles of Incorporation: A foundational document that officially establishes the corporation, including its name, purpose, registered agent, and initial directors. 2. Bylaws: A set of rules and regulations that govern the internal operations of the corporation, including procedures for director and shareholder meetings, appointment of officers, voting rights, and other corporate governance matters. 3. Shareholder Agreements: An agreement among the shareholders of the corporation that outlines their rights, obligations, and restrictions related to stock ownership and transfer, dividend distribution, and decision-making processes. 4. Meeting Minutes: A comprehensive record of all meetings conducted by the board of directors and shareholders, recording the topics discussed, decisions made, and actions taken. These minutes provide evidence of compliance and corporate decision-making processes. 5. Stock Certificates: Documentation that verifies ownership of shares in the corporation, including details such as shareholder name, stock class, and number of shares held. 6. Financial Statements: Documents that present the corporation's financial position, including its income, expenses, assets, and liabilities. These statements, including balance sheets, income statements, and cash flow statements, provide an overview of the corporation's financial health. 7. Annual Reports: An annual filing required by the California Secretary of State that provides an update on the corporation's basic information, such as its business address, officers, and directors. 8. Tax Filings: Various tax-related documents, including federal and state tax returns, payroll tax filings, and other relevant forms that report the corporation's financial activities and tax obligations. 9. Contracts and Agreements: Copies of any legal contracts or agreements entered into by the corporation, such as client agreements, vendor contracts, or lease agreements. 10. Licenses and permits: Documentation demonstrating that the corporation holds the necessary licenses and permits required to conduct its professional activities legally. These Elk Grove Sample Corporate Records for a California Professional Corporation ensure transparency, accountability, and legal compliance while providing an organized record of the corporation's activities. Retaining these records is vital not only for ongoing operations but also for potential audits, litigation, or future transactions involving the corporation.

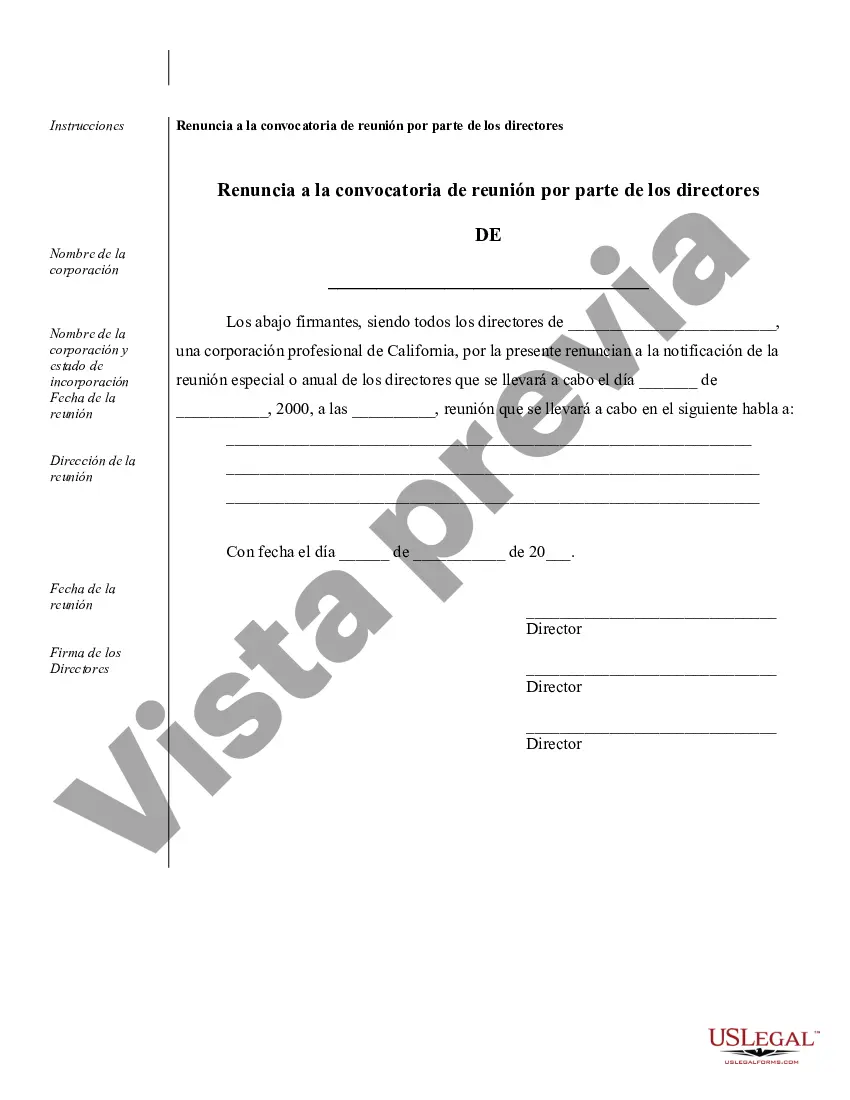

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Elk Grove Ejemplos de registros corporativos para una corporación profesional de California - Sample Corporate Records for a California Professional Corporation

Description

How to fill out Elk Grove Ejemplos De Registros Corporativos Para Una Corporación Profesional De California?

Make use of the US Legal Forms and have instant access to any form you need. Our useful platform with a huge number of document templates allows you to find and obtain virtually any document sample you want. You are able to download, fill, and sign the Elk Grove Sample Corporate Records for a California Professional Corporation in a couple of minutes instead of surfing the Net for hours trying to find the right template.

Utilizing our catalog is a wonderful way to increase the safety of your document filing. Our professional lawyers on a regular basis review all the records to ensure that the forms are appropriate for a particular state and compliant with new laws and polices.

How can you get the Elk Grove Sample Corporate Records for a California Professional Corporation? If you have a profile, just log in to the account. The Download button will appear on all the documents you look at. In addition, you can get all the previously saved documents in the My Forms menu.

If you haven’t registered an account yet, follow the tips below:

- Open the page with the template you need. Ensure that it is the template you were hoping to find: examine its headline and description, and take take advantage of the Preview function when it is available. Otherwise, use the Search field to look for the needed one.

- Launch the saving procedure. Click Buy Now and select the pricing plan you prefer. Then, sign up for an account and process your order utilizing a credit card or PayPal.

- Save the file. Pick the format to obtain the Elk Grove Sample Corporate Records for a California Professional Corporation and revise and fill, or sign it according to your requirements.

US Legal Forms is probably the most extensive and trustworthy form libraries on the internet. We are always happy to assist you in virtually any legal procedure, even if it is just downloading the Elk Grove Sample Corporate Records for a California Professional Corporation.

Feel free to benefit from our platform and make your document experience as straightforward as possible!