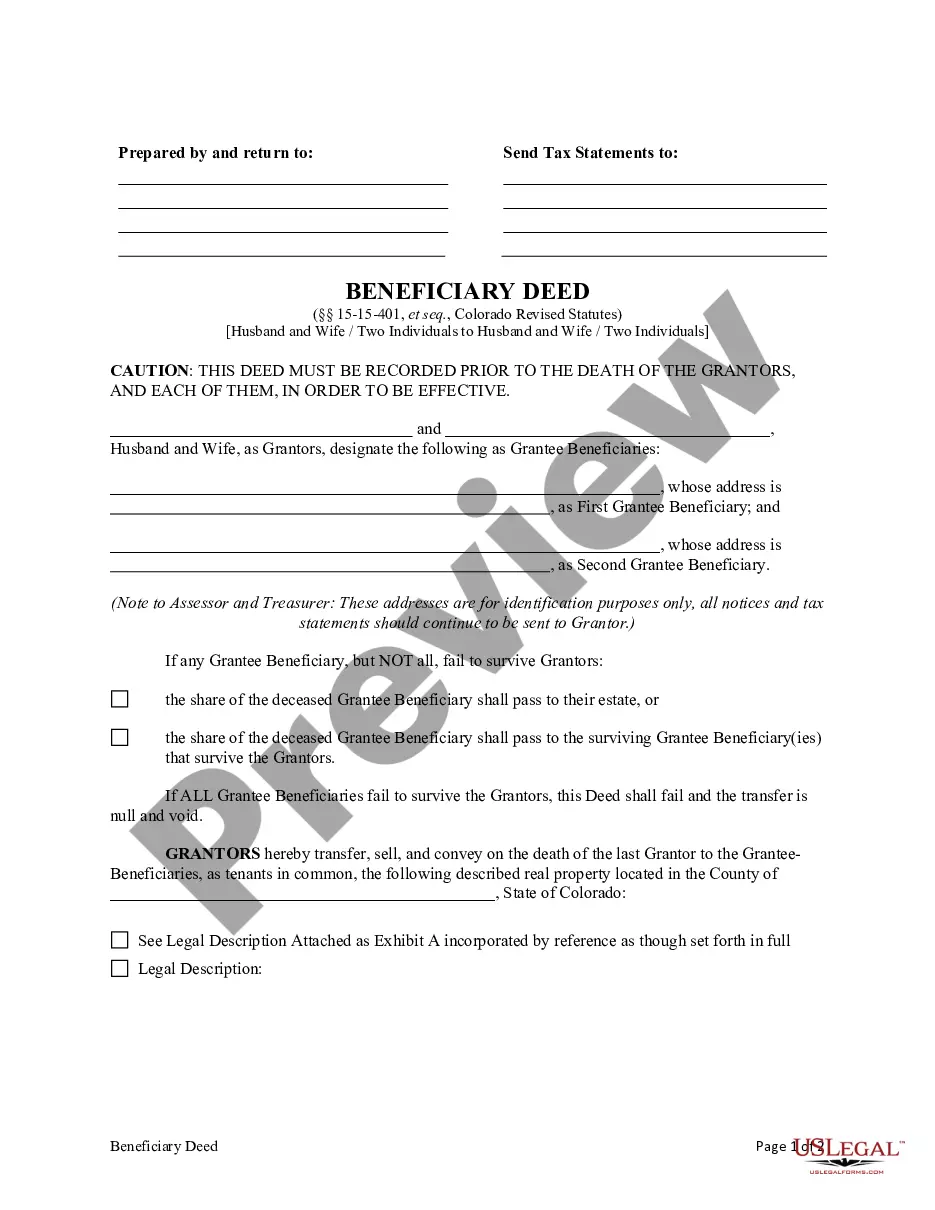

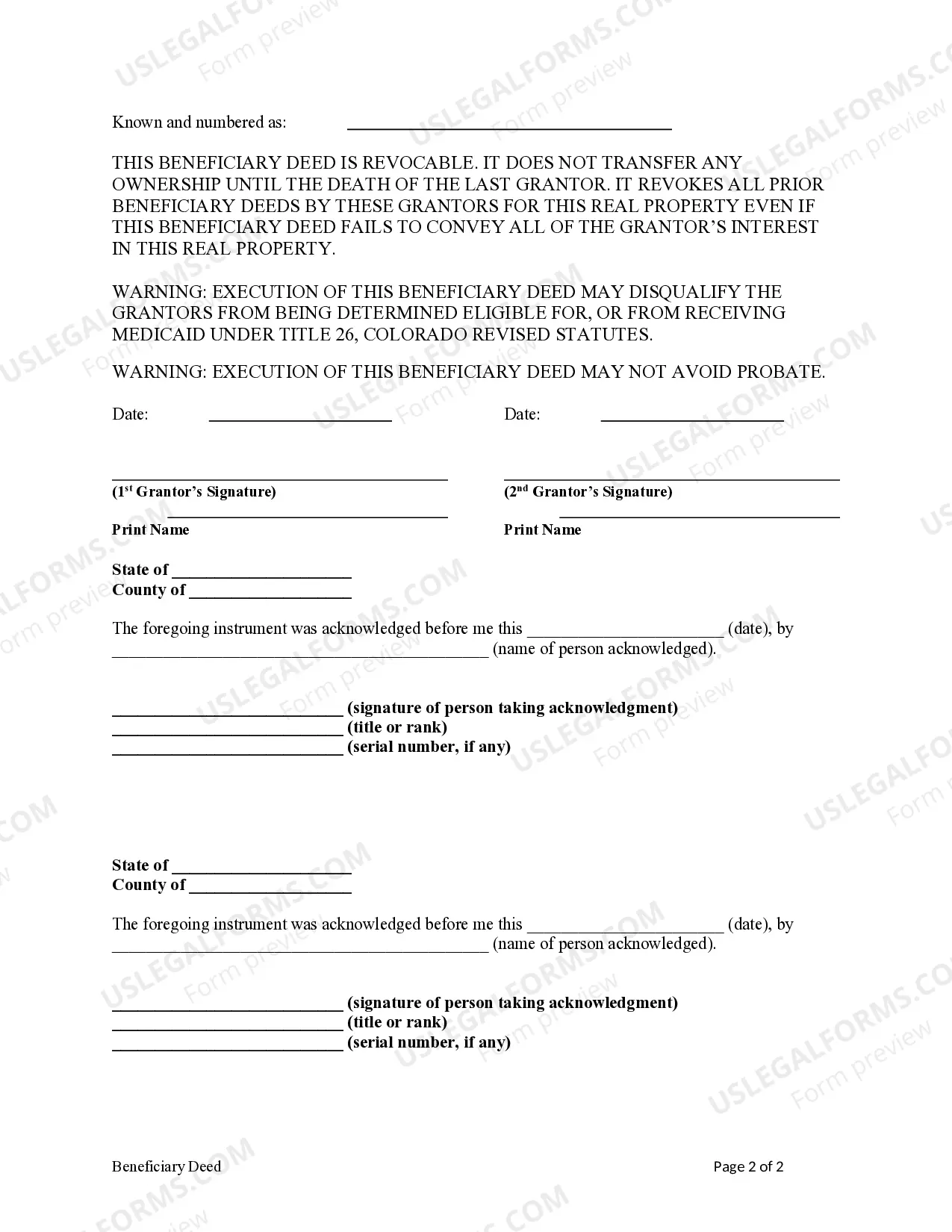

This form is a Beneficiary or Transfer on Death Deed from two individual or husband and wife as Owner Grantors to two individuals or husband and wife as Grantee Beneficiaries. Grantors convey and transfer, upon the death of the last surviving Grantor, to the Grantee Beneficiaries. This Deed is not effective unless recorded prior to the death of either Grantor. This deed complies with all state laws. A Lakewood Colorado Beneficiary or Transfer on Death Deed from Two Individuals / Husband and Wife to Two Individuals / Husband and Wife is a legal document that allows property owners to transfer the ownership of their property upon their death to designated beneficiaries without the need for probate. This type of deed can be used by married couples who jointly own property and want to ensure a smooth and efficient transfer of the property to their chosen recipients. 1. Joint Beneficiary Deed: A Joint Beneficiary Deed is a type of transfer on death deed that allows a married couple to name one or more beneficiaries who will receive the property upon the death of both spouses. This deed allows the property to pass directly to the beneficiaries without going through probate. 2. Living Trust Transfer Deed: A Living Trust Transfer Deed is another option for a married couple to transfer their property to a trust, which would then distribute the property to the named beneficiaries upon the death of both spouses. This type of deed offers added benefits, such as the ability to avoid probate and maintain privacy. 3. Community Property Survivorship Deed: In states where community property laws apply, a Community Property Survivorship Deed allows a married couple to designate each other as joint beneficiaries of the property. Upon the death of one spouse, the property automatically passes to the surviving spouse without the need for probate. When creating a Lakewood Colorado Beneficiary or Transfer on Death Deed from Two Individuals / Husband and Wife to Two Individuals / Husband and Wife, it is essential to consult with an experienced real estate attorney or estate planner to ensure that the deed is properly executed and meets all legal requirements. This will help ensure that the property transfer process is carried out smoothly and according to the wishes of the property owners.

A Lakewood Colorado Beneficiary or Transfer on Death Deed from Two Individuals / Husband and Wife to Two Individuals / Husband and Wife is a legal document that allows property owners to transfer the ownership of their property upon their death to designated beneficiaries without the need for probate. This type of deed can be used by married couples who jointly own property and want to ensure a smooth and efficient transfer of the property to their chosen recipients. 1. Joint Beneficiary Deed: A Joint Beneficiary Deed is a type of transfer on death deed that allows a married couple to name one or more beneficiaries who will receive the property upon the death of both spouses. This deed allows the property to pass directly to the beneficiaries without going through probate. 2. Living Trust Transfer Deed: A Living Trust Transfer Deed is another option for a married couple to transfer their property to a trust, which would then distribute the property to the named beneficiaries upon the death of both spouses. This type of deed offers added benefits, such as the ability to avoid probate and maintain privacy. 3. Community Property Survivorship Deed: In states where community property laws apply, a Community Property Survivorship Deed allows a married couple to designate each other as joint beneficiaries of the property. Upon the death of one spouse, the property automatically passes to the surviving spouse without the need for probate. When creating a Lakewood Colorado Beneficiary or Transfer on Death Deed from Two Individuals / Husband and Wife to Two Individuals / Husband and Wife, it is essential to consult with an experienced real estate attorney or estate planner to ensure that the deed is properly executed and meets all legal requirements. This will help ensure that the property transfer process is carried out smoothly and according to the wishes of the property owners.