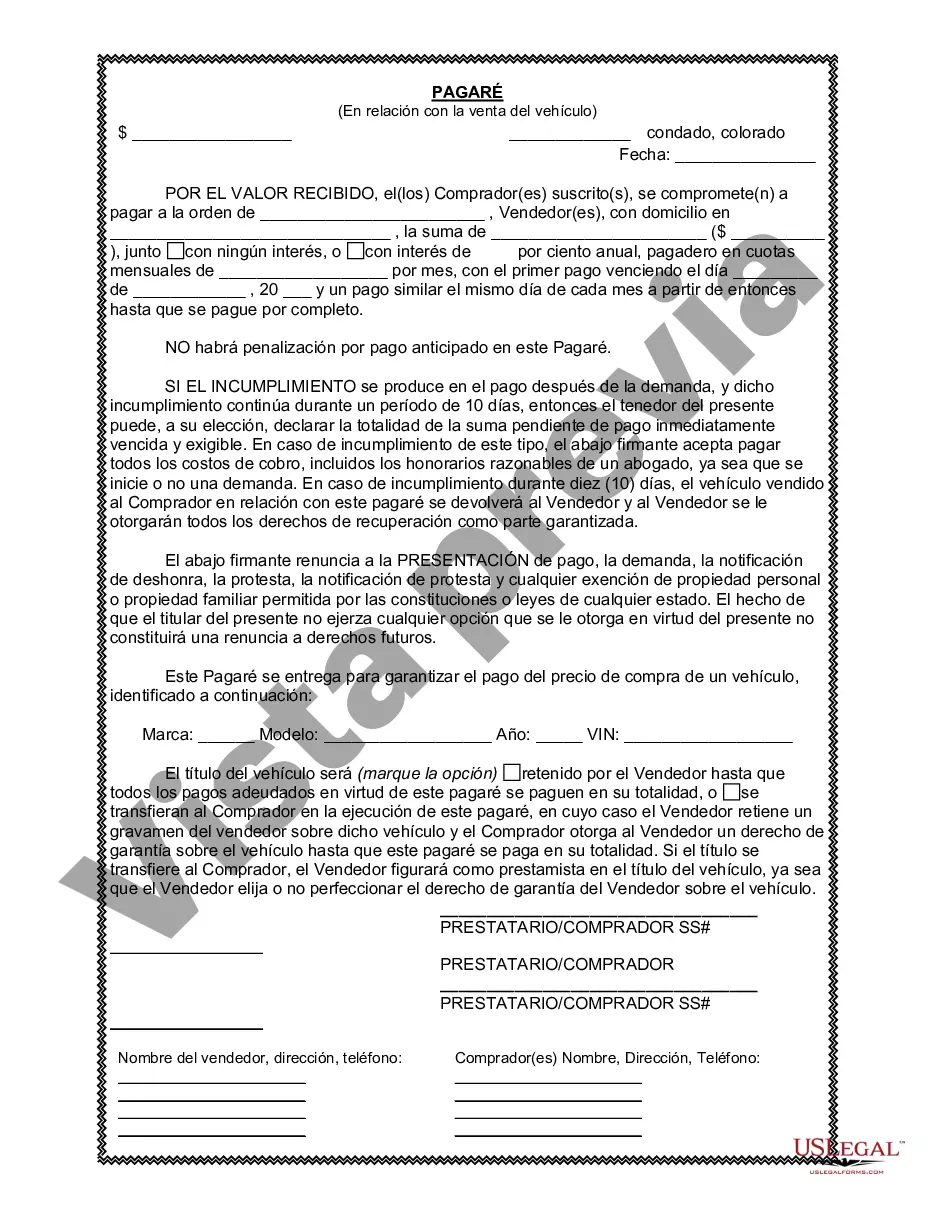

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

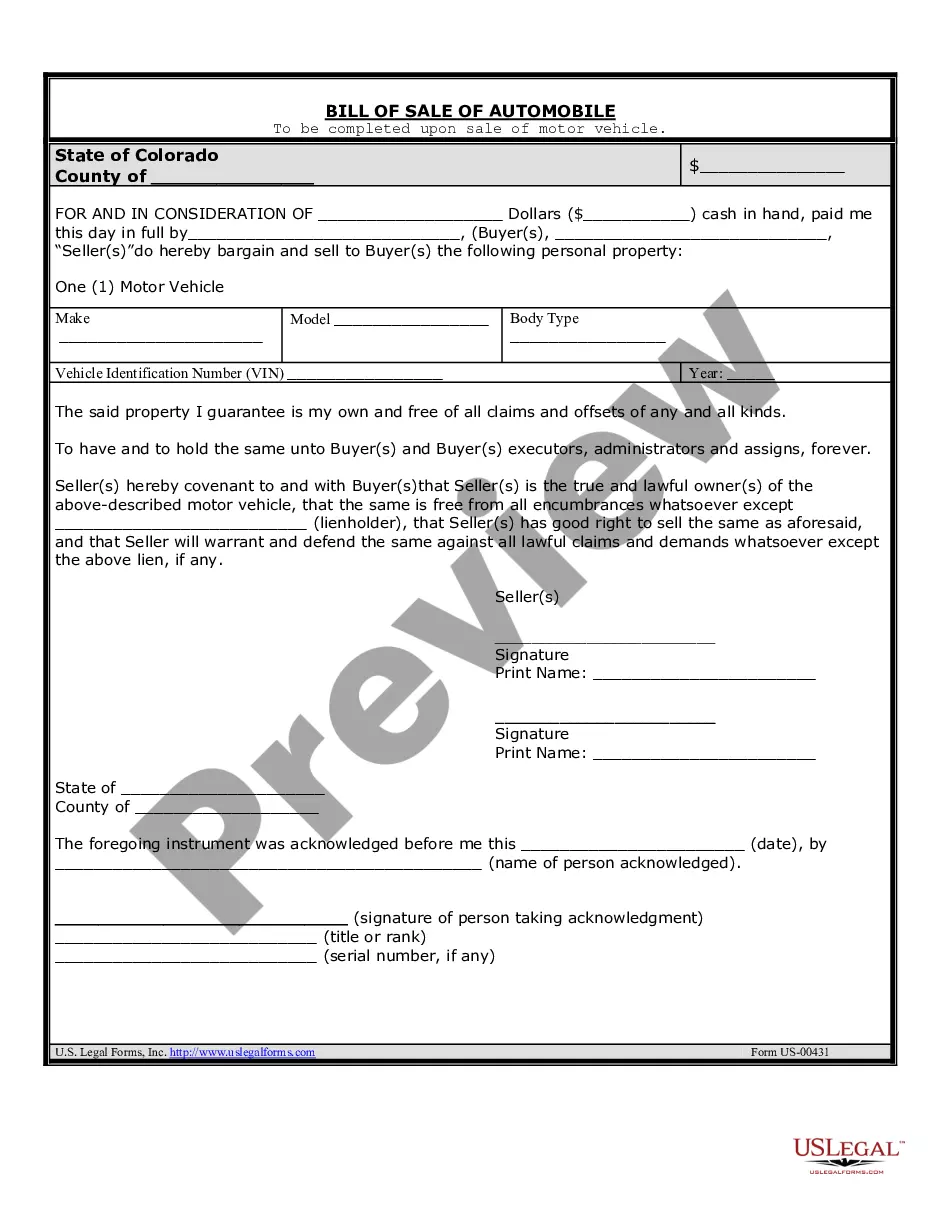

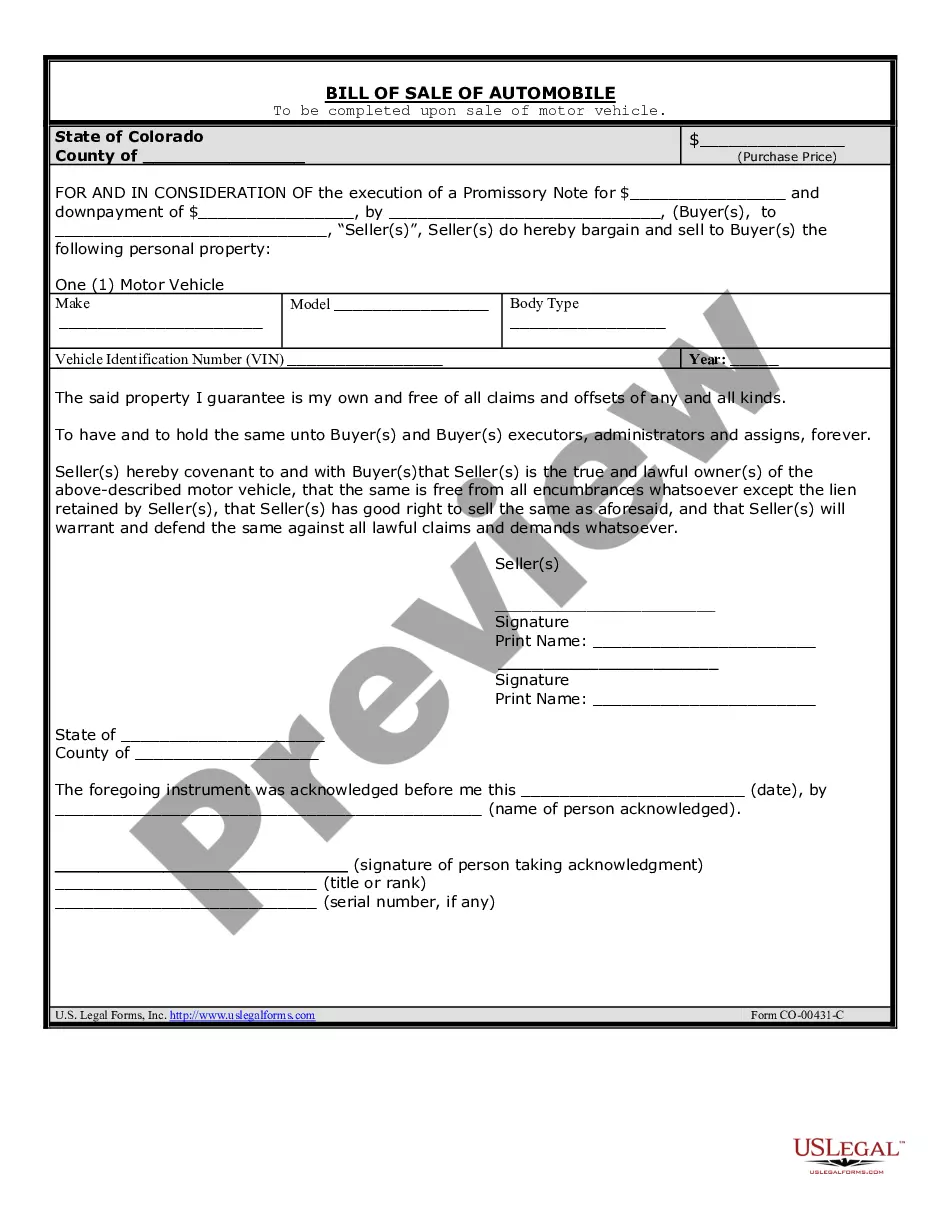

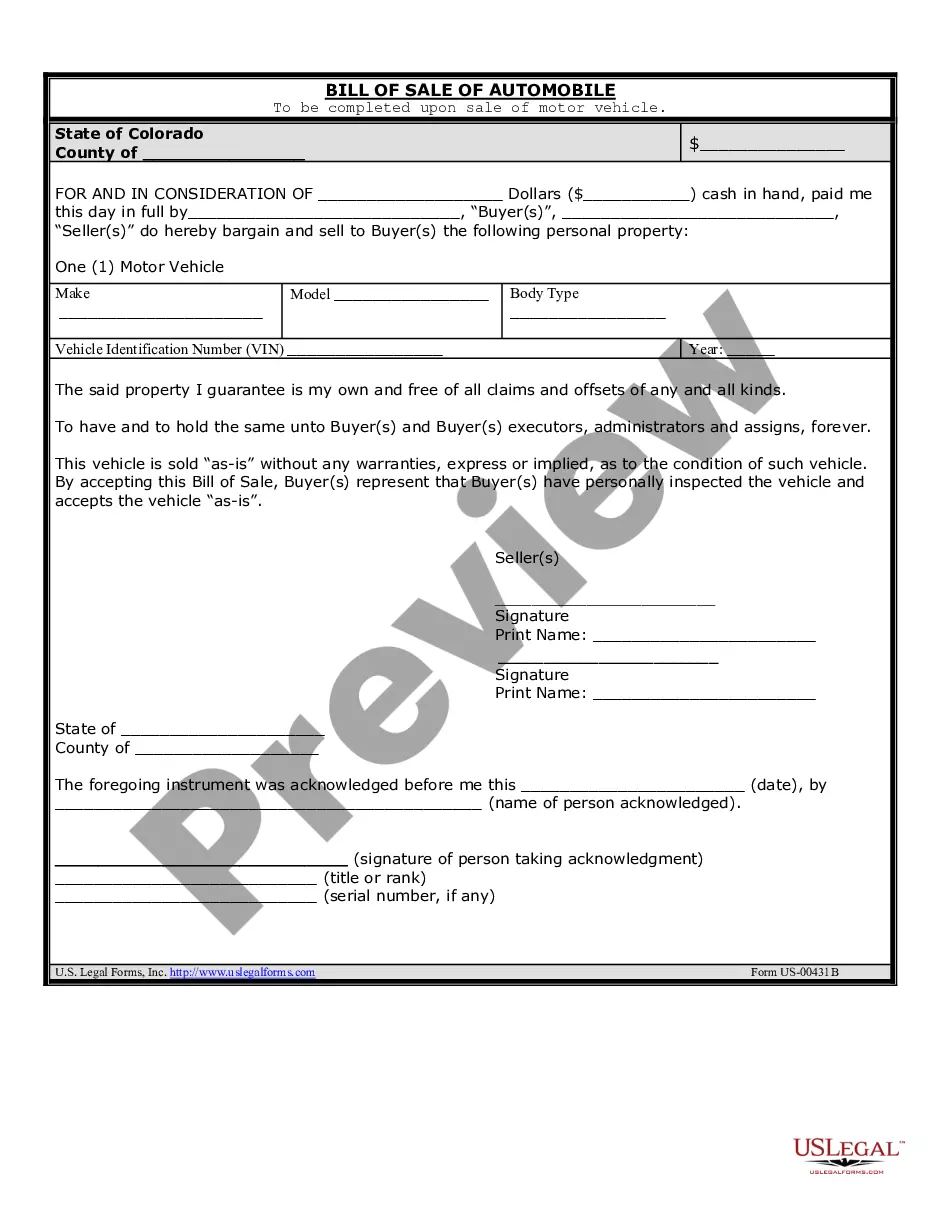

Centennial Colorado Promissory Note in Connection with Sale of Vehicle or Automobile is a legally binding document that outlines the terms and conditions of a vehicle sale agreement between the seller and the buyer. This promissory note serves as a contract, ensuring that both parties are on the same page regarding the payment and transfer of ownership. The Centennial Colorado Promissory Note is tailored specifically for vehicle or automobile sales within Centennial, Colorado. It includes key details related to the transaction such as the names and addresses of the parties involved (seller and buyer), the description of the vehicle being sold (make, model, year, color, VIN number), the agreed purchase price, and the terms of payment. The promissory note typically specifies the payment structure, whether it is a lump sum or installment payments, including the down payment amount and any interest charges if applicable. It also outlines the repayment schedule, indicating the due dates for each installment and any late payment penalties. In some cases, the promissory note may include information about the vehicle's insurance requirements and responsibilities until the completion of payments. Different types of Centennial Colorado Promissory Notes in Connection with Sale of Vehicle or Automobile may include variations in terms and conditions based on the preferences of the parties involved. Some specific types could be: 1. Lump Sum Payment Promissory Note: This type of promissory note involves a one-time payment made in full at the time of purchase. It includes details of the payment made and receipt issued. 2. Installment Payment Promissory Note: This type of promissory note allows the buyer to make payments in installments over a specified period. It defines the number of installments, their amounts, and due dates. 3. Secured Promissory Note: This refers to a promissory note in which the seller retains a security interest in the vehicle until the buyer completes all payments, ensuring the vehicle acts as collateral. If the buyer fails to fulfill their obligations, the seller has the right to reclaim the vehicle. 4. Unsecured Promissory Note: In contrast to a secured promissory note, an unsecured note does not involve any collateral or security interest. If the buyer fails to make payments, the seller may need to pursue legal action to recover the owed amount. It is important to note that the Centennial Colorado Promissory Note in Connection with Sale of Vehicle or Automobile should comply with the specific laws and regulations in Colorado and be drafted or reviewed by a qualified legal professional to protect the interests of both parties involved in the transaction.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.