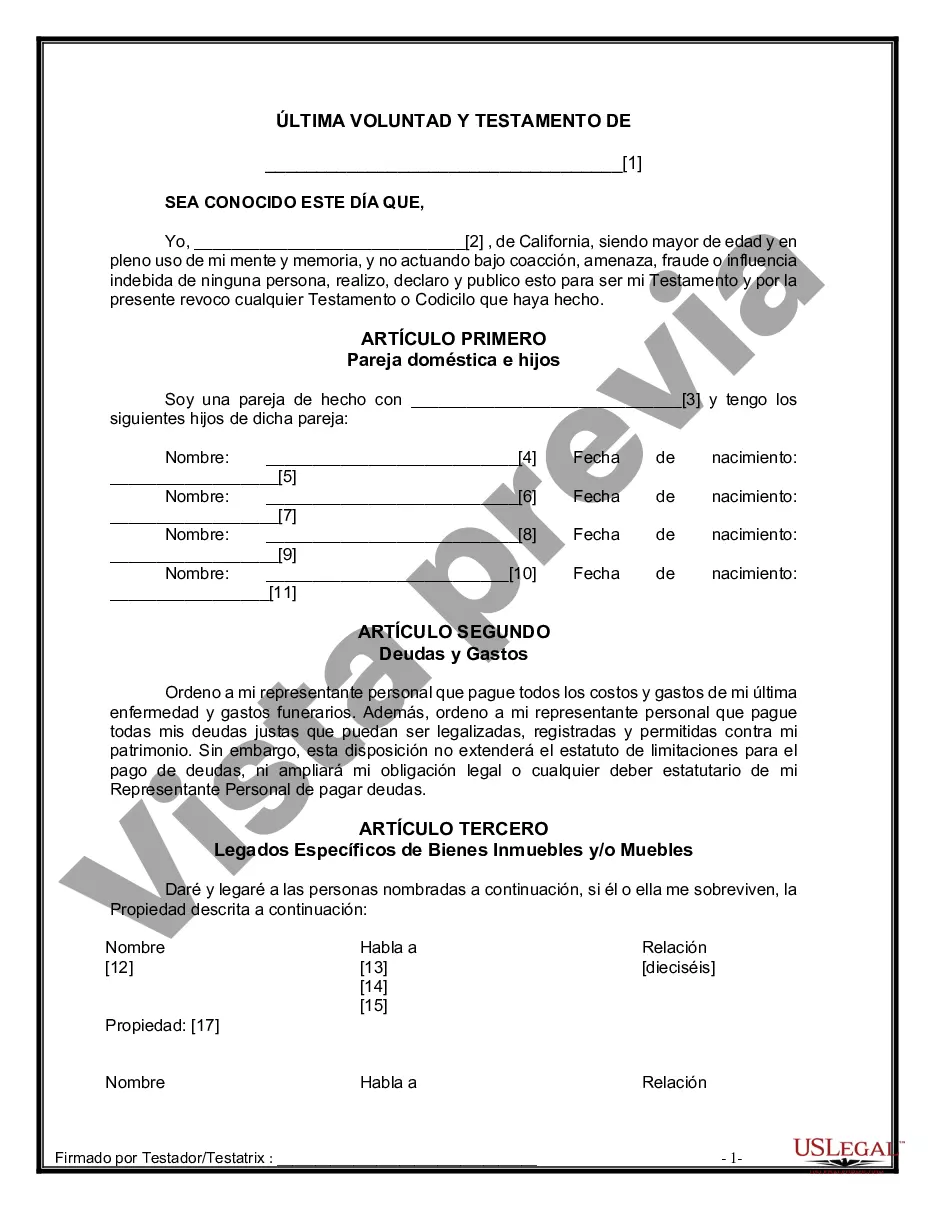

Title: Understanding the Rialto California Legal Last Will and Testament Form for a Domestic Partner with No Children Keywords: Rialto California Legal Last Will and Testament Form, Domestic Partner, No Children, Estate Planning, Beneficiaries, Testator Introduction: When it comes to estate planning, a critical document to have in place is a Last Will and Testament. This legal document not only ensures that your wishes for the distribution of your assets are carried out after your demise but also provides you with the opportunity to protect and provide for your loved ones. In Rialto, California, specific provisions are made for domestic partners with no children through the Rialto California Legal Last Will and Testament Form. Understanding the Rialto California Legal Last Will and Testament Form for a Domestic Partner with No Children: The Rialto California Legal Last Will and Testament Form designed for domestic partners with no children allows individuals in such relationships to outline their wishes regarding the distribution of their property and assets. By completing this form, you can ensure that your partner and other desired beneficiaries are provided for and protected. Key Components of the Rialto California Legal Last Will and Testament Form for a Domestic Partner with No Children: 1. Testator Information: The form requires you to provide your personal details, such as your full legal name, address, and contact information. 2. Appointment of Executor/Executrix: You can designate an executor/executrix who will be responsible for managing your estate, ensuring that your instructions are followed, and handling all legal matters regarding the administration of your assets. 3. Distribution of Assets: This section allows you to specify how you want your assets, including property, investments, bank accounts, and personal belongings, to be distributed among your domestic partner, other beneficiaries, or charitable organizations. 4. Alternate Beneficiaries: In case your domestic partner predeceases you or is unable to inherit, the form provides the option to name alternate beneficiaries to whom your assets will pass. 5. Specific Bequests: You may use this section to make specific bequests of sentimental or valuable items to individuals or organizations close to your heart. 6. Residual Estate: The form allows you to determine how any remaining assets should be distributed after specific bequests and expenses are taken care of. This can include provisions for charities, family members, or organizations. 7. Guardianship Provisions: If you have no children, it is advisable to include provisions to appoint a guardian for any pets or dependents you may have. Different Types of Rialto California Legal Last Will and Testament Form for a Domestic Partner with No Children: While there may not be different variations of the Rialto California Legal Last Will and Testament Form specifically tailored for domestic partners with no children, it is important to note that estate planning may also involve additional documents like Advance Health Care Directives, Power of Attorney, and Living Wills. These documents work in conjunction with the Last Will and Testament to comprehensively address an individual's estate planning needs. Conclusion: The Rialto California Legal Last Will and Testament Form for a Domestic Partner with No Children allows unmarried domestic partners in Rialto, California to carefully plan the distribution of their assets and ensure that their partner and other desired beneficiaries are provided for. By completing this form, individuals can ensure that their wishes are legally binding and that their estate is managed according to their specific instructions.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Rialto California Formulario de última voluntad y testamento legal para una pareja de hecho sin hijos - California Last Will and Testament for a Domestic Partner with No Children

Description

How to fill out Rialto California Formulario De última Voluntad Y Testamento Legal Para Una Pareja De Hecho Sin Hijos?

We always strive to minimize or avoid legal damage when dealing with nuanced legal or financial affairs. To accomplish this, we apply for legal solutions that, as a rule, are extremely expensive. Nevertheless, not all legal issues are as just complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based library of updated DIY legal documents addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without using services of an attorney. We provide access to legal form templates that aren’t always openly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to get and download the Rialto California Legal Last Will and Testament Form for a Domestic Partner with No Children or any other form easily and securely. Simply log in to your account and click the Get button next to it. In case you lose the form, you can always download it again in the My Forms tab.

The process is just as easy if you’re new to the platform! You can register your account within minutes.

- Make sure to check if the Rialto California Legal Last Will and Testament Form for a Domestic Partner with No Children adheres to the laws and regulations of your your state and area.

- Also, it’s crucial that you go through the form’s outline (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve ensured that the Rialto California Legal Last Will and Testament Form for a Domestic Partner with No Children is suitable for your case, you can choose the subscription plan and proceed to payment.

- Then you can download the form in any suitable file format.

For more than 24 years of our presence on the market, we’ve helped millions of people by offering ready to customize and up-to-date legal documents. Take advantage of US Legal Forms now to save efforts and resources!