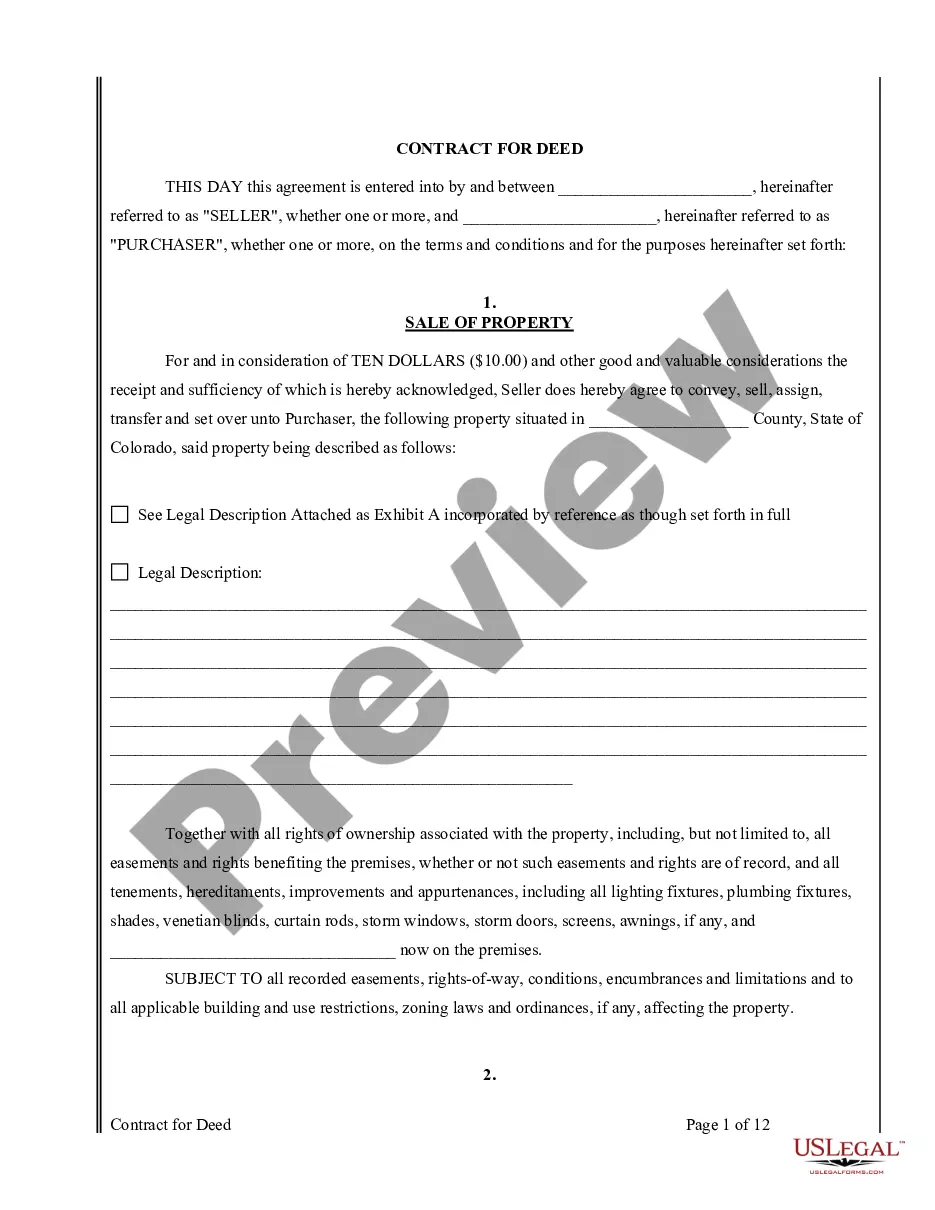

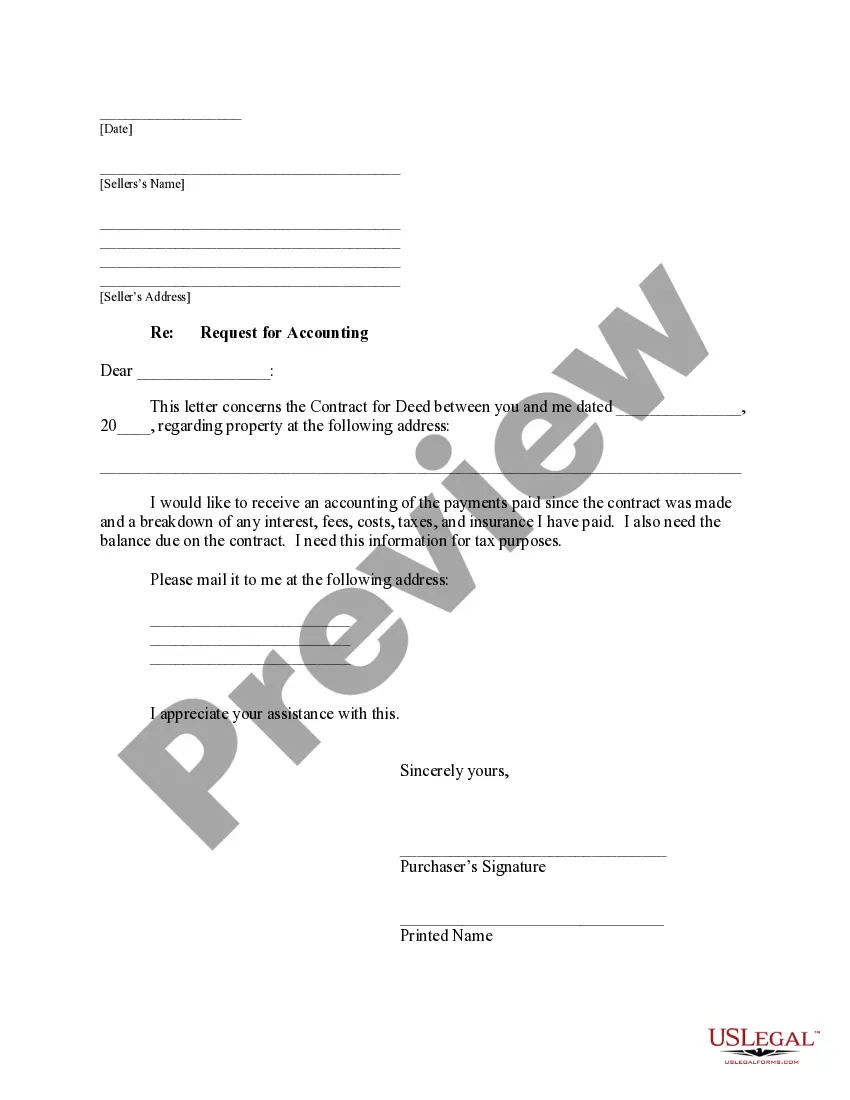

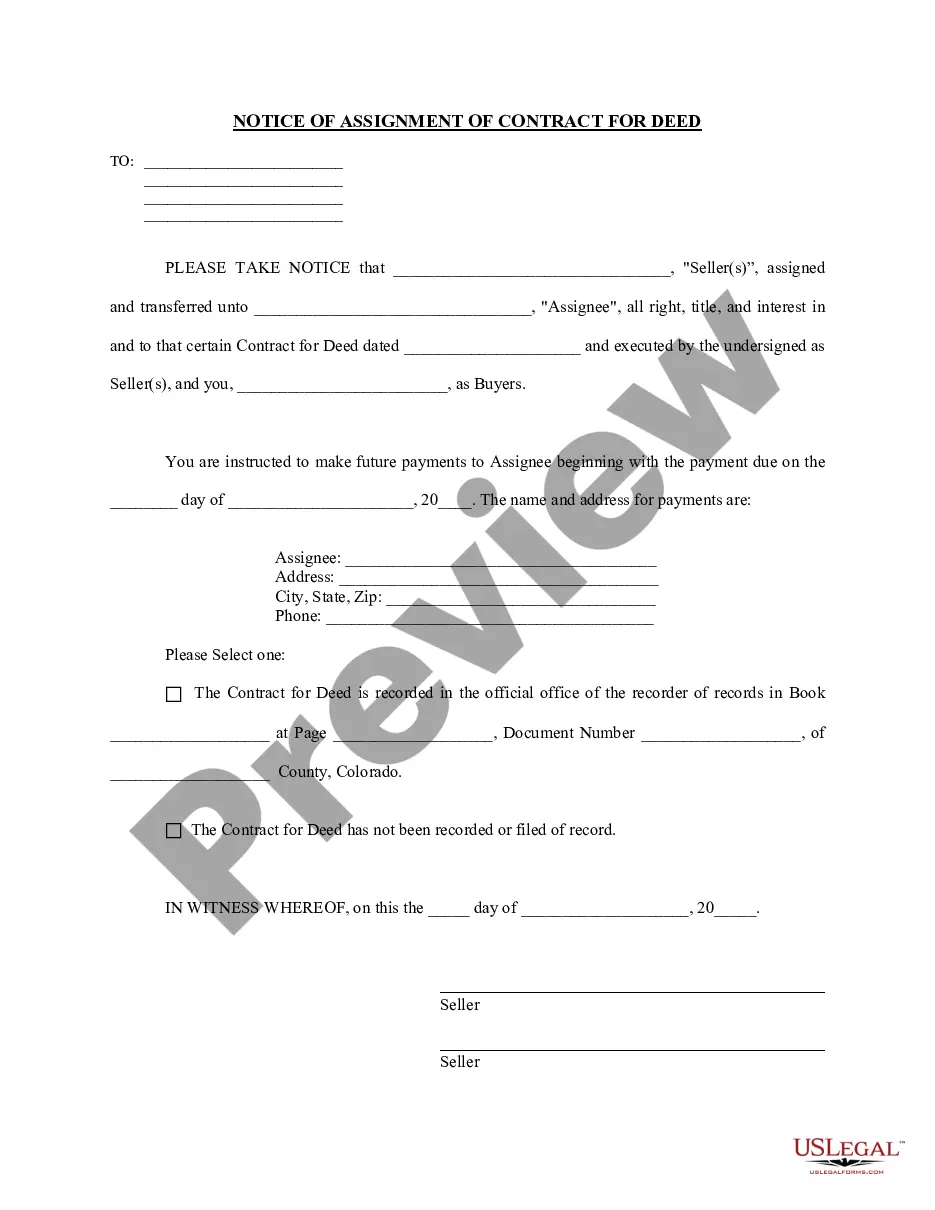

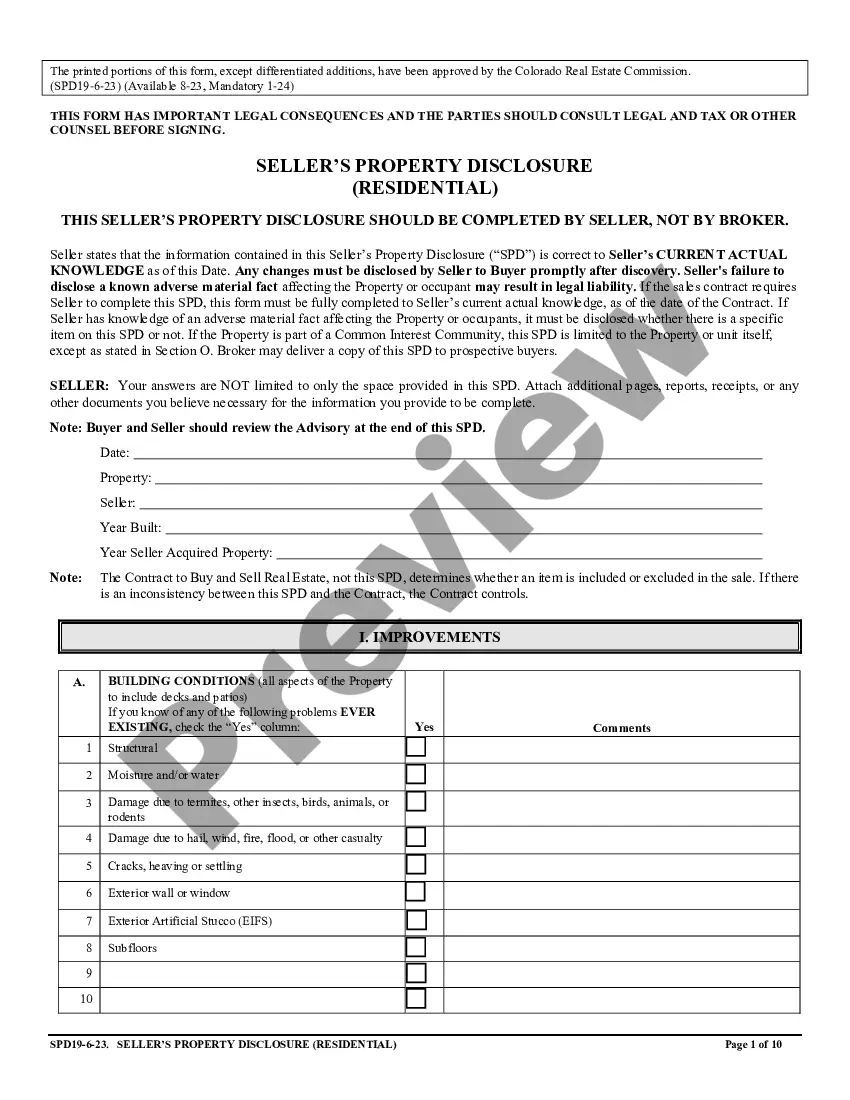

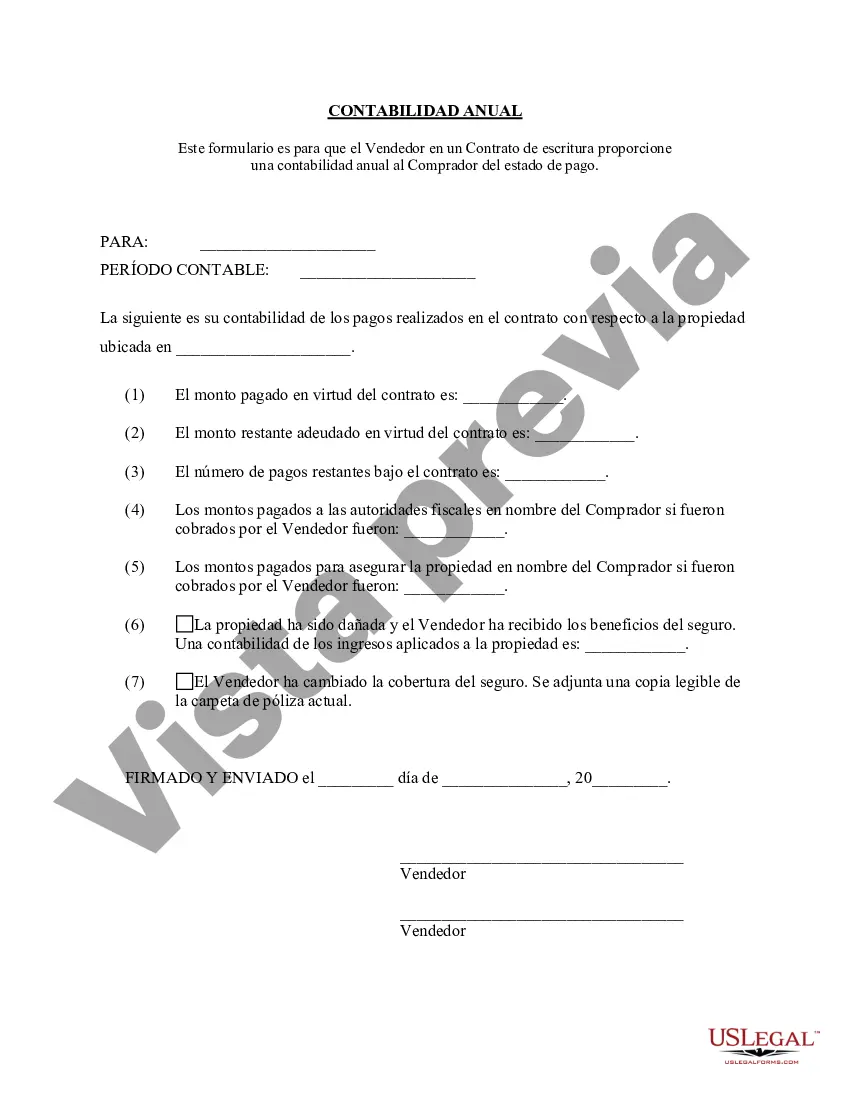

The Fort Collins Colorado Contract for Deed Seller's Annual Accounting Statement is a crucial document that provides a comprehensive overview of financial transactions between a seller and buyer in a contract for deed agreement. This statement is typically prepared by the seller, and it serves as an important record of all monetary activities undertaken during the specified year. Key features within the Fort Collins Colorado Contract for Deed Seller's Annual Accounting Statement include the following: 1. Income and Expenses: This section lists all financial inflows and outflows associated with the property under contract for deed. It accounts for payments received from the buyer, such as monthly installments, interest, and any applicable penalties. Additionally, it itemizes any expenses incurred by the seller, including property taxes, insurance, maintenance costs, or repairs. 2. Principal and Interest Calculations: This statement presents a breakdown of the principal amount paid by the buyer over the year, as well as the corresponding interest charges. It may include details on how the payment was distributed between principal reduction and interest accrual. 3. Escrow Account Summary: If an escrow account is established, this section provides a summary of the funds held in escrow. It includes details of any disbursements made from the account, such as property tax payments or insurance premiums. 4. Late Payments and Penalties: In cases where the buyer fails to make timely payments, this section highlights any late fees or penalties imposed by the seller. It documents the amounts owed and may include an explanation of the terms and conditions surrounding such penalties. 5. Compliance and Legal Requirements: Fort Collins Colorado Contract for Deed Seller's Annual Accounting Statement ensures adherence to legal obligations. It verifies that all required government forms, such as 1098 mortgage interest statements or property tax documents, have been provided to the buyer in a timely manner. Different types or variations of the Fort Collins Colorado Contract for Deed Seller's Annual Accounting Statement may include: 1. Residential Contract for Deed Seller's Annual Accounting Statement: Specifically tailored for residential properties, this statement focuses on financial transactions related to single-family homes, townhouses, and condominiums. 2. Commercial Contract for Deed Seller's Annual Accounting Statement: This variant caters to commercial properties, including office buildings, retail spaces, and industrial warehouses. It considers unique aspects such as lease payments, commercial property taxes, and maintenance costs. 3. Land Contract for Deed Seller's Annual Accounting Statement: Ideal for undeveloped land, this statement concentrates on tracking property payments and related expenses without the inclusion of structures or buildings. In conclusion, the Fort Collins Colorado Contract for Deed Seller's Annual Accounting Statement is a comprehensive financial report that outlines all relevant money matters pertaining to a contract for deed transaction. It ensures transparency and accountability between the seller and buyer, allowing both parties to assess their financial obligations and commitments accurately.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Fort Collins Colorado Contrato de Escrituración Estado Contable Anual del Vendedor - Colorado Contract for Deed Seller's Annual Accounting Statement

Description

How to fill out Fort Collins Colorado Contrato De Escrituración Estado Contable Anual Del Vendedor?

Locating verified templates specific to your local regulations can be challenging unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both individual and professional needs and any real-life situations. All the documents are properly categorized by area of usage and jurisdiction areas, so searching for the Fort Collins Colorado Contract for Deed Seller's Annual Accounting Statement gets as quick and easy as ABC.

For everyone already acquainted with our library and has used it before, getting the Fort Collins Colorado Contract for Deed Seller's Annual Accounting Statement takes just a few clicks. All you need to do is log in to your account, choose the document, and click Download to save it on your device. This process will take just a few additional actions to make for new users.

Adhere to the guidelines below to get started with the most extensive online form catalogue:

- Check the Preview mode and form description. Make certain you’ve chosen the right one that meets your requirements and fully corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you see any inconsistency, utilize the Search tab above to find the correct one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and choose the subscription plan you prefer. You should sign up for an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the service.

- Download the Fort Collins Colorado Contract for Deed Seller's Annual Accounting Statement. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Benefit from the US Legal Forms library to always have essential document templates for any needs just at your hand!