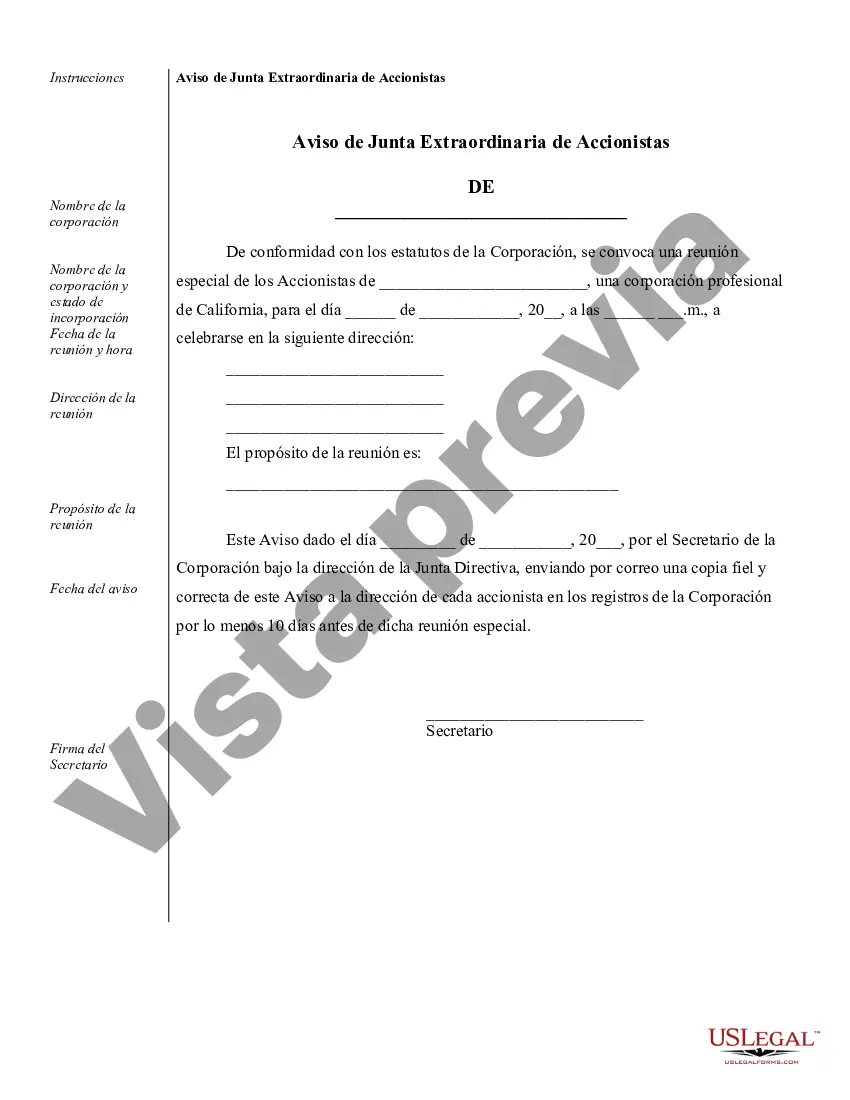

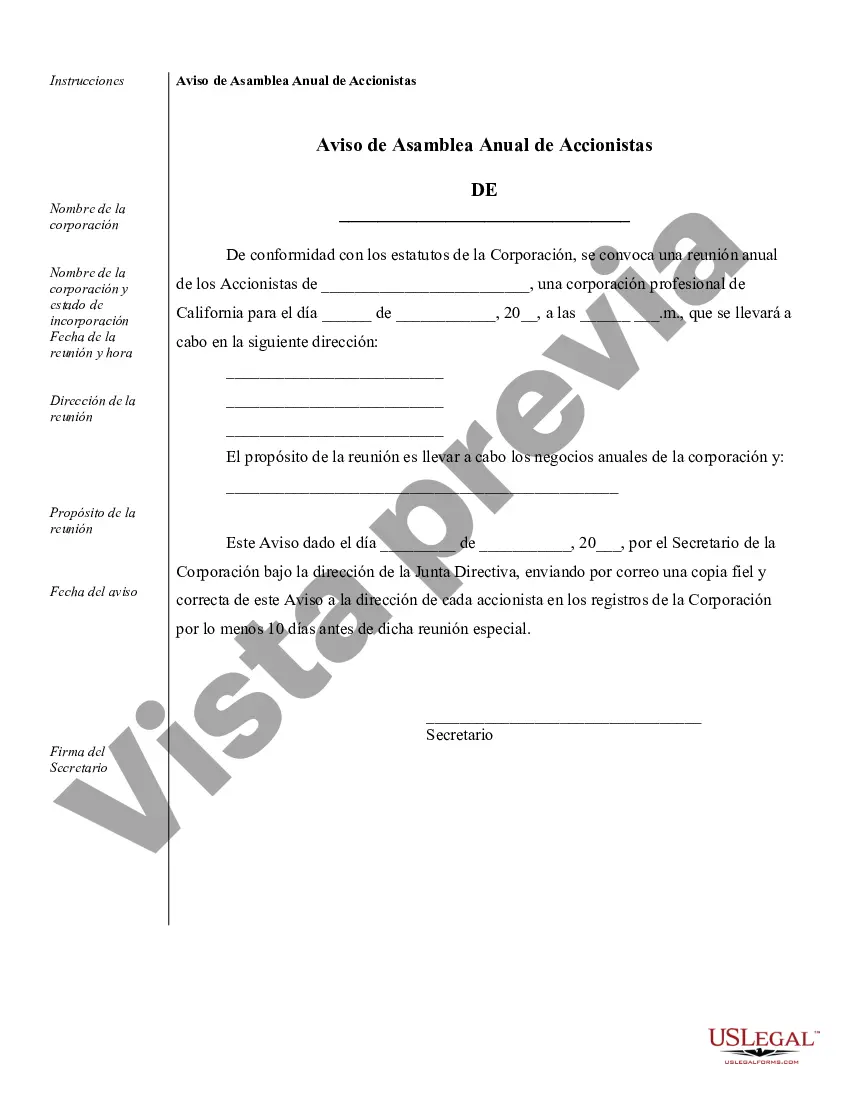

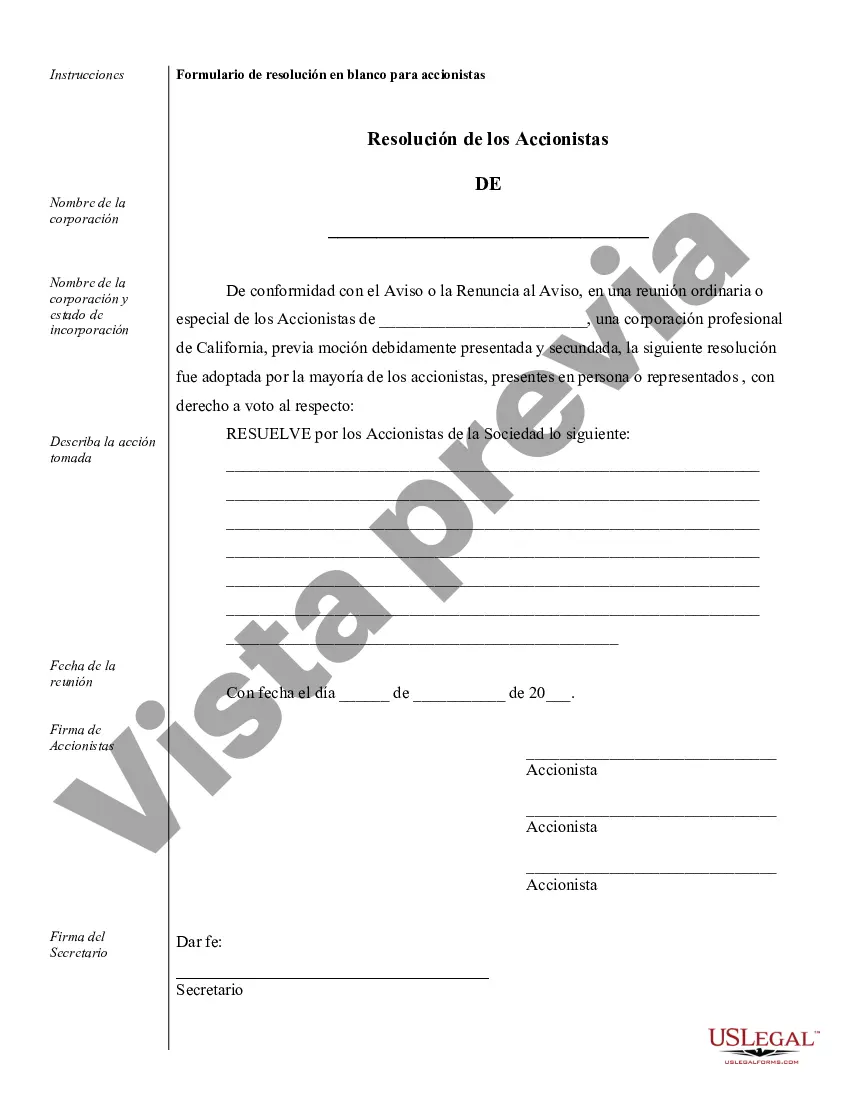

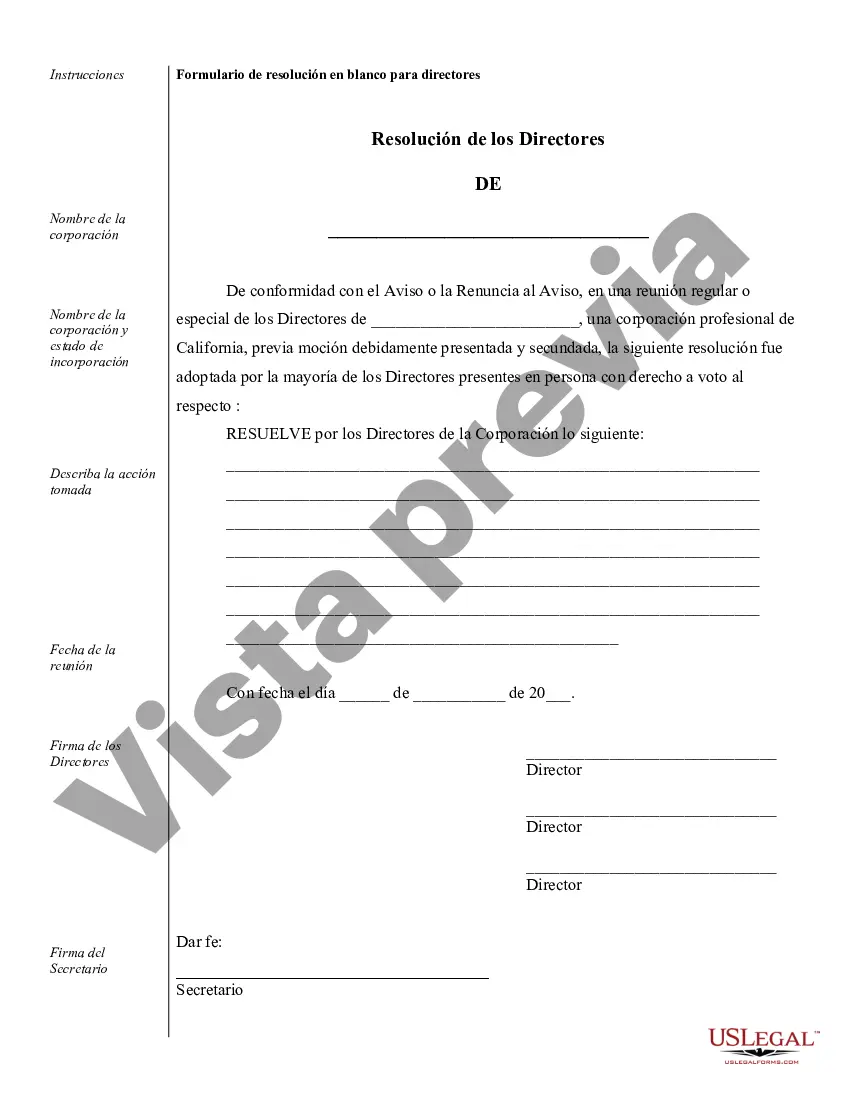

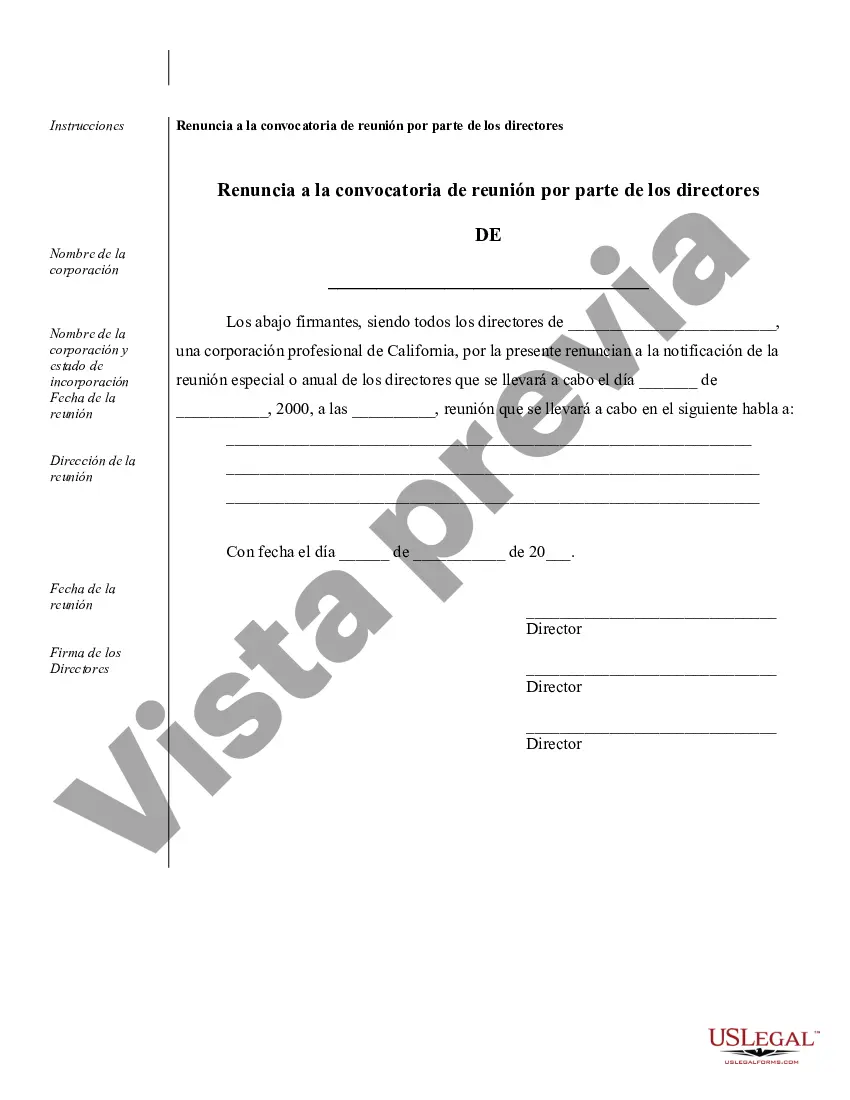

Title: Understanding Temecula Sample Corporate Records for a California Professional Corporation Introduction: Temecula Sample Corporate Records for a California Professional Corporation are essential documents that portray the legal and operational framework of a professional corporation registered in Temecula, California. These records serve as evidence of the corporation's compliance with state laws and provide transparency and accountability to shareholders, employees, and regulatory bodies. In this article, we will discuss the various types of Temecula Sample Corporate Records that exist and their significance within the corporate environment. 1. Articles of Incorporation: The Articles of Incorporation is a foundational document that establishes the existence of the professional corporation. It includes information such as the corporation's name, purpose, registered agent, authorized shares, and names of initial directors and officers. 2. Bylaws: Bylaws outline the rules and internal regulations governing the corporation's day-to-day operations, including guidelines for shareholder meetings, election procedures, board of director functions, voting rights, and more. They are specific to each corporation and serve as a practical guide for corporate governance. 3. Meeting Minutes: Meeting minutes provide a detailed account of discussions, decisions, and actions taken during board of directors, shareholder, or committee meetings. These minutes showcase the corporation's decision-making process and can be referenced in the future for legal compliance, historical purposes, or dispute resolutions. 4. Stock Transfer Ledger: The stock transfer ledger records all stock transactions, including the issuance, transfer, or repurchase of shares, along with relevant details such as the names of shareholders involved and the date of transaction. This ledger is vital for maintaining an accurate record of ownership within the corporation. 5. Financial Statements: Financial statements, such as balance sheets, income statements, and cash flow statements, provide a comprehensive overview of the corporation's financial status, including assets, liabilities, revenues, and expenses. These statements are crucial for analyzing financial health, attracting potential investors, and ensuring compliance with accounting and taxation regulations. 6. Shareholder Agreements: Shareholder agreements set out the rights, obligations, and responsibilities of individual shareholders within the corporation. These agreements may cover topics like voting rights, dividend distribution policies, share transfer restrictions, dispute resolutions, and buy-sell provisions. They help regulate relationships between shareholders and ensure smooth operation of the corporation. 7. Tax Filings: Various tax-related documents, such as federal and state tax returns, payroll tax forms, and sales tax reports, are important for maintaining compliance with taxation regulations at both the state and federal levels. These records provide evidence of the corporation's financial activities and fulfill its obligations towards tax authorities. Conclusion: Temecula Sample Corporate Records for a California Professional Corporation encompass a range of crucial documents that reveal the corporation's legal and operational structure. From the Articles of Incorporation, Bylaws, and Meeting Minutes to Stock Transfer Ledgers, Financial Statements, Shareholder Agreements, and Tax Filings, these records ensure transparency, compliance, and effective governance within the corporation. Proper maintenance of these records is essential for smooth operations and safeguarding the interests of shareholders, employees, and regulatory entities.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Temecula Ejemplos de registros corporativos para una corporación profesional de California - Sample Corporate Records for a California Professional Corporation

Description

How to fill out Temecula Ejemplos De Registros Corporativos Para Una Corporación Profesional De California?

Are you looking for a reliable and affordable legal forms provider to get the Temecula Sample Corporate Records for a California Professional Corporation? US Legal Forms is your go-to option.

Whether you require a simple arrangement to set regulations for cohabitating with your partner or a set of documents to move your separation or divorce through the court, we got you covered. Our website offers over 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t generic and framed in accordance with the requirements of separate state and county.

To download the form, you need to log in account, find the required form, and hit the Download button next to it. Please take into account that you can download your previously purchased document templates at any time from the My Forms tab.

Are you new to our platform? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Find out if the Temecula Sample Corporate Records for a California Professional Corporation conforms to the laws of your state and local area.

- Read the form’s description (if provided) to find out who and what the form is intended for.

- Restart the search if the form isn’t suitable for your specific scenario.

Now you can create your account. Then select the subscription plan and proceed to payment. Once the payment is done, download the Temecula Sample Corporate Records for a California Professional Corporation in any provided format. You can return to the website at any time and redownload the form without any extra costs.

Getting up-to-date legal documents has never been easier. Give US Legal Forms a try now, and forget about wasting hours researching legal paperwork online once and for all.