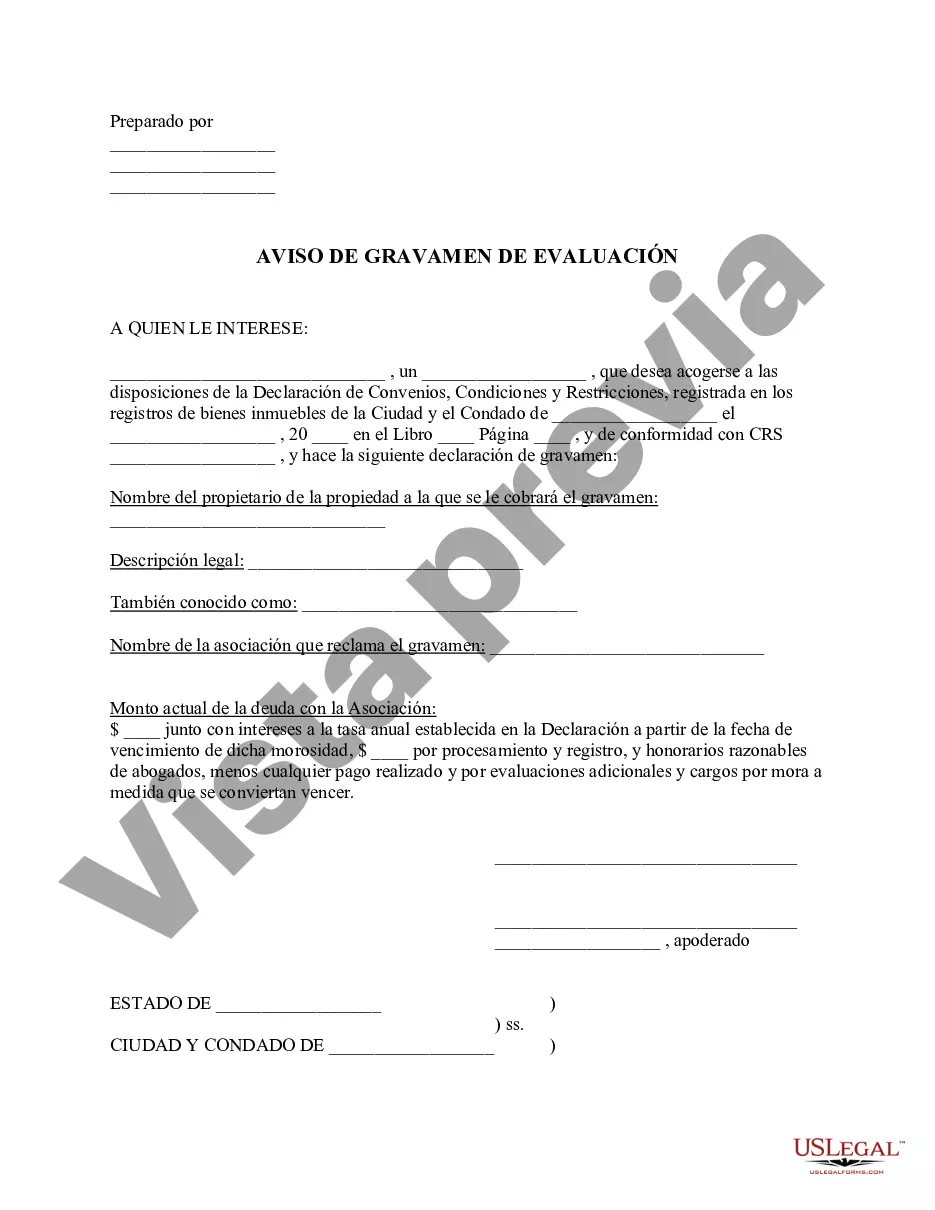

The Arvada Colorado Notice of Assessment of Lien is an important legal document that serves to inform property owners about a lien placed on their property. A lien is a legal claim or right that one party has over another's property as security for a debt or obligation. The Notice of Assessment of Lien is typically issued by the local government, such as the Arvada County Assessor's Office or the Arvada County Treasurer's Office, to notify property owners of an outstanding debt or an unpaid tax obligation. This notice is a critical step in the lien process as it provides detailed information about the debt or tax assessment, including the amount owed, the purpose of the lien, and any consequences that may arise if the debt remains unpaid. The notice will also state the time frame within which the property owner must resolve the outstanding debt to avoid further legal action. There are various types of Arvada Colorado Notice of Assessment of Lien that property owners may encounter based on the reasons behind the lien placement. Some common types include: 1. Property Tax Lien: This type of lien is issued when property owners fail to pay their property taxes in a timely manner. The local government assesses property taxes to fund essential services and infrastructure within the community. If taxes remain unpaid, a property tax lien may be placed on the property as a means to secure the debt. 2. Mechanics Lien: Contractors, subcontractors, or suppliers who have provided labor, materials, or services for construction, repairs, or improvements to a property may file a mechanics lien if they are not paid. This type of lien serves to protect the rights of those who have contributed to the property's value. 3. HOA Lien: Homeowners Associations (Has) often have the authority to place a lien on a property if the homeowner fails to pay their dues, fines, or assessments. The HOA lien acts as a means to enforce compliance with community rules and regulations. Regardless of the type, receiving an Arvada Colorado Notice of Assessment of Lien can have serious implications for property owners. Ignoring or failing to address the outstanding debt can result in the enforcement of the lien, which may lead to foreclosure, auction, or other legal actions to recover the debt. Therefore, it is crucial for property owners in Arvada, Colorado, to carefully review and understand the contents of the Notice of Assessment of Lien. Seeking legal advice or consulting with the relevant authorities — such as the Arvada County Assessor's Office or the Arvada County Treasurer's Office — is advisable to fully comprehend the nature of the lien and the necessary steps to resolve the outstanding debt and prevent further complications.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Arvada Colorado Aviso de evaluación de gravamen - Colorado Notice of Assessment of Lien

Description

How to fill out Arvada Colorado Aviso De Evaluación De Gravamen?

If you are searching for a relevant form template, it’s extremely hard to choose a more convenient platform than the US Legal Forms site – probably the most comprehensive online libraries. With this library, you can find thousands of templates for company and individual purposes by categories and states, or keywords. Using our high-quality search feature, discovering the newest Arvada Colorado Notice of Assessment of Lien is as easy as 1-2-3. In addition, the relevance of every file is proved by a group of skilled attorneys that on a regular basis check the templates on our website and update them in accordance with the newest state and county requirements.

If you already know about our platform and have an account, all you need to get the Arvada Colorado Notice of Assessment of Lien is to log in to your account and click the Download option.

If you make use of US Legal Forms the very first time, just follow the guidelines listed below:

- Make sure you have found the sample you need. Read its description and use the Preview feature (if available) to check its content. If it doesn’t suit your needs, utilize the Search option at the top of the screen to find the needed file.

- Affirm your selection. Click the Buy now option. Following that, select your preferred subscription plan and provide credentials to sign up for an account.

- Make the transaction. Use your credit card or PayPal account to finish the registration procedure.

- Get the form. Choose the file format and download it on your device.

- Make modifications. Fill out, modify, print, and sign the acquired Arvada Colorado Notice of Assessment of Lien.

Each form you add to your account does not have an expiry date and is yours permanently. You can easily access them via the My Forms menu, so if you want to have an additional duplicate for modifying or printing, you may come back and download it again at any time.

Take advantage of the US Legal Forms extensive catalogue to get access to the Arvada Colorado Notice of Assessment of Lien you were seeking and thousands of other professional and state-specific templates in a single place!