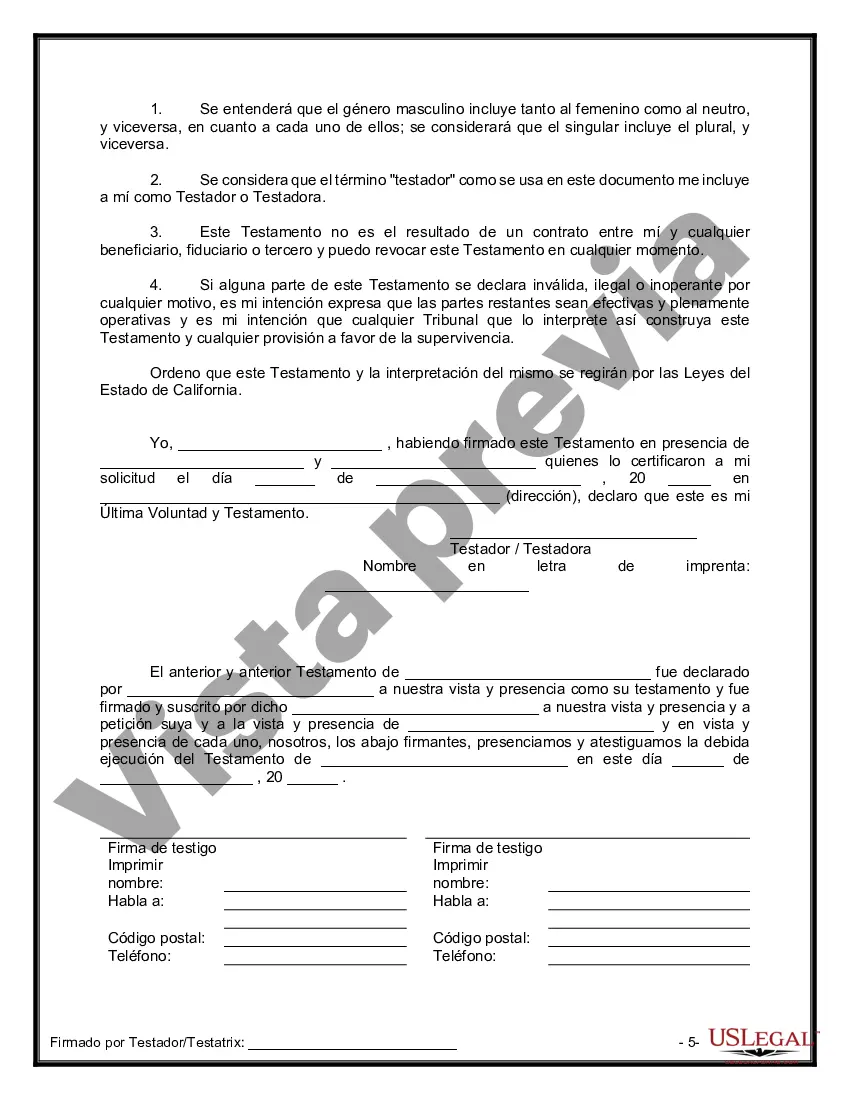

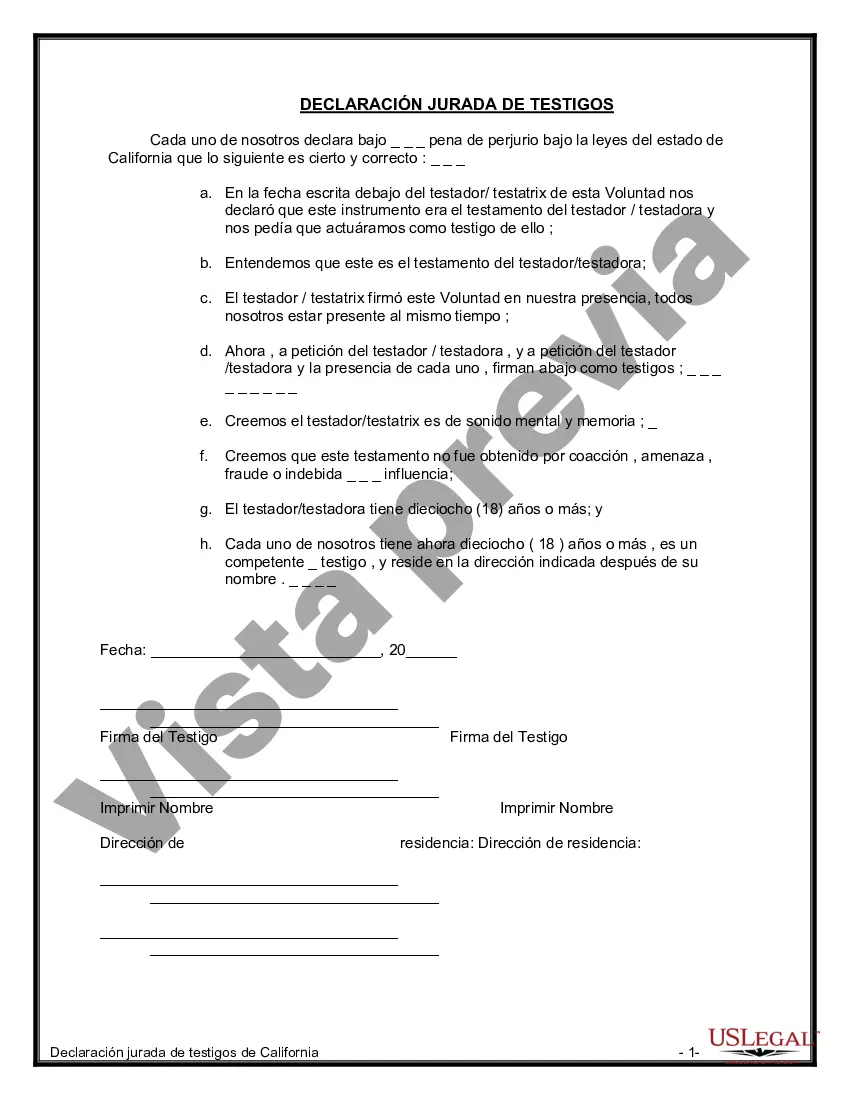

This Legal Last Will and Testament Form with Instructions, called a Pour Over Will, leaves all property that has not already been conveyed to your trust, to your trust. This form is for people who are establishing, or have established, a Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. A "pour-over" will allows a testator to set up a trust prior to his death, and provide in his will that his assets (in whole or in part) will "pour over" into that already-existing trust at the time of his death.

A Rialto California Legal Last Will and Testament Form with All Property to Trust, commonly referred to as a Pour Over Will, is a legal document used to express an individual's final wishes and distribute their assets after their death. This specific type of will has additional provisions that allow for the transfer of all property owned by the testator, also known as the Granter, into a trust. The Pour Over Will ensures that any property or assets not specifically transferred to the trust during the Granter's lifetime will be "poured over" into the trust upon their death. This includes real estate, bank accounts, investments, personal belongings, and other valuable possessions. By doing so, the Pour Over Will effectively supplements the Granter's living trust and ensures that all assets are managed and distributed according to the trust's terms. It's crucial to note that a Rialto California Legal Last Will and Testament Form with All Property to Trust may have variations or alternative names. Some possible types of this pour over will in Rialto, California, include: 1. Simple Pour Over Will: This is the basic form of a Pour Over Will, where all assets are funneled into the trust upon the Granter's death, without detailed specifications or conditions. 2. Conditional Pour Over Will: This type of will includes specific conditions or requirements that must be met for the assets to be transferred to the trust. For example, the will might stipulate that certain beneficiaries receive their share only upon reaching a certain age or completing specific educational milestones. 3. Testamentary Pour Over Will: In cases where the Granter already has an existing will, a Testamentary Pour Over Will is executed. This document amends the previous will, directing the transfer of all assets to the trust instead. 4. Joint Pour Over Will: When a couple or partners wish to establish a joint trust, they can create a Joint Pour Over Will. This will identify both parties as Granters and ensures the transfer of all their assets into the shared trust upon their deaths. It's important to consult with a qualified estate planning attorney in Rialto, California, to determine which type of Pour Over Will best suits your situation and to ensure compliance with state laws.A Rialto California Legal Last Will and Testament Form with All Property to Trust, commonly referred to as a Pour Over Will, is a legal document used to express an individual's final wishes and distribute their assets after their death. This specific type of will has additional provisions that allow for the transfer of all property owned by the testator, also known as the Granter, into a trust. The Pour Over Will ensures that any property or assets not specifically transferred to the trust during the Granter's lifetime will be "poured over" into the trust upon their death. This includes real estate, bank accounts, investments, personal belongings, and other valuable possessions. By doing so, the Pour Over Will effectively supplements the Granter's living trust and ensures that all assets are managed and distributed according to the trust's terms. It's crucial to note that a Rialto California Legal Last Will and Testament Form with All Property to Trust may have variations or alternative names. Some possible types of this pour over will in Rialto, California, include: 1. Simple Pour Over Will: This is the basic form of a Pour Over Will, where all assets are funneled into the trust upon the Granter's death, without detailed specifications or conditions. 2. Conditional Pour Over Will: This type of will includes specific conditions or requirements that must be met for the assets to be transferred to the trust. For example, the will might stipulate that certain beneficiaries receive their share only upon reaching a certain age or completing specific educational milestones. 3. Testamentary Pour Over Will: In cases where the Granter already has an existing will, a Testamentary Pour Over Will is executed. This document amends the previous will, directing the transfer of all assets to the trust instead. 4. Joint Pour Over Will: When a couple or partners wish to establish a joint trust, they can create a Joint Pour Over Will. This will identify both parties as Granters and ensures the transfer of all their assets into the shared trust upon their deaths. It's important to consult with a qualified estate planning attorney in Rialto, California, to determine which type of Pour Over Will best suits your situation and to ensure compliance with state laws.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.