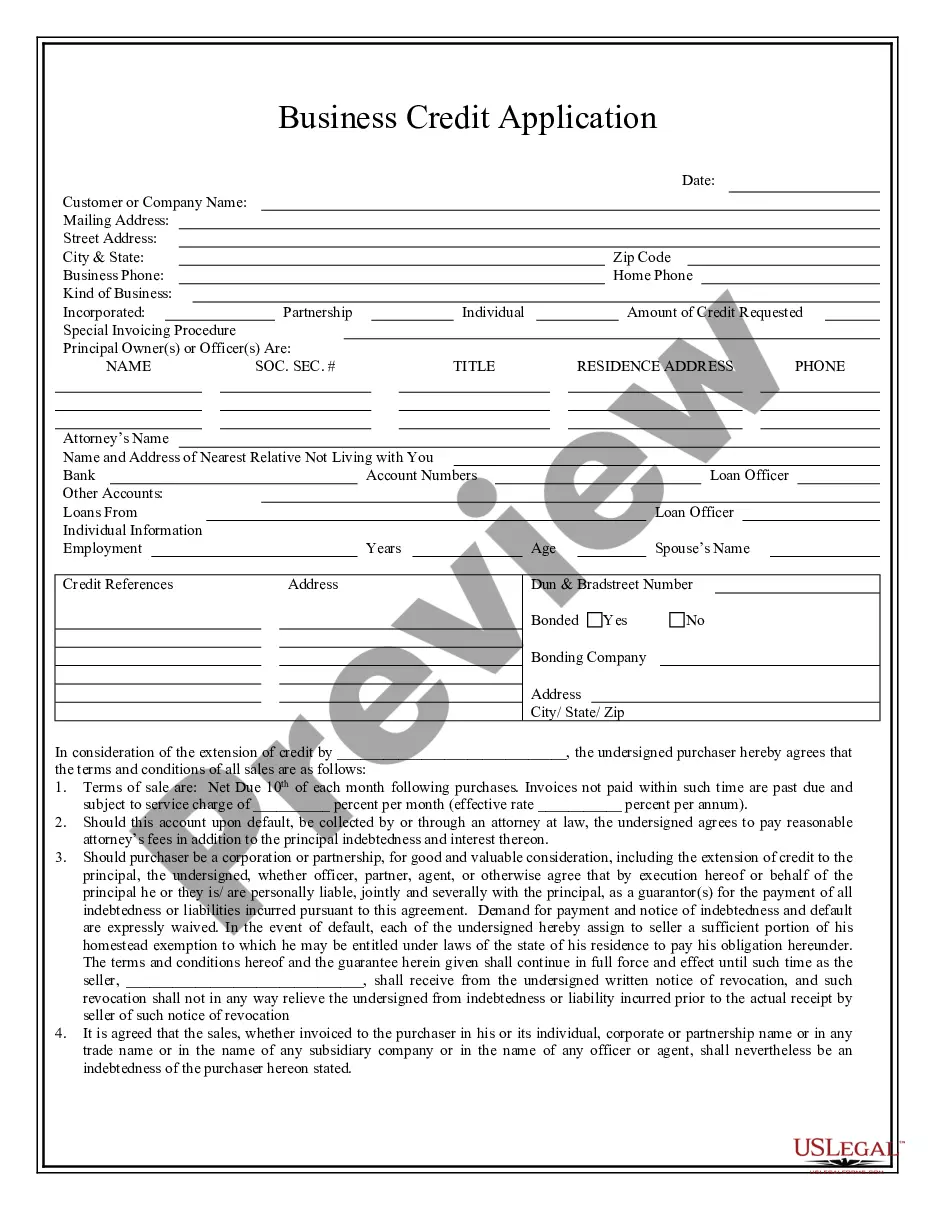

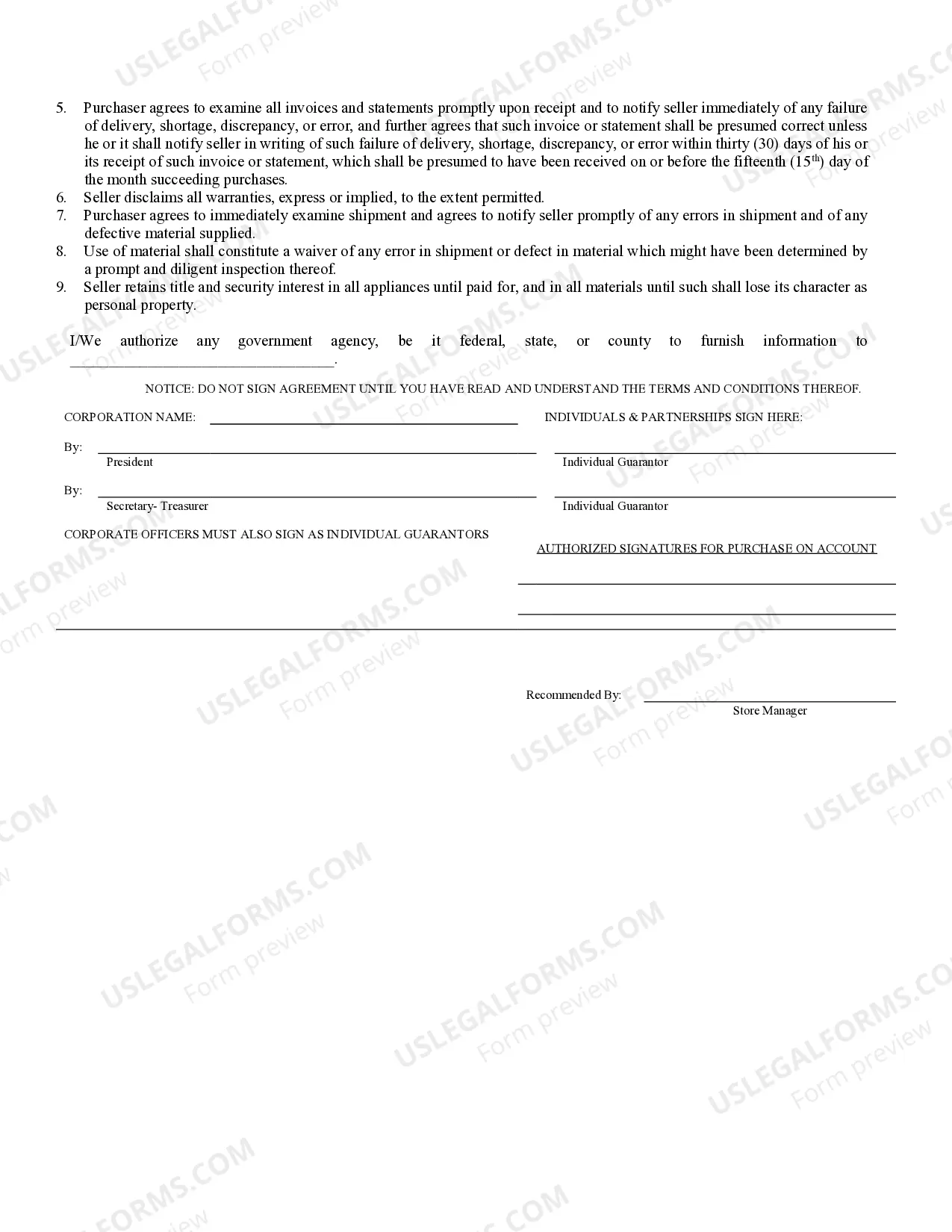

Aurora Colorado Business Credit Application is a vital document used by businesses in Aurora, Colorado, to apply for credit financing options and establish financial agreements with lenders or financial institutions. This comprehensive application form helps businesses access various credit facilities and establishes a financial relationship between a borrower and a lender. This credit application is designed to ensure that businesses in Aurora, Colorado, are provided with extensive information required by lenders to make informed decisions regarding credit approvals. It consists of multiple sections, each focusing on different aspects of the business and its financial standing. The primary purpose of the Aurora Colorado Business Credit Application is to provide lenders with a thorough understanding of the business's financial history, creditworthiness, and ability to repay the credit. It includes sections that require detailed information about the business, such as its legal structure, contact details, years in operation, and a brief overview of products or services offered. Additionally, this application form also requests information about the business's financial statements, including income statements, balance sheets, and cash flow statements. This data gives lenders insight into the company's current financial health and stability. Moreover, the Aurora Colorado Business Credit Application may also require applicants to provide details about their previous credit history, existing debts, liens, and any bankruptcy filings. This helps lenders assess the applicant's creditworthiness and whether they have the capacity to handle additional credit. Furthermore, this application may require information about the business's owners or partners, including their personal financial statements, credit history, and personal guarantees. Lenders often consider the personal creditworthiness of individuals associated with the business when evaluating credit applications. Types of Aurora Colorado Business Credit Application: 1. Small Business Credit Application: Tailored specifically for small businesses in Aurora, Colorado, this application covers the essential information needed to apply for credit financing suitable for the scale and requirements of small enterprises. 2. Corporate Credit Application: Designed for larger corporations, this application form caters to the more complex financial structure and extensive operations of large businesses, including multinational companies operating in Aurora, Colorado. 3. Start-up Business Credit Application: Created specifically for start-up ventures in Aurora, Colorado, this application form considers the unique challenges and limited financial history associated with newly-established businesses. It focuses on providing relevant information regarding the business's business plan, projections, and strategies for growth. In conclusion, the Aurora Colorado Business Credit Application is a critical document that assists businesses in Aurora, Colorado, to request credit financing from lenders or financial institutions. By providing comprehensive information about the business's financial standing, credit history, and owner's personal details, this application enables lenders to make informed decisions regarding credit approvals and financial agreements. Different types of applications are available to cater to the diverse needs of businesses in Aurora, Colorado, including small businesses, corporations, and start-ups.

Aurora Colorado Business Credit Application

Description

How to fill out Aurora Colorado Business Credit Application?

Finding verified templates specific to your local regulations can be difficult unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both personal and professional needs and any real-life scenarios. All the documents are properly grouped by area of usage and jurisdiction areas, so locating the Aurora Colorado Business Credit Application gets as quick and easy as ABC.

For everyone already familiar with our catalogue and has used it before, getting the Aurora Colorado Business Credit Application takes just a few clicks. All you need to do is log in to your account, choose the document, and click Download to save it on your device. This process will take just a few additional actions to make for new users.

Adhere to the guidelines below to get started with the most extensive online form library:

- Check the Preview mode and form description. Make certain you’ve chosen the right one that meets your requirements and totally corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you find any inconsistency, use the Search tab above to find the right one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and select the subscription plan you prefer. You should sign up for an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the service.

- Download the Aurora Colorado Business Credit Application. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Take advantage of the US Legal Forms library to always have essential document templates for any needs just at your hand!