Fontana Sample Corporate Records for a California Professional Corporation play a crucial role in documenting the important information and activities of a company. These records offer a comprehensive snapshot of the business and serve as an essential reference for compliance and legal purposes. Here are some key points that describe the purpose and types of Fontana Sample Corporate Records for a California Professional Corporation: 1. Articles of Incorporation: Fontana Sample Corporate Records include the filed Articles of Incorporation, which outline the key details of the corporation. This document includes important information such as the company's name, purpose, registered agent, share structure, and initial directors. 2. Bylaws: The Fontana Sample Corporate Records for a California Professional Corporation also include a copy of the company's Bylaws. The Bylaws establish the internal rules and regulations that govern the operation of the corporation, including procedures for meetings, voting, and the duties of directors and officers. 3. Shareholder Agreements: For corporations with multiple shareholders, the Fontana Sample Corporate Records might also include any shareholder agreements or stockholders' agreements that define the rights and obligations of each shareholder. These agreements can cover topics such as voting rights, stock transfer restrictions, and buyout provisions. 4. Meeting Minutes: Fontana Sample Corporate Records should consist of detailed meeting minutes, documenting the discussions, decisions, and actions taken during board of director meetings and shareholder meetings. These minutes showcase corporate governance and can serve as evidence of official decision-making processes. 5. Stock Ledger: The Fontana Sample Corporate Records typically include a stock ledger, which tracks the company's issued and outstanding shares. This ledger includes information about shareholders, the number of shares they own, share certificates issued, and any changes in ownership due to transfers or issuance. 6. Financial Statements: Fontana Sample Corporate Records might also incorporate financial statements, including annual balance sheets, income statements, and cash flow statements, which provide a summary of the company's financial performance and position over a certain period. 7. Tax Filings: As part of the Fontana Sample Corporate Records, the corporation should maintain records of all tax filings, including federal and state tax returns, payroll tax filings, and other related documents, ensuring compliance with tax obligations. 8. Contracts and Agreements: The Fontana Sample Corporate Records may also encompass copies of significant contracts and agreements entered into by the corporation, such as leases, financing agreements, client contracts, and vendor agreements. 9. Licenses and Permits: Depending on the nature of the corporation's business, the Fontana Sample Corporate Records might include licenses and permits obtained from regulatory bodies at the state or local level, demonstrating compliance with applicable laws and regulations. It is essential for a California Professional Corporation to maintain accurate and up-to-date Fontana Sample Corporate Records to satisfy legal requirements, facilitate smooth operations, and provide transparency to stakeholders. Properly organized and maintained corporate records not only ensure compliance but also protect the corporation's best interests in the long run.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Fontana Ejemplos de registros corporativos para una corporación profesional de California - Sample Corporate Records for a California Professional Corporation

State:

California

City:

Fontana

Control #:

CA-PC-CR

Format:

Word

Instant download

Description

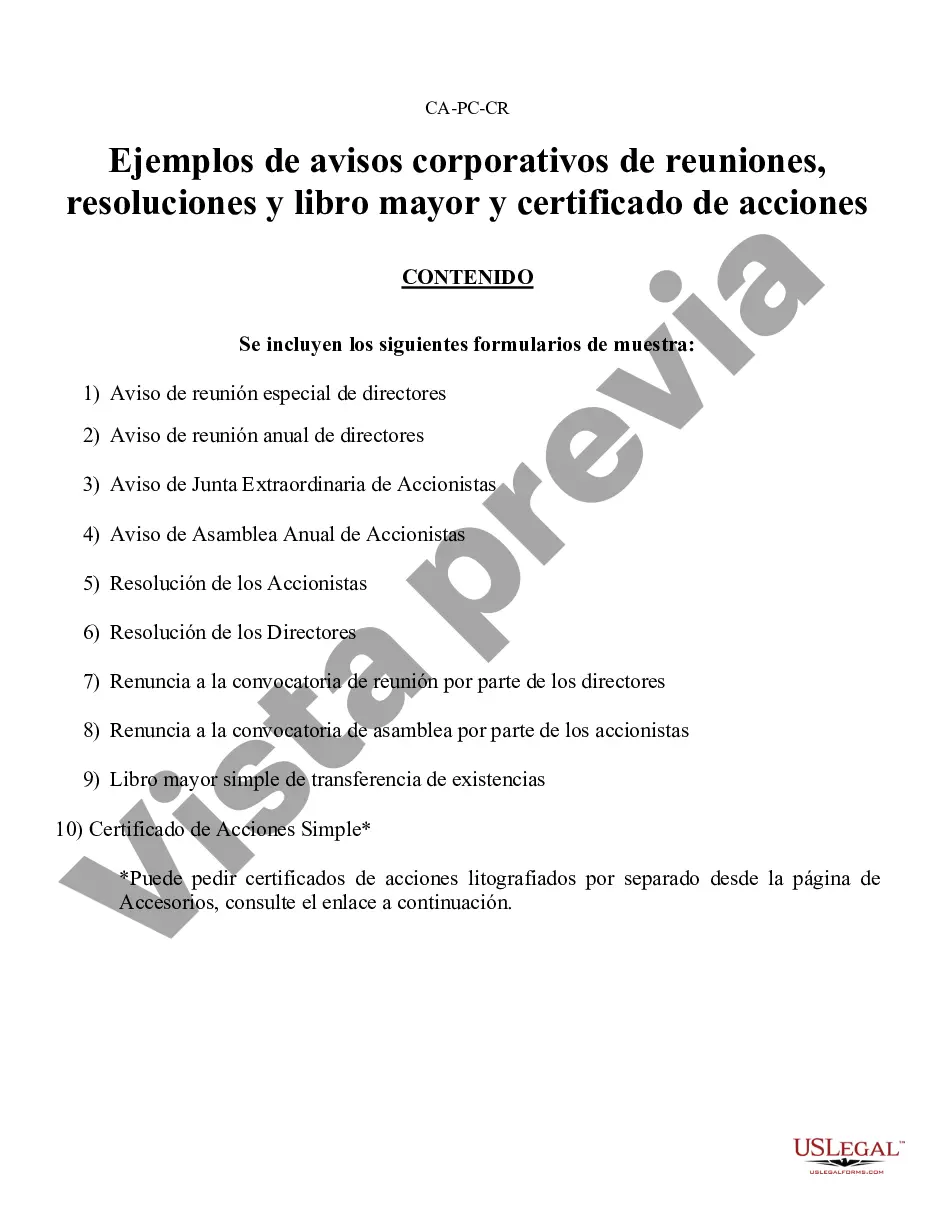

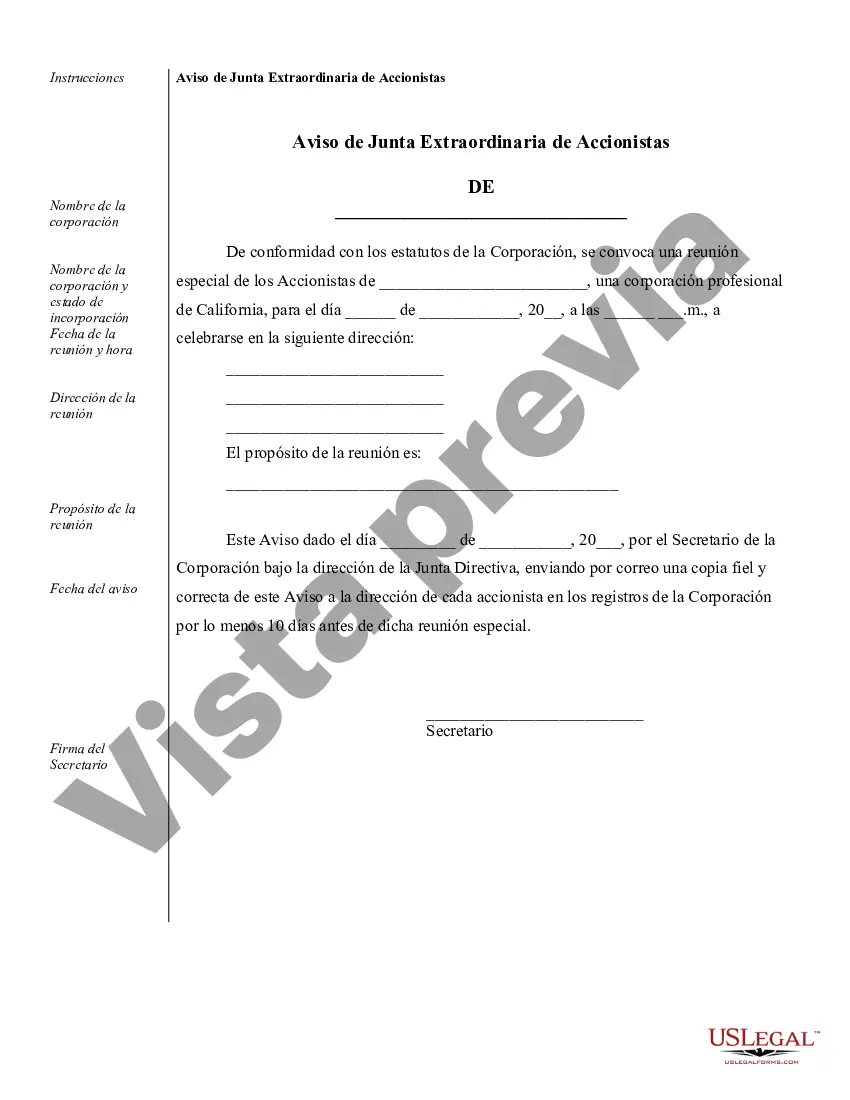

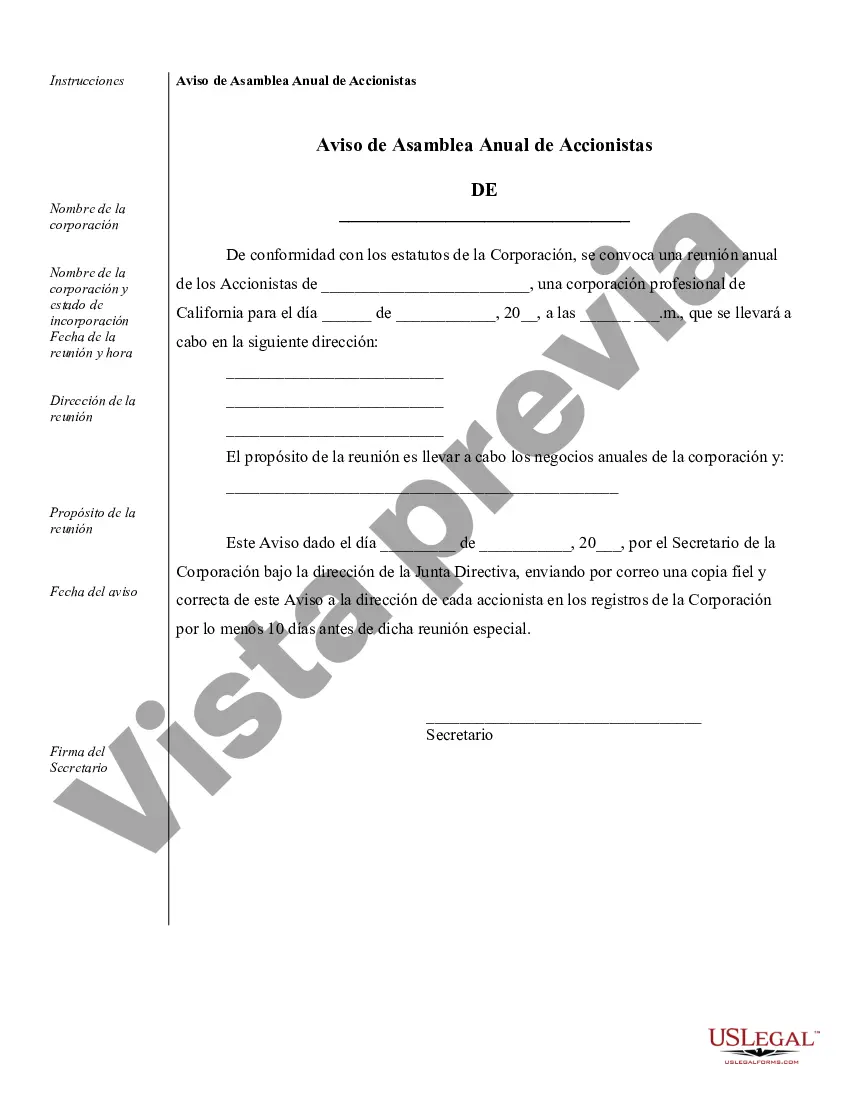

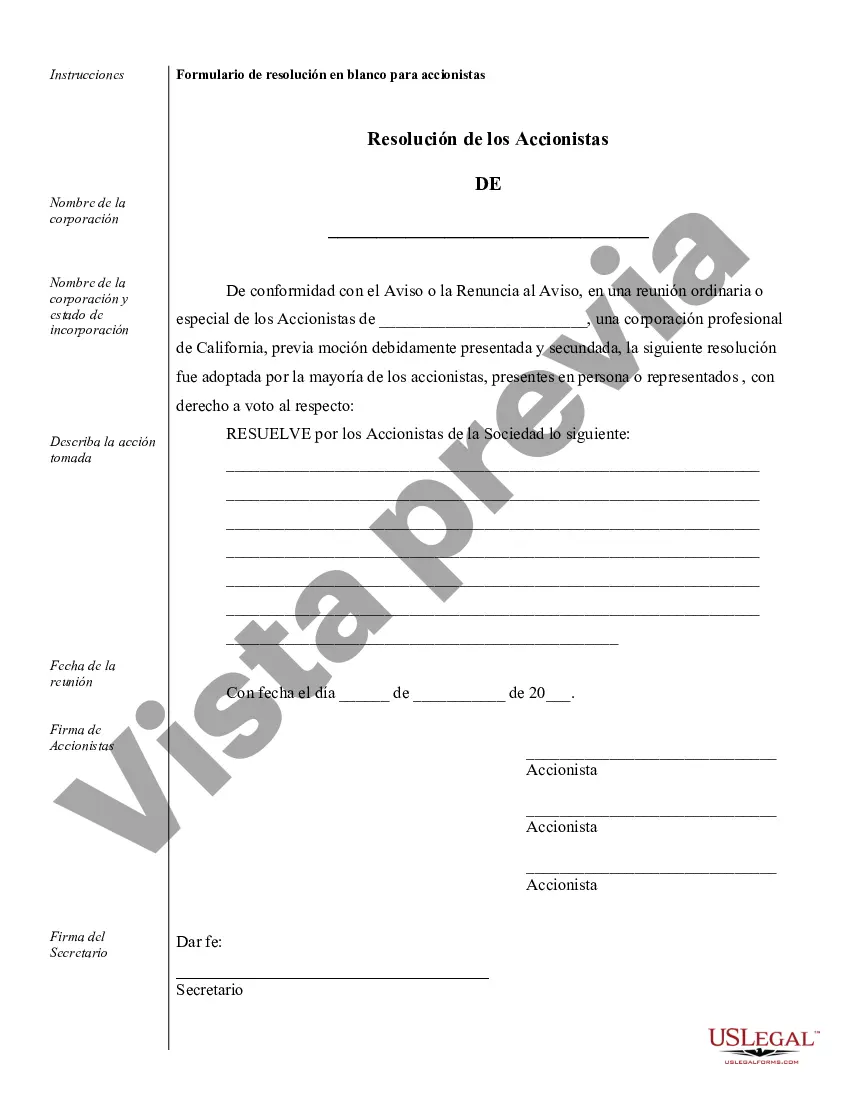

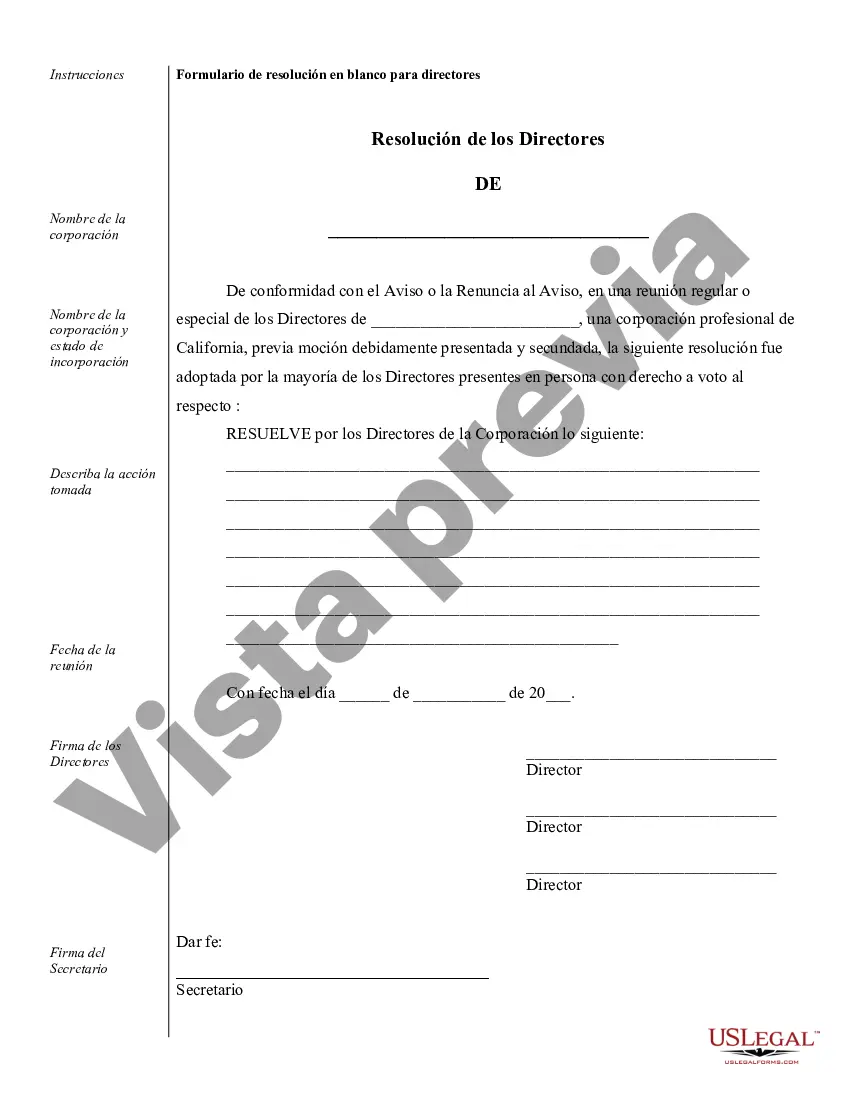

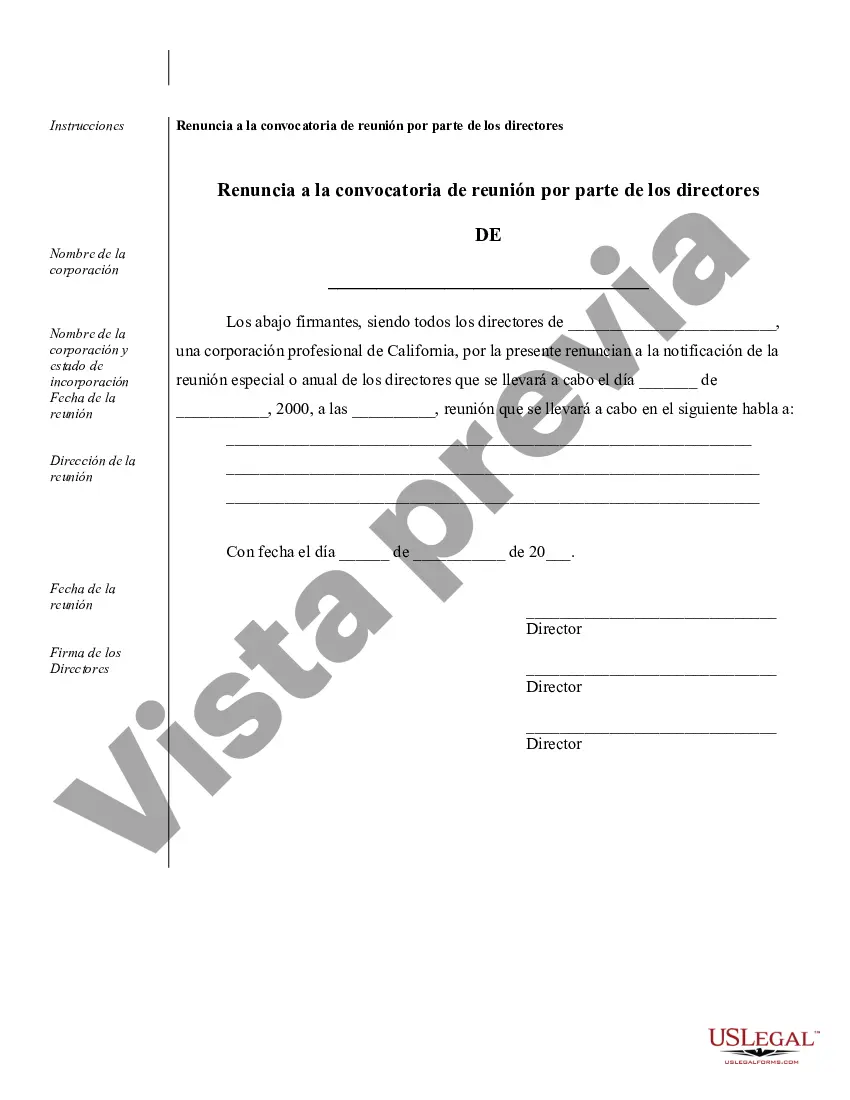

Ejemplos de avisos corporativos de reuniones, resoluciones, libro mayor simple de acciones y certificado.

Fontana Sample Corporate Records for a California Professional Corporation play a crucial role in documenting the important information and activities of a company. These records offer a comprehensive snapshot of the business and serve as an essential reference for compliance and legal purposes. Here are some key points that describe the purpose and types of Fontana Sample Corporate Records for a California Professional Corporation: 1. Articles of Incorporation: Fontana Sample Corporate Records include the filed Articles of Incorporation, which outline the key details of the corporation. This document includes important information such as the company's name, purpose, registered agent, share structure, and initial directors. 2. Bylaws: The Fontana Sample Corporate Records for a California Professional Corporation also include a copy of the company's Bylaws. The Bylaws establish the internal rules and regulations that govern the operation of the corporation, including procedures for meetings, voting, and the duties of directors and officers. 3. Shareholder Agreements: For corporations with multiple shareholders, the Fontana Sample Corporate Records might also include any shareholder agreements or stockholders' agreements that define the rights and obligations of each shareholder. These agreements can cover topics such as voting rights, stock transfer restrictions, and buyout provisions. 4. Meeting Minutes: Fontana Sample Corporate Records should consist of detailed meeting minutes, documenting the discussions, decisions, and actions taken during board of director meetings and shareholder meetings. These minutes showcase corporate governance and can serve as evidence of official decision-making processes. 5. Stock Ledger: The Fontana Sample Corporate Records typically include a stock ledger, which tracks the company's issued and outstanding shares. This ledger includes information about shareholders, the number of shares they own, share certificates issued, and any changes in ownership due to transfers or issuance. 6. Financial Statements: Fontana Sample Corporate Records might also incorporate financial statements, including annual balance sheets, income statements, and cash flow statements, which provide a summary of the company's financial performance and position over a certain period. 7. Tax Filings: As part of the Fontana Sample Corporate Records, the corporation should maintain records of all tax filings, including federal and state tax returns, payroll tax filings, and other related documents, ensuring compliance with tax obligations. 8. Contracts and Agreements: The Fontana Sample Corporate Records may also encompass copies of significant contracts and agreements entered into by the corporation, such as leases, financing agreements, client contracts, and vendor agreements. 9. Licenses and Permits: Depending on the nature of the corporation's business, the Fontana Sample Corporate Records might include licenses and permits obtained from regulatory bodies at the state or local level, demonstrating compliance with applicable laws and regulations. It is essential for a California Professional Corporation to maintain accurate and up-to-date Fontana Sample Corporate Records to satisfy legal requirements, facilitate smooth operations, and provide transparency to stakeholders. Properly organized and maintained corporate records not only ensure compliance but also protect the corporation's best interests in the long run.

Free preview

How to fill out Fontana Ejemplos De Registros Corporativos Para Una Corporación Profesional De California?

If you’ve already utilized our service before, log in to your account and download the Fontana Sample Corporate Records for a California Professional Corporation on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, follow these simple actions to obtain your document:

- Make certain you’ve found a suitable document. Read the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t fit you, utilize the Search tab above to get the appropriate one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Get your Fontana Sample Corporate Records for a California Professional Corporation. Choose the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to every piece of paperwork you have purchased: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to rapidly locate and save any template for your personal or professional needs!