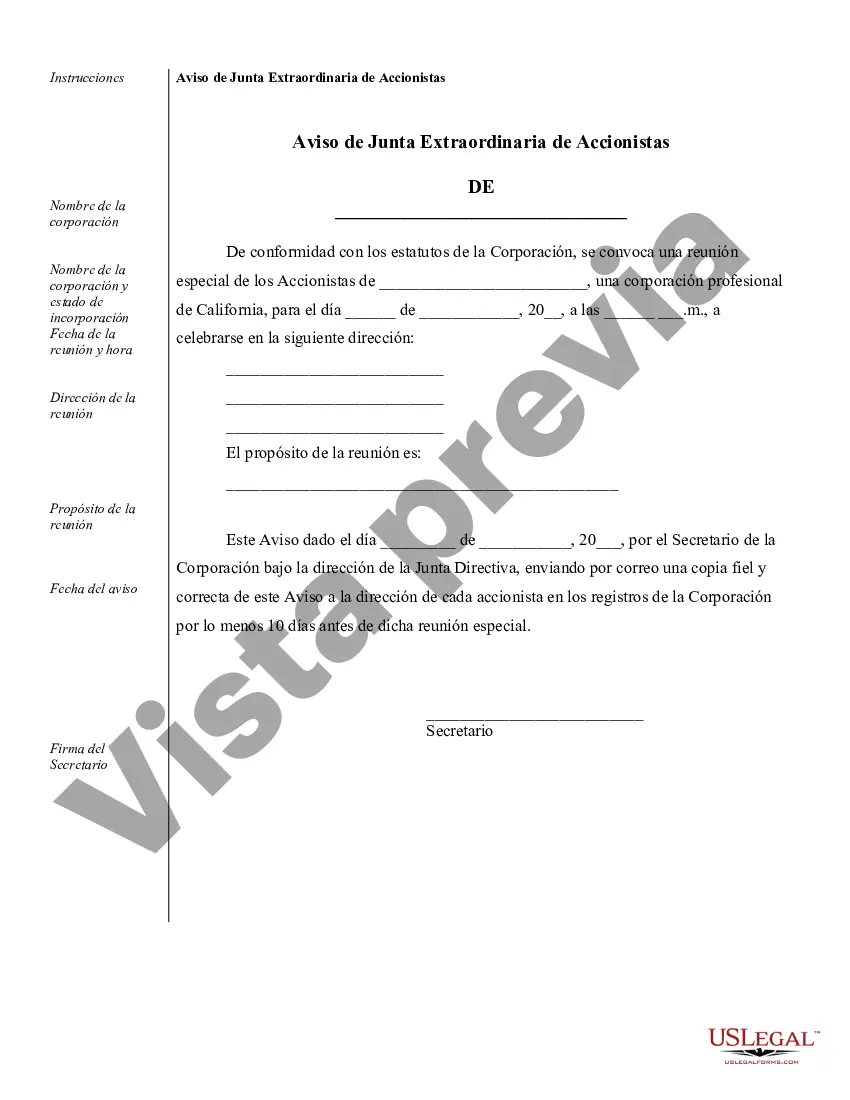

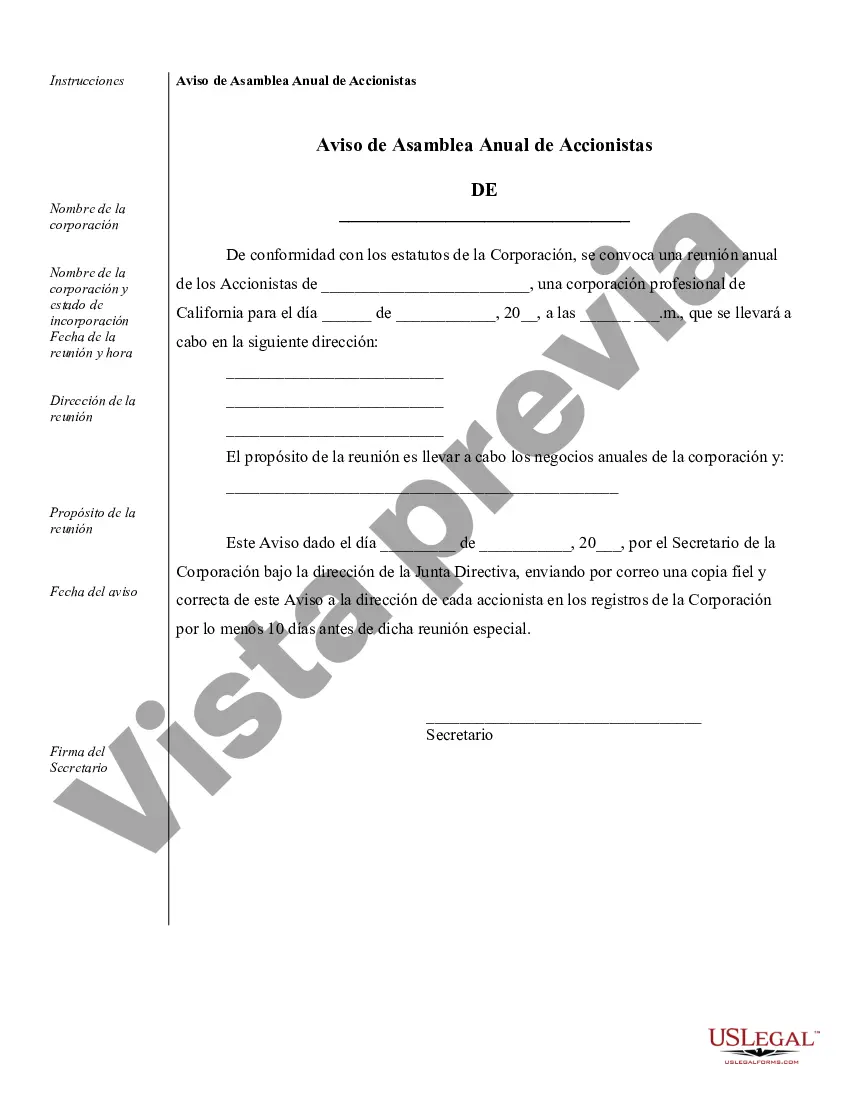

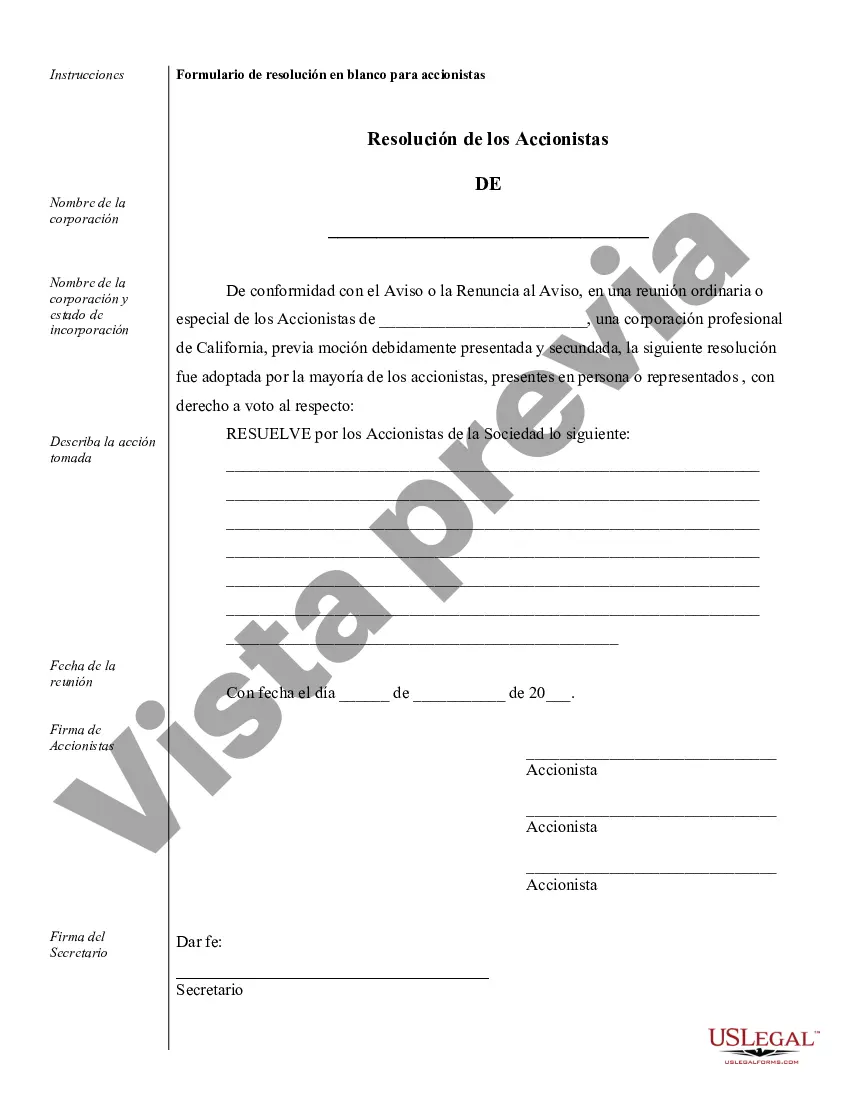

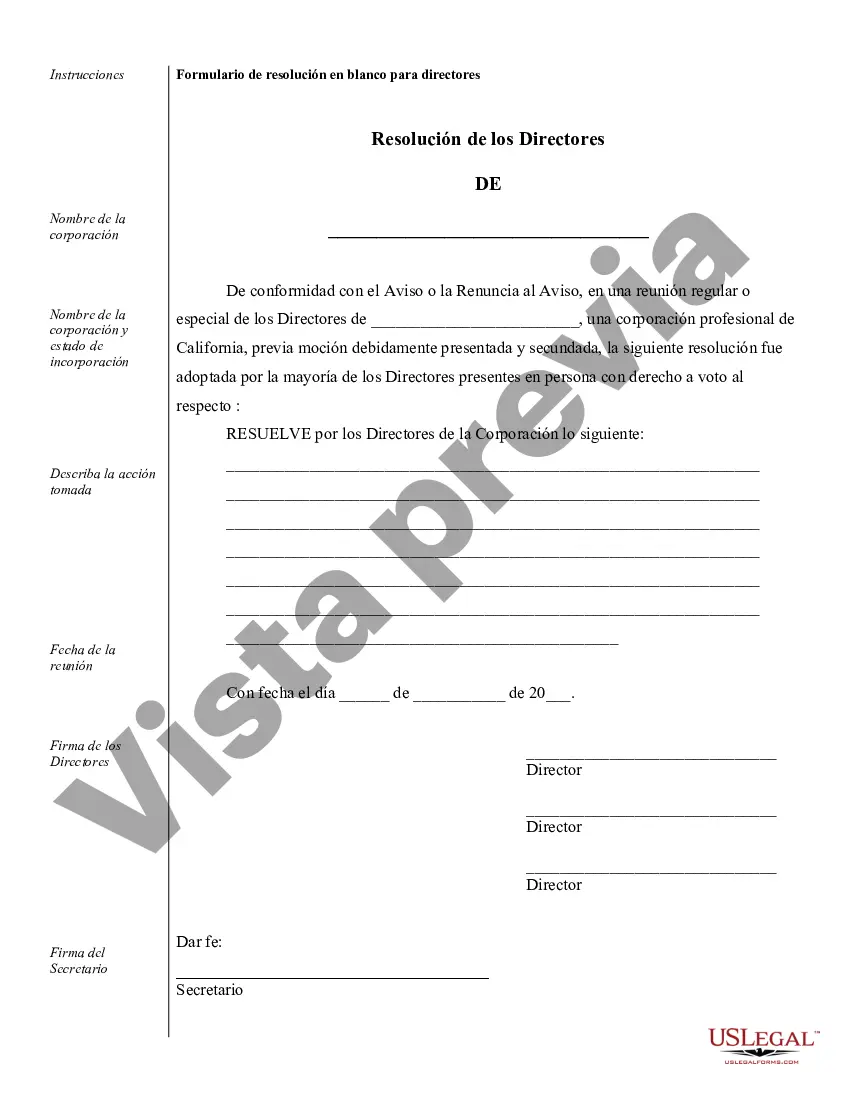

Los Angeles Sample Corporate Records for a California Professional Corporation are vital documents that outline the financial, legal, and operational aspects of a professional corporation operating in Los Angeles, California. These records serve as a comprehensive reference for the company's activities, policies, and compliance with state laws. 1. Articles of Incorporation: This document establishes the formation of the professional corporation and provides important information such as the corporation's name, purpose, registered agent, and the number and type of shares authorized for issuance. 2. Bylaws: The bylaws are a set of rules and regulations that govern the internal operations of the professional corporation. They outline procedures for conducting meetings, electing officers and directors, and handling various corporate matters. 3. Organizational Meeting Minutes: These records document the proceedings of the initial meeting held after the incorporation process. They typically include the election of directors and officers, approval of bylaws, and other decisions important to the professional corporation's establishment. 4. Stock Ledger: A stock ledger tracks the ownership of shares in the professional corporation. It records the name, address, and number of shares owned by each shareholder, as well as any transfers or changes in ownership. 5. Shareholder Agreements: These agreements outline the rights and obligations of the professional corporation's shareholders, including voting rights, restrictions on share transfers, and distributions of profits and dividends. 6. Board of Directors Meeting Minutes: These records document the discussions, decisions, and actions taken during the meetings of the board of directors. They cover a wide range of topics, including the appointment of officers, approval of contracts, financial matters, and strategic decisions. 7. Financial Statements: These records provide a comprehensive overview of the professional corporation's financial position. They include balance sheets, income statements, and cash flow statements, giving insight into the corporation's assets, liabilities, revenues, and expenses. 8. Annual Report: Every professional corporation in California is required to file an annual report with the Secretary of State. This report typically includes updated information about the corporation's directors, officers, and registered agent, as well as a statement of the corporation's capital structure. It is important for a California Professional Corporation in Los Angeles to maintain these records meticulously and keep them updated regularly. Failure to maintain accurate records may lead to penalties, legal complications, or challenges in protecting the corporation's limited liability status. Therefore, it is advisable for professional corporations to seek professional advice and utilize sample corporate records that are specific to California and Los Angeles to ensure compliance and governance.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Los Angeles Ejemplos de registros corporativos para una corporación profesional de California - Sample Corporate Records for a California Professional Corporation

Description

How to fill out Los Angeles Ejemplos De Registros Corporativos Para Una Corporación Profesional De California?

We always strive to minimize or prevent legal damage when dealing with nuanced legal or financial affairs. To accomplish this, we apply for attorney solutions that, as a rule, are extremely costly. Nevertheless, not all legal matters are as just complex. Most of them can be taken care of by ourselves.

US Legal Forms is an online collection of updated DIY legal forms addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without turning to an attorney. We provide access to legal document templates that aren’t always openly available. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the Los Angeles Sample Corporate Records for a California Professional Corporation or any other document quickly and safely. Simply log in to your account and click the Get button next to it. In case you lose the form, you can always re-download it from within the My Forms tab.

The process is just as straightforward if you’re unfamiliar with the website! You can create your account within minutes.

- Make sure to check if the Los Angeles Sample Corporate Records for a California Professional Corporation adheres to the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s description (if available), and if you spot any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve made sure that the Los Angeles Sample Corporate Records for a California Professional Corporation would work for your case, you can pick the subscription plan and make a payment.

- Then you can download the form in any suitable file format.

For over 24 years of our existence, we’ve helped millions of people by offering ready to customize and up-to-date legal forms. Make the most of US Legal Forms now to save efforts and resources!

Form popularity

FAQ

En Colombia, las empresas tienen las siguientes cargas fiscales: Impuesto de Renta, Impuesto al Valor Agregado (IVA), ICA, Retencion en la Fuente, Impuesto al Patrimonio, Gravamen a los Movimientos Financieros, y Aportes Parafiscales, que aunque se discute sobre si son tributos o no, si es una carga economica

La SBA establece que las pequenas empresas de todos los tipos pagan una tasa impositiva federal promedio estimada del 19.8 %. El promedio para las empresas de propiedad individual es del 13.3 %, para las pequenas asociaciones del 23.6 % y para las corporaciones S pequenas del 26.9 %.

Como Crear Una LLC En California Paso 1. Nombrar una LLC. Paso 2. Elegir un Agente Registrado. Paso 3. Crear el Acta Constitutiva Step. Paso 4. Informe Bienal. Paso 5. Crear un Acuerdo Operativo. Paso 6. Obtener un EIN.

Prepara tus impuestos en 4 pasos Paso 1: Repasa tu informacion financiera.Paso 2: Organiza tus documentos.Paso 3: Ten en cuenta extensiones, deducciones y reembolsos.Paso 4: Busca asesoria especializada.Formularios para Propiedades Individuales.Formularios para Sociedades y LLCs.Formularios para Corporaciones.

Requisitos para abrir una LLC en Estados Unidos Nombre de la compania. Agente registrado. Acuerdo de operacion. Articulos de organizacion. Licencias y permisos comerciales (locales y federales) Formulario de declaracion de informacion. Declaracion de impuestos. EIN (Numero de Identificacion del Empleador)

Una Compania de Responsabilidad Limitada (LLC) es una estructura comercial legal que se utiliza para proteger sus activos personales (casa, automovil, cuenta bancaria) en caso de que su empresa sea demandada.

Despues de averiguar los requerimientos sigue los siguientes pasos para registrar una LLC: Elige el nombre. Decide como se llamara la empresa e investiga si esta disponible.Consigue un agente registrado.Crea el acta constitutiva.Redacta el acuerdo operativo.Solicitar la calificacion foranea.Pago de cuotas.

Una compania de responsabilidad limitada (LLC) no paga impuestos a nivel empresarial. En cambio, los ingresos de la LLC se tributan a la declaracion de impuestos sobre la renta personal del miembro.

Los impuestos de una corporacion se pagan segun los beneficios que obtiene, y ademas, sus accionistas pagan impuestos sobre sus salarios y los dividendos que reciben (la parte del beneficio que se reparte entre los accionistas de una empresa).

Despues de averiguar los requerimientos sigue los siguientes pasos para registrar una LLC: Elige el nombre. Decide como se llamara la empresa e investiga si esta disponible.Consigue un agente registrado.Crea el acta constitutiva.Redacta el acuerdo operativo.Solicitar la calificacion foranea.Pago de cuotas.

Interesting Questions

More info

The first few steps can become cumbersome with a huge number of questions. Your business entity may need to be amended, formed, and dissolved on a regular basis. If so, the process of drafting a California entity law can take weeks. There are several forms that can be used in an in-depth search of corporate records. To avoid confusion as to who records should be sent to, choose a format that can be filled out electronically. For all the required forms, make sure you select the information requested. California Corporations Law Firm is one of the most experienced lawyers in the area and has an office in Los Angeles where we can work for small or large corporations to help them create and operate businesses under a single business name.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.