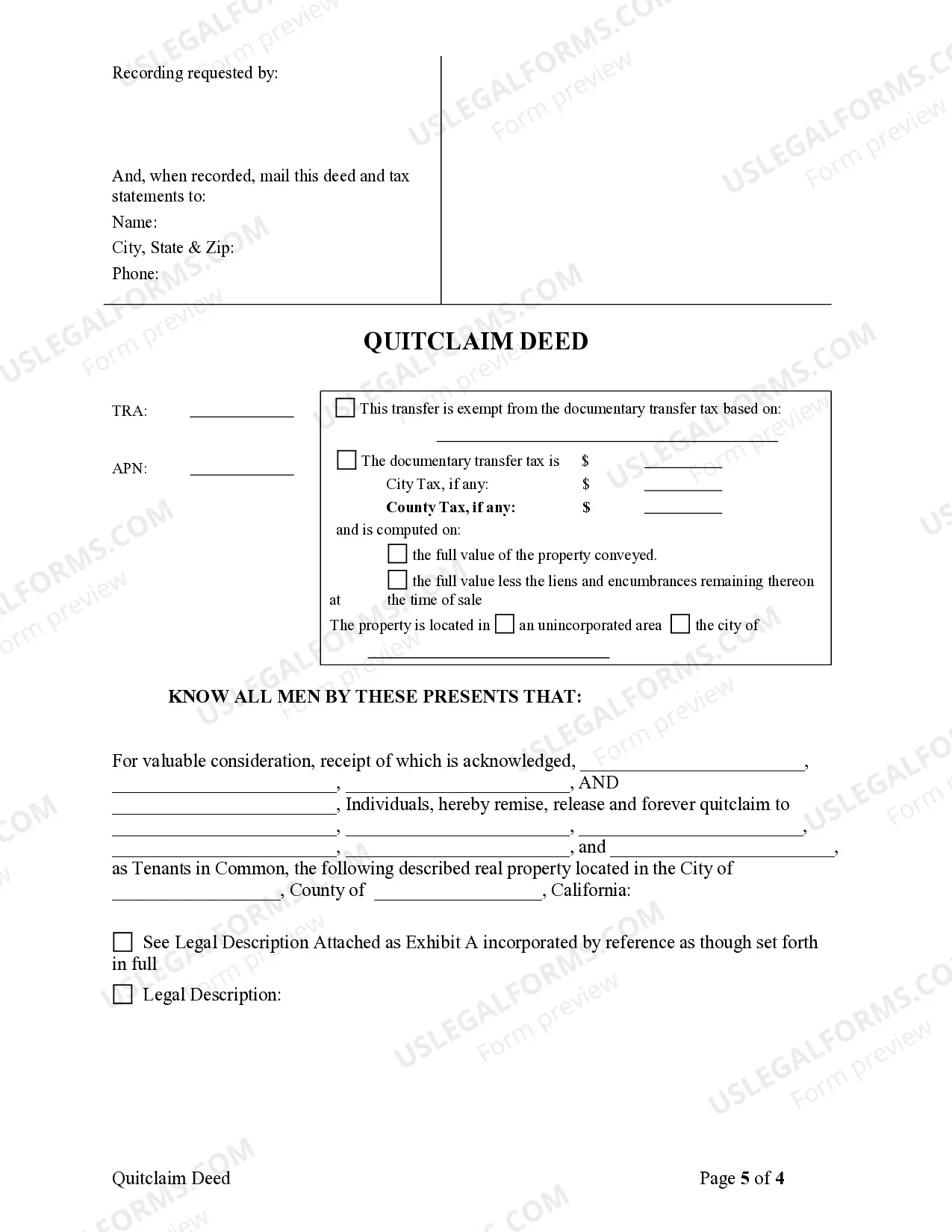

This form is a Quitclaim Deed where the grantors are four individuals and the grantees are six individuals holding title as tenants in common.

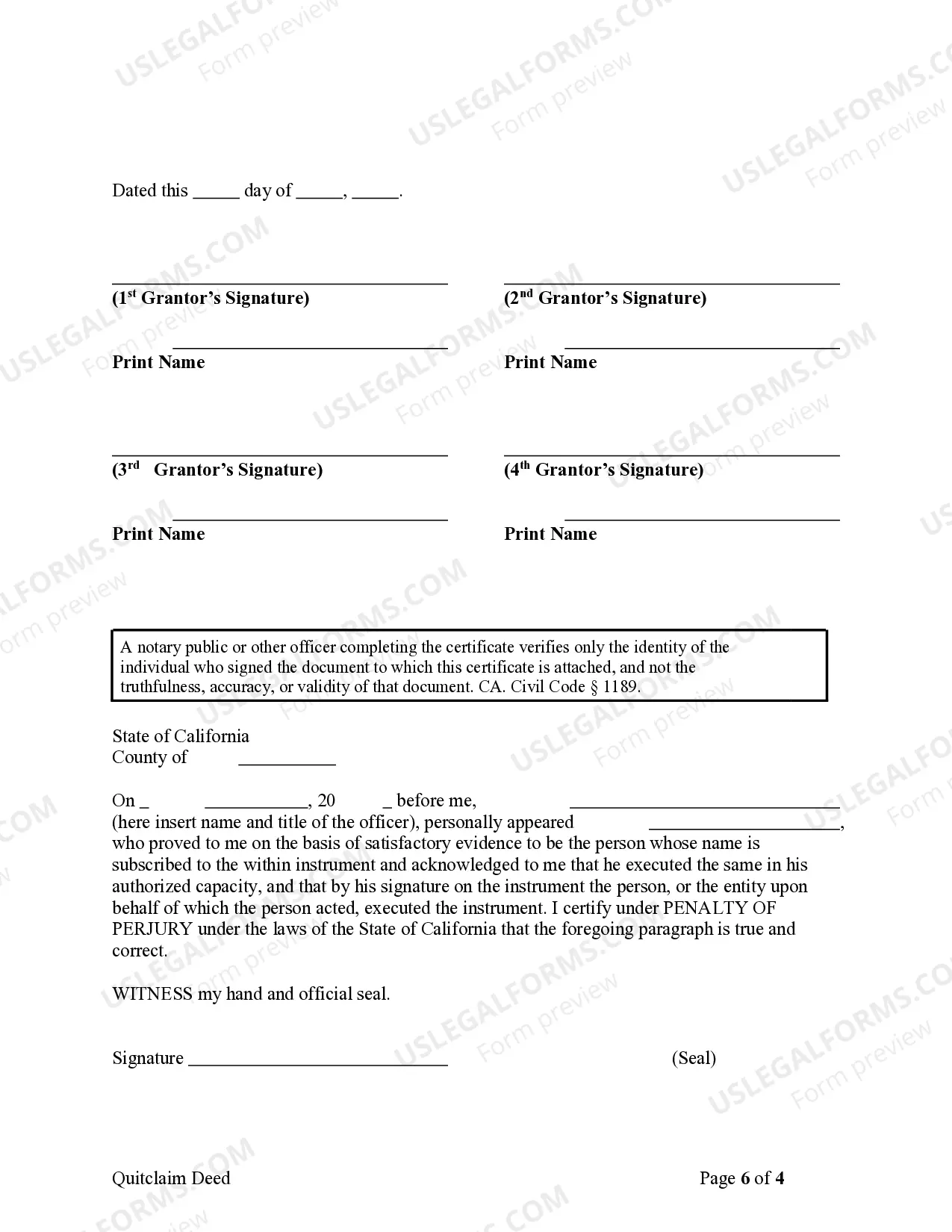

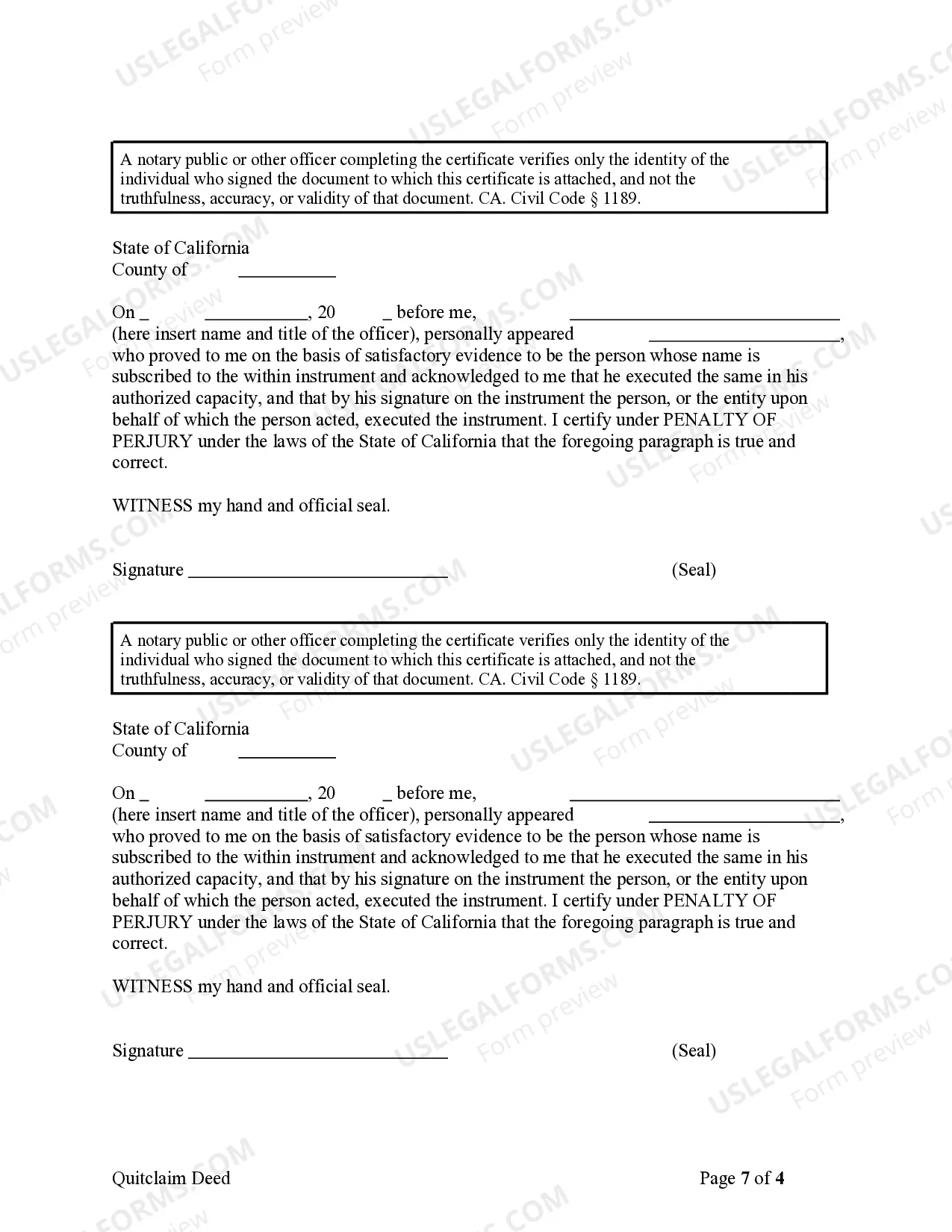

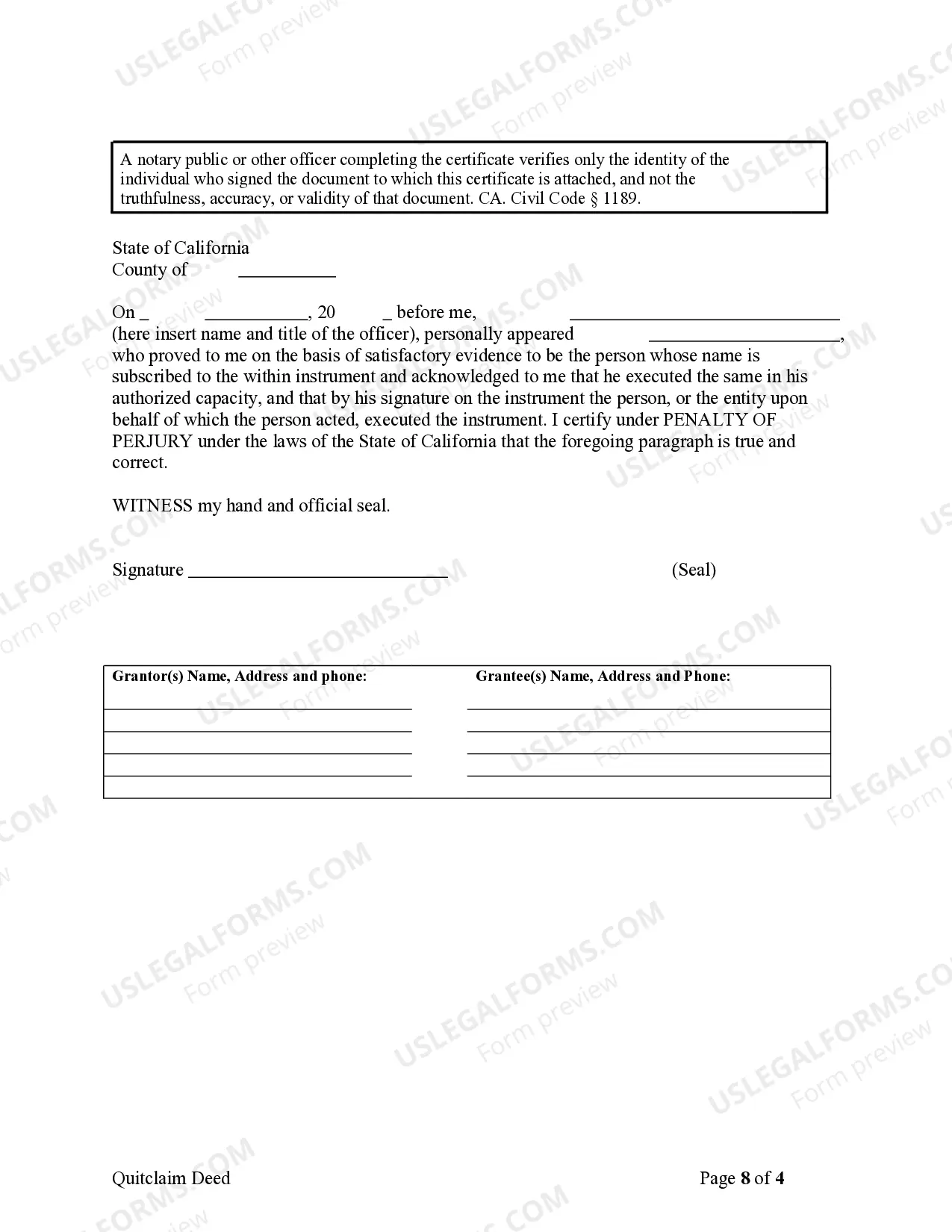

A Salinas California Quitclaim Deed for Four Individuals to Six Individuals as Tenants in Common is a legal document that transfers ownership of a property from four individuals to six individuals, with the new owners holding the property as tenants in common. This type of deed is commonly used when multiple individuals want to own a property together while retaining separate interests and rights in the property. In a tenant in Common arrangement, each owner has an undivided interest in the property, which means they have the right to use and occupy the entire property, rather than being limited to a specific portion. Additionally, if one owner passes away, their share of the property can be inherited or transferred according to their estate plan or applicable laws. There may be different versions or variations of the Salinas California Quitclaim Deed for Four Individuals to Six Individuals as Tenants in Common, including: 1. Standard Quitclaim Deed: This is the most common type of quitclaim deed, which provides a simple transfer of ownership without any guarantees or warranties regarding the title. 2. Enhanced Quitclaim Deed: This type of deed includes additional warranties or guarantees regarding the title, offering more protection to the new owners. 3. Grant Deed: While not a quitclaim deed, it is worth mentioning that a Grant Deed could also be used to transfer ownership of the property from four individuals to six individuals as tenants in common. This type of deed provides some warranties regarding the title and is more commonly used in California for property transfers. It is important to note that in California, a notary public must witness the signing of the deed, and it must be recorded with the county recorder's office where the property is located in order to be legally valid. Additionally, it is strongly recommended consulting with a qualified attorney or real estate professional to ensure the deed is prepared and executed correctly, and to address any specific legal or tax implications that may arise from this type of transfer.A Salinas California Quitclaim Deed for Four Individuals to Six Individuals as Tenants in Common is a legal document that transfers ownership of a property from four individuals to six individuals, with the new owners holding the property as tenants in common. This type of deed is commonly used when multiple individuals want to own a property together while retaining separate interests and rights in the property. In a tenant in Common arrangement, each owner has an undivided interest in the property, which means they have the right to use and occupy the entire property, rather than being limited to a specific portion. Additionally, if one owner passes away, their share of the property can be inherited or transferred according to their estate plan or applicable laws. There may be different versions or variations of the Salinas California Quitclaim Deed for Four Individuals to Six Individuals as Tenants in Common, including: 1. Standard Quitclaim Deed: This is the most common type of quitclaim deed, which provides a simple transfer of ownership without any guarantees or warranties regarding the title. 2. Enhanced Quitclaim Deed: This type of deed includes additional warranties or guarantees regarding the title, offering more protection to the new owners. 3. Grant Deed: While not a quitclaim deed, it is worth mentioning that a Grant Deed could also be used to transfer ownership of the property from four individuals to six individuals as tenants in common. This type of deed provides some warranties regarding the title and is more commonly used in California for property transfers. It is important to note that in California, a notary public must witness the signing of the deed, and it must be recorded with the county recorder's office where the property is located in order to be legally valid. Additionally, it is strongly recommended consulting with a qualified attorney or real estate professional to ensure the deed is prepared and executed correctly, and to address any specific legal or tax implications that may arise from this type of transfer.