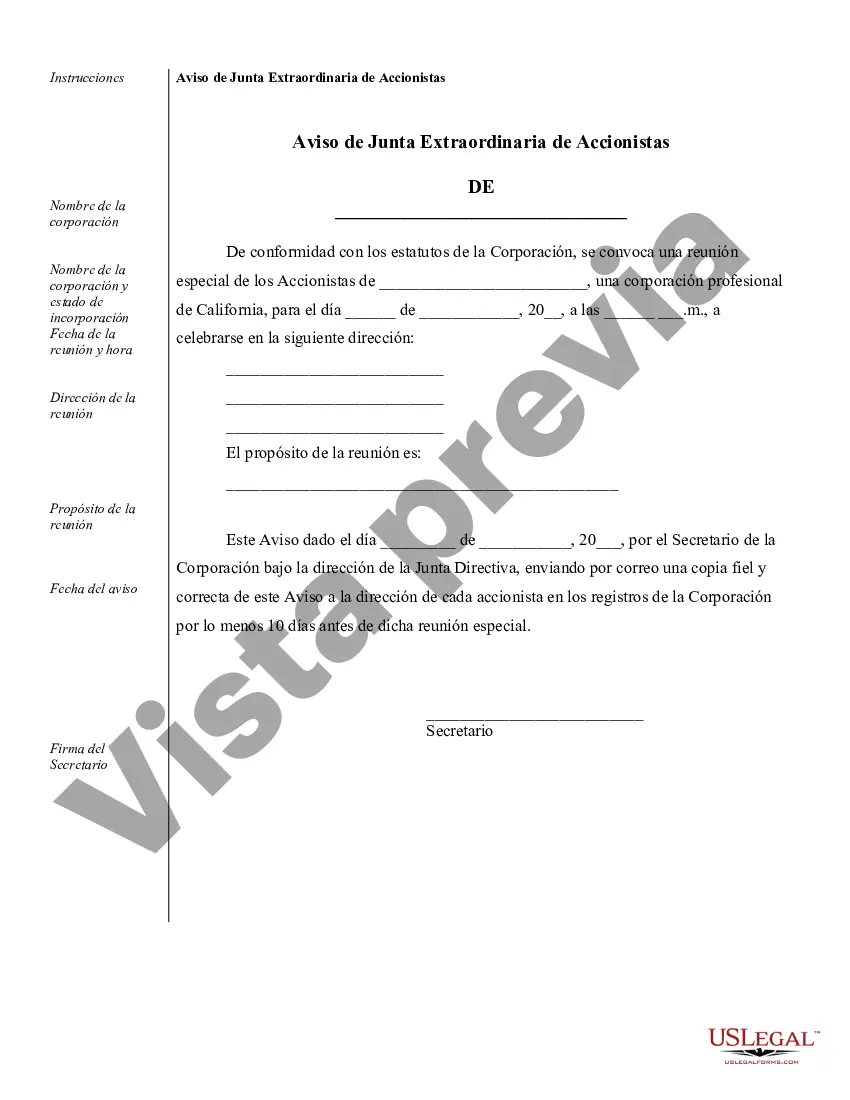

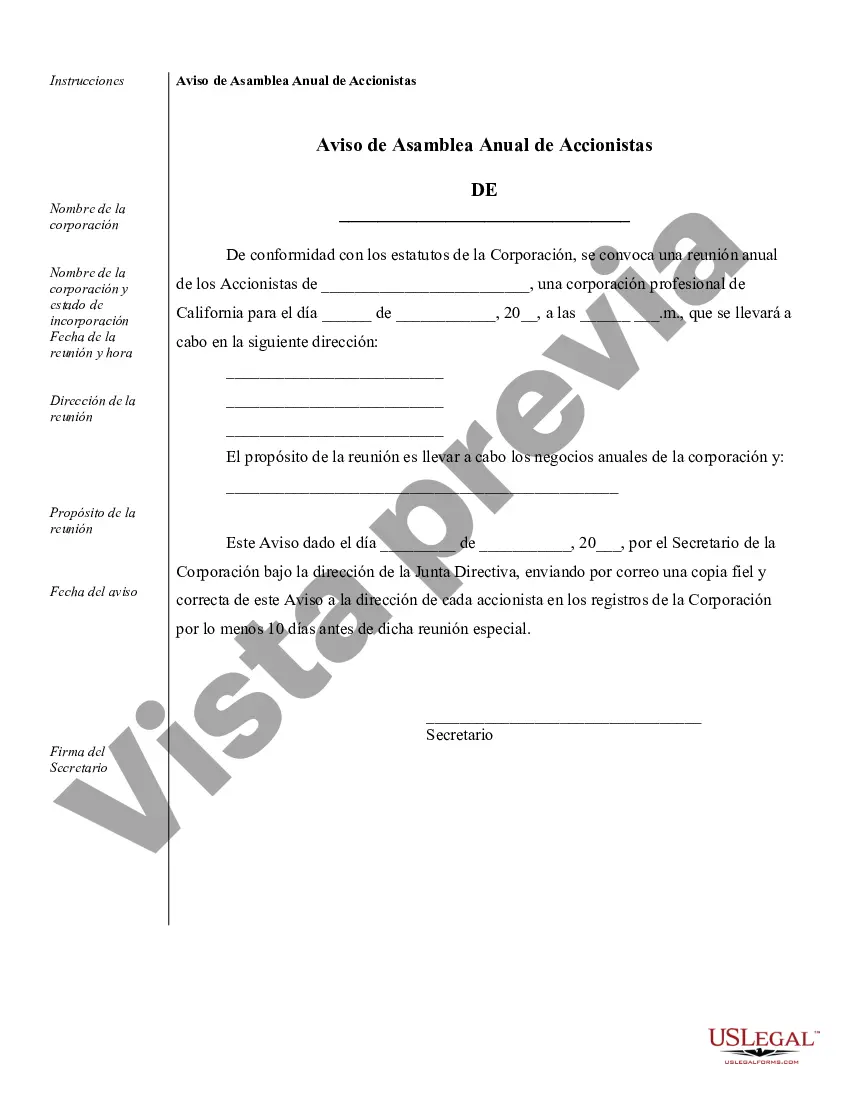

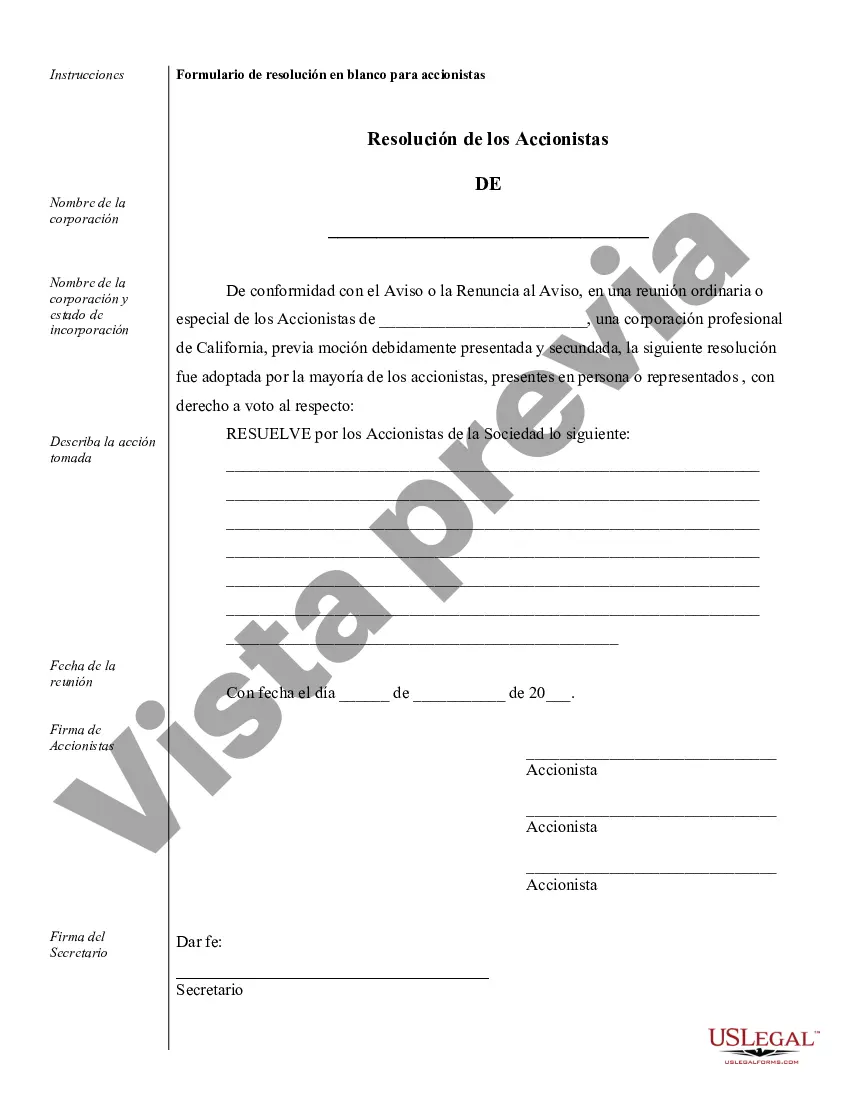

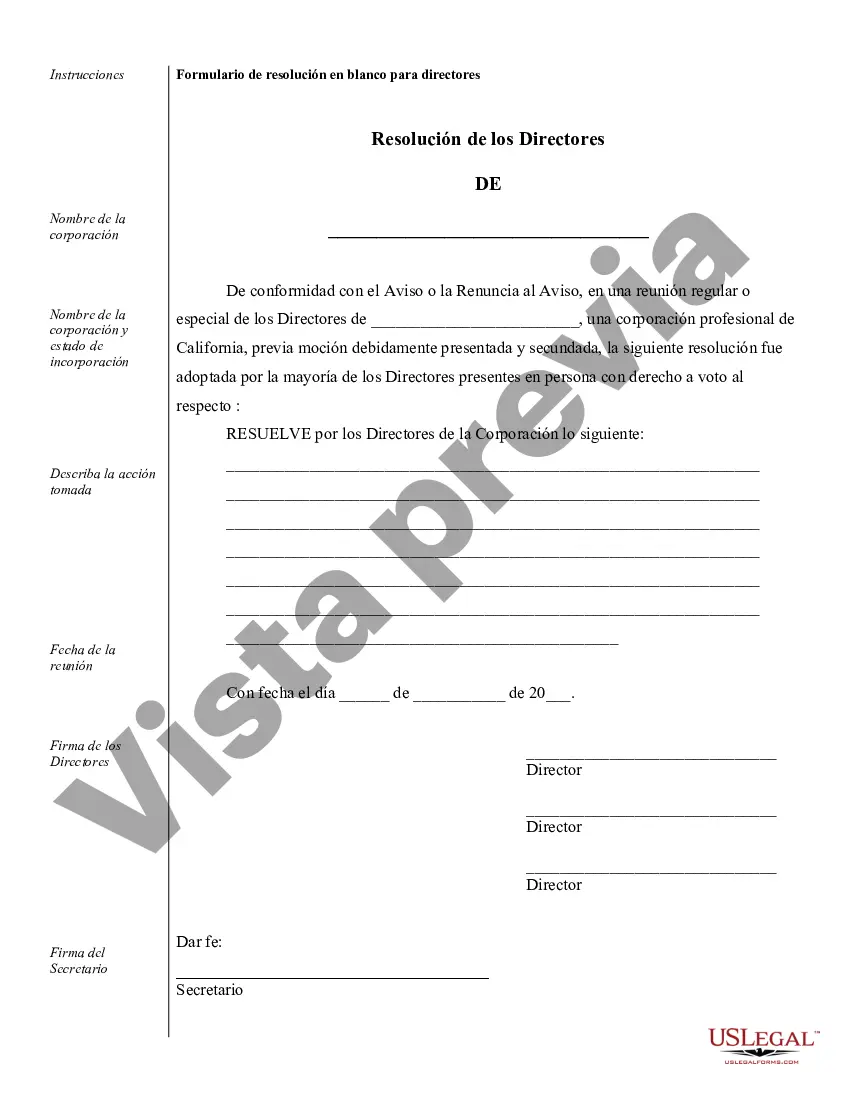

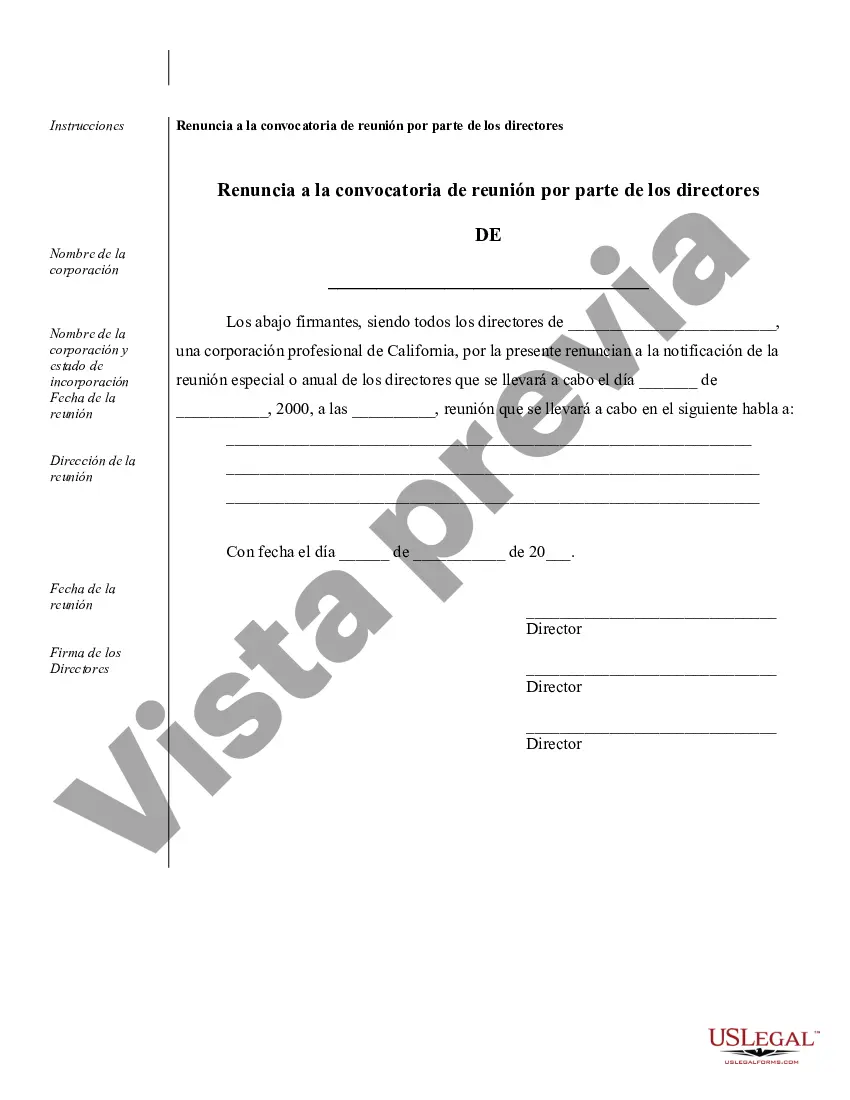

Fullerton Sample Corporate Records for a California Professional Corporation are essential documents that provide a comprehensive record of the activities, structure, and legal compliance of a professional corporation registered in California. These records play a vital role in maintaining transparency, accountability, and compliance with state laws and regulations. Below, we outline the different types of Fullerton Sample Corporate Records that are typically included: 1. Articles of Incorporation: The Articles of Incorporation establish the formation of the professional corporation and contain key information such as the corporation's name, purpose, registered agent, shares of stock, and initial directors. 2. Bylaws: Bylaws outline the rules and procedures for the corporation's internal governance and day-to-day operations. They specify the roles and responsibilities of directors, officers, shareholders, and any committees, providing guidelines for decision-making, meetings, voting rights, and more. 3. Stock Ledger: The stock ledger is a record of all shares issued by the corporation, including details like the shareholder's name, address, and the number of shares they own. This ledger is essential for tracking ownership and facilitating the transfer of shares. 4. Meeting Minutes: Detailed meeting minutes document the proceedings of board meetings, annual general meetings, and special shareholder meetings. These records include topics discussed, decisions made, resolutions passed, and the attendance of directors and shareholders. 5. Financial Statements: Fullerton Sample Corporate Records should include financial statements, including balance sheets, income statements, and cash flow statements. These document the corporation's financial performance and position, fostering transparency and regulatory compliance. 6. Stock Certificates: Stock certificates are legal documents representing ownership of shares in the corporation. These certificates typically indicate the shareholder's name, number of shares owned, and any specific restrictions or conditions. 7. IRS Filings: Fullerton Sample Corporate Records should include copies of all filings made with the Internal Revenue Service (IRS), including tax returns, financial statements, and any other required forms like the employer identification number (EIN) application. 8. Licenses and Permits: California professional corporations may require various professional licenses or permits operating legally. Fullerton Sample Corporate Records may include copies of these licenses and permits, ensuring compliance with California state regulations. 9. Contracts and Agreements: Any significant contracts or agreements entered into by the professional corporation should be kept in the Fullerton Sample Corporate Records. These may include client contracts, vendor agreements, lease agreements, and employment contracts. 10. Annual Reports: Fullerton Sample Corporate Records should include annual reports filed with the California Secretary of State and other relevant regulatory bodies. These reports typically summarize the corporation's financial performance, identify its directors and officers, and update any changes in corporate structure. By utilizing these Fullerton Sample Corporate Records for a California Professional Corporation, businesses can maintain accurate, organized, and compliant records, allowing for smooth operations, regulatory adherence, and a solid foundation for growth.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Fullerton Ejemplos de registros corporativos para una corporación profesional de California - Sample Corporate Records for a California Professional Corporation

Description

How to fill out Fullerton Ejemplos De Registros Corporativos Para Una Corporación Profesional De California?

No matter the social or professional status, completing legal documents is an unfortunate necessity in today’s professional environment. Too often, it’s virtually impossible for a person without any legal background to create such papers cfrom the ground up, mostly because of the convoluted jargon and legal subtleties they involve. This is where US Legal Forms comes in handy. Our platform provides a massive library with more than 85,000 ready-to-use state-specific documents that work for almost any legal case. US Legal Forms also serves as an excellent resource for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI tpapers.

Whether you need the Fullerton Sample Corporate Records for a California Professional Corporation or any other document that will be good in your state or area, with US Legal Forms, everything is at your fingertips. Here’s how you can get the Fullerton Sample Corporate Records for a California Professional Corporation quickly using our reliable platform. If you are presently a subscriber, you can proceed to log in to your account to download the needed form.

Nevertheless, in case you are new to our platform, ensure that you follow these steps prior to obtaining the Fullerton Sample Corporate Records for a California Professional Corporation:

- Ensure the form you have chosen is specific to your location because the regulations of one state or area do not work for another state or area.

- Review the form and read a quick outline (if available) of scenarios the document can be used for.

- If the one you chosen doesn’t meet your needs, you can start over and search for the necessary document.

- Click Buy now and pick the subscription plan that suits you the best.

- Log in to your account credentials or create one from scratch.

- Select the payment method and proceed to download the Fullerton Sample Corporate Records for a California Professional Corporation once the payment is done.

You’re good to go! Now you can proceed to print the form or fill it out online. Should you have any issues locating your purchased documents, you can quickly find them in the My Forms tab.

Regardless of what situation you’re trying to solve, US Legal Forms has got you covered. Give it a try now and see for yourself.