This deed, or deed-related form, is for use in property transactions in the designated state. This document, a sample Request for Reconveyance of Deed of Trust by Individual (Category: Mortgages and Deeds of Trust), can be used in the transfer process or related task. Adapt the language to fit your circumstances. Available for download now in standard format(s). USLF control no. CA-S123F

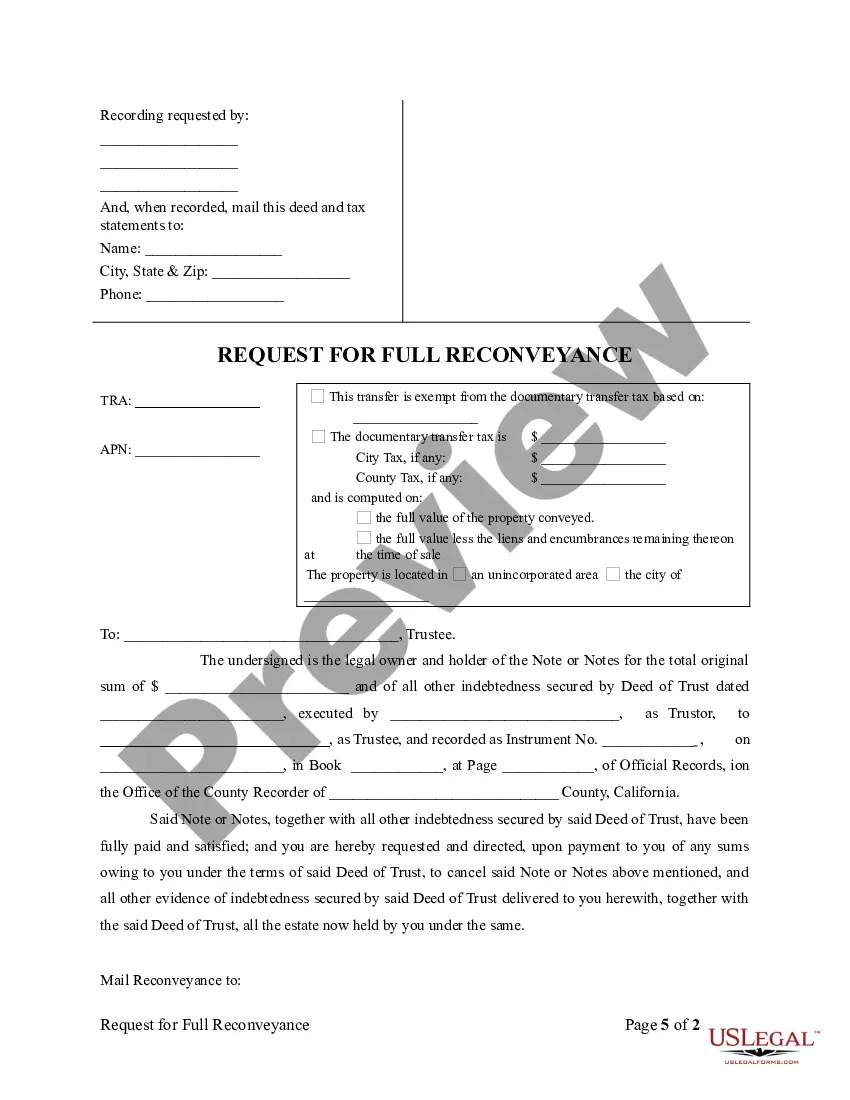

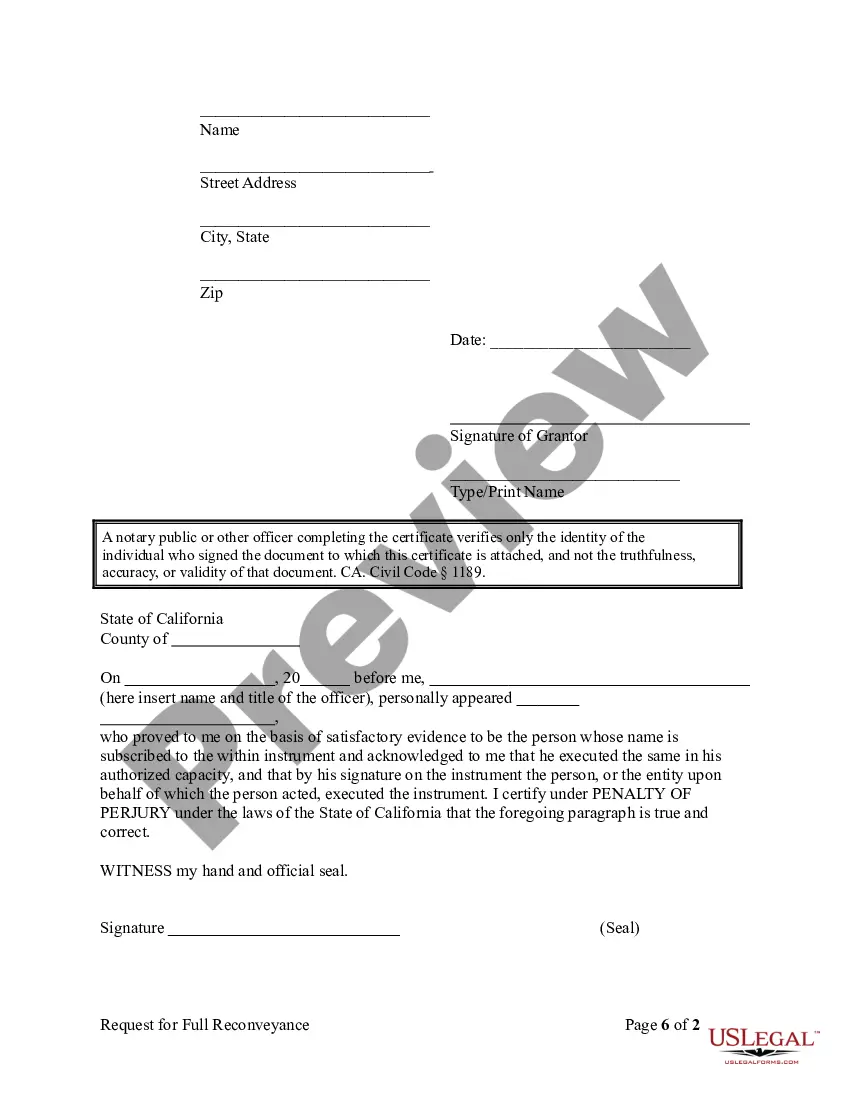

Title: Understanding Thousand Oaks California Request for Re conveyance of Deed of Trust by Individual Introduction: Thousand Oaks, California offers property owners the opportunity to request a reconveyance of their Deed of Trust by Individual, a vital legal document that signifies the satisfaction of a mortgage loan. This detailed description will delve into the purpose, process, and different types of Thousand Oaks California Request for Re conveyance of Deed of Trust by Individual. 1. What is a Thousand Oaks California Request for Re conveyance of Deed of Trust by Individual? A Thousand Oaks California Request for Re conveyance of Deed of Trust by Individual is a legal document submitted by a property owner to request the release of a lien or encumbrance on their property. This reconveyance signifies that the mortgage loan has been fully paid off. 2. Purpose and Importance: Conveying the trust to the individual is crucial as it signifies the completion of a mortgage loan and transfers full ownership of the property to the homeowner. This document ensures that the original lender releases their claim on the property, providing the owner with complete ownership rights. 3. Process of Requesting a Thousand Oaks California Re conveyance: To request a Thousand Oaks California Re conveyance of Deed of Trust by Individual, property owners must follow these steps: a. Obtain a copy of the Deed of Trust: Property owners should acquire a copy of the original Deed of Trust from the County Recorder's Office or the lender. b. Pay off the mortgage loan: The property owner must fully satisfy the mortgage loan, ensuring all outstanding balances, interest, and fees are paid. c. Prepare the request document: The property owner must draft a formal document requesting the reconveyance of the Deed of Trust. This document should be formatted as per the local legal standards, including accurate property and loan details, along with the owner's information. d. Notarize the request: The property owner needs to sign the reconveyance request in the presence of a notary public, affirming its authenticity. e. File the request: The completed and notarized request, along with any required supporting documents, should be filed with the County Recorder's Office in Thousand Oaks, California. There may be applicable filing fees that need to be paid. 4. Different Types of Thousand Oaks California Request for Re conveyance of Deed of Trust by Individual: While there are no distinct types of Thousand Oaks California Request for Re conveyance of Deed of Trust by Individual, it is important to note that reconveyance requests can vary based on the specific circumstances. Some situations that may require a distinct request include: a. Refinance Re conveyance: This type of request is made when an owner refinances their existing mortgage loan with a different lender. It allows for the release of the previous lender's claim and the establishment of a new Deed of Trust. b. Partial Re conveyance: In some cases, a homeowner may wish to release a portion of their property from the mortgage loan. This type of request allows for the release of the mortgage lien on a specific portion identified by legal description. Conclusion: A Thousand Oaks California Request for Re conveyance of Deed of Trust by Individual is a crucial step in the homeownership journey. By understanding its purpose, the process of requesting reconveyance, and considering specific situations that may require a distinct request, property owners can successfully navigate the reconveyance process in Thousand Oaks, California.Title: Understanding Thousand Oaks California Request for Re conveyance of Deed of Trust by Individual Introduction: Thousand Oaks, California offers property owners the opportunity to request a reconveyance of their Deed of Trust by Individual, a vital legal document that signifies the satisfaction of a mortgage loan. This detailed description will delve into the purpose, process, and different types of Thousand Oaks California Request for Re conveyance of Deed of Trust by Individual. 1. What is a Thousand Oaks California Request for Re conveyance of Deed of Trust by Individual? A Thousand Oaks California Request for Re conveyance of Deed of Trust by Individual is a legal document submitted by a property owner to request the release of a lien or encumbrance on their property. This reconveyance signifies that the mortgage loan has been fully paid off. 2. Purpose and Importance: Conveying the trust to the individual is crucial as it signifies the completion of a mortgage loan and transfers full ownership of the property to the homeowner. This document ensures that the original lender releases their claim on the property, providing the owner with complete ownership rights. 3. Process of Requesting a Thousand Oaks California Re conveyance: To request a Thousand Oaks California Re conveyance of Deed of Trust by Individual, property owners must follow these steps: a. Obtain a copy of the Deed of Trust: Property owners should acquire a copy of the original Deed of Trust from the County Recorder's Office or the lender. b. Pay off the mortgage loan: The property owner must fully satisfy the mortgage loan, ensuring all outstanding balances, interest, and fees are paid. c. Prepare the request document: The property owner must draft a formal document requesting the reconveyance of the Deed of Trust. This document should be formatted as per the local legal standards, including accurate property and loan details, along with the owner's information. d. Notarize the request: The property owner needs to sign the reconveyance request in the presence of a notary public, affirming its authenticity. e. File the request: The completed and notarized request, along with any required supporting documents, should be filed with the County Recorder's Office in Thousand Oaks, California. There may be applicable filing fees that need to be paid. 4. Different Types of Thousand Oaks California Request for Re conveyance of Deed of Trust by Individual: While there are no distinct types of Thousand Oaks California Request for Re conveyance of Deed of Trust by Individual, it is important to note that reconveyance requests can vary based on the specific circumstances. Some situations that may require a distinct request include: a. Refinance Re conveyance: This type of request is made when an owner refinances their existing mortgage loan with a different lender. It allows for the release of the previous lender's claim and the establishment of a new Deed of Trust. b. Partial Re conveyance: In some cases, a homeowner may wish to release a portion of their property from the mortgage loan. This type of request allows for the release of the mortgage lien on a specific portion identified by legal description. Conclusion: A Thousand Oaks California Request for Re conveyance of Deed of Trust by Individual is a crucial step in the homeownership journey. By understanding its purpose, the process of requesting reconveyance, and considering specific situations that may require a distinct request, property owners can successfully navigate the reconveyance process in Thousand Oaks, California.