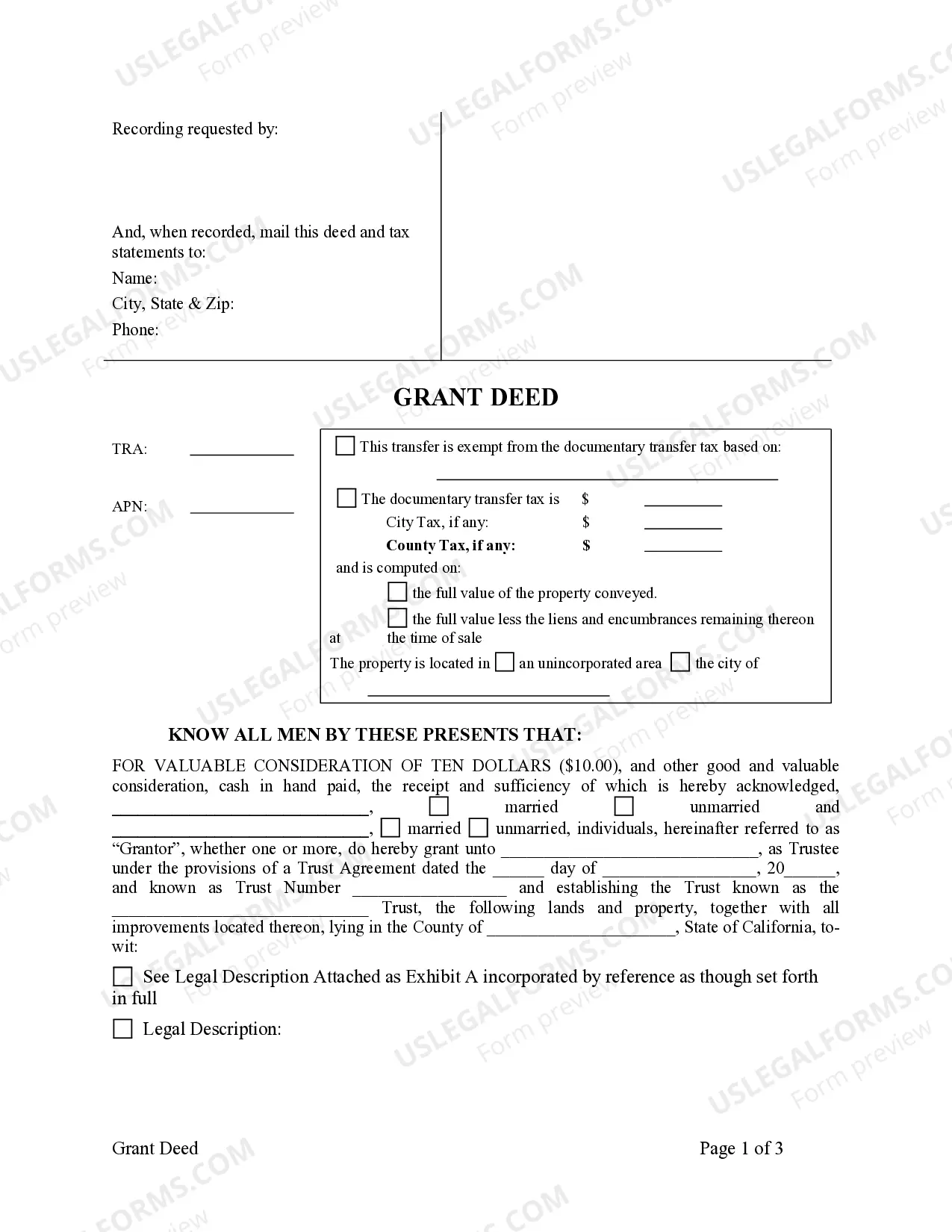

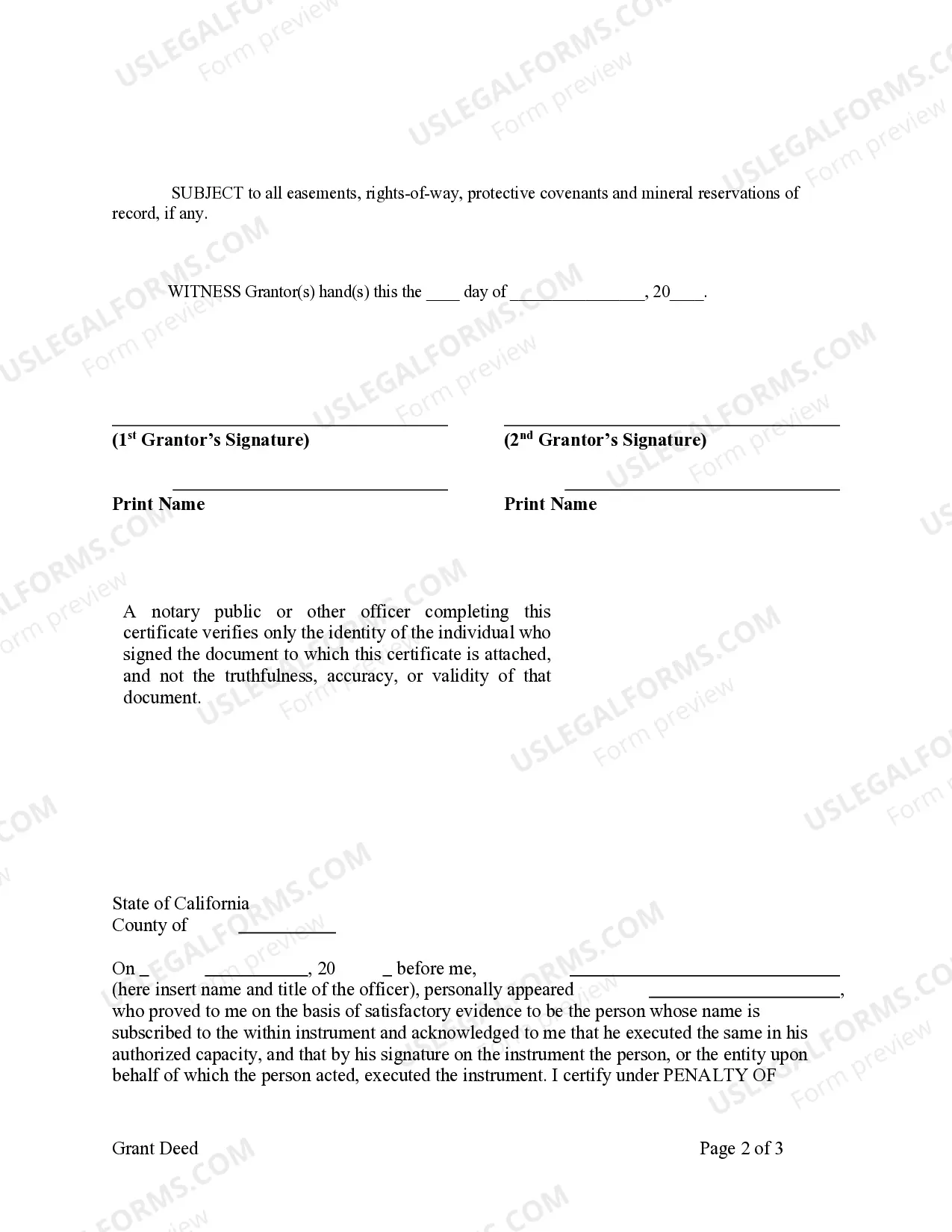

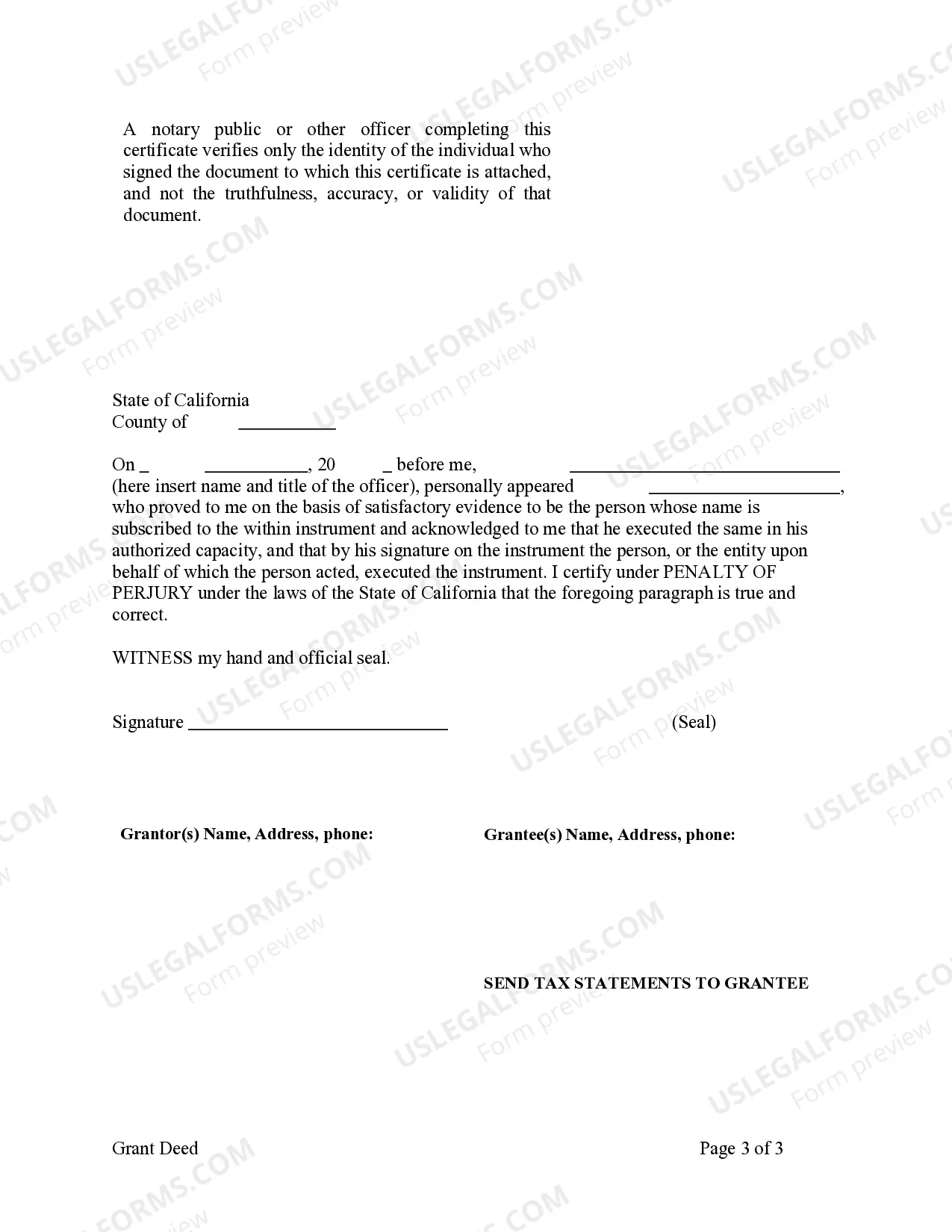

This form is a Grant Deed where the grantors are two individuals and the grantee is a trust.

Stockton California Grant Deed - Two Individuals to a Trust

Description

How to fill out California Grant Deed - Two Individuals To A Trust?

Are you searching for a reliable and budget-friendly legal forms provider to obtain the Stockton California Grant Deed - Two Individuals to a Trust? US Legal Forms is your premier choice.

Whether you require a straightforward agreement to establish guidelines for living together with your spouse or a collection of forms to facilitate your divorce through the court system, we have you covered. Our platform supplies more than 85,000 current legal document templates for personal and business usage. All templates that we provide access to are not generic and are tailored based on the specifications of various states and counties.

To acquire the form, you must Log In to your account, search for the desired template, and click the Download button adjacent to it. Please remember that you can retrieve your previously bought document templates at any time from the My documents section.

Is this your first visit to our website? No problem. You can create an account in just a few minutes, but first, ensure that you do the following: Check if the Stockton California Grant Deed - Two Individuals to a Trust meets the regulations of your state and locality. Review the form’s specifications (if available) to determine who and what the form is appropriate for. Restart the search if the template does not fit your legal situation.

Give US Legal Forms a try now, and eliminate the hassle of wasting your precious time searching for legal documents online forever.

- Now you can register your account.

- Then select the subscription plan and move ahead to payment.

- Once the payment is completed, download the Stockton California Grant Deed - Two Individuals to a Trust in any available file format.

- You can revisit the website at any time and redownload the form without incurring any additional charges.

- Obtaining current legal forms has never been simpler.

Form popularity

FAQ

To transfer a deed to a trust in California, you must first prepare a new Stockton California Grant Deed - Two Individuals to a Trust. This document must clearly state the name of the trust and the individuals involved. After signing the deed, you need to ensure it gets filed with the county recorder's office to complete the process. Utilizing services like uslegalforms can simplify the experience, providing the necessary forms and guidance along the way.

In a trust, the legal title of the property is held by the trustee, while the beneficiaries hold equitable interest. This means that the trustee manages the property according to the wishes specified in the Stockton California Grant Deed - Two Individuals to a Trust. The beneficiaries benefit from the assets without having direct ownership, which often simplifies estate planning. If you have further questions about this process, consider exploring our platform at uslegalforms to find comprehensive legal resources.

Yes, two people can own a trust, typically as co-grantors and co-trustees. This arrangement promotes collaboration, as both individuals actively participate in trust management. It’s essential that both parties agree on the terms outlined in the Stockton California Grant Deed - Two Individuals to a Trust to ensure smooth operations. By working together, they can optimize the trust's benefits for their intended beneficiaries.

Certainly, a trust can be owned by two people. When individuals create a trust together, they usually serve as co-trustees, sharing the management of the trust assets. This setup can enhance communication and decision-making about the assets included in the Stockton California Grant Deed - Two Individuals to a Trust. Utilizing a well-drafted trust agreement helps clarify each person’s rights and duties.

Yes, there can be two grantors of a trust. When two individuals create a trust together, they can both be listed as grantors on the Stockton California Grant Deed - Two Individuals to a Trust. This arrangement allows both parties to contribute assets and specify how the trust manages those assets. It’s important to ensure that both grantors fully understand their roles and responsibilities.

The best way to add someone to a deed is by using a grant deed or a quitclaim deed, clearly specifying the new owner's details. Additionally, you should ensure that all parties understand their rights and responsibilities regarding the property. For ease and clarity, utilizing a platform like US Legal Forms can simplify the process of managing a Stockton California Grant Deed - Two Individuals to a Trust.

Adding someone to a deed in California can trigger tax repercussions, particularly if the property is transferred as a gift. The new owner may need to consider property taxes based on current market value and their share of ownership. Familiarizing yourself with local regulations is essential, especially in the context of a Stockton California Grant Deed - Two Individuals to a Trust, to avoid unexpected financial burdens.

Yes, you can add someone to a deed without a lawyer by completing the appropriate deed form yourself, such as a grant deed or a quitclaim deed. Ensure you accurately fill in details like names, property descriptions, and any relevant trust information. However, consulting a legal expert can provide peace of mind and ensure compliance with local laws, particularly when dealing with a Stockton California Grant Deed - Two Individuals to a Trust.

To amend a grant deed in California, you must complete a new deed form, usually a grant deed or a quitclaim deed. It's essential to include the original property's details, including the APN and the names of the individuals involved. After filling out the form, you need to sign it, have it notarized, and record it with the county recorder's office. This process is crucial for properties associated with a Stockton California Grant Deed - Two Individuals to a Trust.

To add someone to a grant deed in California, you need to create a new grant deed that includes both names and specifies how the property will be held. After preparing the document, you must sign it in front of a notary public and file it with the county recorder's office. This process is crucial for updating your Stockton California Grant Deed - Two Individuals to a Trust smoothly.