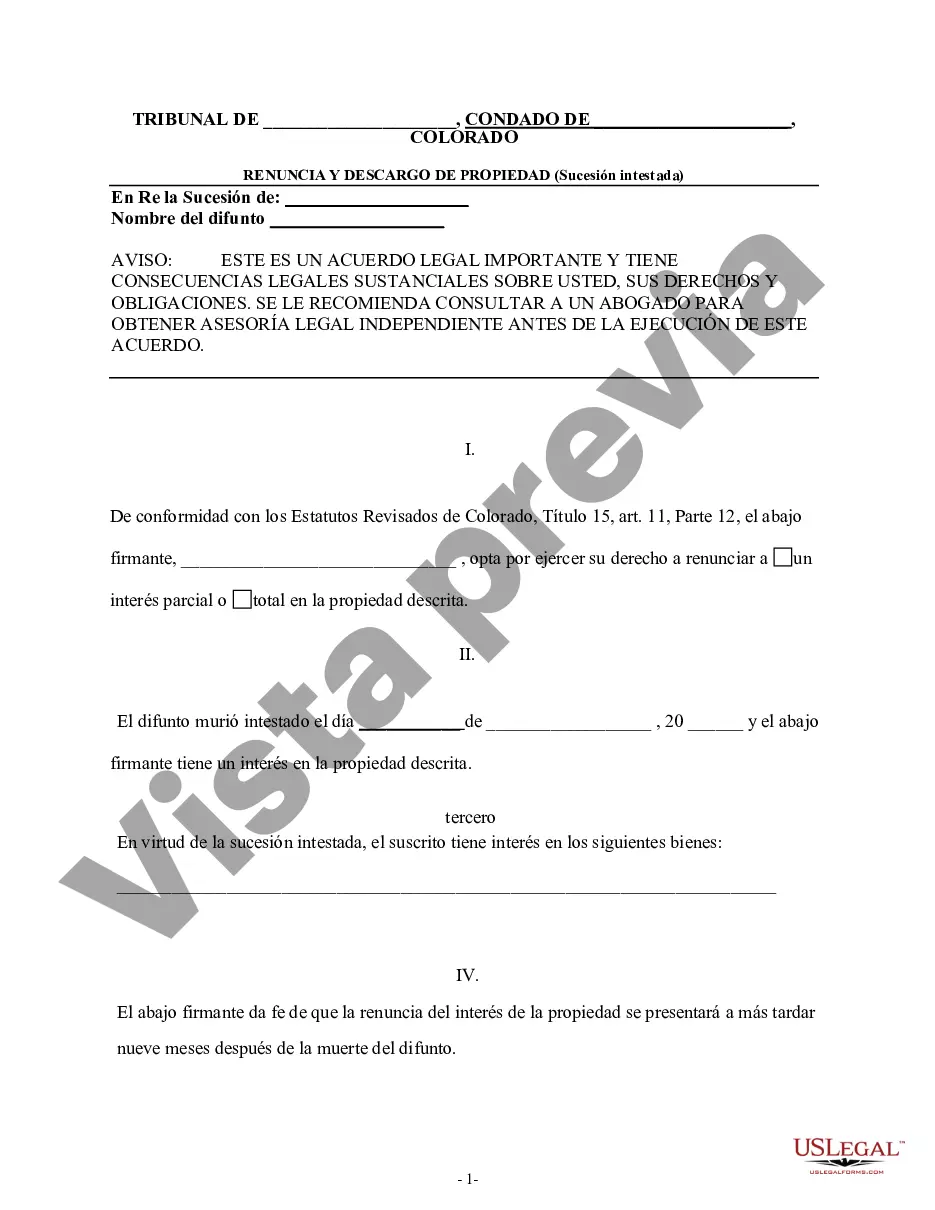

This form is a Renunciation and Disclaimer of Property acquired through intestate succession. The decedent died intestate and the beneficiary gained an interest in the described property. Pursuant to the Colorado Revised Statutes, Title 15, Art. 11, Part 8, the beneficiary has chosen to disclaim a portion of or the entire interest in the property. The disclaimer will relate back to the date of death of the decedent and is an irrevocable refusal to accept the property. The form also contains a state specific acknowledgment and a certificate to verify delivery.

Fort Collins Colorado Renunciation And Disclaimer of Property received by Intestate Succession is a legal process wherein an individual chooses to decline or give up their right to inherit property from a deceased person who passed away without a will. This renunciation and disclaimer are governed by specific laws and regulations in Fort Collins, Colorado. When an individual dies without a will, their property is distributed according to the laws of intestate succession. However, beneficiaries have the option to renounce or disclaim their share of the property if they do not wish to accept it. The Fort Collins Colorado Renunciation And Disclaimer of Property offer several types depending on the circumstances: 1. Renunciation of Inheritance: This type enables a beneficiary to formally decline their share of the property left by the deceased. By doing so, the beneficiary is effectively stating that they do not wish to accept any rights or responsibilities associated with the inherited property. 2. Disclaiming Property by Heir: In cases where an individual is entitled to inherit property due to their legal relationship with the deceased, they may disclaim their right to the inheritance. By disclaiming, the heir avoids any legal or financial obligations tied to the property. 3. Disclaiming Property by Devised or Legatee: Devises or legatees, who are specifically mentioned in a will but wish to waive their inheritance, may utilize this type of renunciation. They can formally state that they disclaim their rights to the property left to them in the will. It is essential to note that the Fort Collins Colorado Renunciation And Disclaimer of Property received by Intestate Succession should be done in writing and submitted to the appropriate authorities within a specified period. The renunciation is irrevocable once it is accepted by the court, meaning it cannot be reversed. By renouncing or disclaiming the inheritance, individuals often choose to pass their share of property to the next eligible beneficiary in line. This ensures a smoother distribution process and allows the estate to be settled efficiently. In conclusion, the Fort Collins Colorado Renunciation And Disclaimer of Property received by Intestate Succession provides beneficiaries with the opportunity to decline or disclaim their right to inherit property left by a deceased person. This legal process enables individuals to avoid any legal obligations or responsibilities associated with the inherited property. It is crucial to consult with a qualified attorney to understand the implications and proper procedures regarding renunciation and disclaimer of property in Fort Collins, Colorado.Fort Collins Colorado Renunciation And Disclaimer of Property received by Intestate Succession is a legal process wherein an individual chooses to decline or give up their right to inherit property from a deceased person who passed away without a will. This renunciation and disclaimer are governed by specific laws and regulations in Fort Collins, Colorado. When an individual dies without a will, their property is distributed according to the laws of intestate succession. However, beneficiaries have the option to renounce or disclaim their share of the property if they do not wish to accept it. The Fort Collins Colorado Renunciation And Disclaimer of Property offer several types depending on the circumstances: 1. Renunciation of Inheritance: This type enables a beneficiary to formally decline their share of the property left by the deceased. By doing so, the beneficiary is effectively stating that they do not wish to accept any rights or responsibilities associated with the inherited property. 2. Disclaiming Property by Heir: In cases where an individual is entitled to inherit property due to their legal relationship with the deceased, they may disclaim their right to the inheritance. By disclaiming, the heir avoids any legal or financial obligations tied to the property. 3. Disclaiming Property by Devised or Legatee: Devises or legatees, who are specifically mentioned in a will but wish to waive their inheritance, may utilize this type of renunciation. They can formally state that they disclaim their rights to the property left to them in the will. It is essential to note that the Fort Collins Colorado Renunciation And Disclaimer of Property received by Intestate Succession should be done in writing and submitted to the appropriate authorities within a specified period. The renunciation is irrevocable once it is accepted by the court, meaning it cannot be reversed. By renouncing or disclaiming the inheritance, individuals often choose to pass their share of property to the next eligible beneficiary in line. This ensures a smoother distribution process and allows the estate to be settled efficiently. In conclusion, the Fort Collins Colorado Renunciation And Disclaimer of Property received by Intestate Succession provides beneficiaries with the opportunity to decline or disclaim their right to inherit property left by a deceased person. This legal process enables individuals to avoid any legal obligations or responsibilities associated with the inherited property. It is crucial to consult with a qualified attorney to understand the implications and proper procedures regarding renunciation and disclaimer of property in Fort Collins, Colorado.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.