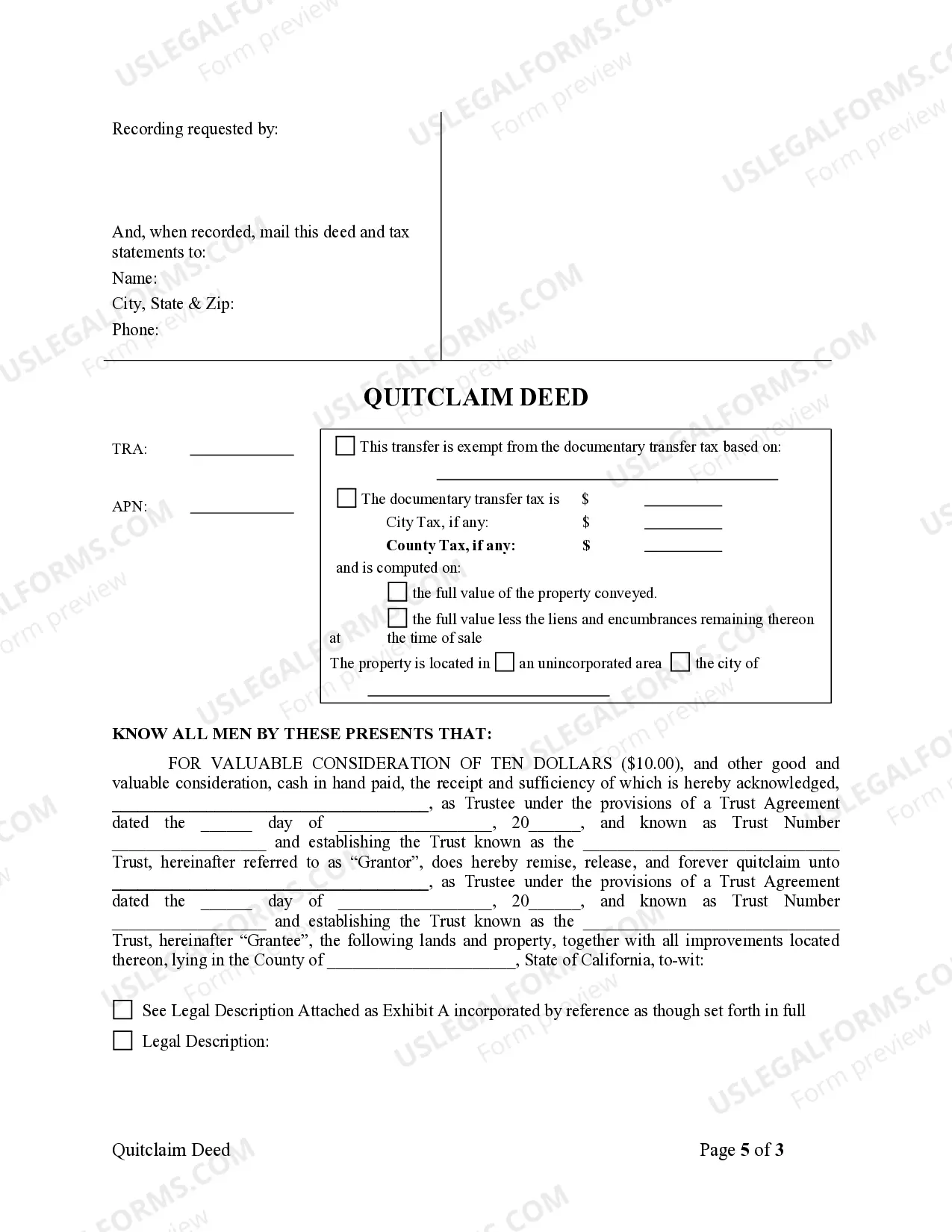

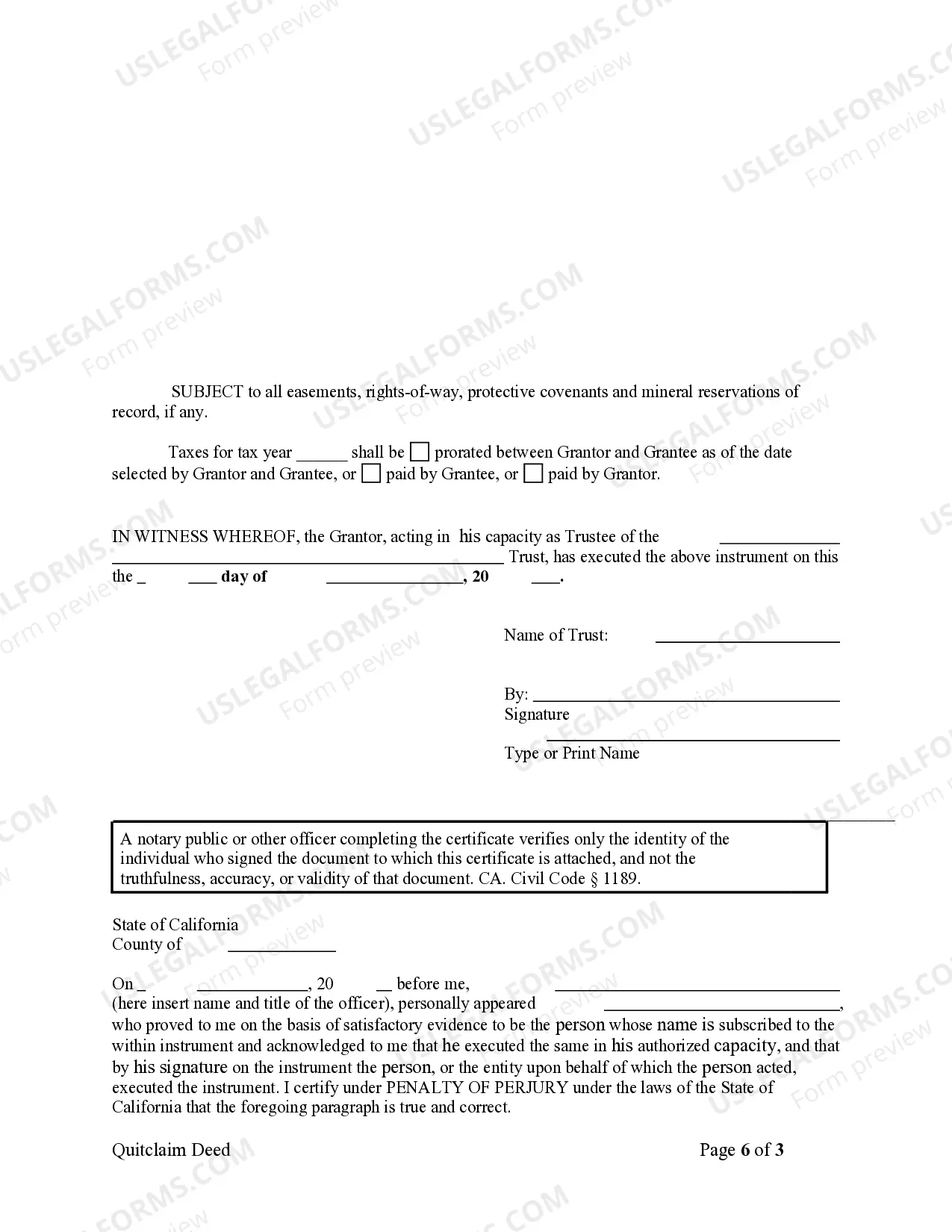

This form is a Quitclaim Deed where the grantor is a trust and the grantee is a trust.

Keywords: Antioch California, quitclaim deed, trust to trust, types Title: Understanding Antioch California Quitclaim Deed for Trust to Trust: A Comprehensive Guide Introduction: In Antioch, California, a quitclaim deed for trust to trust is an essential legal document used for transferring real property ownership between two trusts. This deed provides a straightforward and efficient method for avoiding probate and ensuring a smooth transfer of assets. In this article, we will explore the concept of a quitclaim deed for trust to trust in Antioch, California, including its purpose, benefits, and available types. 1. Purpose of a Quitclaim Deed for Trust to Trust: A quitclaim deed for trust to trust serves the purpose of transferring property ownership from one trust to another. It allows individuals to change the trustees or consolidate multiple trusts while maintaining control and avoiding potential probate disputes. This legal document effectively updates the trust ownership structure and ensures a seamless transfer process. 2. Benefits of Using a Quitclaim Deed for Trust to Trust: — Avoiding probate: By utilizing a quitclaim deed for trust to trust, property owners can keep their assets out of probate, saving time, money, and potential conflicts that may arise through the court process. — Maintaining privacy: Unlike the public probate process, a quitclaim deed for trust to trust keeps the transfer of assets discreetly within the trust structure, maintaining confidentiality for the involved parties. — Retaining control and flexibility: Trust owners have the freedom to modify the trust structure, change trustees, or consolidate multiple trusts through a quitclaim deed, ensuring flexibility and adaptability to future circumstances. 3. Types of Antioch California Quitclaim Deeds for Trust to Trust: While the concept of a quitclaim deed for trust to trust remains consistent, variations can exist depending on specific circumstances. The following are the different types of quitclaim deeds commonly used in Antioch, California: Interviewsos Trust-to-Trust Quitclaim Deed: This type of quitclaim deed is used when transferring property between two revocable living trusts. It allows individuals to make changes or adjustments to their trusts during their lifetime. — Testamentary Trust-to-Trust Quitclaim Deed: This deed is applicable when transferring property between two testamentary trusts. It comes into effect after the primary owner's passing and is typically part of an estate plan to ensure a smooth transition of property. Conclusion: The use of a quitclaim deed for trust to trust in Antioch, California offers an efficient and flexible method for transferring property ownership between trusts. It allows individuals to maintain control, avoid probate, and make changes to their estate plans or trust structure as needed. By understanding the purpose, benefits, and available types of quitclaim deeds for trust to trust, property owners can confidently navigate the transfer process while ensuring the protection and preservation of their assets.Keywords: Antioch California, quitclaim deed, trust to trust, types Title: Understanding Antioch California Quitclaim Deed for Trust to Trust: A Comprehensive Guide Introduction: In Antioch, California, a quitclaim deed for trust to trust is an essential legal document used for transferring real property ownership between two trusts. This deed provides a straightforward and efficient method for avoiding probate and ensuring a smooth transfer of assets. In this article, we will explore the concept of a quitclaim deed for trust to trust in Antioch, California, including its purpose, benefits, and available types. 1. Purpose of a Quitclaim Deed for Trust to Trust: A quitclaim deed for trust to trust serves the purpose of transferring property ownership from one trust to another. It allows individuals to change the trustees or consolidate multiple trusts while maintaining control and avoiding potential probate disputes. This legal document effectively updates the trust ownership structure and ensures a seamless transfer process. 2. Benefits of Using a Quitclaim Deed for Trust to Trust: — Avoiding probate: By utilizing a quitclaim deed for trust to trust, property owners can keep their assets out of probate, saving time, money, and potential conflicts that may arise through the court process. — Maintaining privacy: Unlike the public probate process, a quitclaim deed for trust to trust keeps the transfer of assets discreetly within the trust structure, maintaining confidentiality for the involved parties. — Retaining control and flexibility: Trust owners have the freedom to modify the trust structure, change trustees, or consolidate multiple trusts through a quitclaim deed, ensuring flexibility and adaptability to future circumstances. 3. Types of Antioch California Quitclaim Deeds for Trust to Trust: While the concept of a quitclaim deed for trust to trust remains consistent, variations can exist depending on specific circumstances. The following are the different types of quitclaim deeds commonly used in Antioch, California: Interviewsos Trust-to-Trust Quitclaim Deed: This type of quitclaim deed is used when transferring property between two revocable living trusts. It allows individuals to make changes or adjustments to their trusts during their lifetime. — Testamentary Trust-to-Trust Quitclaim Deed: This deed is applicable when transferring property between two testamentary trusts. It comes into effect after the primary owner's passing and is typically part of an estate plan to ensure a smooth transition of property. Conclusion: The use of a quitclaim deed for trust to trust in Antioch, California offers an efficient and flexible method for transferring property ownership between trusts. It allows individuals to maintain control, avoid probate, and make changes to their estate plans or trust structure as needed. By understanding the purpose, benefits, and available types of quitclaim deeds for trust to trust, property owners can confidently navigate the transfer process while ensuring the protection and preservation of their assets.