Centennial Colorado Notice of Assessment of Lien is an official notification sent by the Centennial County Tax Assessor's Office to property owners in Centennial, Colorado, indicating the assessment of a lien on their property. This legal document serves as a means of informing property owners about outstanding tax liabilities or unpaid fines associated with their property. The Notice of Assessment of Lien is an important tool for the county to recover delinquent taxes or other outstanding debts. The assessment of a lien on a property means that the county has a legal claim against the property until the debt is satisfied. This lien may be imposed for various reasons, such as unpaid property taxes, utility bills, code violations, or other outstanding fines. Property owners receiving this notice should carefully review its contents to understand the specific reasons for the assessment of the lien. The notice typically includes details such as the property owner's name, address, identification number, and a detailed breakdown of the outstanding debt or unpaid charges. It also includes the legal basis for the assessment of the lien, the date of assessment, and the total amount owed. Once a Notice of Assessment of Lien is issued, property owners have a limited period to address the outstanding debt to prevent further legal action. It is crucial for property owners to act promptly to avoid additional penalties, interest, or potential foreclosure. Different types of Centennial Colorado Notice of Assessment of Lien may include: 1. Property Tax Lien: This type of lien is imposed when a property owner fails to pay their annual property taxes to the county. 2. Utility Lien: A utility lien may be assessed when a property owner has unpaid utility bills related to water, sewer, or garbage services provided by the city or county. 3. Code Violation Lien: If a property owner fails to comply with local building codes, zoning regulations, or other laws, a lien may be imposed to cover the cost of necessary repairs or fines issued by the relevant authorities. 4. Special Assessment Lien: This type of lien is levied when the city or county undertakes specific infrastructure projects, such as road improvements or sidewalk construction, and charges property owners a share of the costs. 5. Tax lien on Personal Property: In some cases, liens may also be imposed on personal property, such as vehicles, boats, or equipment, if the owner fails to pay required taxes or fees. Receiving a Centennial Colorado Notice of Assessment of Lien requires immediate attention to prevent further financial complications. Property owners should carefully review the notice, seek professional advice if needed, and take appropriate actions to resolve the outstanding debt and remove the lien on their property.

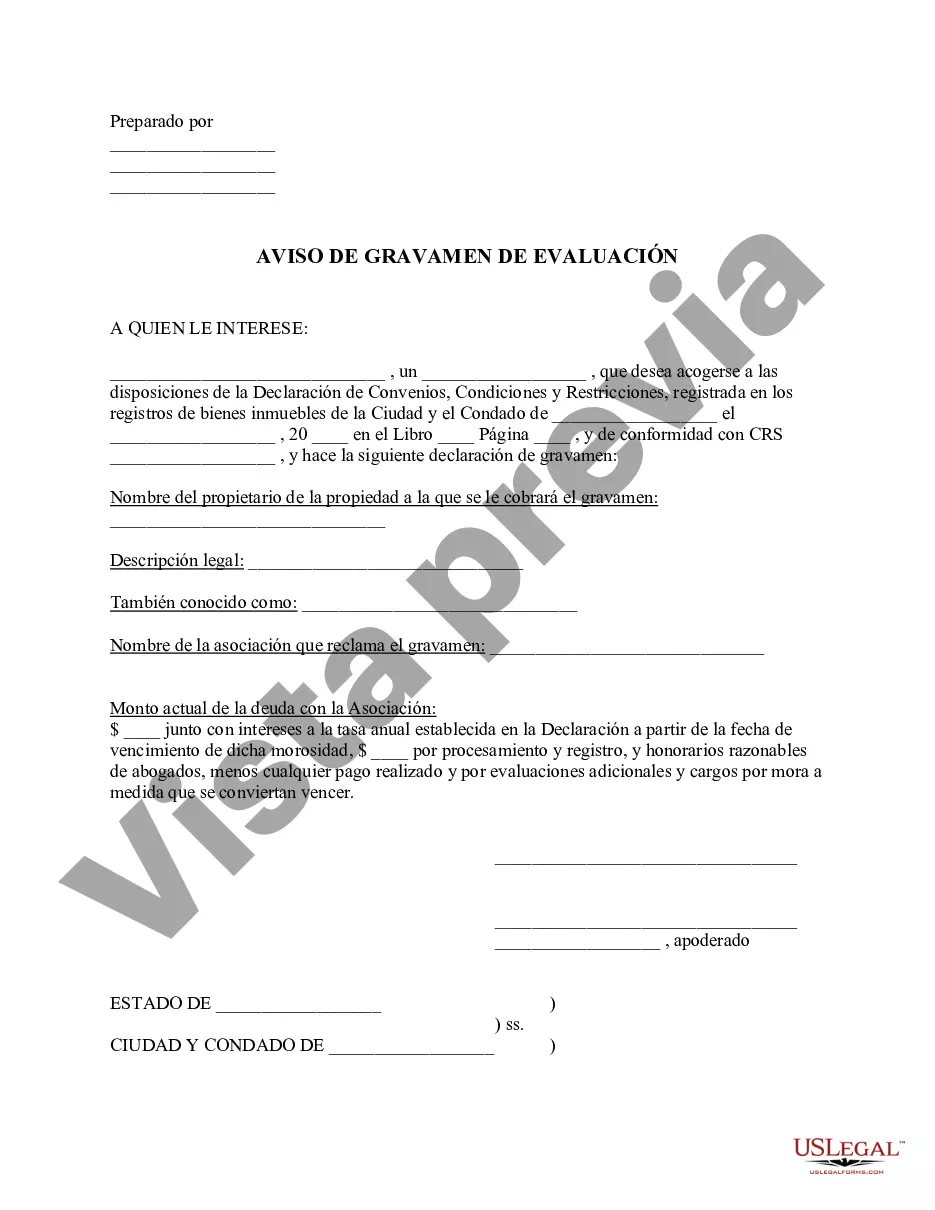

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Centennial Colorado Aviso de evaluación de gravamen - Colorado Notice of Assessment of Lien

Category:

State:

Colorado

City:

Centennial

Control #:

CO-009LRS

Format:

Word

Instant download

Description

An assessment lien is a legal claim or "hold" on an owner's unit or lot making the property collateral against delinquent assessments, whether regular or special assessments, owed to the home owners association (HOA).

Centennial Colorado Notice of Assessment of Lien is an official notification sent by the Centennial County Tax Assessor's Office to property owners in Centennial, Colorado, indicating the assessment of a lien on their property. This legal document serves as a means of informing property owners about outstanding tax liabilities or unpaid fines associated with their property. The Notice of Assessment of Lien is an important tool for the county to recover delinquent taxes or other outstanding debts. The assessment of a lien on a property means that the county has a legal claim against the property until the debt is satisfied. This lien may be imposed for various reasons, such as unpaid property taxes, utility bills, code violations, or other outstanding fines. Property owners receiving this notice should carefully review its contents to understand the specific reasons for the assessment of the lien. The notice typically includes details such as the property owner's name, address, identification number, and a detailed breakdown of the outstanding debt or unpaid charges. It also includes the legal basis for the assessment of the lien, the date of assessment, and the total amount owed. Once a Notice of Assessment of Lien is issued, property owners have a limited period to address the outstanding debt to prevent further legal action. It is crucial for property owners to act promptly to avoid additional penalties, interest, or potential foreclosure. Different types of Centennial Colorado Notice of Assessment of Lien may include: 1. Property Tax Lien: This type of lien is imposed when a property owner fails to pay their annual property taxes to the county. 2. Utility Lien: A utility lien may be assessed when a property owner has unpaid utility bills related to water, sewer, or garbage services provided by the city or county. 3. Code Violation Lien: If a property owner fails to comply with local building codes, zoning regulations, or other laws, a lien may be imposed to cover the cost of necessary repairs or fines issued by the relevant authorities. 4. Special Assessment Lien: This type of lien is levied when the city or county undertakes specific infrastructure projects, such as road improvements or sidewalk construction, and charges property owners a share of the costs. 5. Tax lien on Personal Property: In some cases, liens may also be imposed on personal property, such as vehicles, boats, or equipment, if the owner fails to pay required taxes or fees. Receiving a Centennial Colorado Notice of Assessment of Lien requires immediate attention to prevent further financial complications. Property owners should carefully review the notice, seek professional advice if needed, and take appropriate actions to resolve the outstanding debt and remove the lien on their property.

Free preview

How to fill out Centennial Colorado Aviso De Evaluación De Gravamen?

If you’ve already utilized our service before, log in to your account and download the Centennial Colorado Notice of Assessment of Lien on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, follow these simple actions to get your document:

- Make sure you’ve found a suitable document. Look through the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t suit you, use the Search tab above to find the appropriate one.

- Buy the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Get your Centennial Colorado Notice of Assessment of Lien. Opt for the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to rapidly find and save any template for your individual or professional needs!