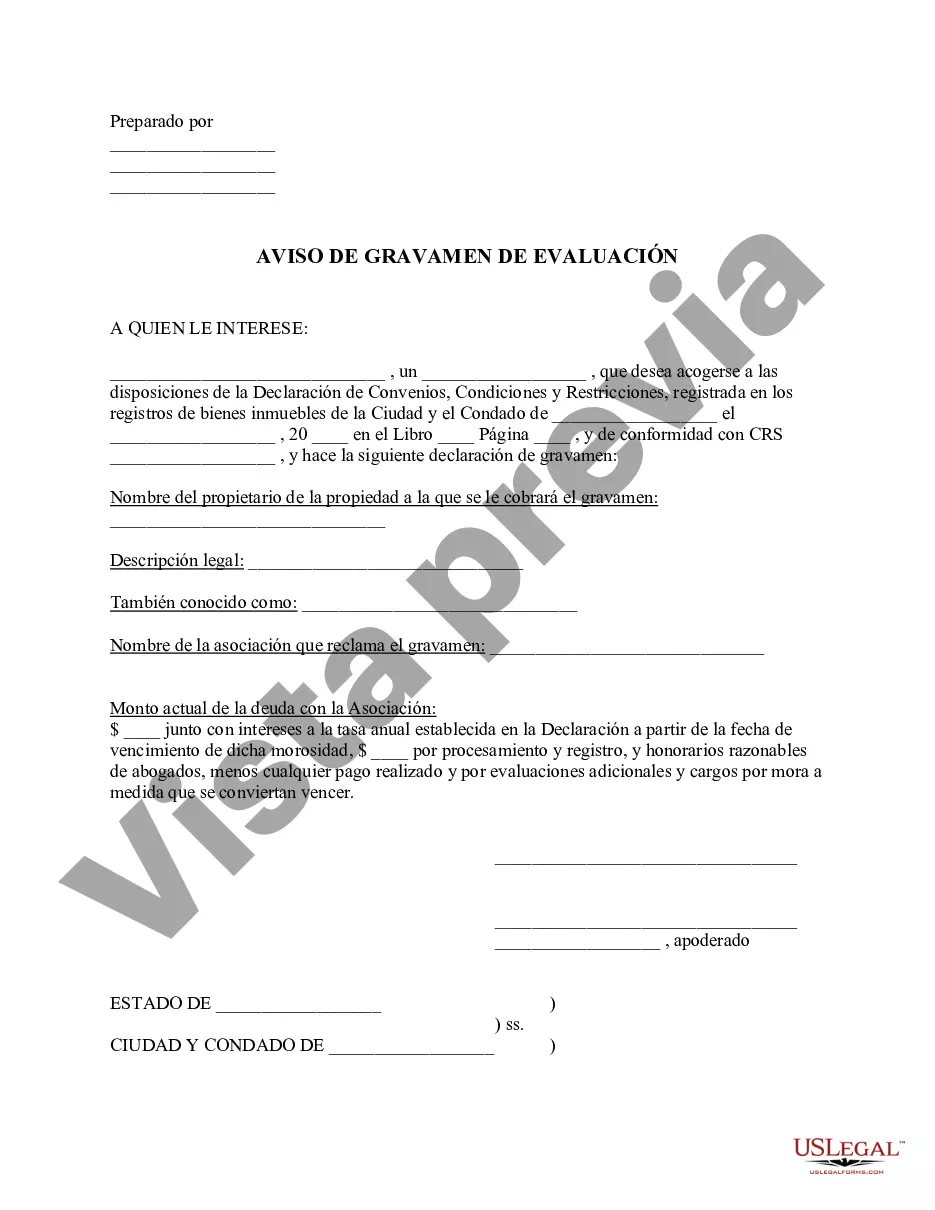

Fort Collins, Colorado Notice of Assessment of Lien is a legal document issued by the local government to address tax delinquency issues or unpaid obligations. This notice serves as a formal and official notification to property owners, informing them of the existence and amount of any outstanding tax lien against their property. The Notice of Assessment of Lien is an essential step taken by the government authorities to protect their rights and interests by securing the payment of past-due taxes. The lien is filed against the property and remains attached until the delinquent taxes are fully paid off. In Fort Collins, Colorado, this process is governed by specific laws and regulations to ensure a fair and transparent procedure. Keywords: Fort Collins, Colorado, Notice of Assessment of Lien, tax delinquency, unpaid obligations, legal document, local government, tax lien, property owners, outstanding taxes, government authorities, rights and interests, past-due taxes, filed against the property, laws and regulations, fair and transparent procedure. Different types of Fort Collins, Colorado Notice of Assessment of Lien include: 1. Real Estate Tax Lien: This type of lien is directly related to unpaid property taxes on real estate assets. Property owners receive a Notice of Assessment of Lien specifying the amount owed and the actions required to satisfy the outstanding tax liability. 2. Personal Property Tax Lien: When individuals or businesses fail to pay their personal property taxes, a Notice of Assessment of Lien may be issued against their movable assets such as vehicles, equipment, or inventory. This lien serves as a legal claim against the personal property until the tax debt is settled. 3. Special Assessment Lien: In some cases, the local government may impose special assessments to fund public infrastructure projects, such as road repairs or sewer system upgrades. If property owners fail to pay their assigned share of these assessments, a Notice of Assessment of Lien may be filed against the property until the outstanding amount is resolved. 4. Business Tax Lien: Businesses are required to pay various taxes, such as sales tax or payroll tax, to the government. If a business fails to fulfill its tax obligations, a Notice of Assessment of Lien can be issued against the business assets, including real estate and personal property. 5. State Income Tax Lien: Individuals who owe state income taxes may receive a Notice of Assessment of Lien if they fail to pay the outstanding amounts. This type of lien is specific to state income tax liabilities and serves as a legal claim against the individual's property until the tax debt is settled. It's crucial for property owners in Fort Collins, Colorado, to take prompt action upon receiving a Notice of Assessment of Lien to avoid further complications and potential consequences. Seeking professional advice from tax attorneys or consultants can help navigate the process and work towards resolving the outstanding tax obligations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Fort Collins Colorado Aviso de evaluación de gravamen - Colorado Notice of Assessment of Lien

Description

How to fill out Fort Collins Colorado Aviso De Evaluación De Gravamen?

Finding verified templates specific to your local laws can be difficult unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both individual and professional needs and any real-life situations. All the documents are properly grouped by area of usage and jurisdiction areas, so locating the Fort Collins Colorado Notice of Assessment of Lien gets as quick and easy as ABC.

For everyone already familiar with our catalogue and has used it before, getting the Fort Collins Colorado Notice of Assessment of Lien takes just a few clicks. All you need to do is log in to your account, choose the document, and click Download to save it on your device. The process will take just a few more steps to make for new users.

Follow the guidelines below to get started with the most extensive online form collection:

- Check the Preview mode and form description. Make certain you’ve picked the right one that meets your requirements and fully corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you see any inconsistency, use the Search tab above to get the right one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and select the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the service.

- Download the Fort Collins Colorado Notice of Assessment of Lien. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Take advantage of the US Legal Forms library to always have essential document templates for any needs just at your hand!