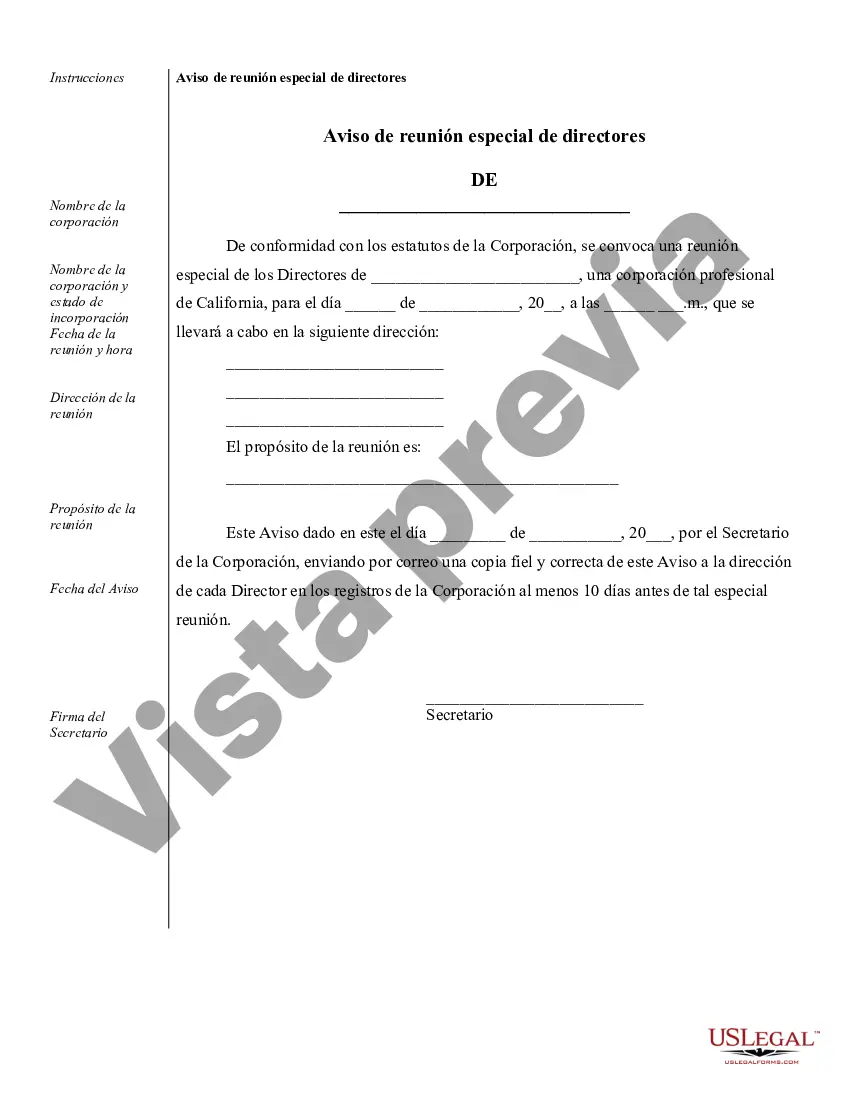

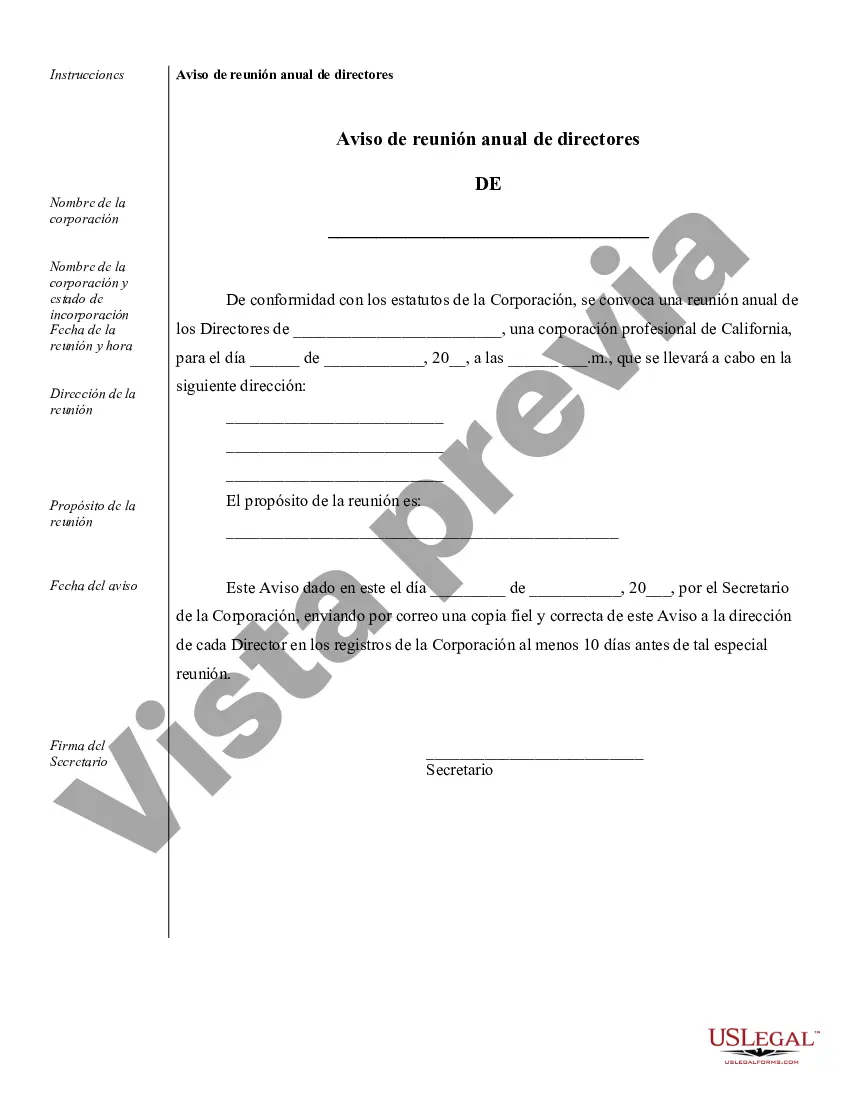

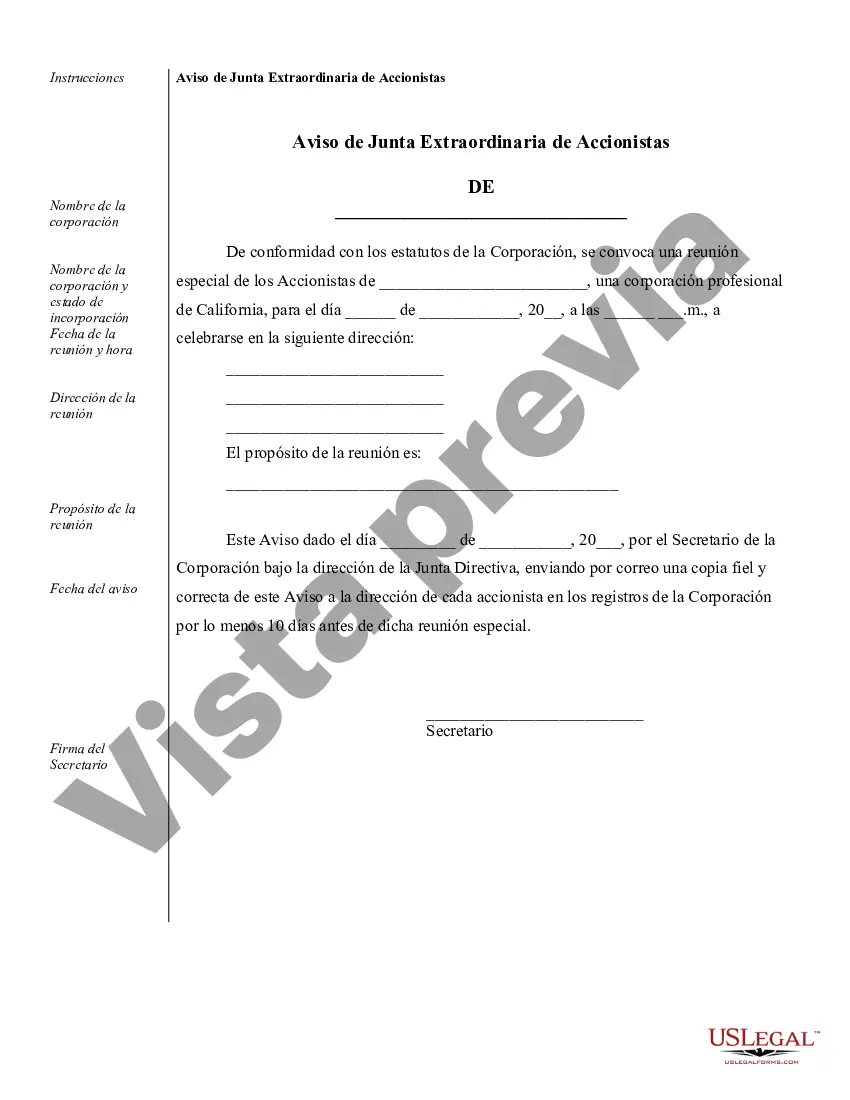

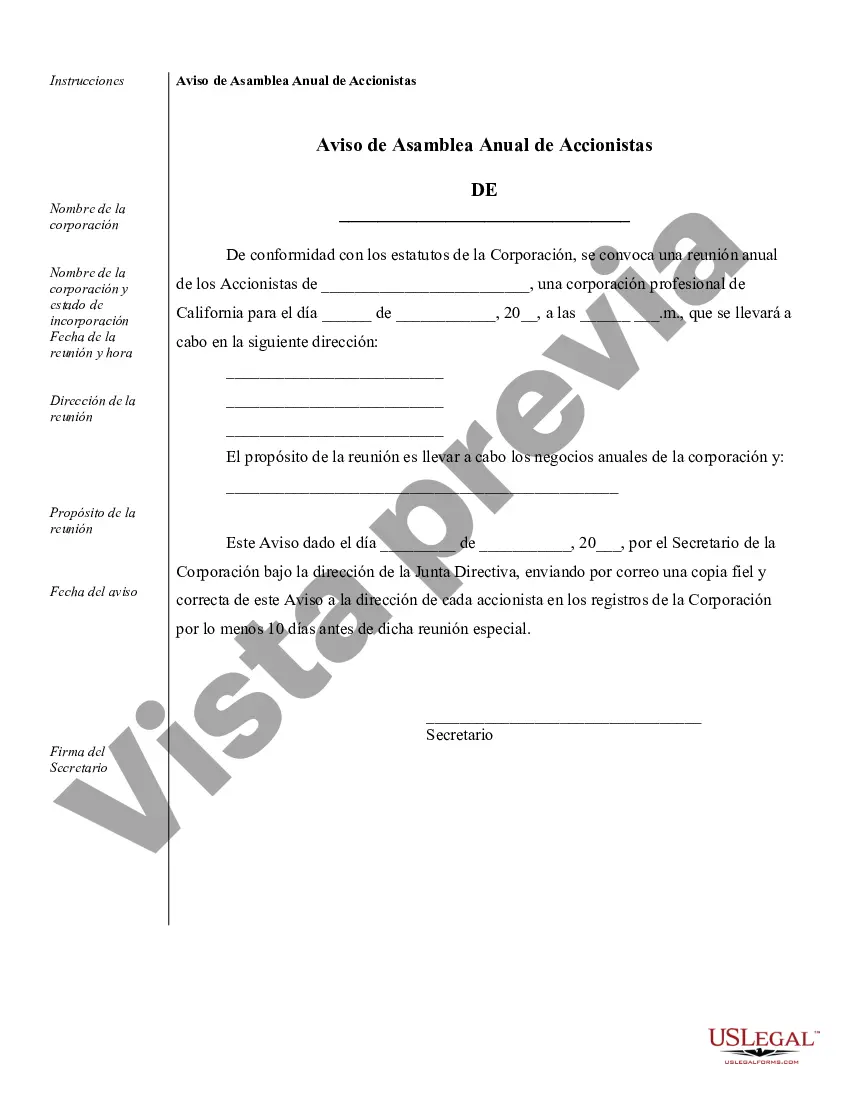

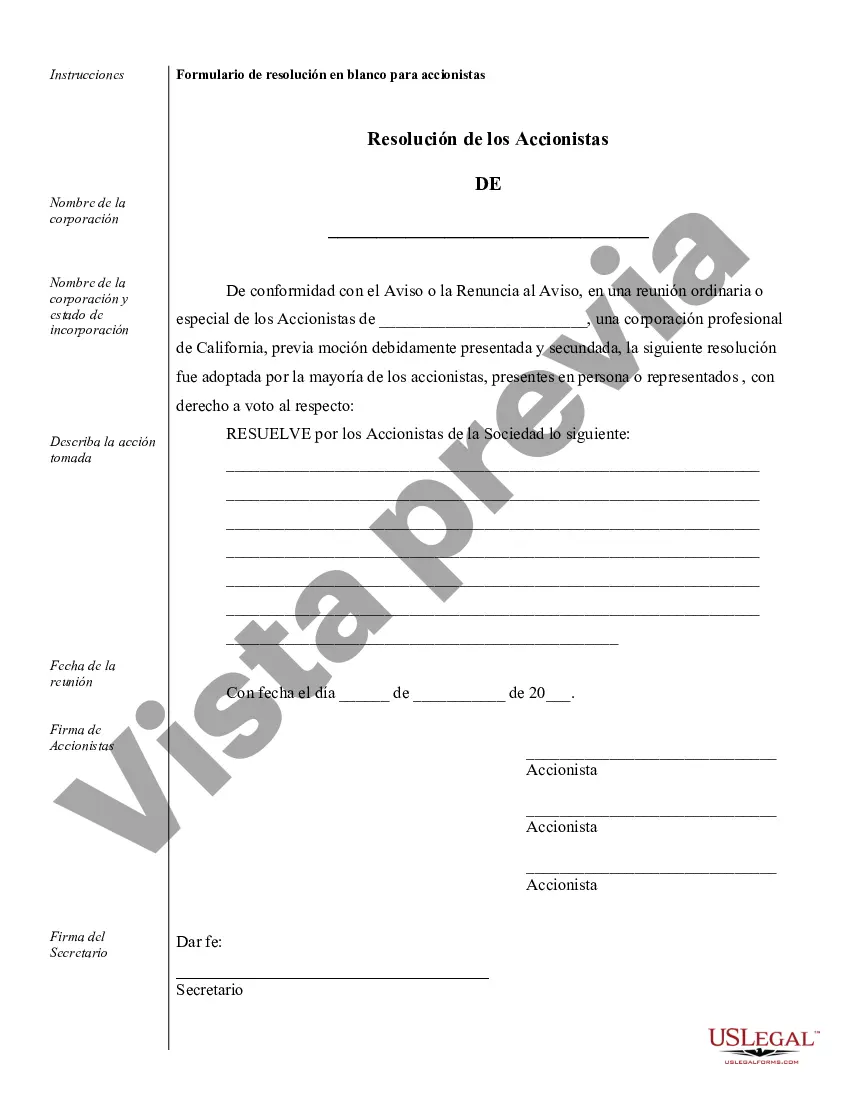

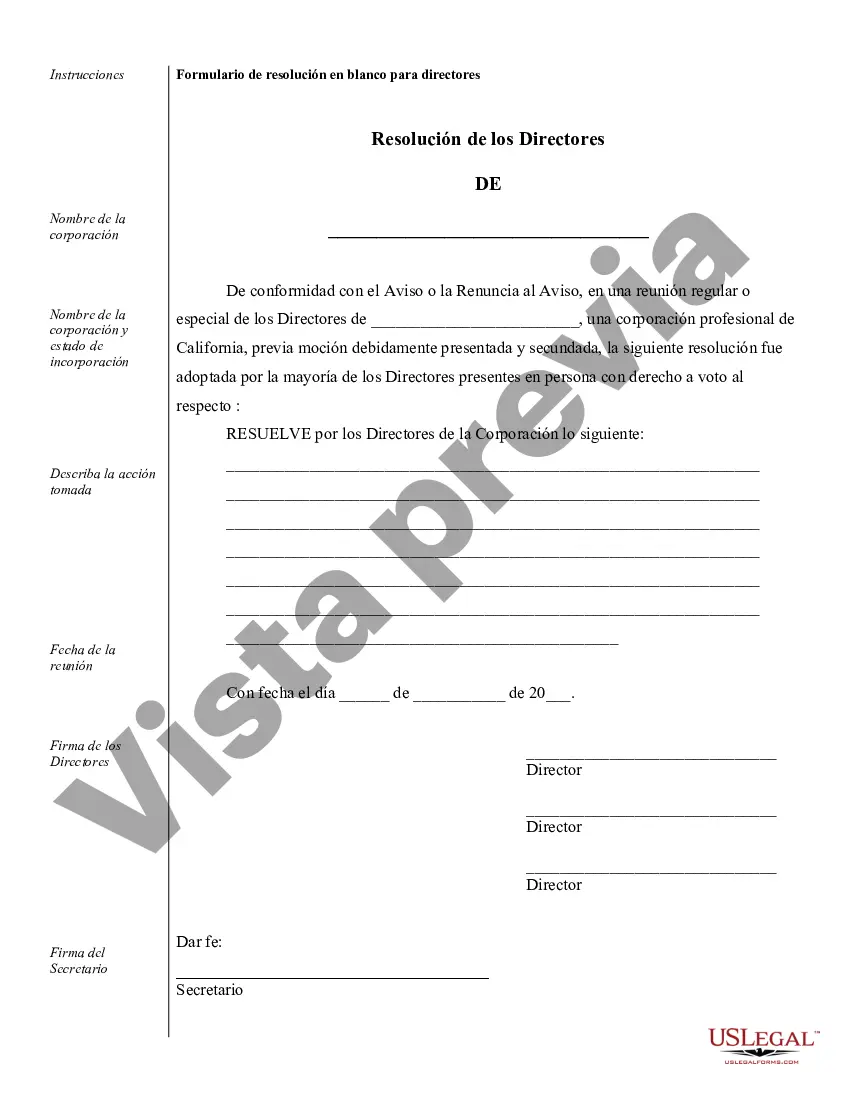

Orange Sample Corporate Records for a California Professional Corporation are essential documents that serve as evidence of the corporation's existence and its operations. These records provide legal protection, help maintain corporate compliance, and facilitate transparency and accountability. Here are some of the key types of Orange Sample Corporate Records for a California Professional Corporation: 1. Articles of Incorporation: This record marks the official establishment of the corporation. It includes details such as the corporation's name, purpose, registered agent, authorized shares, and other important information relevant to its formation. 2. Bylaws: These are the rules and regulations governing the internal operations of the corporation. Bylaws outline procedures for conducting meetings, appointing officers and directors, voting rights, and other essential corporate governance matters. 3. Meeting Minutes: These records document the proceedings and decisions made during corporate meetings, such as board of directors' meetings and shareholder meetings. Meeting minutes typically cover topics like discussions, resolutions, elections, and approvals. 4. Stock Ledger: An Orange Sample Corporate Record for stock ledger serves as a register for recording all stock issuance, transfers, and ownership details. It helps the corporation keep track of shareholders, their respective shares, and any changes in ownership structure. 5. Shareholder Agreements: Shareholder agreements outline the rights, responsibilities, and obligations of the corporation and its shareholders. These agreements often cover dividend distribution, transfer restrictions, governance, and dispute resolution mechanisms. 6. Financial Statements: Regularly updated financial statements provide an overview of the corporation's financial position, performance, and cash flow. These statements include balance sheets, income statements, and cash flow statements. 7. Annual Reports: California Professional Corporations are required to file annual reports with the Secretary of State. These reports summarize the corporation's activities, management changes, and financial status, ensuring compliance with state regulations. 8. Tax Documents: Corporate tax records, including federal and state tax returns, 1099 forms, and related supporting documentation, are important for meeting tax obligations and ensuring compliance with tax laws. 9. Contracts and Legal Agreements: These include agreements related to employment, leases, vendor contracts, client agreements, and any other legally binding documents that impact the corporation's operations. 10. Licenses and Permits: California Professional Corporations may be required to maintain various licenses and permits to legally operate in the state. These records validate the corporation's compliance with industry-specific regulations and requirements. Maintaining accurate, up-to-date, and organized Orange Sample Corporate Records for a California Professional Corporation is crucial for legal and regulatory purposes. These records contribute to the corporation's overall transparency, credibility, and smooth operation.

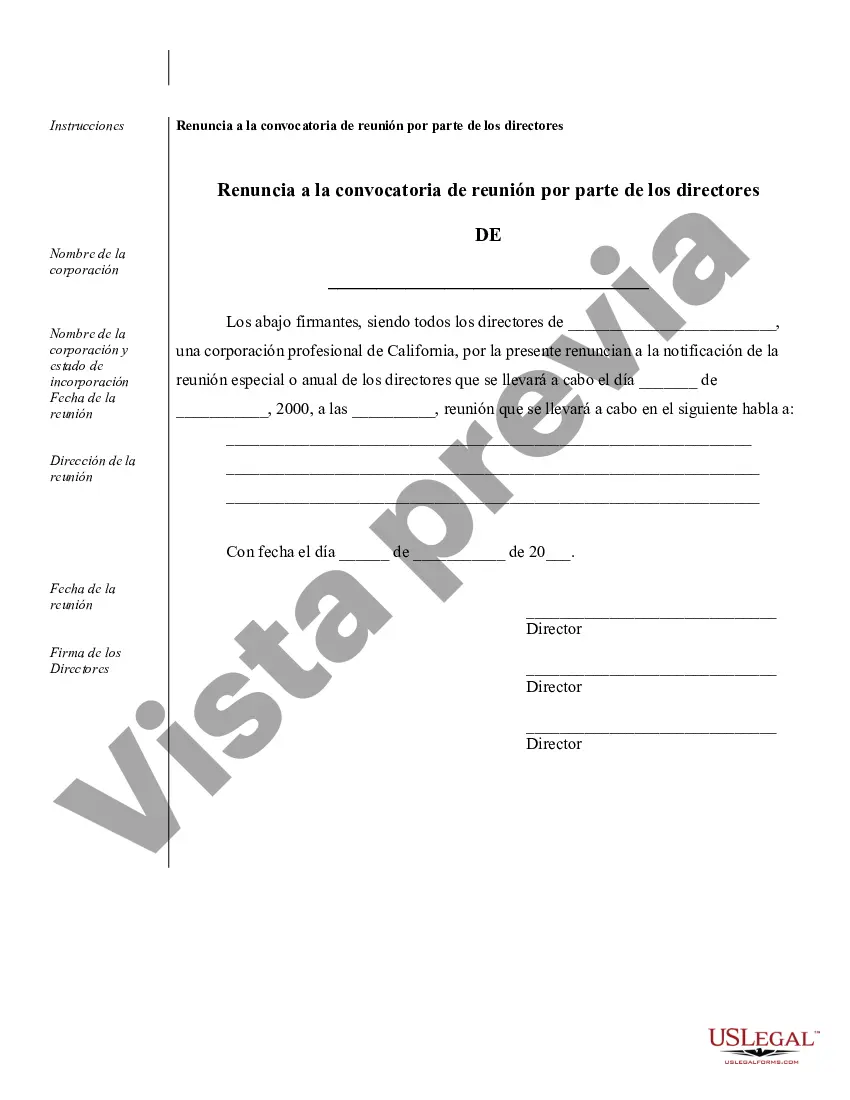

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Orange Ejemplos de registros corporativos para una corporación profesional de California - Sample Corporate Records for a California Professional Corporation

Description

How to fill out Orange Ejemplos De Registros Corporativos Para Una Corporación Profesional De California?

Finding verified templates specific to your local laws can be challenging unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both individual and professional needs and any real-life situations. All the documents are properly categorized by area of usage and jurisdiction areas, so locating the Orange Sample Corporate Records for a California Professional Corporation gets as quick and easy as ABC.

For everyone already acquainted with our catalogue and has used it before, obtaining the Orange Sample Corporate Records for a California Professional Corporation takes just a couple of clicks. All you need to do is log in to your account, choose the document, and click Download to save it on your device. The process will take just a couple of more actions to make for new users.

Follow the guidelines below to get started with the most extensive online form library:

- Check the Preview mode and form description. Make certain you’ve selected the correct one that meets your requirements and fully corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you see any inconsistency, utilize the Search tab above to get the right one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and select the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the subscription.

- Download the Orange Sample Corporate Records for a California Professional Corporation. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Benefit from the US Legal Forms library to always have essential document templates for any demands just at your hand!