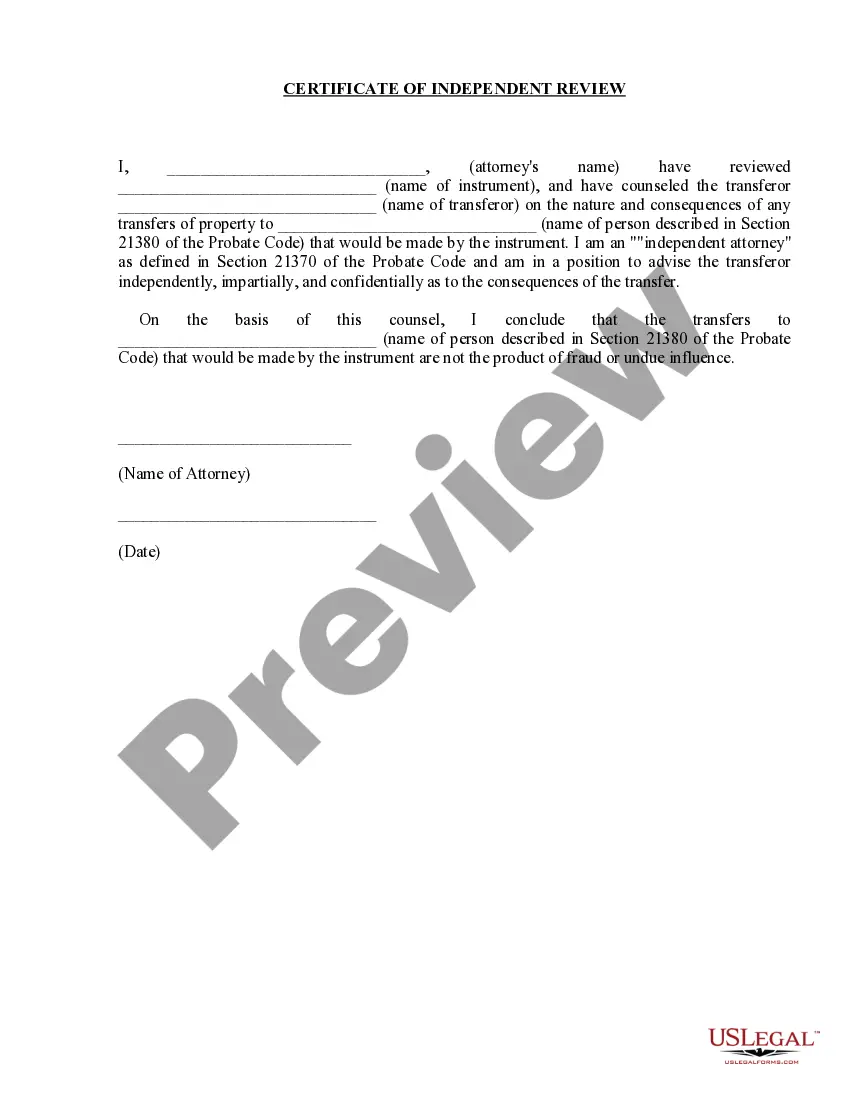

The Sunnyvale California Certificate of Independent Review for Do native Transfers is an official legal document that serves as a safeguard to ensure transparency and fairness in the process of transferring gifts or assets by donors to individuals, organizations, or charities. This certificate plays a vital role in the estate planning, trust administration, and probate processes in Sunnyvale, California. It helps protect the rights and interests of all parties involved, including the donors, beneficiaries, and the public. The purpose of the Certificate of Independent Review is to provide an independent evaluation and assessment of the proposed do native transfer to determine its legality, appropriateness, and compliance with applicable laws and regulations. It ensures that the transfer does not involve any undue influence, fraud, or coercion. The certificate is typically issued by an independent third party, such as an attorney, financial advisor, or accountant. These professionals have the knowledge, expertise, and legal understanding necessary to review and verify the details of the do native transfer. The Certificate of Independent Review includes various important elements, such as a thorough examination of the donor's capacity to make the transfer, a review of any existing wills, trusts, or other estate planning documents, an assessment of the donor's assets and liabilities, and an analysis of the intended beneficiaries and their relationship to the donor. In Sunnyvale, California, there might be different types of Certificates of Independent Review for Do native Transfers, each tailored to specific situations or circumstances. These may include: 1. General Gift Transfer Certificate: This type of certificate is used when the donor is transferring a general gift to an individual, organization, or charity. It ensures that the transfer is legally sound and properly executed. 2. Estate Planning Certificate: This certificate focuses on evaluating and reviewing the donor's entire estate planning strategy, including wills, trusts, and other assets involved in the intended transfer. It ensures that the proposed do native transfer aligns with the donor's overall estate plan. 3. Charitable Donations Certificate: Donors who intend to make charitable contributions can obtain this certificate to ensure their donations comply with the relevant tax laws and regulations. It verifies the legitimacy and appropriateness of the intended charitable transfer. 4. Asset Transfer Certificate: When a donor plans to transfer specific assets, such as real estate, stocks, or artwork, this certificate examines the legal and financial aspects of the transfer. It ensures that the assets are properly valued and transferred in accordance with the applicable laws. In conclusion, the Sunnyvale California Certificate of Independent Review for Do native Transfers plays a crucial role in safeguarding the rights and interests of all parties involved in the transfer of gifts or assets. It ensures transparency, legality, and fairness, thereby enhancing the trust and confidence of donors and beneficiaries in the transfer process.

Sunnyvale California Certificate of Independent Review for Donative Transfers

Description

How to fill out Sunnyvale California Certificate Of Independent Review For Donative Transfers?

Do you need a trustworthy and affordable legal forms supplier to get the Sunnyvale California Certificate of Independent Review for Donative Transfers? US Legal Forms is your go-to choice.

No matter if you need a simple arrangement to set regulations for cohabitating with your partner or a package of documents to advance your separation or divorce through the court, we got you covered. Our website provides more than 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t universal and framed based on the requirements of specific state and county.

To download the form, you need to log in account, find the needed template, and click the Download button next to it. Please keep in mind that you can download your previously purchased document templates at any time from the My Forms tab.

Is the first time you visit our website? No worries. You can set up an account in minutes, but before that, make sure to do the following:

- Check if the Sunnyvale California Certificate of Independent Review for Donative Transfers conforms to the regulations of your state and local area.

- Read the form’s description (if available) to learn who and what the form is intended for.

- Restart the search if the template isn’t suitable for your specific situation.

Now you can create your account. Then pick the subscription option and proceed to payment. Once the payment is done, download the Sunnyvale California Certificate of Independent Review for Donative Transfers in any available format. You can return to the website at any time and redownload the form without any extra costs.

Getting up-to-date legal documents has never been easier. Give US Legal Forms a try today, and forget about spending hours researching legal paperwork online for good.