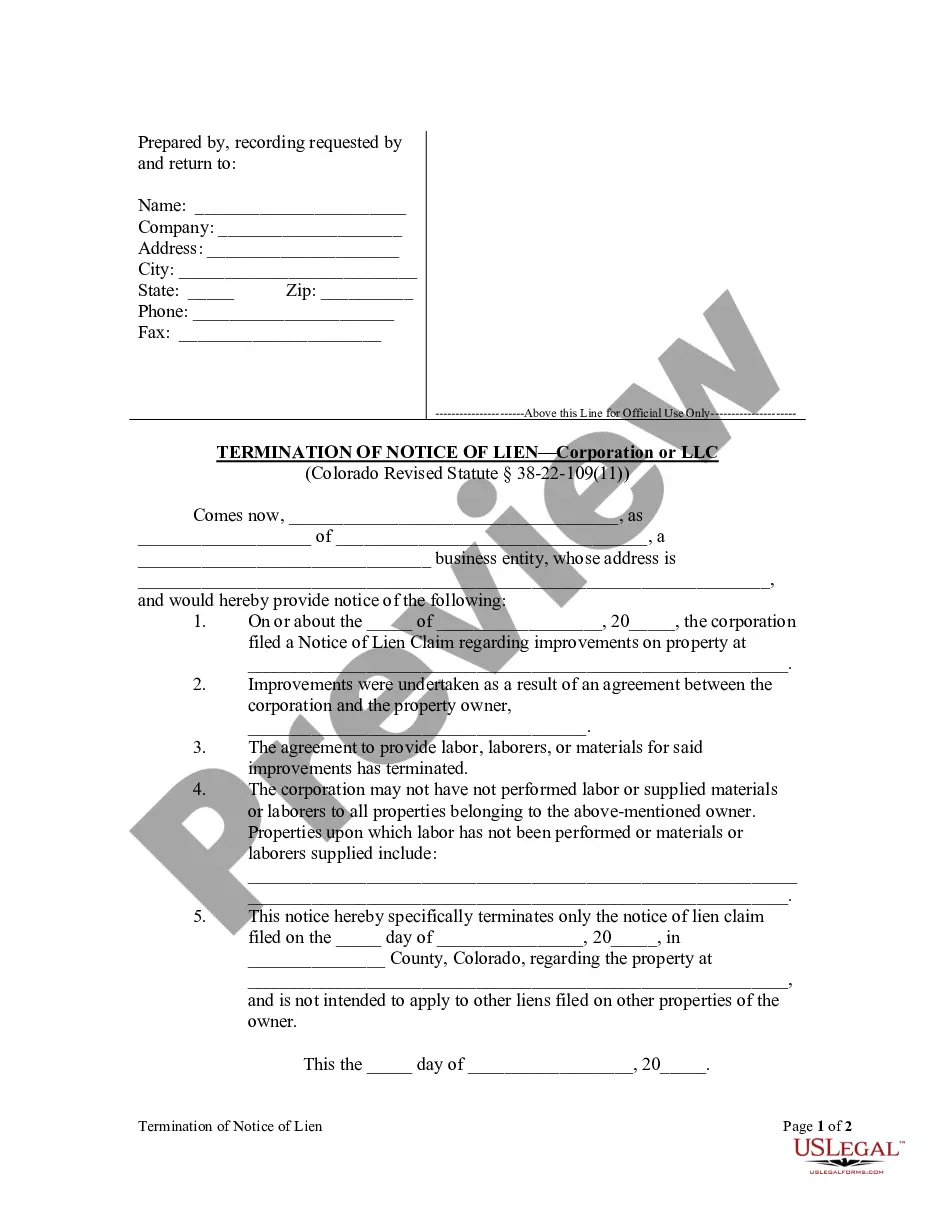

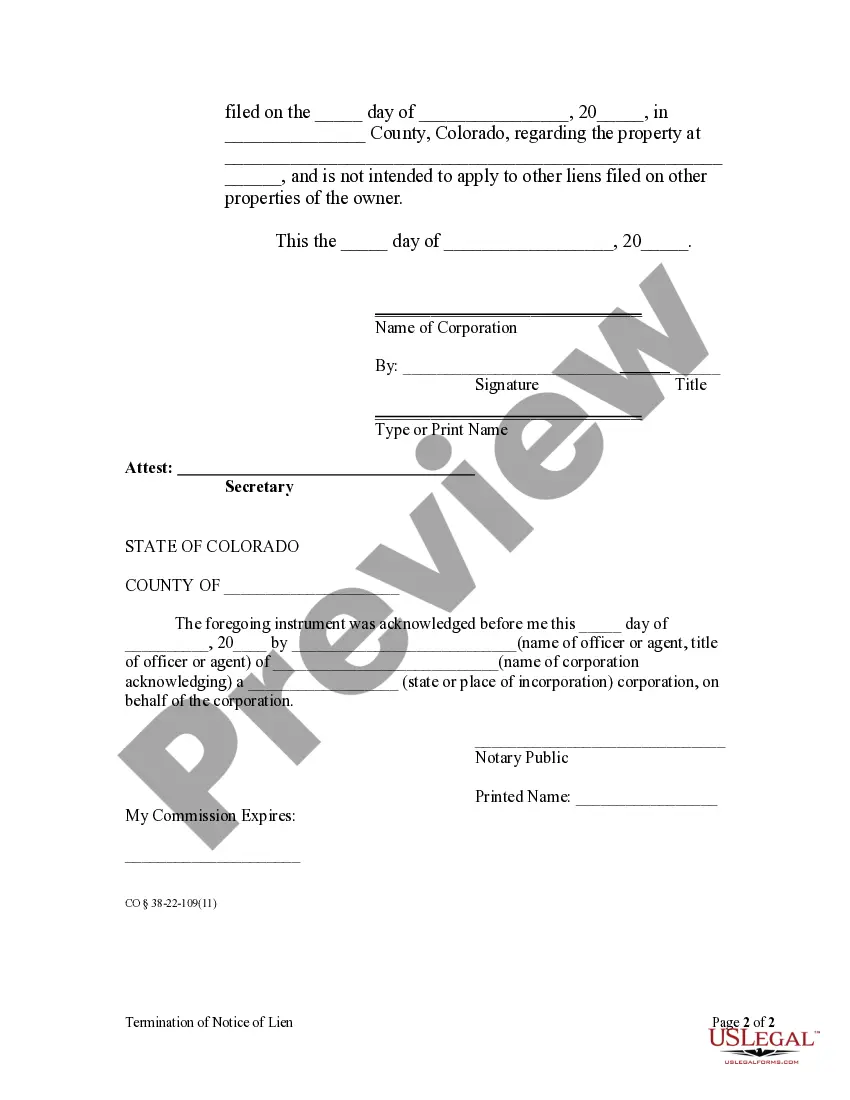

Colorado Revised Statute section 38-22-109(10) allows a potential lien claimant to file a Notice of Lien Claim. Upon the termination of an agreement to provide labor, materials, or laborers, an owner may demand pursuant to section 38-22-109(11) that the party filing the Notice of Lien Claim file a termination of that notice. The termination should be filed in the office of the county clerk or recorder where the original notice was recorded.

Arvada, Colorado Termination of Notice of Lien by Corporation or LLC In Arvada, Colorado, when a corporation or limited liability company (LLC) files a Notice of Lien against a property, it is important for them to understand the process and requirements for terminating that lien. Termination of a Notice of Lien is crucial as it releases the claim on the property, allowing the property owner to regain control and potentially sell or refinance the property. This article will provide a detailed description of the Arvada, Colorado Termination of Notice of Lien process, highlighting the steps involved and relevant keywords. To begin the process of terminating a Notice of Lien, the corporation or LLC must file the necessary documents with the Arvada County Clerk and Recorder's Office. The specific documents required may vary depending on the type of lien being terminated. However, generally, the following steps are involved: 1. Research and Gather Documentation: The corporation or LLC should gather all relevant information and documentation related to the lien, including the Notice of Lien itself, any supporting agreements, contracts, or other documents that establish the claim. 2. Draft a Termination of Notice of Lien: Using the required forms or templates available on the Arvada County Clerk and Recorder's Office website, the corporation or LLC must draft a Termination of Notice of Lien document. This document should include specific details, such as the property description, lien filing information, and the corporation or LLC's official statement of lien release. 3. Notarize the Document: Once the Termination of Notice of Lien document is completed, it must be notarized. This ensures the document's authenticity and compliance with legal requirements. 4. File the Document: The corporation or LLC should submit the notarized Termination of Notice of Lien document to the Arvada County Clerk and Recorder's Office for filing. This can typically be done in person, by mail, or even online, depending on the county's regulations and available options. 5. Notify All Parties Involved: It is crucial for the corporation or LLC to notify all relevant parties involved in the original lien, such as the property owner, other lien holders, and any interested parties. This notification can be done by providing a copy of the filed Termination of Notice of Lien document to each party or sending them a formal notice. By following these steps and ensuring that all required documentation and notifications are completed accurately and promptly, a corporation or LLC can successfully terminate the Notice of Lien in Arvada, Colorado. Different types of Arvada, Colorado Termination of Notice of Lien by Corporation or LLC may include: 1. Termination of Mechanic's Lien: This type of lien applies to contractors, subcontractors, and suppliers who have provided labor, materials, or services for the improvement or construction of real property. 2. Termination of Judgment Lien: Judgment liens are created when a court issues a judgment against an individual or entity, allowing the lien holder to claim an interest in the debtor's property. 3. Termination of Tax Lien: When an individual or entity fails to pay their taxes, the government may place a tax lien on their property. Termination of this type of lien requires adherence to specific procedures and regulations set forth by the tax authorities. 4. Termination of HOA Lien: Homeowners Associations (Has) may file a lien against a property when the owner fails to pay their dues or violates other regulations. A corporation or LLC involved with an HOA may need to terminate this type of lien. These are just a few examples of the various types of Arvada, Colorado Termination of Notice of Lien by Corporation or LLC. It is essential for the concerned party to understand the specific requirements and processes associated with each type to ensure a successful termination. Consulting with legal professionals or conducting detailed research on the applicable laws and regulations is highly recommended.Arvada, Colorado Termination of Notice of Lien by Corporation or LLC In Arvada, Colorado, when a corporation or limited liability company (LLC) files a Notice of Lien against a property, it is important for them to understand the process and requirements for terminating that lien. Termination of a Notice of Lien is crucial as it releases the claim on the property, allowing the property owner to regain control and potentially sell or refinance the property. This article will provide a detailed description of the Arvada, Colorado Termination of Notice of Lien process, highlighting the steps involved and relevant keywords. To begin the process of terminating a Notice of Lien, the corporation or LLC must file the necessary documents with the Arvada County Clerk and Recorder's Office. The specific documents required may vary depending on the type of lien being terminated. However, generally, the following steps are involved: 1. Research and Gather Documentation: The corporation or LLC should gather all relevant information and documentation related to the lien, including the Notice of Lien itself, any supporting agreements, contracts, or other documents that establish the claim. 2. Draft a Termination of Notice of Lien: Using the required forms or templates available on the Arvada County Clerk and Recorder's Office website, the corporation or LLC must draft a Termination of Notice of Lien document. This document should include specific details, such as the property description, lien filing information, and the corporation or LLC's official statement of lien release. 3. Notarize the Document: Once the Termination of Notice of Lien document is completed, it must be notarized. This ensures the document's authenticity and compliance with legal requirements. 4. File the Document: The corporation or LLC should submit the notarized Termination of Notice of Lien document to the Arvada County Clerk and Recorder's Office for filing. This can typically be done in person, by mail, or even online, depending on the county's regulations and available options. 5. Notify All Parties Involved: It is crucial for the corporation or LLC to notify all relevant parties involved in the original lien, such as the property owner, other lien holders, and any interested parties. This notification can be done by providing a copy of the filed Termination of Notice of Lien document to each party or sending them a formal notice. By following these steps and ensuring that all required documentation and notifications are completed accurately and promptly, a corporation or LLC can successfully terminate the Notice of Lien in Arvada, Colorado. Different types of Arvada, Colorado Termination of Notice of Lien by Corporation or LLC may include: 1. Termination of Mechanic's Lien: This type of lien applies to contractors, subcontractors, and suppliers who have provided labor, materials, or services for the improvement or construction of real property. 2. Termination of Judgment Lien: Judgment liens are created when a court issues a judgment against an individual or entity, allowing the lien holder to claim an interest in the debtor's property. 3. Termination of Tax Lien: When an individual or entity fails to pay their taxes, the government may place a tax lien on their property. Termination of this type of lien requires adherence to specific procedures and regulations set forth by the tax authorities. 4. Termination of HOA Lien: Homeowners Associations (Has) may file a lien against a property when the owner fails to pay their dues or violates other regulations. A corporation or LLC involved with an HOA may need to terminate this type of lien. These are just a few examples of the various types of Arvada, Colorado Termination of Notice of Lien by Corporation or LLC. It is essential for the concerned party to understand the specific requirements and processes associated with each type to ensure a successful termination. Consulting with legal professionals or conducting detailed research on the applicable laws and regulations is highly recommended.