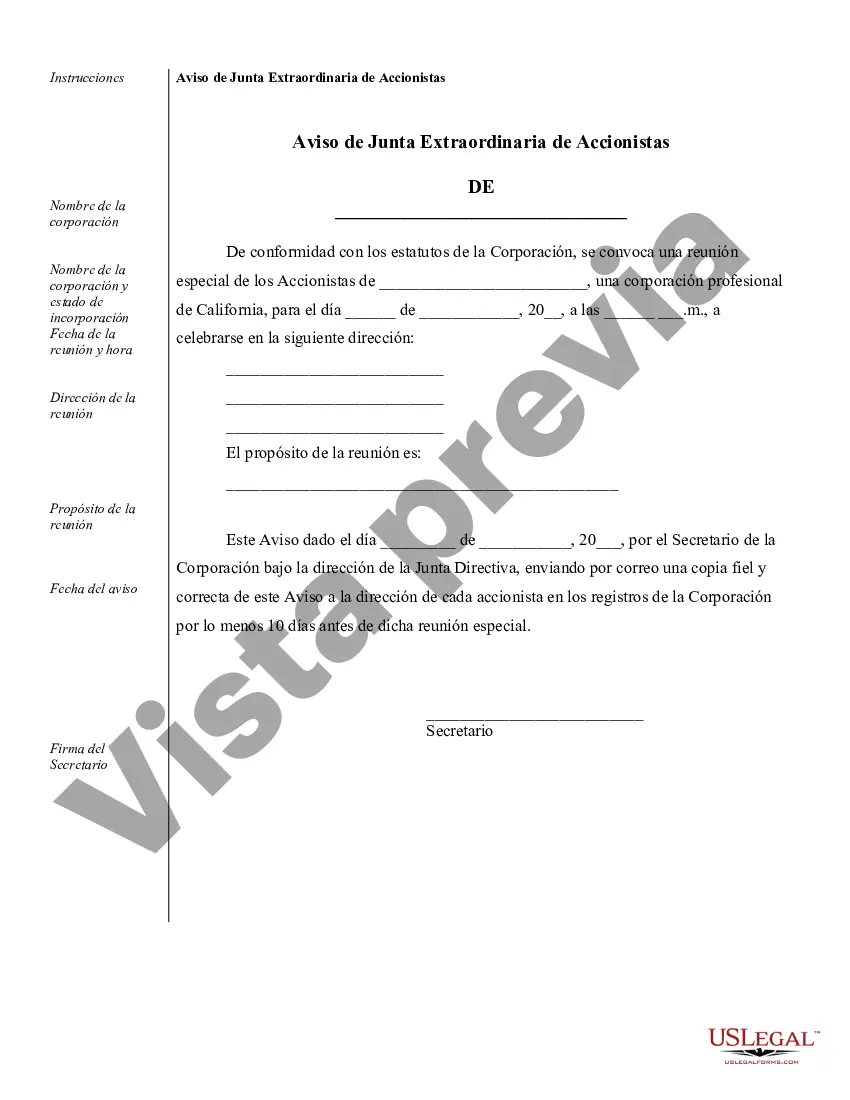

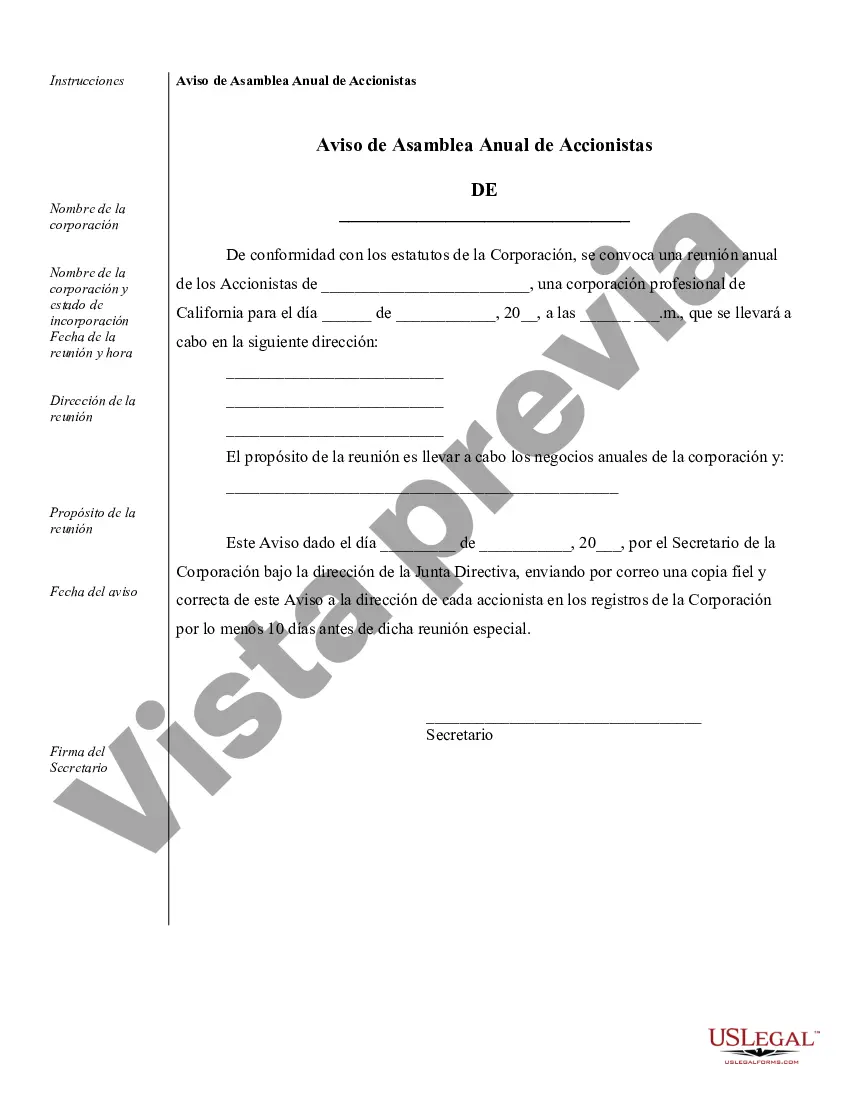

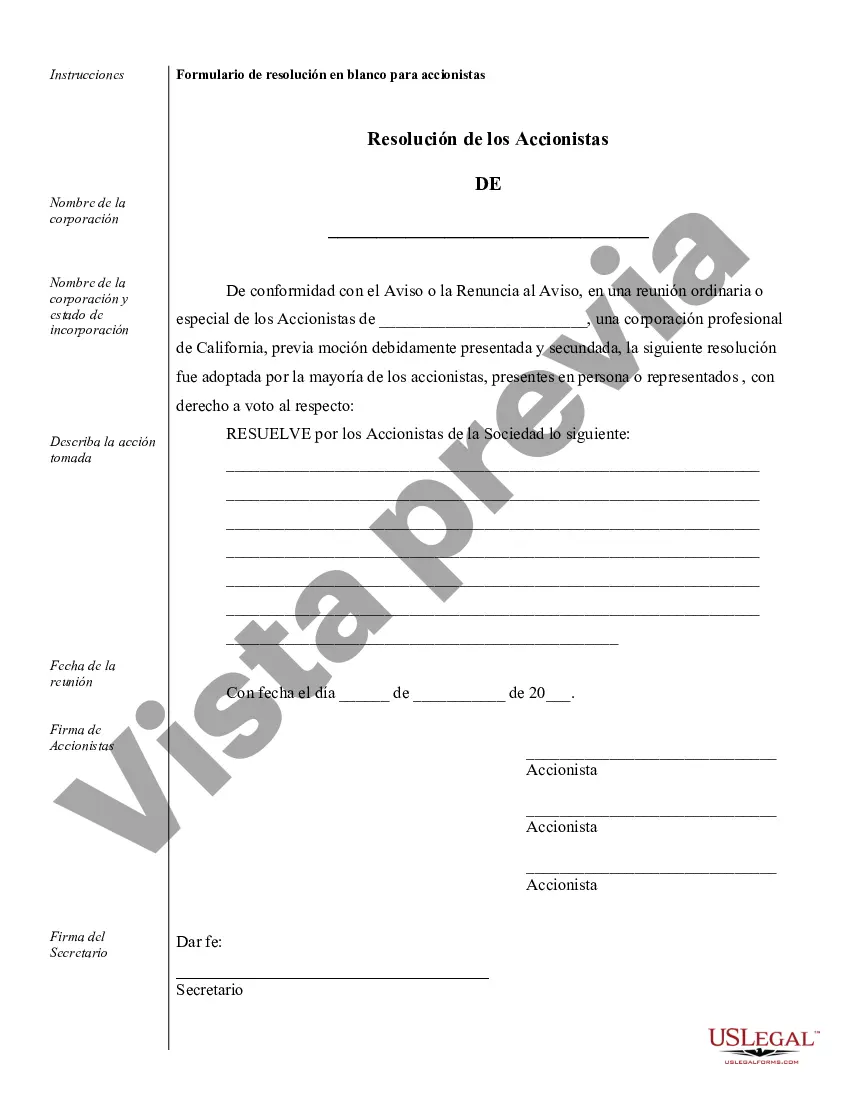

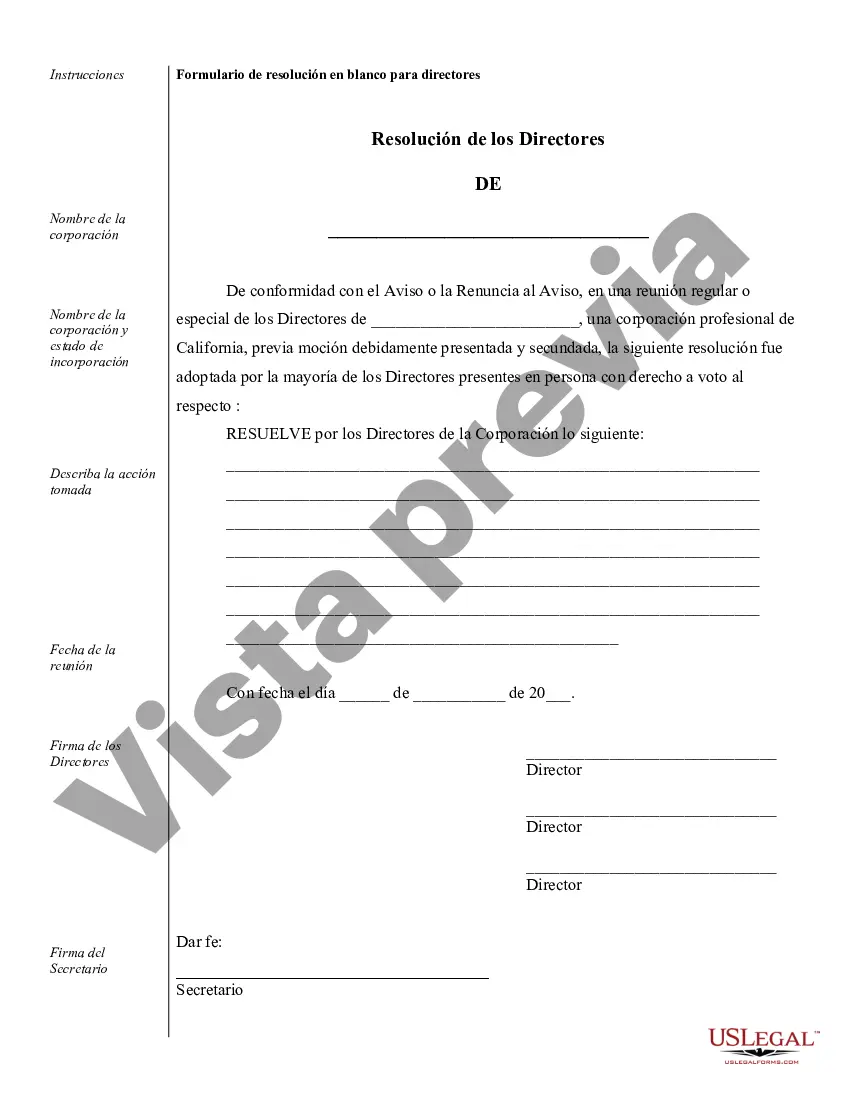

Santa Clarita Sample Corporate Records for a California Professional Corporation serve as a crucial document that outlines the legal and administrative details of the corporation's operations. These records are essential for maintaining compliance with state laws and regulations and ensuring transparency within the corporation. Below are some key types of Santa Clarita Sample Corporate Records that are commonly required for a California Professional Corporation: 1. Articles of Incorporation: These records establish the existence of the corporation and include details such as the corporation's name, purpose, registered agent, capital stock, and address. 2. Bylaws: Bylaws serve as the governing rules for the corporation and provide guidelines for how the corporation will operate. They specify the powers and responsibilities of the directors, officers, and shareholders, as well as the procedures for meetings and decision-making. 3. Shareholder Agreements: Shareholder agreements outline the rights and obligations of the corporation's shareholders and detail matters such as stock ownership, dividend policies, shareholders' voting rights, and transfer of shares. 4. Board of Directors' Resolutions: These records document the decisions made by the board of directors relating to various corporate matters, such as authorizing significant transactions, approving contracts, appointing officers, and declaring dividends. 5. Minutes of Shareholders' and Directors' Meetings: Minutes provide a detailed record of discussions, actions, and decisions made during shareholders' and directors' meetings. They document important matters such as the election or removal of directors, approval of financial statements, or adoption of new policies. 6. Stock Ledger: The stock ledger keeps track of the corporation's stock issuance, transfers, and ownership records. It includes details such as shareholders' names, addresses, number of shares held, and dates of acquisitions or transfers. 7. Financial Records: Financial records, including balance sheets, income statements, and cash flow statements, demonstrate the financial health and performance of the corporation. These records help monitor revenue, expenses, assets, and liabilities. 8. Resolutions for Certain Corporate Actions: These records are necessary to document decisions made by the shareholders or board of directors regarding significant corporate actions, such as amendment of articles of incorporation, changes to the corporation's capital structure, or the dissolution of the corporation. Santa Clarita Sample Corporate Records for a California Professional Corporation are vital for ensuring legal compliance and maintaining good corporate governance practices. These records provide a clear record of the corporation's activities, decision-making processes, and financial information, which can be examined by relevant authorities, shareholders, or potential investors. It is essential for corporations to maintain accurate and up-to-date records to facilitate smooth operations and minimize legal risks.

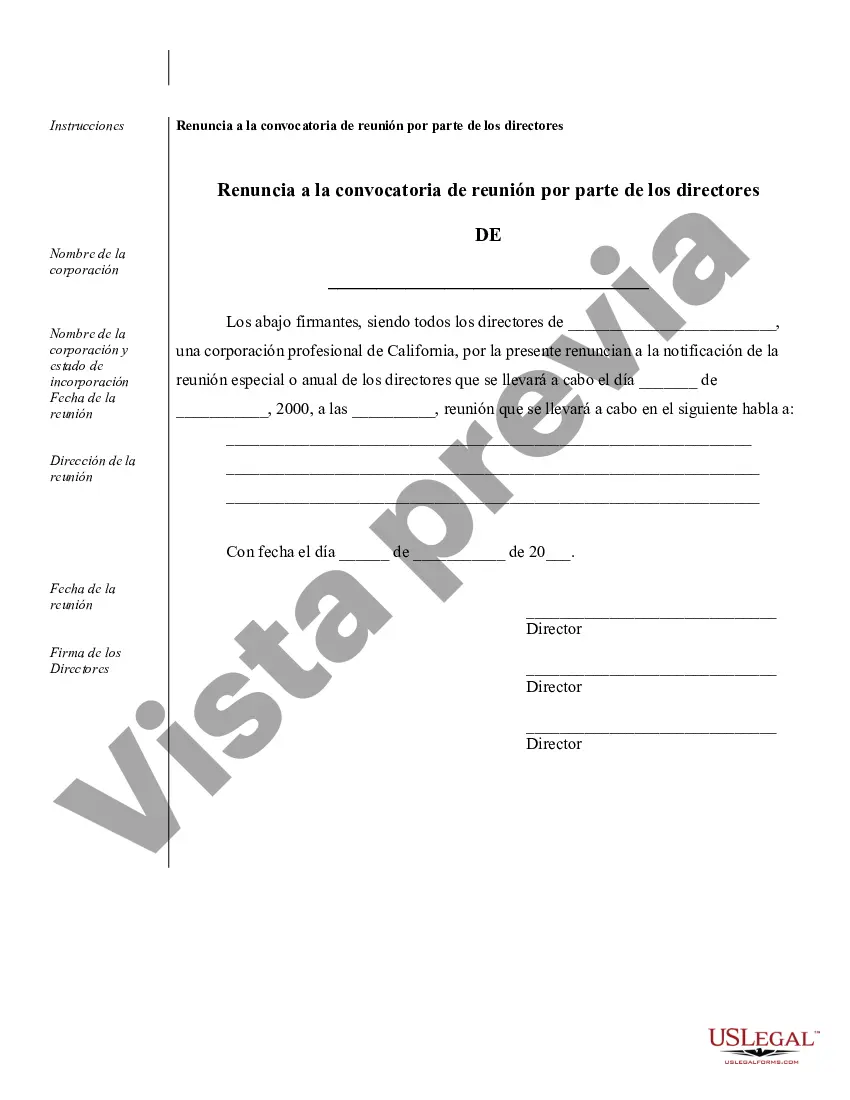

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Santa Clarita Ejemplos de registros corporativos para una corporación profesional de California - Sample Corporate Records for a California Professional Corporation

Description

How to fill out Santa Clarita Ejemplos De Registros Corporativos Para Una Corporación Profesional De California?

Utilize the US Legal Forms to gain immediate access to any form template you require.

Our convenient website featuring thousands of document templates simplifies the process of locating and acquiring nearly any document sample you might need.

You can save, complete, and validate the Santa Clarita Sample Corporate Records for a California Professional Corporation within minutes instead of spending hours searching the internet for a suitable template.

Leveraging our collection is an excellent approach to enhancing the security of your record filing.

If you do not yet have an account, follow these steps.

Visit the page containing the template you need. Make sure it is the template you intended to find: verify its title and description, and use the Preview option if accessible. Otherwise, utilize the Search bar to locate the required one.

- Our knowledgeable attorneys routinely review all records to verify that the templates are applicable for a specific area and comply with updated laws and regulations.

- How can you obtain the Santa Clarita Sample Corporate Records for a California Professional Corporation? If you already have a subscription, simply Log In to your account.

- The Download option will be accessible for all the samples you examine. Additionally, you can locate all previously saved documents in the My documents section.