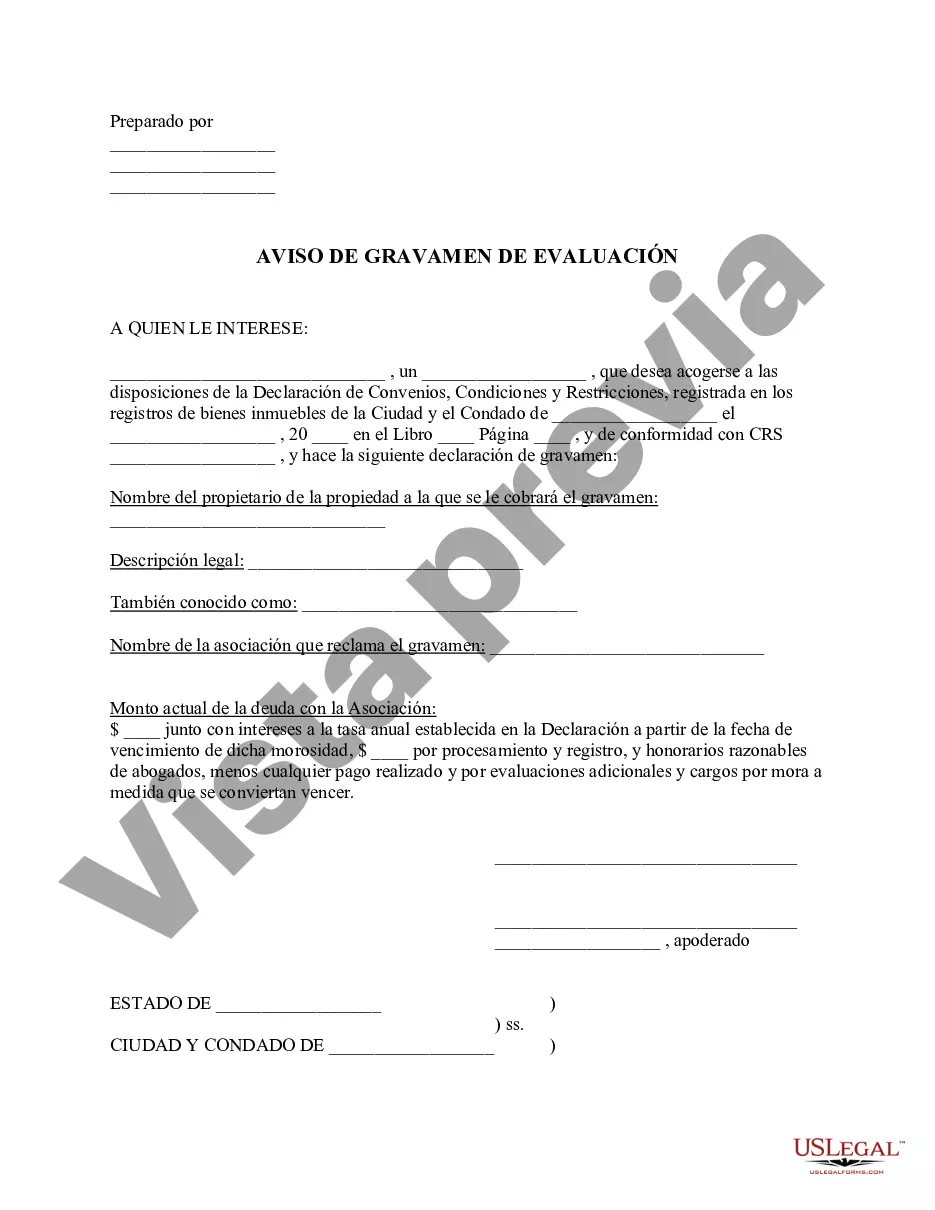

The Lakewood Colorado Notice of Assessment of Lien is an important document that property owners in Lakewood, Colorado should be aware of. It is a legal notice issued by the city's authorities to inform property owners about a lien placed on their property due to outstanding tax debts or other financial obligations. This notice signifies that the city has taken legal action to recover the overdue amount by potentially selling the property to satisfy the debt. The Notice of Assessment of Lien serves as official documentation indicating that the city has assessed the overdue amount and has attached a legal claim to the property in question. This lien is a way for the city to safeguard its interest and ensure that property owners fulfill their obligations. Typically, when property taxes, fees, or fines remain unpaid for an extended period, the city may take this action to recover the outstanding debt. There are different types of Lakewood Colorado Notice of Assessment of Lien, depending on the specific financial obligations that triggered the lien. Some common types include: 1. Property Tax Lien: This type of lien is imposed when property taxes remain unpaid. Property owners must settle their outstanding property tax bills to avoid the risk of foreclosure. 2. Municipal Utility Lien: If a property owner fails to pay utility bills such as water, sewer, or trash services, the city can place a lien on the property. 3. Municipal Code Violation Lien: In case of violations related to building codes, health and safety regulations, or other city ordinances, the city may impose a lien. The property owner needs to address the violations and settle any resulting fines or fees. It is essential for property owners to pay attention to these notices, as they can have serious consequences if left unresolved. Upon receiving a Lakewood Colorado Notice of Assessment of Lien, property owners should promptly contact the city authorities to discuss payment options and resolve any outstanding debts. Ignoring or neglecting these liens may lead to further legal action, including foreclosure or forced sale of the property. Navigating the complexities of property liens can be challenging. Seeking the guidance of a qualified real estate attorney or financial advisor can provide property owners with the necessary expertise to navigate the lien resolution process successfully. Prompt and diligent action is advised to protect one's property rights and financial stability.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Lakewood Colorado Aviso de evaluación de gravamen - Colorado Notice of Assessment of Lien

Description

How to fill out Lakewood Colorado Aviso De Evaluación De Gravamen?

Are you looking for a trustworthy and affordable legal forms supplier to get the Lakewood Colorado Notice of Assessment of Lien? US Legal Forms is your go-to solution.

Whether you need a simple agreement to set rules for cohabitating with your partner or a package of forms to move your divorce through the court, we got you covered. Our platform provides over 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t generic and frameworked based on the requirements of separate state and area.

To download the form, you need to log in account, locate the needed form, and hit the Download button next to it. Please take into account that you can download your previously purchased form templates at any time in the My Forms tab.

Are you new to our platform? No worries. You can create an account in minutes, but before that, make sure to do the following:

- Find out if the Lakewood Colorado Notice of Assessment of Lien conforms to the regulations of your state and local area.

- Read the form’s description (if available) to learn who and what the form is intended for.

- Start the search over in case the form isn’t good for your legal scenario.

Now you can create your account. Then choose the subscription option and proceed to payment. As soon as the payment is completed, download the Lakewood Colorado Notice of Assessment of Lien in any available file format. You can get back to the website at any time and redownload the form free of charge.

Getting up-to-date legal forms has never been easier. Give US Legal Forms a go today, and forget about spending your valuable time learning about legal paperwork online once and for all.