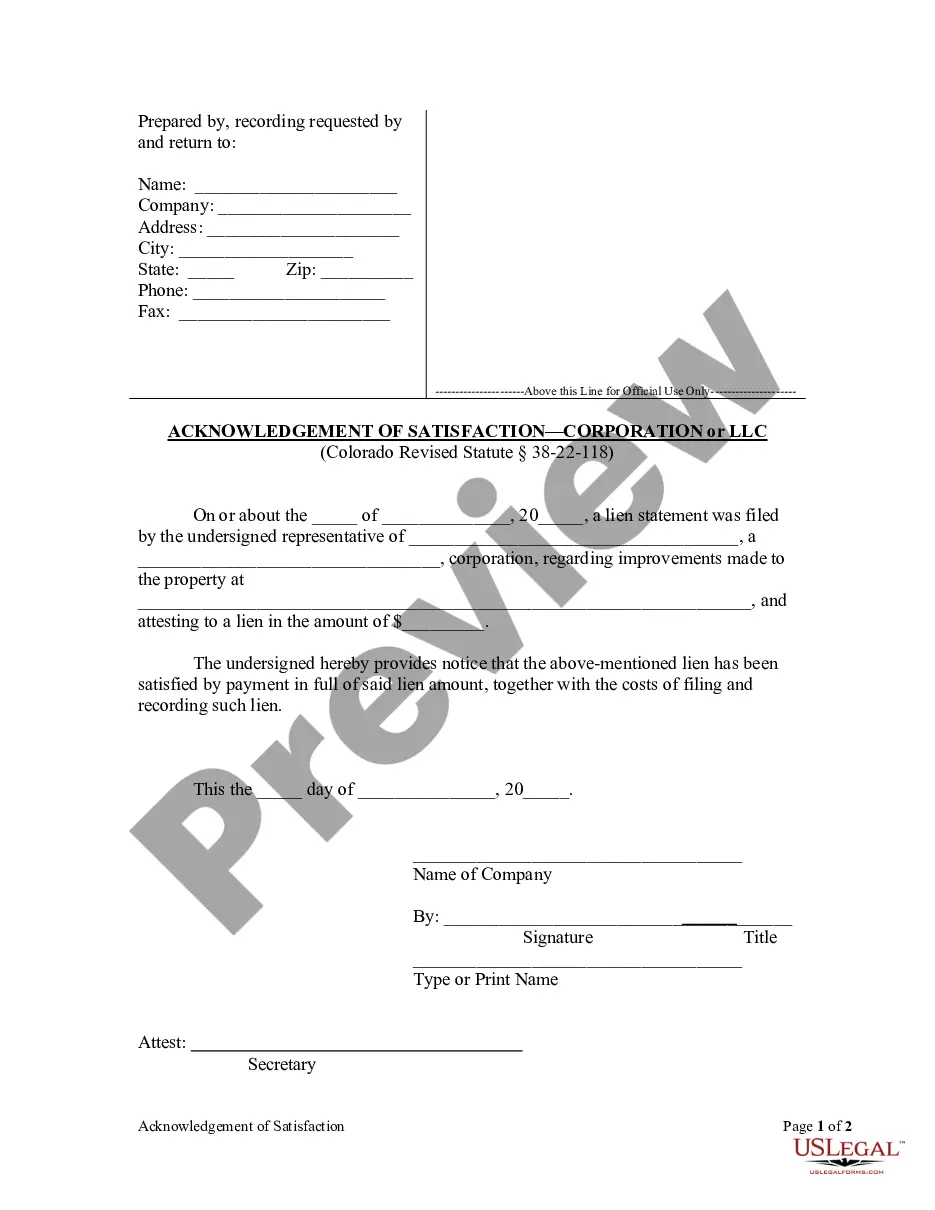

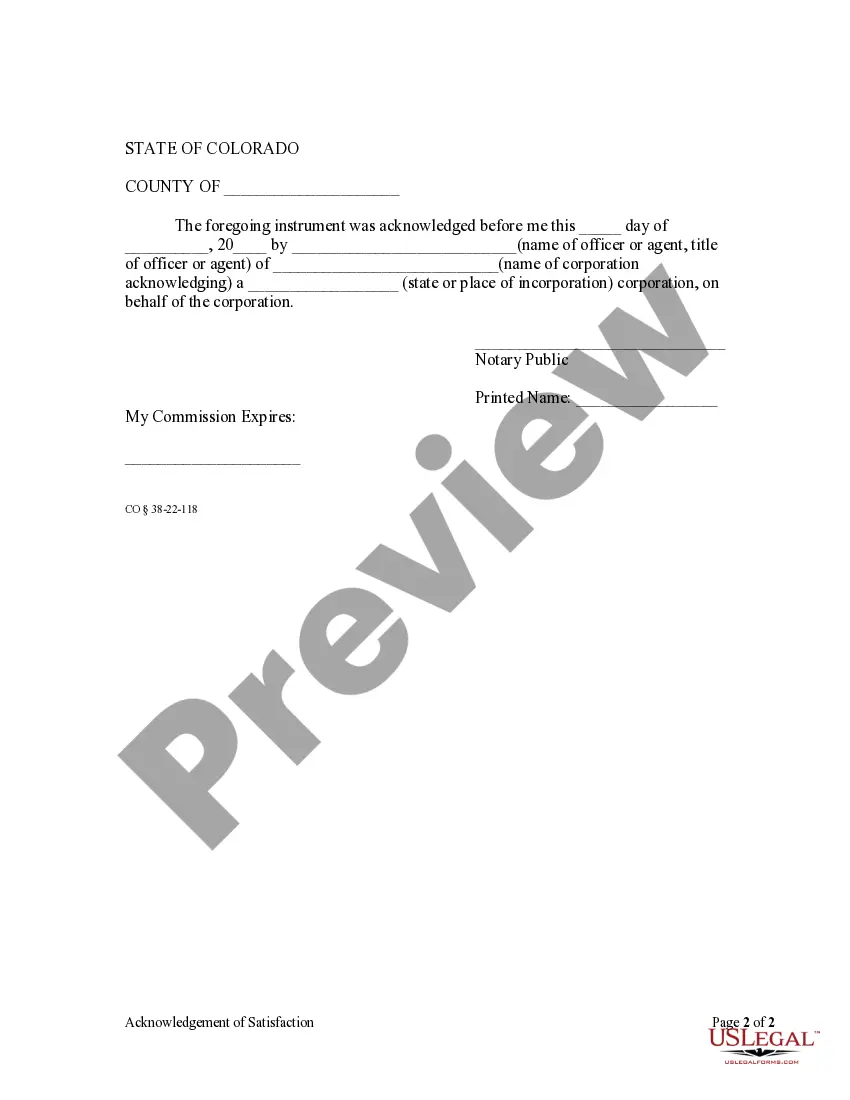

Pursuant to Colorado Revised Statute section 38-22-118, a corporation who has previously filed a lien statement must file an Acknowledgment of Satisfaction after payment in full of the amount attested to in the lien statement, including the cost of filing and recording said lien. Failure to file this acknowledgment within ten (10) days of the request of the property owner to do so may result in a statutory penalty of $10.00 per day being assessed against the lien claimant.

The Thornton Colorado Acknowledgment of Satisfaction of Lien by Corporation or LLC is a legal document that acknowledges the release and satisfaction of a lien by a corporation or limited liability company (LLC) in the city of Thornton, Colorado. This document is crucial in providing evidence that any outstanding lien against a property has been paid in full or otherwise satisfied. This acknowledgment serves as a confirmation from the corporation or LLC that the lien has been legally discharged, allowing the property owner to regain full ownership and control of their property. A lien is typically placed on a property when the owner owes a debt or has an outstanding obligation to the corporation or LLC, and the acknowledgment of satisfaction is necessary to remove that encumbrance. It is important to note that there might be different types of Thornton Colorado Acknowledgment of Satisfaction of Lien by Corporation or LLC depending on the specific circumstances. Some possible variations may include: 1. General Acknowledgment of Satisfaction of Lien by Corporation or LLC: This type of acknowledgment is used when a corporation or LLC has received payment or otherwise satisfied an outstanding lien. It establishes the release of the lien and confirms the corporation or LLC's acknowledgment and agreement to discharge it fully. 2. Partial Satisfaction of Lien by Corporation or LLC: In cases where only a portion of the debt or obligation has been satisfied, a Partial Satisfaction of Lien acknowledgment may be used. This document would specify the exact amount paid or otherwise satisfied and indicate that the remaining amount of the lien is still active and enforceable. 3. Release of Lien by Corporation or LLC: Similar to the General Acknowledgment, this document is used when a corporation or LLC wishes to formally release and discharge a lien on a property, indicating that the lien is no longer enforceable. It is crucial for property owners to obtain this acknowledgment to establish their clear title to the property. 4. Conditional Acknowledgment of Satisfaction of Lien by Corporation or LLC: This type of acknowledgment is used in situations where the satisfaction of the lien by the corporation or LLC is subject to certain conditions. This document would outline the specific conditions that need to be met before the lien will be released or discharged. It is essential to consult with a legal professional or refer to the specific guidelines and requirements provided by Thornton, Colorado's local government to determine the exact type of Acknowledgment of Satisfaction of Lien by Corporation or LLC that is applicable in a given situation.The Thornton Colorado Acknowledgment of Satisfaction of Lien by Corporation or LLC is a legal document that acknowledges the release and satisfaction of a lien by a corporation or limited liability company (LLC) in the city of Thornton, Colorado. This document is crucial in providing evidence that any outstanding lien against a property has been paid in full or otherwise satisfied. This acknowledgment serves as a confirmation from the corporation or LLC that the lien has been legally discharged, allowing the property owner to regain full ownership and control of their property. A lien is typically placed on a property when the owner owes a debt or has an outstanding obligation to the corporation or LLC, and the acknowledgment of satisfaction is necessary to remove that encumbrance. It is important to note that there might be different types of Thornton Colorado Acknowledgment of Satisfaction of Lien by Corporation or LLC depending on the specific circumstances. Some possible variations may include: 1. General Acknowledgment of Satisfaction of Lien by Corporation or LLC: This type of acknowledgment is used when a corporation or LLC has received payment or otherwise satisfied an outstanding lien. It establishes the release of the lien and confirms the corporation or LLC's acknowledgment and agreement to discharge it fully. 2. Partial Satisfaction of Lien by Corporation or LLC: In cases where only a portion of the debt or obligation has been satisfied, a Partial Satisfaction of Lien acknowledgment may be used. This document would specify the exact amount paid or otherwise satisfied and indicate that the remaining amount of the lien is still active and enforceable. 3. Release of Lien by Corporation or LLC: Similar to the General Acknowledgment, this document is used when a corporation or LLC wishes to formally release and discharge a lien on a property, indicating that the lien is no longer enforceable. It is crucial for property owners to obtain this acknowledgment to establish their clear title to the property. 4. Conditional Acknowledgment of Satisfaction of Lien by Corporation or LLC: This type of acknowledgment is used in situations where the satisfaction of the lien by the corporation or LLC is subject to certain conditions. This document would outline the specific conditions that need to be met before the lien will be released or discharged. It is essential to consult with a legal professional or refer to the specific guidelines and requirements provided by Thornton, Colorado's local government to determine the exact type of Acknowledgment of Satisfaction of Lien by Corporation or LLC that is applicable in a given situation.