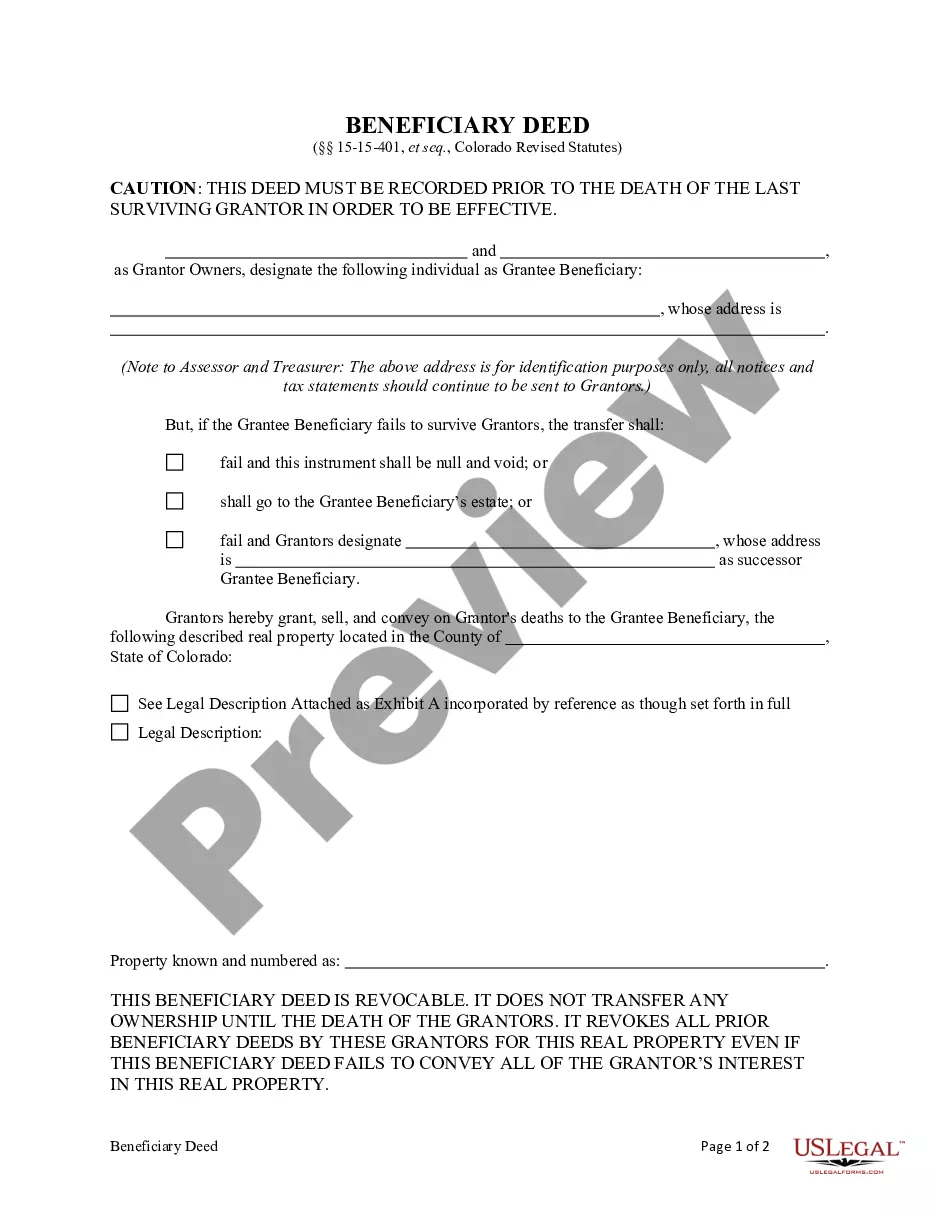

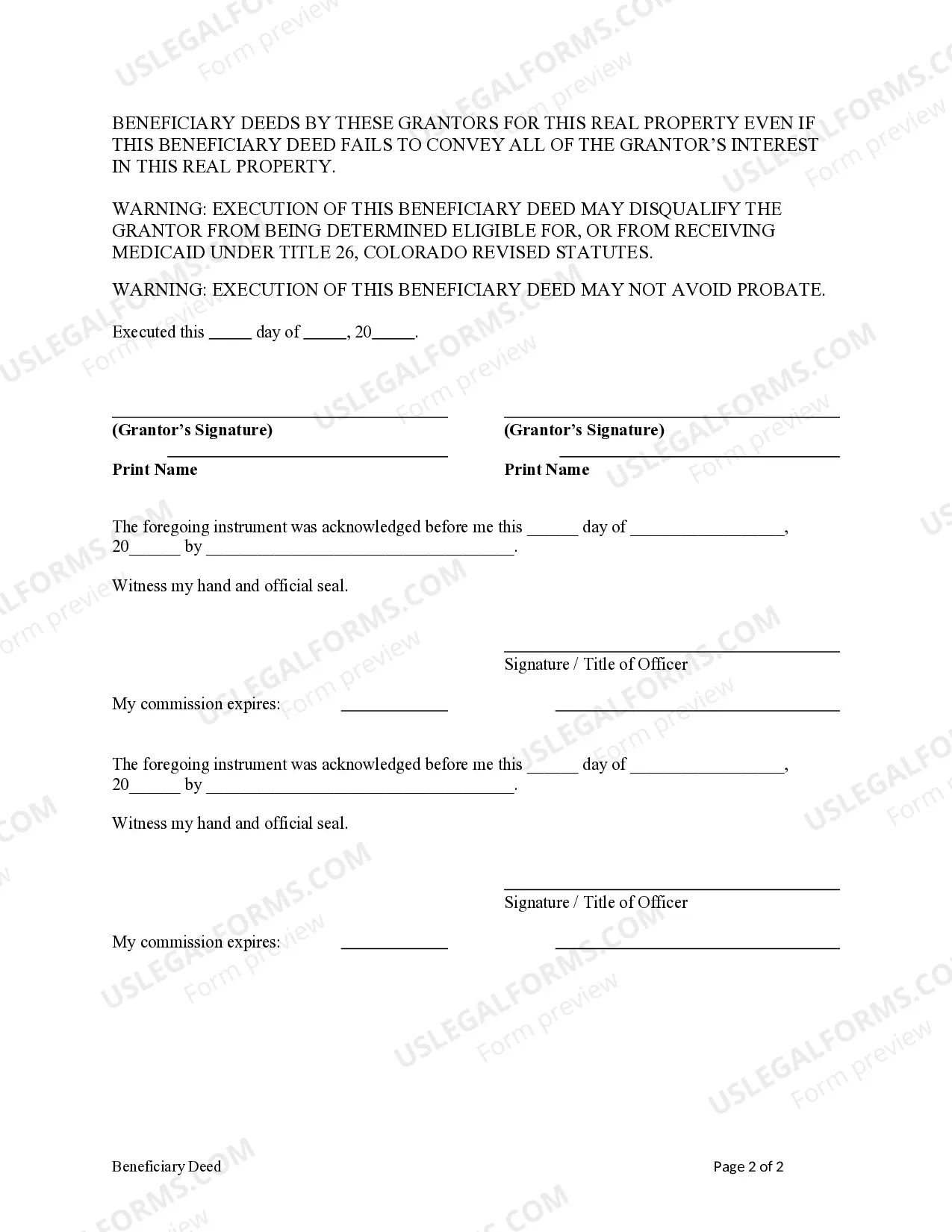

Transfer on Death Deed - Colorado - Husband and Wife to Individual: This deed is used to transfer the ownership or title of a parcel of land, upon the death of the last surviving Grantor, to the Grantee. It does not transfer any present ownership interest in the property and is revocable at any time.

Aurora Colorado Transfer on Death Deed or TOD — Beneficiary Dee— - Husband and Wife to Individual is a legal document that allows property owners in Aurora, Colorado, to designate a specific individual as the beneficiary of their property upon their death. This type of deed provides a simplified and straightforward way to transfer property to the intended recipient, bypassing the probate process. The Transfer on Death Deed or TOD — Beneficiary Deed is specifically designed for married couples who wish to transfer their property to an individual beneficiary. This document ensures that the property automatically passes to the designated beneficiary upon the death of the owners, without the need for a will or probate proceedings. It allows the property owners to retain complete ownership and control over the property during their lifetimes. In Aurora, Colorado, there are different types of Aurora Colorado Transfer on Death Deed or TOD — Beneficiary Dee— - Husband and Wife to Individual, including: 1. Joint Tenancy with Right of Survivorship: This type of deed allows couples to hold property jointly, ensuring that after the death of one spouse, the ownership automatically transfers to the surviving spouse. 2. Tenancy by the Entirety: This form of ownership is exclusively available to married couples and provides additional protection from individual creditors. Upon the death of one spouse, the ownership automatically transfers to the surviving spouse. 3. Community Property with Right of Survivorship: This form of property ownership is only available to spouses. It allows both spouses to hold equal ownership rights, and upon the death of one spouse, the property automatically transfers to the surviving spouse. Regardless of the specific form of ownership chosen, utilizing an Aurora Colorado Transfer on Death Deed or TOD — Beneficiary Dee— - Husband and Wife to Individual ensures a smooth and efficient transfer of property to the intended beneficiary, without the need for probate. It is crucial to consult with a qualified attorney to draft and execute the deed correctly, ensuring compliance with Colorado state laws and requirements. By having a carefully prepared and executed deed, property owners can have peace of mind knowing that their wishes will be fulfilled and their property will be passed on as intended.Aurora Colorado Transfer on Death Deed or TOD — Beneficiary Dee— - Husband and Wife to Individual is a legal document that allows property owners in Aurora, Colorado, to designate a specific individual as the beneficiary of their property upon their death. This type of deed provides a simplified and straightforward way to transfer property to the intended recipient, bypassing the probate process. The Transfer on Death Deed or TOD — Beneficiary Deed is specifically designed for married couples who wish to transfer their property to an individual beneficiary. This document ensures that the property automatically passes to the designated beneficiary upon the death of the owners, without the need for a will or probate proceedings. It allows the property owners to retain complete ownership and control over the property during their lifetimes. In Aurora, Colorado, there are different types of Aurora Colorado Transfer on Death Deed or TOD — Beneficiary Dee— - Husband and Wife to Individual, including: 1. Joint Tenancy with Right of Survivorship: This type of deed allows couples to hold property jointly, ensuring that after the death of one spouse, the ownership automatically transfers to the surviving spouse. 2. Tenancy by the Entirety: This form of ownership is exclusively available to married couples and provides additional protection from individual creditors. Upon the death of one spouse, the ownership automatically transfers to the surviving spouse. 3. Community Property with Right of Survivorship: This form of property ownership is only available to spouses. It allows both spouses to hold equal ownership rights, and upon the death of one spouse, the property automatically transfers to the surviving spouse. Regardless of the specific form of ownership chosen, utilizing an Aurora Colorado Transfer on Death Deed or TOD — Beneficiary Dee— - Husband and Wife to Individual ensures a smooth and efficient transfer of property to the intended beneficiary, without the need for probate. It is crucial to consult with a qualified attorney to draft and execute the deed correctly, ensuring compliance with Colorado state laws and requirements. By having a carefully prepared and executed deed, property owners can have peace of mind knowing that their wishes will be fulfilled and their property will be passed on as intended.