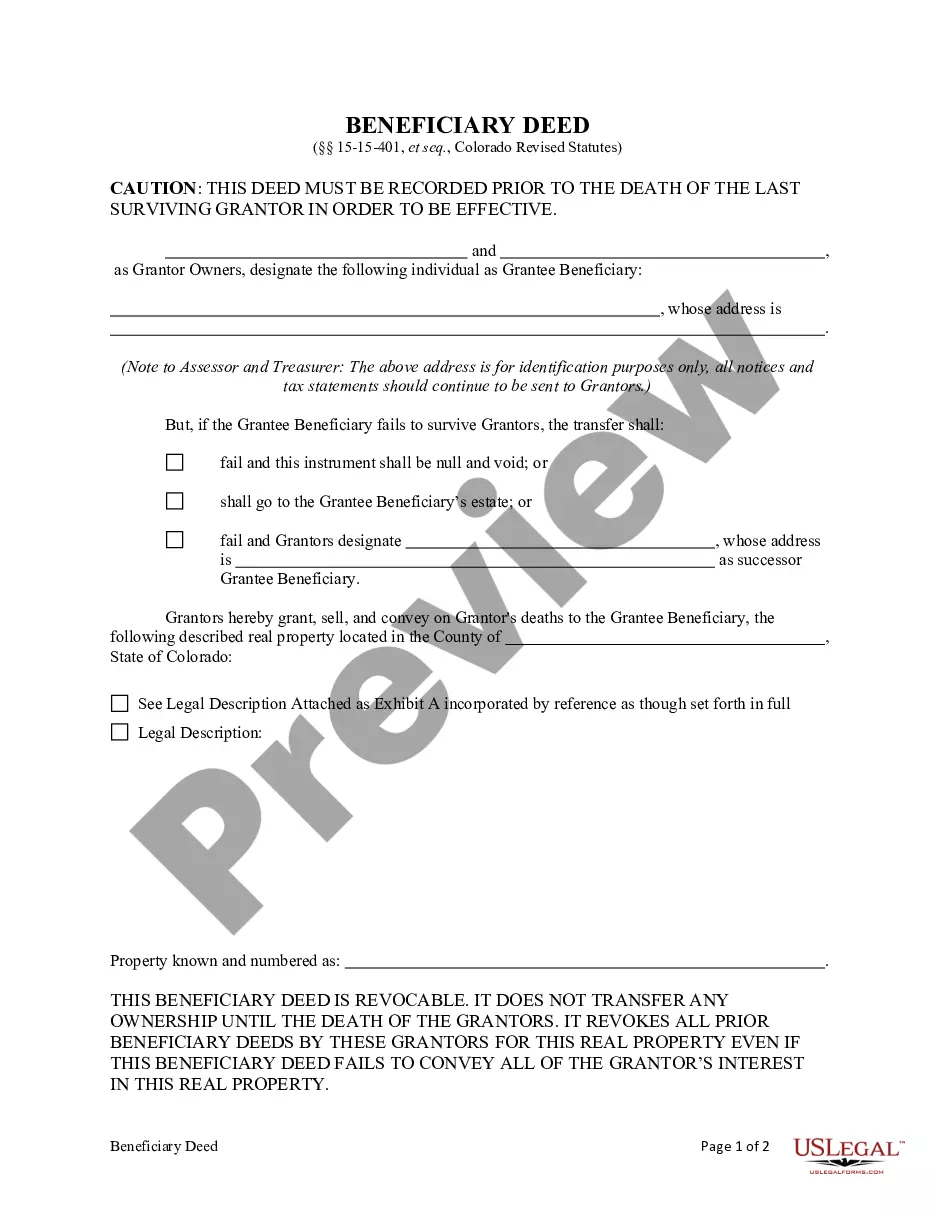

Transfer on Death Deed - Colorado - Husband and Wife to Individual: This deed is used to transfer the ownership or title of a parcel of land, upon the death of the last surviving Grantor, to the Grantee. It does not transfer any present ownership interest in the property and is revocable at any time.

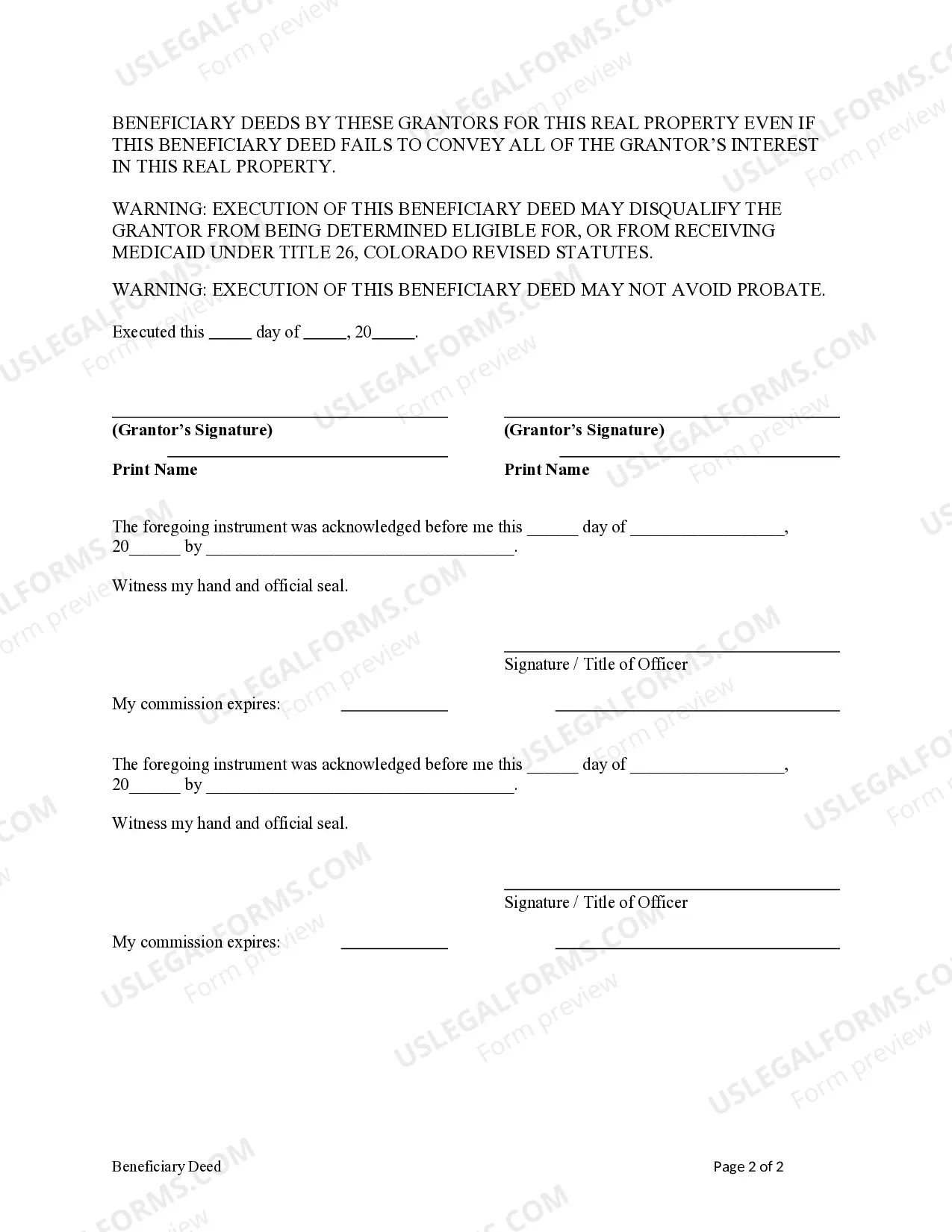

Centennial Colorado Transfer on Death Deed (TOD) is a legal document that allows property owners in Centennial, Colorado, to transfer the ownership of their real estate to a designated beneficiary upon their death. It provides a straightforward and efficient way to transfer property without the need for probate court proceedings. The TOD — Beneficiary Dee— - Husband and Wife to Individual is a specific type of Transfer on Death Deed available in Centennial, Colorado. It is designed for married couples who wish to designate an individual beneficiary as the recipient of their property after both spouses pass away. Key features of the Centennial Colorado Transfer on Death Deed include: 1. Non-probate transfer: With a TOD, the property is transferred directly to the designated beneficiary upon the owner's death, bypassing the probate process. This helps to save time and money associated with probate court proceedings. 2. Revocable nature: The TOD can be revoked or changed at any time by the property owner, allowing flexibility in estate planning. 3. Contingencies: The TOD can include contingent beneficiaries, ensuring that if the primary beneficiary predeceases the property owner, an alternate beneficiary can receive the property. 4. Minimal requirements: To create a valid TOD, the document must meet specific legal requirements in Colorado, including being in writing, signed by the property owner in the presence of a notary public, and recorded with the county clerk and recorder's office before the owner's death. Other types of Centennial Colorado Transfer on Death Deeds available may include variations such as: 1. TOD — Joint Tenancy to Individual: Designed for joint tenants who wish to transfer their interest in the property to an individual beneficiary upon their deaths. 2. TOD — Tenants in Common to Individual: Intended for tenants in common who want to pass their respective shares of the property to an individual beneficiary upon their deaths. In conclusion, the Centennial Colorado Transfer on Death Deed (TOD) — Beneficiary Dee— - Husband and Wife to Individual is a legal tool that provides married couples in Centennial, Colorado, with a straightforward and efficient way to transfer their property to an individual beneficiary upon their deaths. By avoiding probate, this deed can help simplify the estate planning process while ensuring a smooth transition of property ownership.Centennial Colorado Transfer on Death Deed (TOD) is a legal document that allows property owners in Centennial, Colorado, to transfer the ownership of their real estate to a designated beneficiary upon their death. It provides a straightforward and efficient way to transfer property without the need for probate court proceedings. The TOD — Beneficiary Dee— - Husband and Wife to Individual is a specific type of Transfer on Death Deed available in Centennial, Colorado. It is designed for married couples who wish to designate an individual beneficiary as the recipient of their property after both spouses pass away. Key features of the Centennial Colorado Transfer on Death Deed include: 1. Non-probate transfer: With a TOD, the property is transferred directly to the designated beneficiary upon the owner's death, bypassing the probate process. This helps to save time and money associated with probate court proceedings. 2. Revocable nature: The TOD can be revoked or changed at any time by the property owner, allowing flexibility in estate planning. 3. Contingencies: The TOD can include contingent beneficiaries, ensuring that if the primary beneficiary predeceases the property owner, an alternate beneficiary can receive the property. 4. Minimal requirements: To create a valid TOD, the document must meet specific legal requirements in Colorado, including being in writing, signed by the property owner in the presence of a notary public, and recorded with the county clerk and recorder's office before the owner's death. Other types of Centennial Colorado Transfer on Death Deeds available may include variations such as: 1. TOD — Joint Tenancy to Individual: Designed for joint tenants who wish to transfer their interest in the property to an individual beneficiary upon their deaths. 2. TOD — Tenants in Common to Individual: Intended for tenants in common who want to pass their respective shares of the property to an individual beneficiary upon their deaths. In conclusion, the Centennial Colorado Transfer on Death Deed (TOD) — Beneficiary Dee— - Husband and Wife to Individual is a legal tool that provides married couples in Centennial, Colorado, with a straightforward and efficient way to transfer their property to an individual beneficiary upon their deaths. By avoiding probate, this deed can help simplify the estate planning process while ensuring a smooth transition of property ownership.