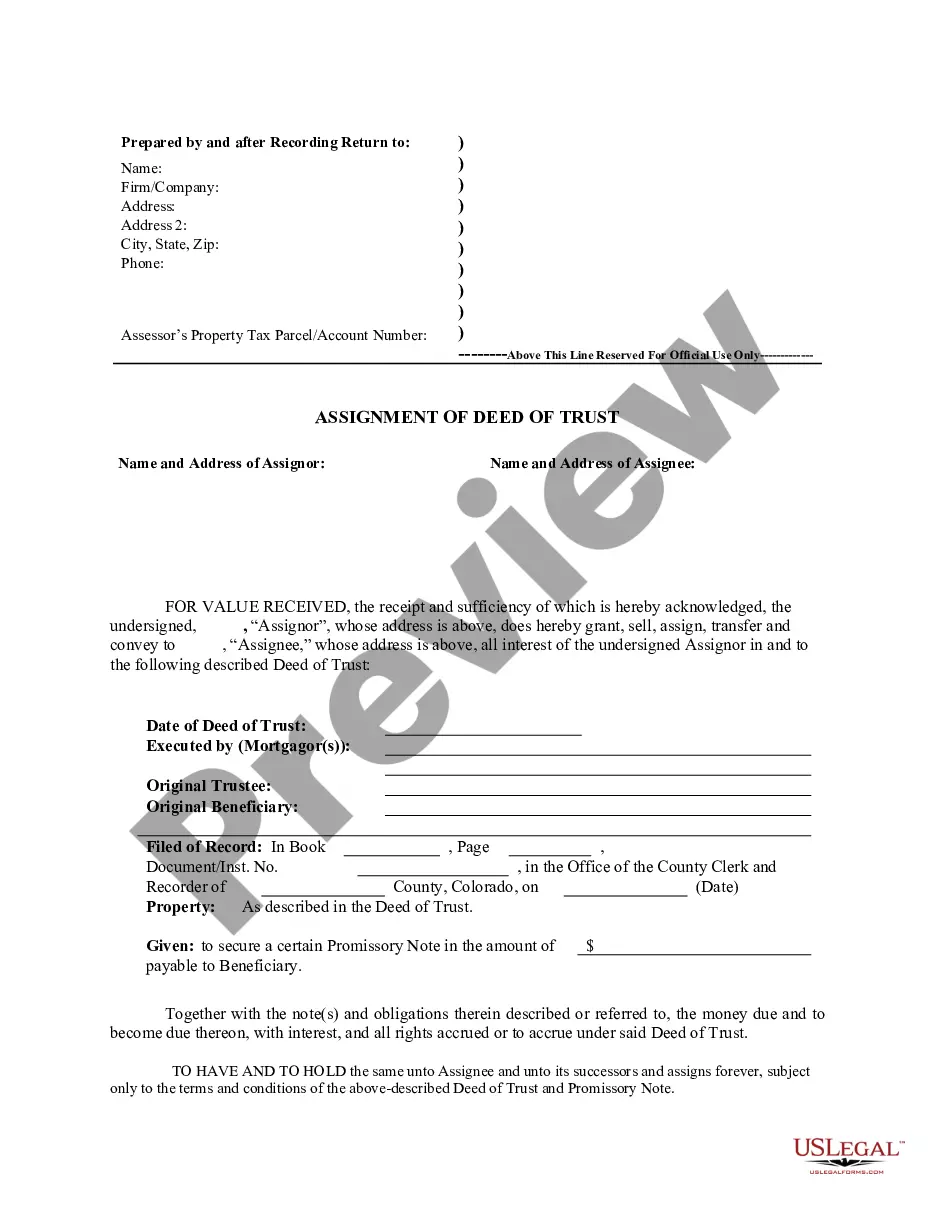

Assignment of Deed of Trust by Corporate Mortgage Holder

Assignments Generally: Lenders,

or holders of mortgages or deeds of trust, often assign mortgages or deeds

of trust to other lenders, or third parties. When this is done the

assignee (person who received the assignment) steps into the place of the

original lender or assignor. To effectuate an assignment, the general

rules is that the assignment must be in proper written format and recorded

to provide notice of the assignment.

Satisfactions Generally: Once a mortgage

or deed of trust is paid, the holder of the mortgage is required to satisfy

the mortgage or deed of trust of record to show that the mortgage or deed

of trust is no longer a lien on the property. The general rule is that

the satisfaction must be in proper written format and recorded to provide

notice of the satisfaction. If the lender fails to record a satisfaction

within set time limits, the lender may be responsible for damages set by

statute for failure to timely cancel the lien. Depending on your state,

a satisfaction may be called a Satisfaction, Cancellation, or Reconveyance.

Some states still recognize marginal satisfaction but this is slowly being

phased out. A marginal satisfaction is where the holder of the mortgage

physically goes to the recording office and enters a satisfaction on the

face of the the recorded mortgage, which is attested by the clerk.

Colorado Law

Assignment: It is recommended that an assignment

be in writing and recorded.

Demand to Satisfy: None required.

Recording Satisfaction: Upon full payoff

and receipt from debtor of the reasonable costs of recording (and within

90 days thereof), the creditor or holder of the debt shall record with

the appropriate clerk and recorder the documents necessary to release or

satisfy the lien of record or, in the case of an indebtedness secured by

a deed of trust to a public trustee, file with the public trustee the documents

required for a release as prescribed by section 38-39-102, whereupon immediately

upon execution of the release of the lien of deed of trust by the public

trustee, the public trustee shall cause such release to be recorded in

the office of the county clerk and recorder of the county in which the

property described in such release is located.

Marginal Satisfaction: Not allowed.

Penalty: Any creditor who fails to timely

comply with the obligations of recording satisfaction shall be liable to

the owner of the real property encumbered by such indebtedness.

Acknowledgment: An assignment or satisfaction

must contain a proper Colorado acknowledgment, or other acknowledgment

approved by Statute.

Colorado Statutes

38-35-124. Requirements upon satisfaction of indebtedness.

... when all indebtedness, whether absolute or contingent,

secured by a lien on real property has been satisfied, unless the debtor

requests in writing that the lien not be released, the creditor or

holder of the indebtedness shall, within ninety days after the satisfaction

of the indebtedness and receipt from the debtor of the reasonable costs

of procuring and recording the release documents, record with the

appropriate clerk and recorder the documents necessary to release or satisfy

the lien of record or, in the case of an indebtedness secured by a deed

of trust to a public trustee, file with the public trustee the documents

required for a release as prescribed by section 38-39-102. If the debtor

requests in writing that the lien be released, or fails to request in writing

that the lien not be released, then the debtor's request or the actual

release shall cancel any obligations on the part of the creditor or holder

to make any further loan or advance that would be secured by the lien.

If the person satisfying the indebtedness requests in writing delivery

to him of the cancelled instruments of indebtedness at the time of satisfaction,

the creditor or holder shall be relieved of any further obligation or liability

under this section after such delivery has been completed. Upon satisfaction

of the indebtedness, the creditor or holder shall return to the person

satisfying the indebtedness all papers and personal property of the debtor

which have been held by the creditor or holder in connection with the indebtedness.

Any

person who fails to comply with this section shall be liable to the owner

of the real property encumbered by such indebtedness.

38-39-102 - When liens of deeds of trust shall be released.

(1) (a) Except as otherwise provided in subsection (3.5) of this

section, liens of deeds of trust to the public trustee, upon compliance

with the provisions of such deeds of trust, shall be released by the public

trustee upon the:

(I) Receipt of a written request of the owner of the evidence of

debt secured by such deed of trust, or the agent or attorney thereof, or

a title insurance company providing an indemnification agreement and affidavit

described in paragraph (c) of subsection (3) of this section, which request

shall be duly executed and acknowledged;

(II) Production of the original cancelled evidence of debt such

as a note or bond as evidence that the indebtedness secured by such deed

of trust has been paid; except that such production may be omitted in the

circumstances contemplated in subsection (3.5) of this section; and (III)

Receipt by the public trustee of the fee prescribed by section 38-37-104

(1) (a) and the fee for recording the release.

(b) Immediately upon execution of the release of the lien of deed

of trust by the public trustee, the public trustee shall cause such

release to be recorded in the office of the county clerk and recorder

of the county in which the property described in such release is located.

(2) If the purpose of the deed of trust has been fully or partially

satisfied and the indebtedness secured by such deed of trust has not been

paid, the public trustee shall release the lien of the deed of trust as

to all or portions of the property encumbered by the deed of trust pursuant

to the provisions of subsection (1) of this section if the request to release

certifies that the purpose of the deed of trust has been fully or partially

satisfied and if either the original evidence of debt is exhibited or the

owner is an entity described in paragraph (b) of subsection (3.5) of this

section that has made, in the owner's request for release or partial release,

the certification contemplated in paragraph (a) of subsection (3.5) of

this section.

(3) With respect to either subsection (1) or (2) of this section,

if such original evidence of debt cannot be produced, the public trustee

may accept one of the following in lieu thereof:

(a) An indemnification agreement accompanied by a certified copy

of an authorizing resolution passed by the board of directors of a bank,

as defined in section 11-1-102 (2), C.R.S., an industrial bank, as provided

for in article 22 of title 11, C.R.S., a savings and loan association licensed

to do business in Colorado, a federal housing administration approved mortgagee,

or a federally chartered credit union operating in Colorado or a state-chartered

credit union, as defined in section 11-30-101, C.R.S., or an indemnification

agreement which has been duly authorized by any agency of the federal government

or by any federally created corporation which originates, guarantees, or

purchases loans indemnifying the public trustee against claims for issuing

a release under this subsection (3) made within the time period described

in subsection (7) of this section, which indemnification agreement is satisfactory

to the public trustee;

(b) A corporate surety bond issued by a company authorized to issue

such bonds in the state of Colorado with the public trustee as obligee,

conditioned against the delivery of any such original evidence of debt

to the damage of the public trustee and in a sum equal to the original

principal amount recited in such deed of trust, which corporate surety

bond shall remain in full force and effect for the time period described

in subsection (7) of this section; or

(c) An indemnification agreement from a title insurance company

licensed and qualified in Colorado in a form acceptable to the public trustee

indemnifying the public trustee from any and all damages as the result

of issuing such release accompanied by an affidavit executed by an officer

of the title insurance company stating that the title insurance company

has caused the debtedness secured by the deed of trust to be satisfied

in full. (3.5) (a) If the owner of the evidence of debt is a financial

institution described in paragraph (b) of this subsection (3.5), the public

trustee may accept, in lieu of production or exhibition of the original

evidence of debt required by subsection (1) or (2) of this section, a certification

made in the owner's request for release or partial release certifying that

the owner is a financial institution described in paragraph (b) of this

subsection (3.5), that the original evidence of debt is not being exhibited

or produced, and that the owner agrees that the owner is obligated to indemnify

the public trustee pursuant to this paragraph (a). Whether such agreement

is contained in the certification, the owner, by requesting release or

partial release without production or exhibition of the evidence of indebtedness,

shall be deemed to have agreed to indemnify the public trustee for any

and all damages, costs, liabilities, and reasonable attorney fees incurred

as a result of the action of the public trustee taken in accordance with

such request, and no separate indemnification agreement shall be necessary

for the agreement to indemnify to be effective. Venue for any action based

upon such indemnification agreement shall be proper only in the county

in which the public trustee receiving the certification is located.

(b) Only the following financial institutions shall be entitled

to submit a certification pursuant to paragraph (a) of this subsection

(3.5):

(I) A bank, as defined in section 11-1-102 (2), C.R.S.;

(II) An industrial bank, as defined in section 11-22-101 (1), C.R.S.;

(III) A savings and loan association licensed to do business in

Colorado;

(IV) A supervised lender, as defined in section 5-1-301 (46), C.R.S.,

that is licensed to make supervised loans pursuant to section 5-2-302,

C.R.S., and that is either:

(A) A public entity, as defined in paragraph (c) of this subsection

(3.5); or

(B) An entity in which all of the outstanding voting securities

are held, directly or indirectly, by a public entity;

(V) An entity in which all of the outstanding voting securities

are held, directly or indirectly, by a public entity also owning, directly

or indirectly, all of the voting securities of a supervised lender, as

defined in section 5-1-301 (46), C.R.S., that is licensed to make supervised

loans pursuant to section 5-2-302, C.R.S.;

(VI) A federal housing administration approved mortgagee;

(VII) A federally chartered credit union doing business in Colorado

or a state chartered credit union, as defined in section 11-30-101, C.R.S.;

(VIII) An agency of the federal government; or

(IX) A federally created corporation that originates, guarantees,

or purchases loans.

(c) For purposes of this subsection (3.5), "public entity" means

an entity that has issued voting securities that are listed on a national

securities exchange registered under the federal "Securities Exchange Act

of 1934".

(4) A public trustee shall have no duty to retain the original cancelled

evidence of debt or deed of trust upon a release granted pursuant to this

section.

(5) The lien of any deed of trust to the public trustee which secures

an obligation other than an evidence of debt shall be released by the public

trustee pursuant to the provisions of subsection (1) of this section as

to all or portions of the property encumbered by the deed of trust upon

the:

(a) Receipt of a written request of the beneficiary or assignee

of such deed of trust, which request shall be duly executed and acknowledged;

(b) Presentation to the public trustee of an affidavit of such beneficiary

or assignee stating that the purpose of the deed of trust has been fully

or partially satisfied; and

(c) Receipt by the public trustee of the fee prescribed by section

38-37-104 (1) (a) and the fee for recording the release.

(6) The public trustee shall have no liability to any person, and

no action may be commenced against the public trustee, as a result of issuing

a release or partial release of a deed of trust under subsection (3) of

this section, unless such action is rommenced within six years from the

date of the recording of such release or partial release or within the

period of time prescribed by any statute of limitation of this state

in which a suit to enforce payment of the indebtedness or performance

of the obligation secured by said deed of trust may be commenced, whichever

is less. Nothing in this article shall be construed to waive immunity

of a public trustee that is provided in sections 24-10-101 to 24-10-120,

C.R.S.

(7) The indemnification agreements or the corporate surety bond

described in this section shall, in each case, remain effective for the

time period described in subsection (6) of this section or until such time

as any claim made against the public trustee within such time period has

been finally resolved, whichever is longer.

(8) If the written request to release the lien of any deed of trust

is a fraudulent request, the release by the public trustee based upon such

request shall be void.

38-39-104 - Satisfaction of mortgage.

The lien of any mortgage encumbering property within the state of

Colorado can be released only by the mortgagee executing a separate

instrument of release executed under the formalities prescribed by

the law regulating conveyances. All releases made prior to July 1, 1973,

either on the mortgage or on the record of the mortgage, and signed by

the mortgagee, shall have the same effect as a separate instrument of release

legally executed by the mortgagee.