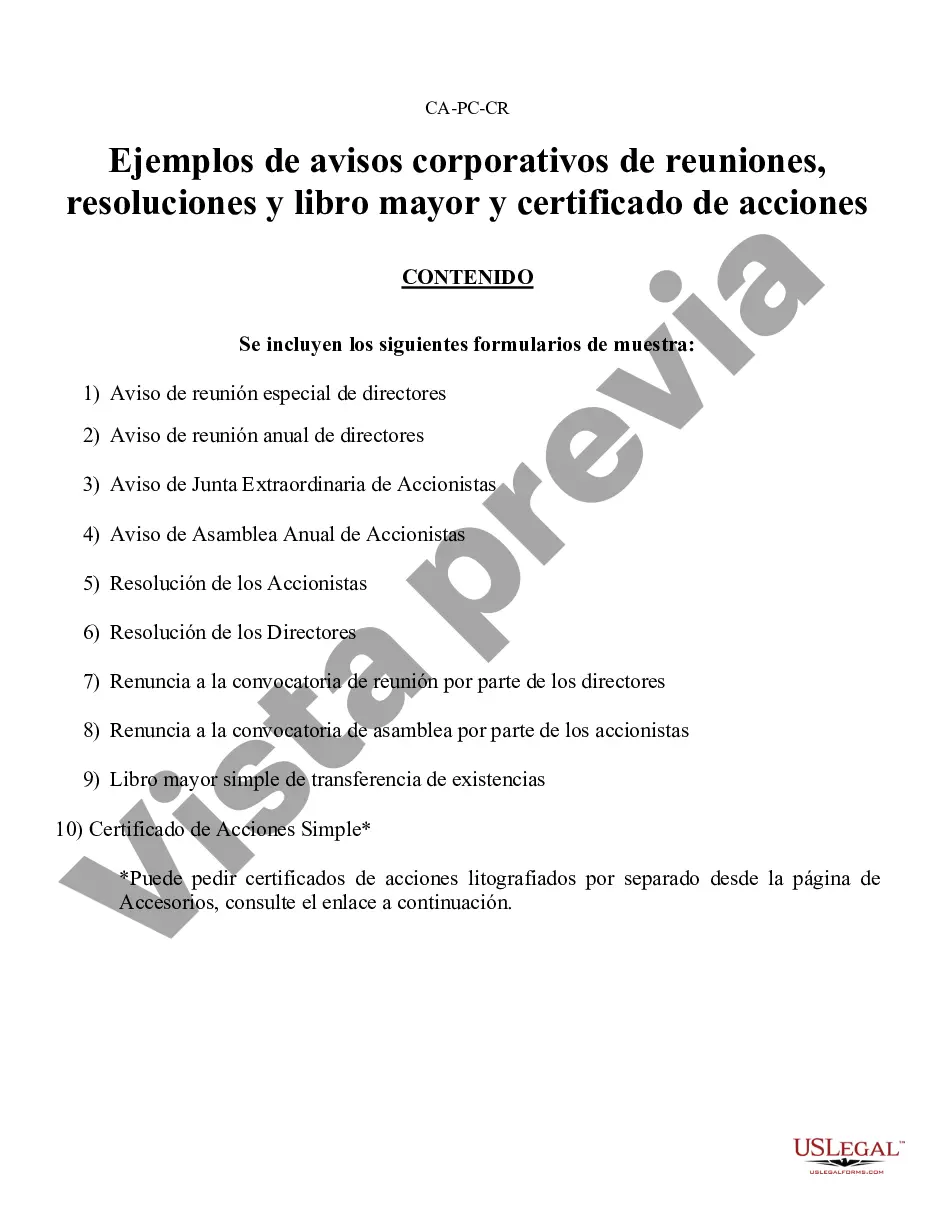

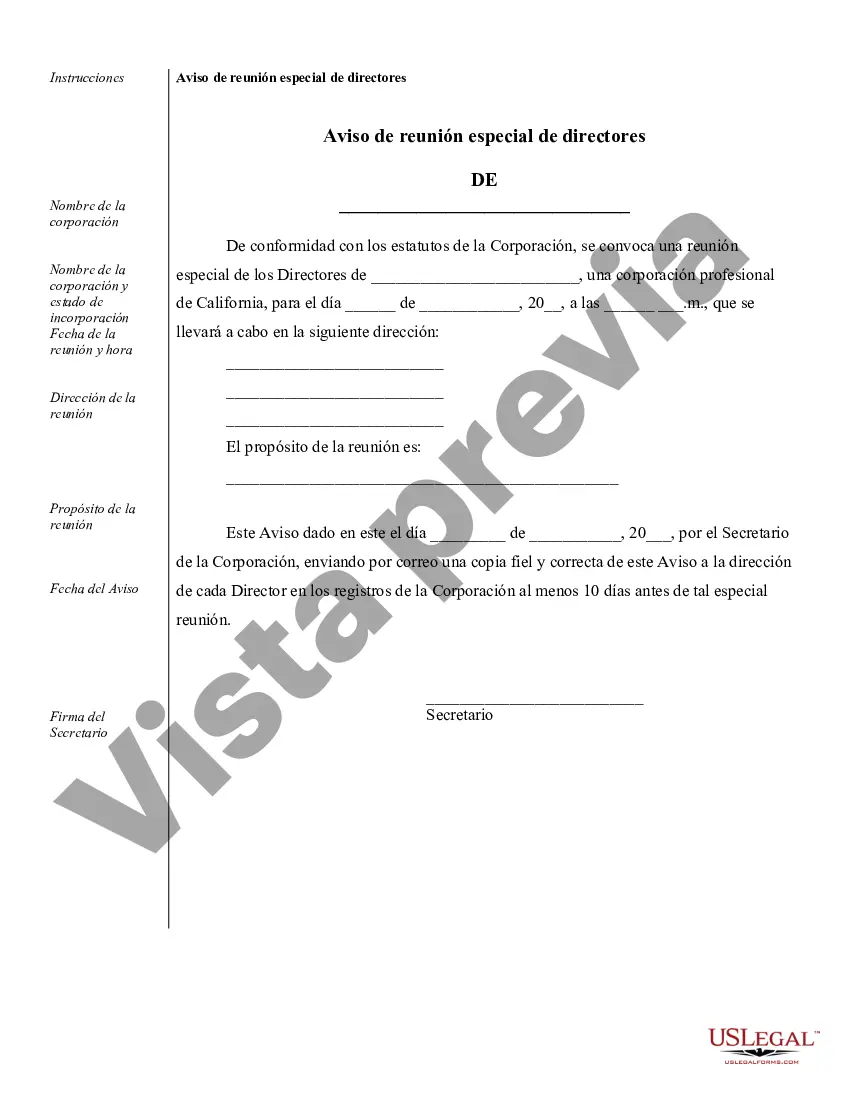

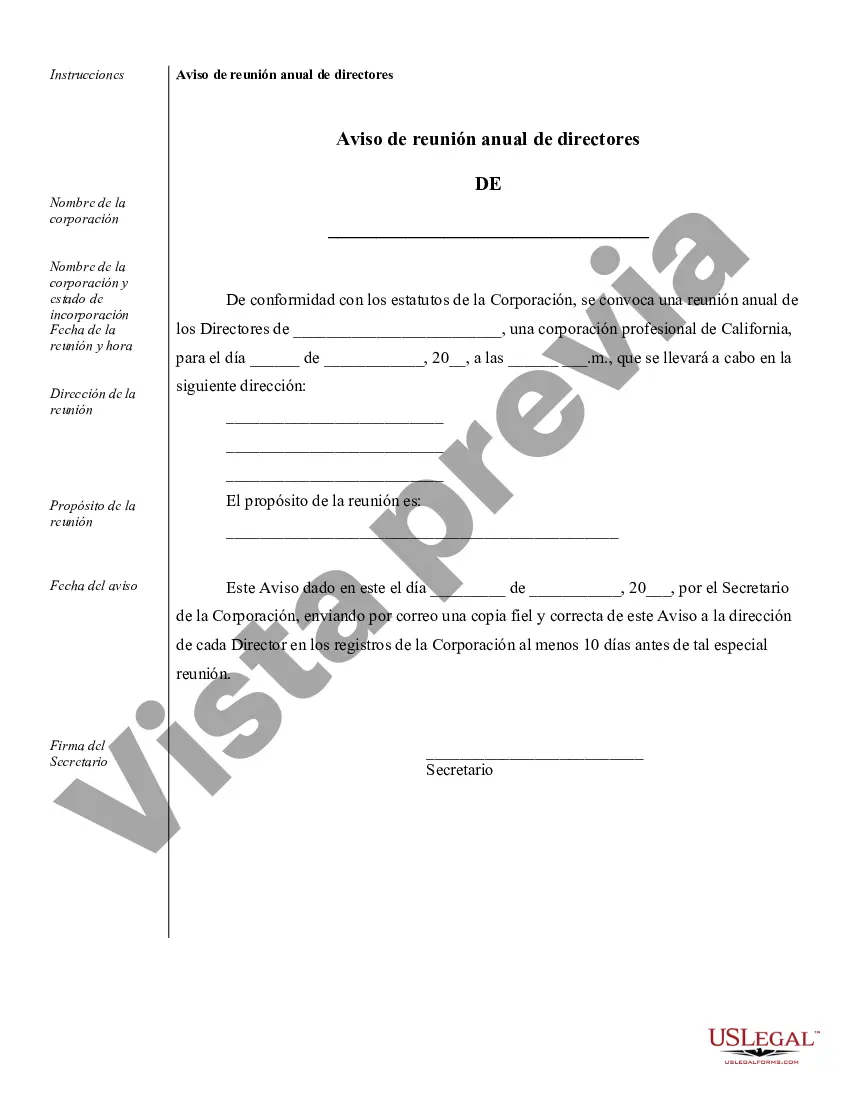

Oxnard Sample Corporate Records for a California Professional Corporation are comprehensive documents that serve as an organized record of the company's operations, activities, and legal compliance. These records are crucial for maintaining transparency, ensuring proper corporate governance, and meeting regulatory requirements. Below are the various types of Oxnard Sample Corporate Records for a California Professional Corporation: 1. Articles of Incorporation: This document establishes the existence of the corporation, outlining key information such as the corporation's name, purpose, registered agent, and the number of authorized shares. 2. Bylaws: The bylaws dictate the internal rules and procedures that govern the corporation's operations, including the roles and responsibilities of directors, officers, committees, and shareholders. 3. Meeting Minutes: These records provide a detailed account of discussions, decisions, and actions taken during the corporation's board meetings, annual general meetings, and special shareholder meetings. Meeting minutes typically cover topics such as elections, financial reports, major transactions, and corporate strategy. 4. Shareholders' Agreements: These agreements outline the rights and obligations of shareholders, including restrictions on share transfers, voting rights, and procedures to resolve disputes among shareholders. 5. Stock Ledger: The stock ledger serves as a register for recording all the details related to the corporation's stock, including the names of shareholders, the number of shares held, and any transfers or changes in ownership. 6. Financial Statements: These documents present the corporation's financial performance and position, including balance sheets, income statements, cash flow statements, and accompanying footnotes. Financial statements provide vital information to shareholders, creditors, and regulatory authorities. 7. Contracts and Agreements: Sample copies of various contracts and agreements the corporation has entered into, such as client contracts, vendor agreements, employment contracts, leases, and loans, are maintained as part of the corporate records. 8. Licensing and Permits: Documents related to obtaining and maintaining required licenses and permits for the corporation's professional activities, ensuring compliance with professional regulatory bodies. 9. Tax Filings: These records include copies of filed federal, state, and local tax returns, as well as supporting documentation like W-2s, 1099s, and expense receipts. It also encompasses correspondence with tax authorities and records of tax payments made by the corporation. 10. Insurance Policies: Certificates of insurance and related documents demonstrating the corporation's coverage for general liability, professional liability, workers' compensation, and other insurances are maintained for risk management purposes. It is important for Oxnard Sample Corporate Records for a California Professional Corporation to be accurate, up-to-date, and easily accessible to key stakeholders and regulatory bodies, as they play a critical role in the proper functioning and compliance of the corporation.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Oxnard Ejemplos de registros corporativos para una corporación profesional de California - Sample Corporate Records for a California Professional Corporation

State:

California

City:

Oxnard

Control #:

CA-PC-CR

Format:

Word

Instant download

Description

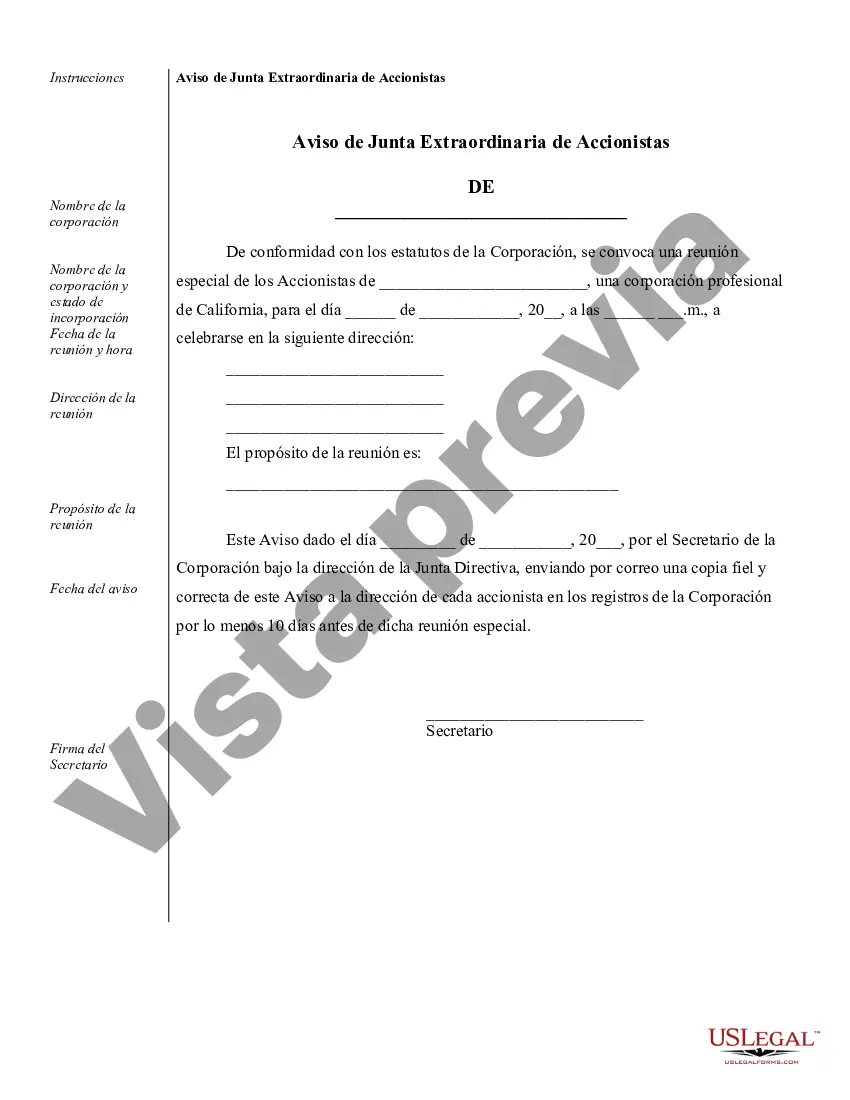

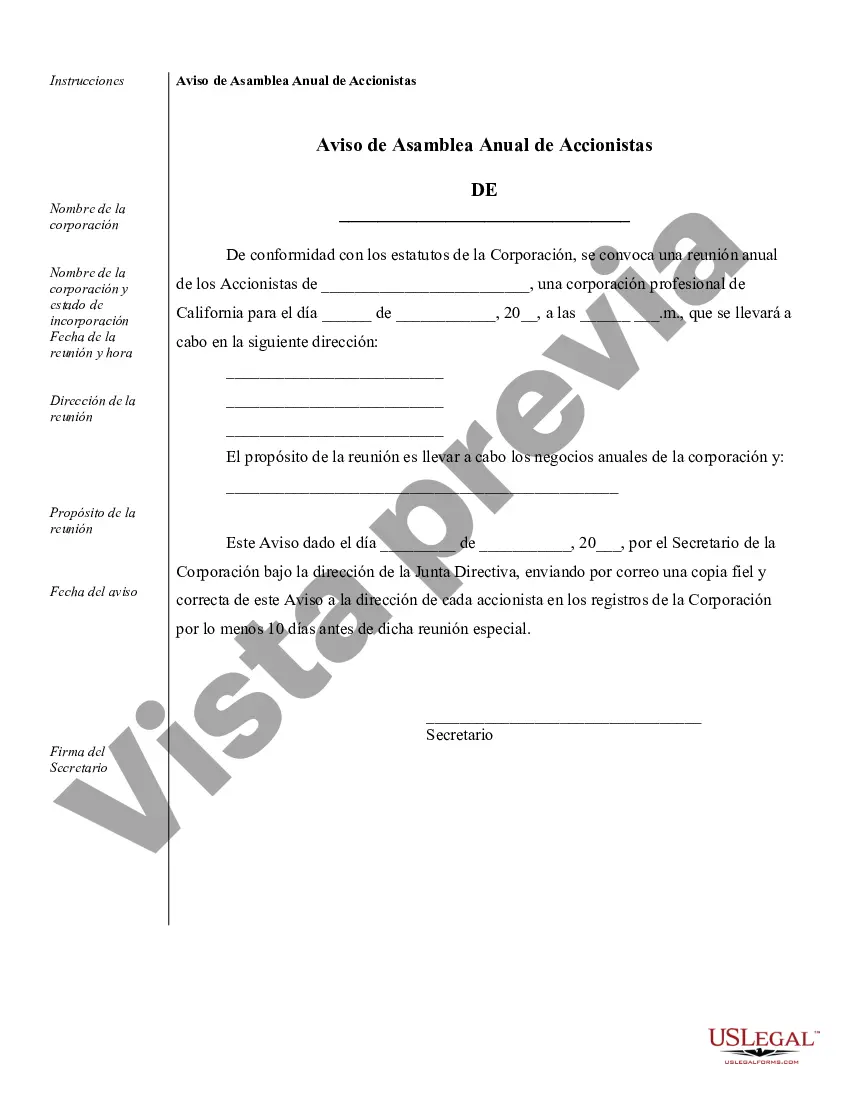

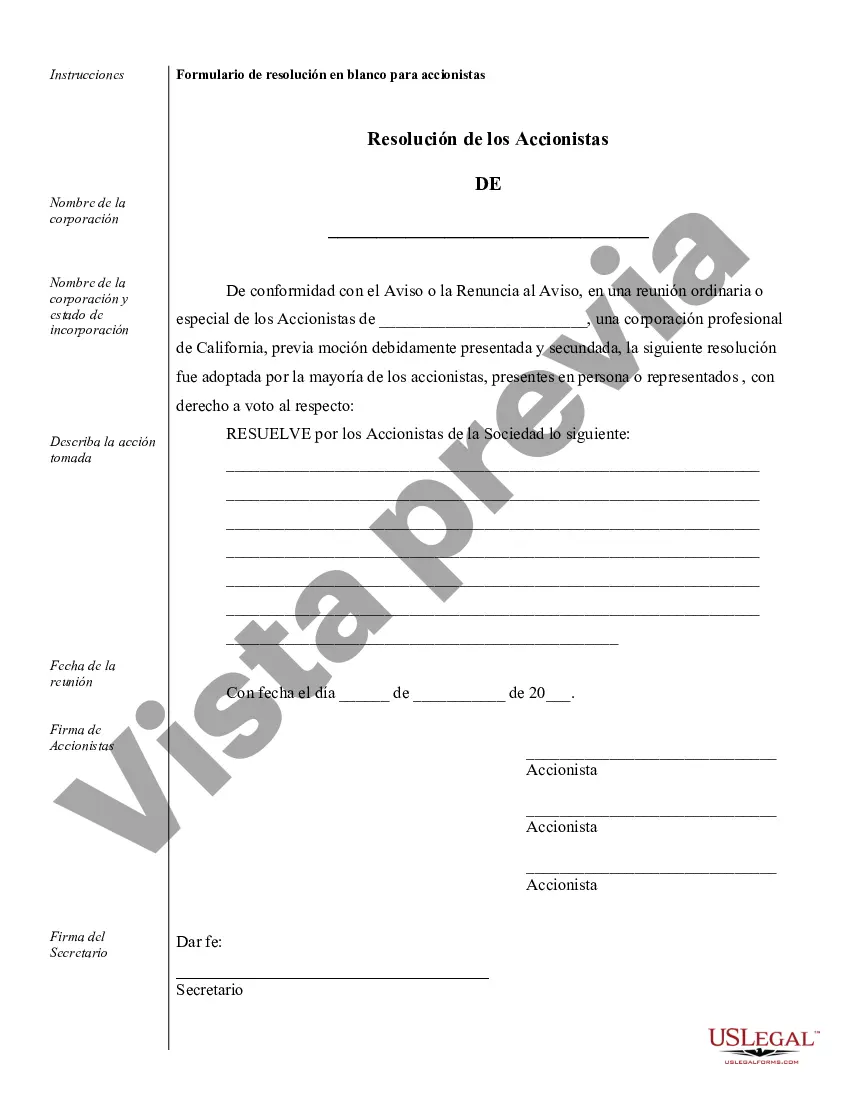

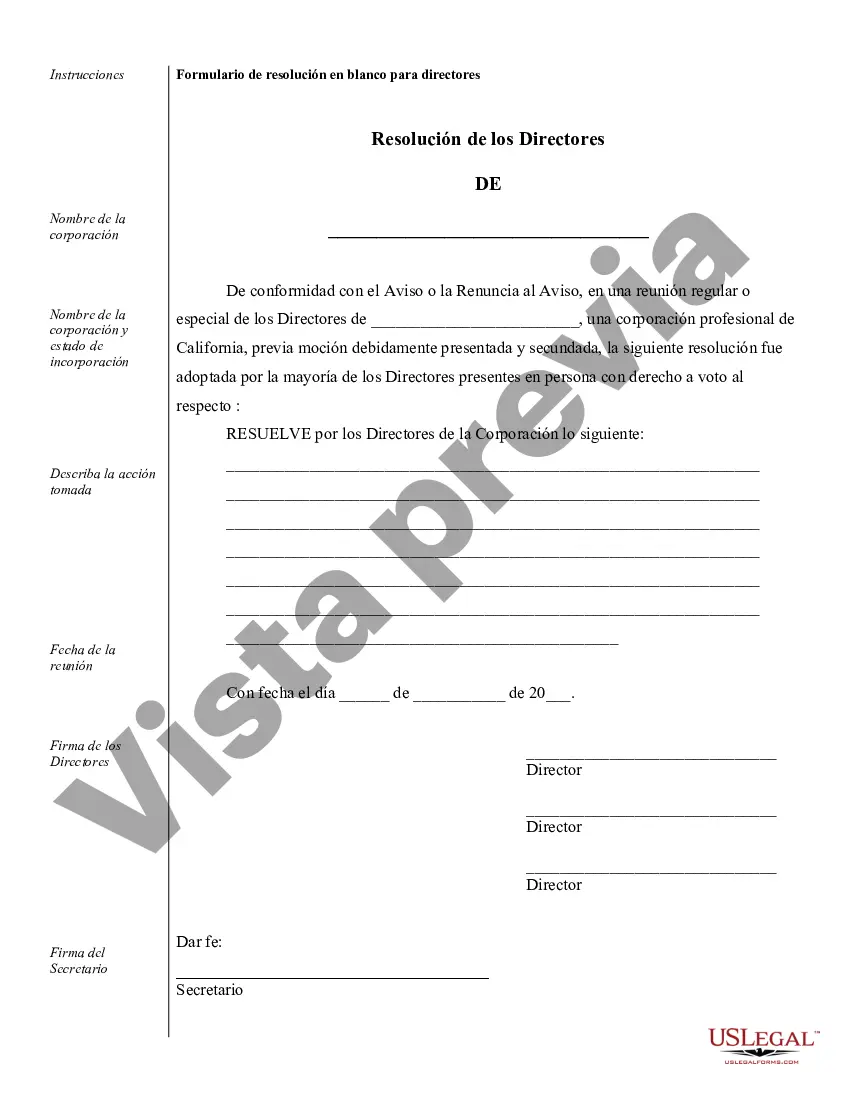

Ejemplos de avisos corporativos de reuniones, resoluciones, libro mayor simple de acciones y certificado.

Oxnard Sample Corporate Records for a California Professional Corporation are comprehensive documents that serve as an organized record of the company's operations, activities, and legal compliance. These records are crucial for maintaining transparency, ensuring proper corporate governance, and meeting regulatory requirements. Below are the various types of Oxnard Sample Corporate Records for a California Professional Corporation: 1. Articles of Incorporation: This document establishes the existence of the corporation, outlining key information such as the corporation's name, purpose, registered agent, and the number of authorized shares. 2. Bylaws: The bylaws dictate the internal rules and procedures that govern the corporation's operations, including the roles and responsibilities of directors, officers, committees, and shareholders. 3. Meeting Minutes: These records provide a detailed account of discussions, decisions, and actions taken during the corporation's board meetings, annual general meetings, and special shareholder meetings. Meeting minutes typically cover topics such as elections, financial reports, major transactions, and corporate strategy. 4. Shareholders' Agreements: These agreements outline the rights and obligations of shareholders, including restrictions on share transfers, voting rights, and procedures to resolve disputes among shareholders. 5. Stock Ledger: The stock ledger serves as a register for recording all the details related to the corporation's stock, including the names of shareholders, the number of shares held, and any transfers or changes in ownership. 6. Financial Statements: These documents present the corporation's financial performance and position, including balance sheets, income statements, cash flow statements, and accompanying footnotes. Financial statements provide vital information to shareholders, creditors, and regulatory authorities. 7. Contracts and Agreements: Sample copies of various contracts and agreements the corporation has entered into, such as client contracts, vendor agreements, employment contracts, leases, and loans, are maintained as part of the corporate records. 8. Licensing and Permits: Documents related to obtaining and maintaining required licenses and permits for the corporation's professional activities, ensuring compliance with professional regulatory bodies. 9. Tax Filings: These records include copies of filed federal, state, and local tax returns, as well as supporting documentation like W-2s, 1099s, and expense receipts. It also encompasses correspondence with tax authorities and records of tax payments made by the corporation. 10. Insurance Policies: Certificates of insurance and related documents demonstrating the corporation's coverage for general liability, professional liability, workers' compensation, and other insurances are maintained for risk management purposes. It is important for Oxnard Sample Corporate Records for a California Professional Corporation to be accurate, up-to-date, and easily accessible to key stakeholders and regulatory bodies, as they play a critical role in the proper functioning and compliance of the corporation.

Free preview

How to fill out Oxnard Ejemplos De Registros Corporativos Para Una Corporación Profesional De California?

If you’ve already utilized our service before, log in to your account and download the Oxnard Sample Corporate Records for a California Professional Corporation on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple steps to get your file:

- Make certain you’ve located an appropriate document. Read the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t fit you, utilize the Search tab above to find the appropriate one.

- Purchase the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Get your Oxnard Sample Corporate Records for a California Professional Corporation. Choose the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to every piece of paperwork you have bought: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly locate and save any template for your individual or professional needs!