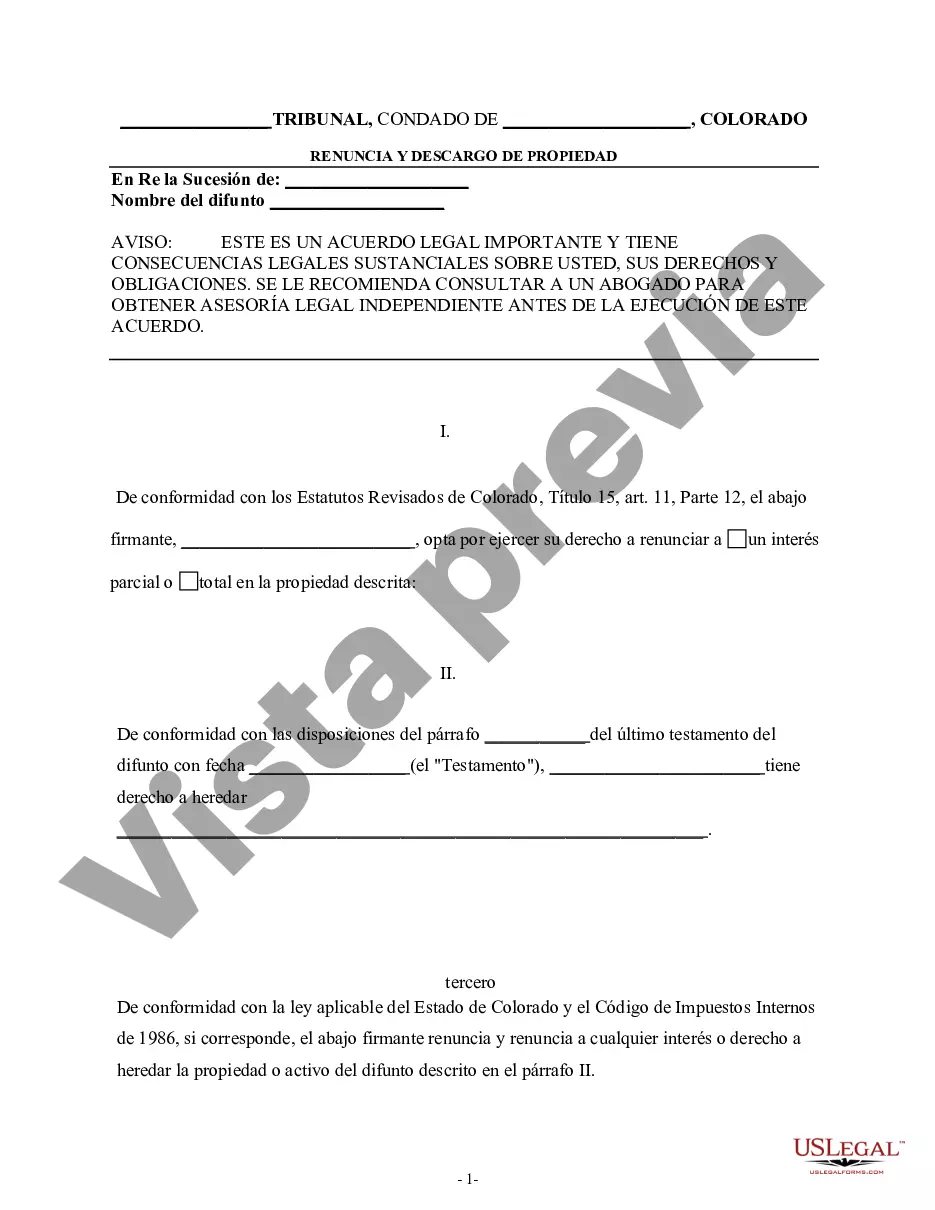

This form is a Renunciation and Disclaimer of Property acquired by the beneficiary through the last will and testament of the decedent. The beneficiary has gained an interest in the described property of the decedent. Pursuant to the Colorado Revised Statutes, Title 15, Art. 11, Part 8, the beneficiary wishes to disclaim a portion of the property or the entire interest in the property. The disclaimer will relate back to the date of the death of the decedent and will be an irrevocable refusal to accept the property. The form also contains a state specific acknowledgment and a certificate to verify delivery.

Centennial Colorado Renunciation And Disclaimer of Property from Will by Testate is a legal process through which a beneficiary voluntarily gives up their rights to inherit property as stated in a will. This renunciation and disclaimer are applicable only when the deceased individual executed a valid will prior to their death. By disclaiming the property, the beneficiary rejects any claim to it and allows it to pass to other named beneficiaries or according to the laws of intestacy. This disclaimer must meet specific legal requirements and should be filed in accordance with the rules established in Centennial, Colorado. There are different types of Centennial Colorado Renunciation And Disclaimer of Property from Will by Testate: 1. Conditional Disclaimers: In certain cases, a beneficiary might choose to renounce property from the will under specific conditions. For example, if the property generates debts or obligations, the beneficiary may want to disclaim it to avoid liabilities. 2. Partial Disclaimers: Beneficiaries may decide to renounce only a portion of the property rather than its entirety. This can be motivated by personal reasons or to benefit other heirs, beneficiaries, or charities mentioned in the will. 3. Qualified Disclaimers: A qualified disclaimer refers to the renunciation of property in a way that qualifies for specific tax benefits. By following the guidelines outlined by specific tax codes, beneficiaries can avoid incurring unnecessary tax liabilities. It is crucial to note that the renunciation and disclaimer process should be carried out carefully, ensuring adherence to all legal guidelines and within the specified timeframes to be considered valid. Consulting with an experienced probate attorney or legal advisor who specializes in Centennial, Colorado estate laws is highly recommended ensuring compliance with all necessary procedures.Centennial Colorado Renunciation And Disclaimer of Property from Will by Testate is a legal process through which a beneficiary voluntarily gives up their rights to inherit property as stated in a will. This renunciation and disclaimer are applicable only when the deceased individual executed a valid will prior to their death. By disclaiming the property, the beneficiary rejects any claim to it and allows it to pass to other named beneficiaries or according to the laws of intestacy. This disclaimer must meet specific legal requirements and should be filed in accordance with the rules established in Centennial, Colorado. There are different types of Centennial Colorado Renunciation And Disclaimer of Property from Will by Testate: 1. Conditional Disclaimers: In certain cases, a beneficiary might choose to renounce property from the will under specific conditions. For example, if the property generates debts or obligations, the beneficiary may want to disclaim it to avoid liabilities. 2. Partial Disclaimers: Beneficiaries may decide to renounce only a portion of the property rather than its entirety. This can be motivated by personal reasons or to benefit other heirs, beneficiaries, or charities mentioned in the will. 3. Qualified Disclaimers: A qualified disclaimer refers to the renunciation of property in a way that qualifies for specific tax benefits. By following the guidelines outlined by specific tax codes, beneficiaries can avoid incurring unnecessary tax liabilities. It is crucial to note that the renunciation and disclaimer process should be carried out carefully, ensuring adherence to all legal guidelines and within the specified timeframes to be considered valid. Consulting with an experienced probate attorney or legal advisor who specializes in Centennial, Colorado estate laws is highly recommended ensuring compliance with all necessary procedures.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.