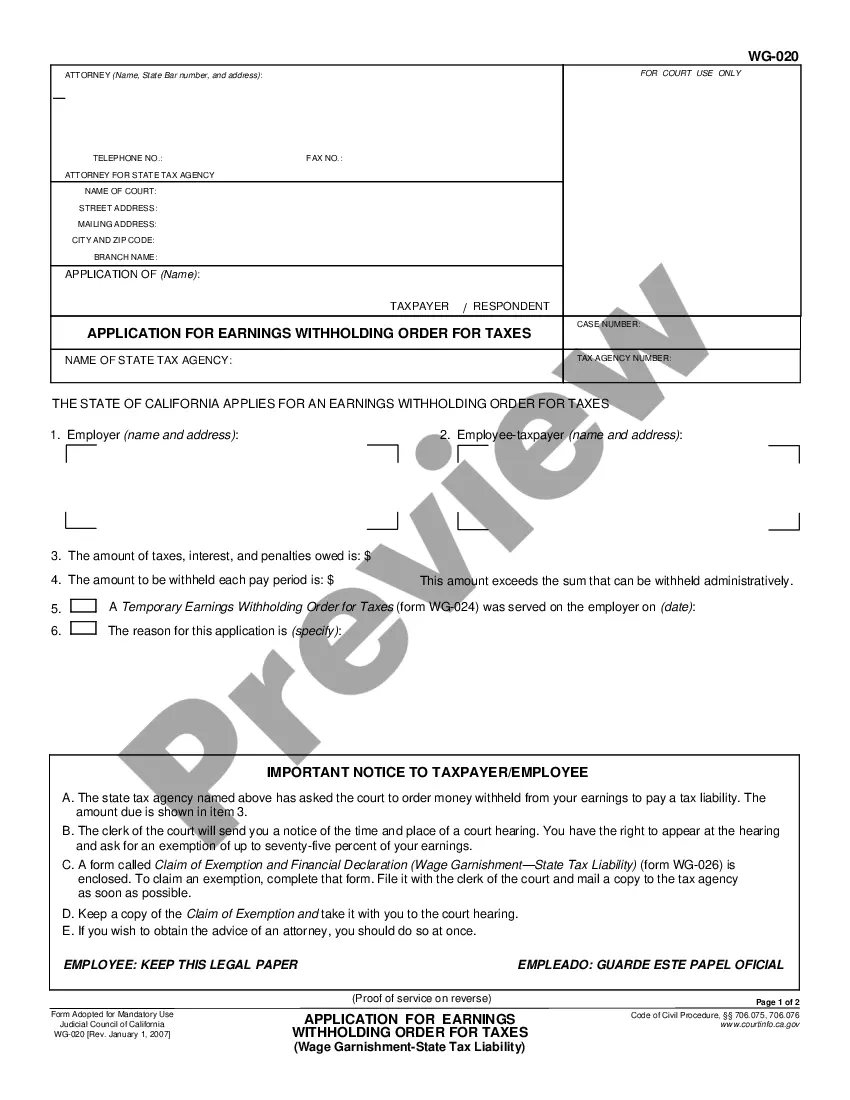

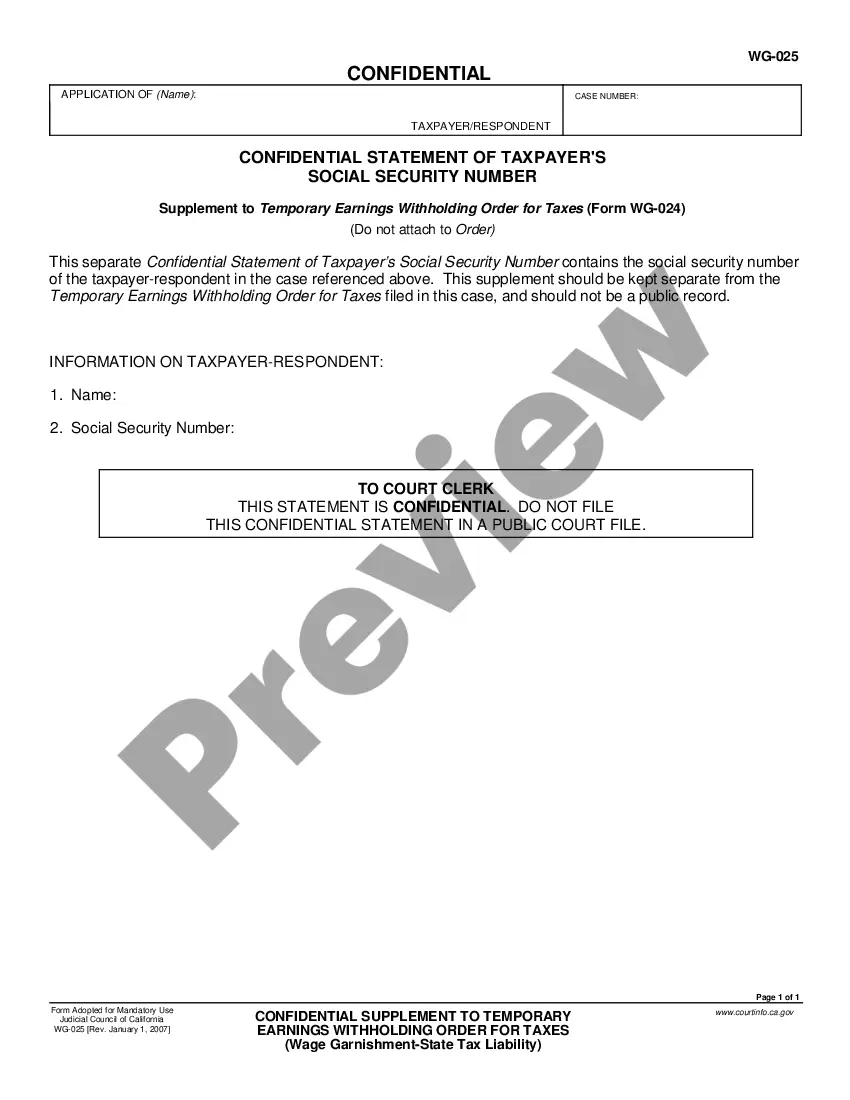

This is a California Judicial Council form that is used in Wage Garnishment - State Tax Liability proceedings. This form is a confidential supplement to the Application for Earnings Withholding Order for Taxes. It contains the social security number of the taxpayer and should be kept separate from the Application for Earnings Withholding Order for Taxes filed in the case.

Temecula California Confidential Supplement to Application for Earnings Withholding Order for Taxes

Description

How to fill out California Confidential Supplement To Application For Earnings Withholding Order For Taxes?

Acquiring confirmed templates tailored to your regional regulations can be difficult unless you utilize the US Legal Forms library.

It’s an online resource comprising over 85,000 legal forms for both private and professional purposes, encompassing various real-world situations.

All the documents are accurately sorted by area of application and jurisdictional regions, making the retrieval of the Temecula California Confidential Supplement to Application for Earnings Withholding Order for Taxes as straightforward as possible.

Maintaining documentation orderly and compliant with legal standards holds considerable significance. Leverage the US Legal Forms library to consistently have crucial document templates readily available for any requirements.

- Examine the Preview mode and document description.

- Ensure you’ve chosen the right one that suits your needs and aligns with your local jurisdiction requirements.

- Search for another template, if necessary.

- Upon identifying any discrepancies, utilize the Search tab above to find the correct document.

- If it meets your criteria, advance to the subsequent step.

Form popularity

FAQ

A withholding order is a legal requirement directing an employer to deduct a specific amount from an employee’s wages for payment of debts, such as taxes. This ensures that financial obligations are met without delay. If you are navigating a withholding order in Temecula, California, the Confidential Supplement to Application for Earnings Withholding Order for Taxes serves as a helpful tool to understand your responsibilities and options.

Filling out a California tax withholding form involves collecting your personal information, income details, and dependent information accurately. You’ll need to ensure that you understand the tax brackets and withholding allowances applicable to your situation. Using the Temecula California Confidential Supplement to Application for Earnings Withholding Order for Taxes can be an excellent resource in this process, offering guidance and support.

You may receive an earnings withholding order for various reasons, typically due to unpaid tax obligations or a court order. It's crucial to review the documentation you received to understand the specific circumstances surrounding your order. If you're in Temecula, California, the Confidential Supplement to Application for Earnings Withholding Order for Taxes can help clarify the situation and guide your next steps.

An earnings withholding order for taxes is a legal directive that commands your employer to deduct a specified amount from your paycheck for tax obligations. When you receive such an order, it is essential to understand your rights and obligations. Utilizing the Temecula California Confidential Supplement to Application for Earnings Withholding Order for Taxes can provide clarity and assist you in taking appropriate action to address the tax withholding effectively.

A notice of earnings withholding order termination indicates that your earnings withholding order has ended. This typically occurs when the debt has been satisfied or the court has issued a release. In Temecula, California, we recommend using the Confidential Supplement to Application for Earnings Withholding Order for Taxes to ensure proper processing. This document helps clarify your situation and supports a smooth termination process.

A termination of an order to withhold tax indicates that the employer is no longer required to deduct taxes from an employee’s earnings. This could result from several factors, including the resolution of debts or a change in the employee’s employment status. Utilizing the Temecula California Confidential Supplement to Application for Earnings Withholding Order for Taxes provides clarity on how to manage these changes effectively.

When an employer fails to withhold taxes, the employee may face unexpected tax liabilities and possible penalties from tax authorities. This situation can lead to financial difficulties for employees when filing their tax returns. It is essential to recognize the importance of the Temecula California Confidential Supplement to Application for Earnings Withholding Order for Taxes to avoid such pitfalls and ensure proper tax handling.

Withholding taxes means that an employer subtracts a specific amount from an employee's wages to cover the employee's tax liability. This practice helps to alleviate the burden of tax payments for employees when tax season arrives. The Temecula California Confidential Supplement to Application for Earnings Withholding Order for Taxes can help streamline the process and ensure compliance with local tax regulations.

A withholding order is an official document that instructs an employer to retain a portion of an employee's earnings for tax purposes. This order typically comes from a court or governing tax authority. By understanding the implications of a withholding order through the Temecula California Confidential Supplement to Application for Earnings Withholding Order for Taxes, both employers and employees can manage their tax responsibilities effectively.

An order to withhold taxes is a legal directive that requires an employer to deduct tax amounts from an employee's earnings before payment is issued. This mechanism ensures that tax obligations are met in a timely manner. Utilizing the Temecula California Confidential Supplement to Application for Earnings Withholding Order for Taxes helps clarify this process and ensures proper handling of withholding orders.