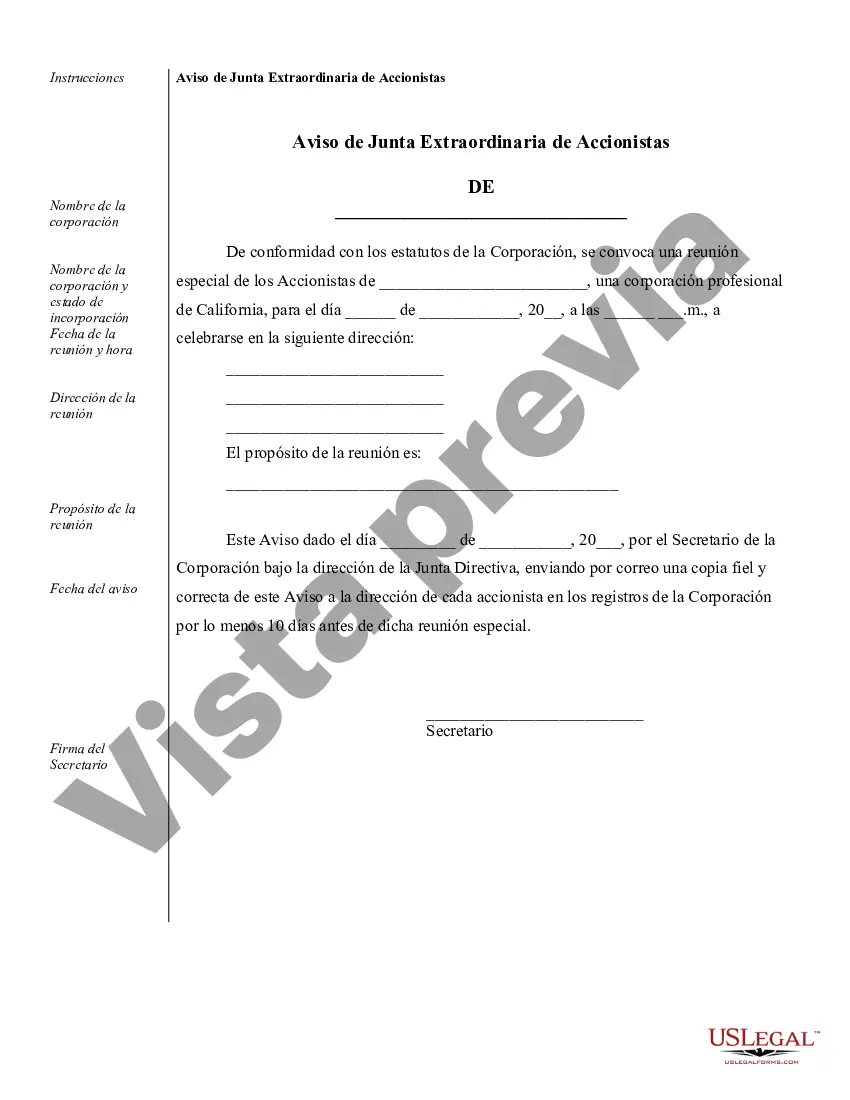

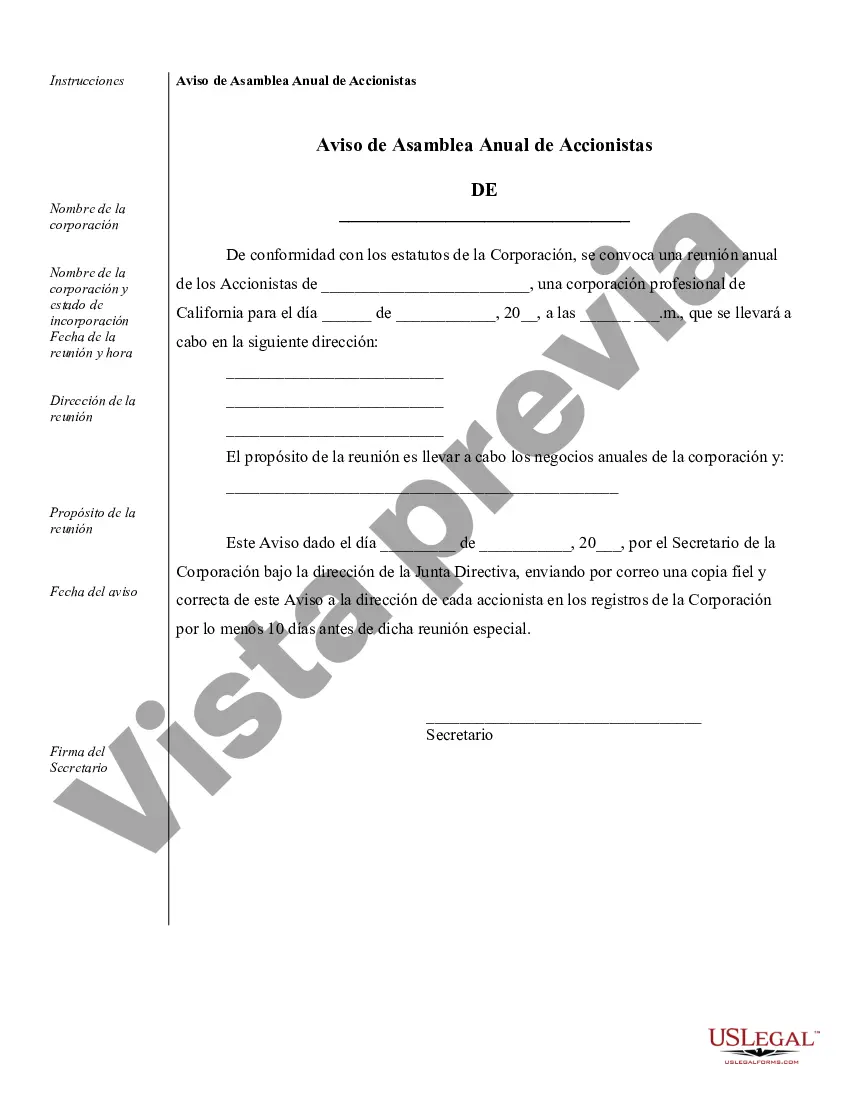

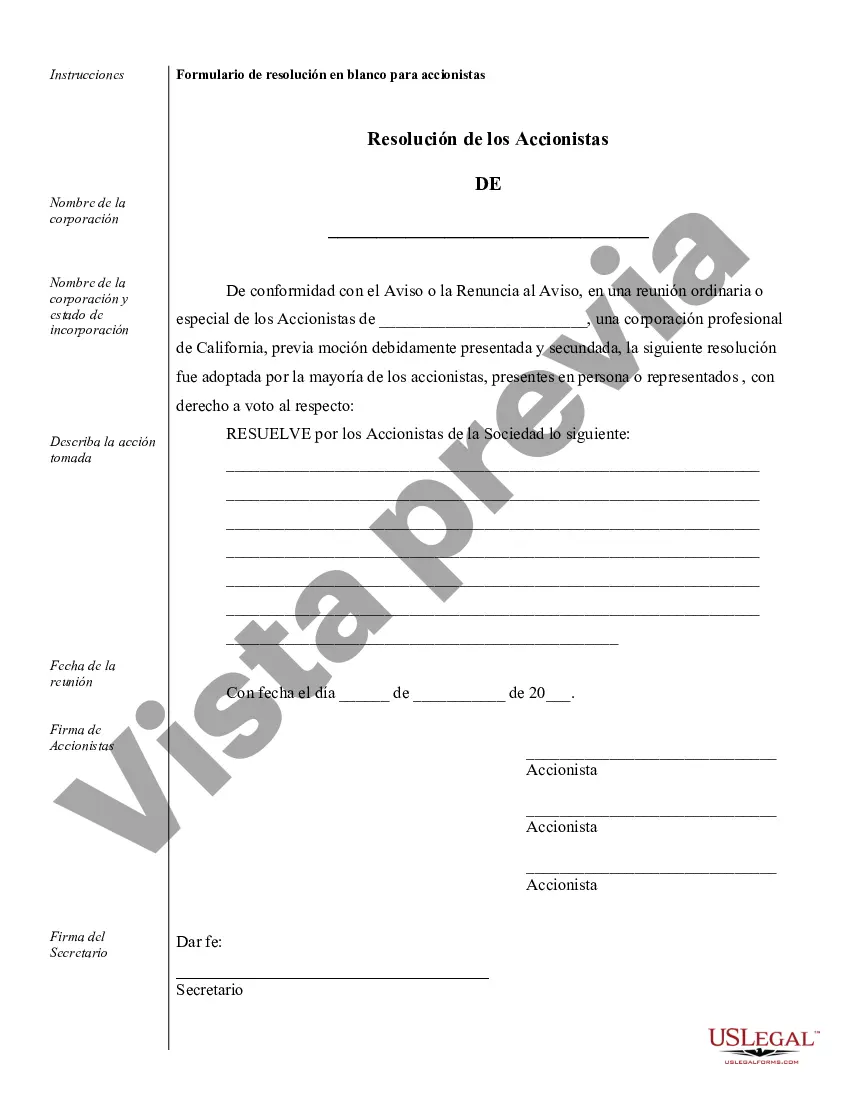

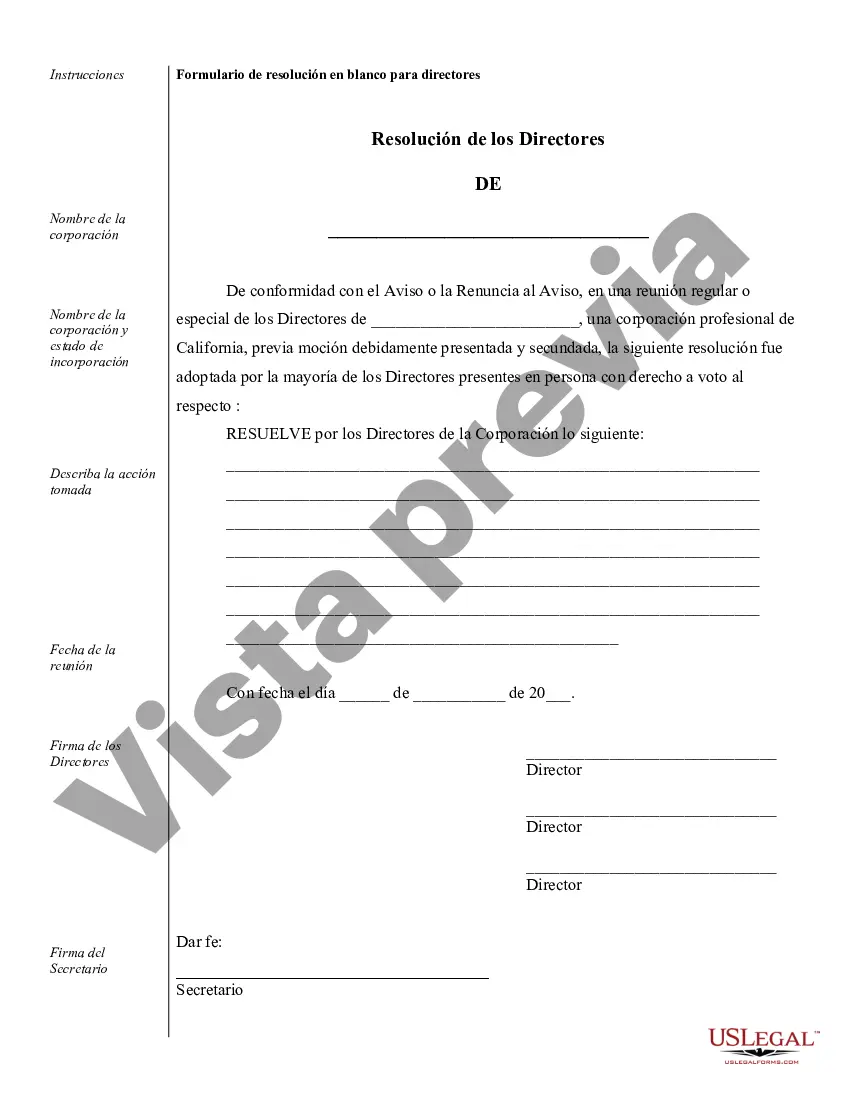

Escondido Sample Corporate Records for a California Professional Corporation are essential documents that serve as evidence and provide a comprehensive record of the organization's activities, decisions, and responsibilities. These records help maintain the legality and transparency of professional corporations operating in Escondido, California. By keeping well-organized corporate records, businesses can demonstrate compliance with state regulations and ensure proper corporate governance practices. Here are some key types of Escondido Sample Corporate Records specific to California Professional Corporations: 1. Articles of Incorporation: This vital document establishes the existence and structure of the professional corporation. It includes information such as the corporation's name, purpose, stock structure, and the names of initial directors and officers. 2. Bylaws: These are the guidelines and rules governing how the corporation will operate. Bylaws typically include information about shareholder meetings, director responsibilities, voting procedures, and other corporate formalities. 3. Shareholder Agreements: In cases where there are multiple shareholders, a shareholder agreement outlines the rights, responsibilities, and obligations of each shareholder within the organization. This agreement may cover topics such as share transfers, dispute resolution mechanisms, and restrictions on shareholder actions. 4. Meeting Minutes: Detailed minutes of meetings held by the board of directors and shareholders capture the discussions, decisions, and resolutions taken during these meetings. These minutes should accurately reflect the deliberations and actions to ensure legal compliance. 5. Stock Certificates: Stock certificates are issued to shareholders as evidence of ownership in the professional corporation. These certificates should include relevant information, such as the shareholder's name, certificate number, number of shares owned, and class of shares. 6. Financial Statements: Accurate financial records, including balance sheets, income statements, and cash flow statements, help track the financial health of the professional corporation. This information is vital for tax compliance, securing loans, attracting investors, and making informed business decisions. 7. Annual Reports and Statements of Information: California Professional Corporations are required to file annual reports with the Secretary of State. These reports provide updates on the corporation's activities, including identifying information about directors, officers, and shareholders. 8. Employee Records: Records related to employee contracts, payroll, benefits, and personnel policies are essential for maintaining a professional and compliant work environment. These records also help ensure compliance with employment laws and regulations. 9. Licenses and Permits: Professional corporations may require specific licenses or permits operating legally in Escondido. Keeping records of these licenses and permits, as well as any renewals, helps demonstrate legal compliance. It is crucial for a California Professional Corporation in Escondido to maintain well-organized sample corporate records. These records can be used as references to ensure compliance with local laws, facilitate audits, attract potential investors, and enhance overall corporate transparency.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Escondido Ejemplos de registros corporativos para una corporación profesional de California - Sample Corporate Records for a California Professional Corporation

Description

How to fill out Escondido Ejemplos De Registros Corporativos Para Una Corporación Profesional De California?

Are you looking for a reliable and affordable legal forms provider to buy the Escondido Sample Corporate Records for a California Professional Corporation? US Legal Forms is your go-to option.

No matter if you need a simple agreement to set regulations for cohabitating with your partner or a package of documents to advance your divorce through the court, we got you covered. Our website offers over 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t universal and framed based on the requirements of separate state and area.

To download the document, you need to log in account, find the required form, and hit the Download button next to it. Please keep in mind that you can download your previously purchased document templates anytime from the My Forms tab.

Are you new to our platform? No worries. You can create an account with swift ease, but before that, make sure to do the following:

- Find out if the Escondido Sample Corporate Records for a California Professional Corporation conforms to the regulations of your state and local area.

- Go through the form’s details (if provided) to find out who and what the document is good for.

- Restart the search in case the form isn’t suitable for your specific scenario.

Now you can create your account. Then pick the subscription option and proceed to payment. Once the payment is completed, download the Escondido Sample Corporate Records for a California Professional Corporation in any provided file format. You can get back to the website when you need and redownload the document free of charge.

Finding up-to-date legal documents has never been easier. Give US Legal Forms a try today, and forget about spending hours researching legal paperwork online once and for all.