- US Legal Forms

- Localized Forms

- Colorado

- Colorado Springs

-

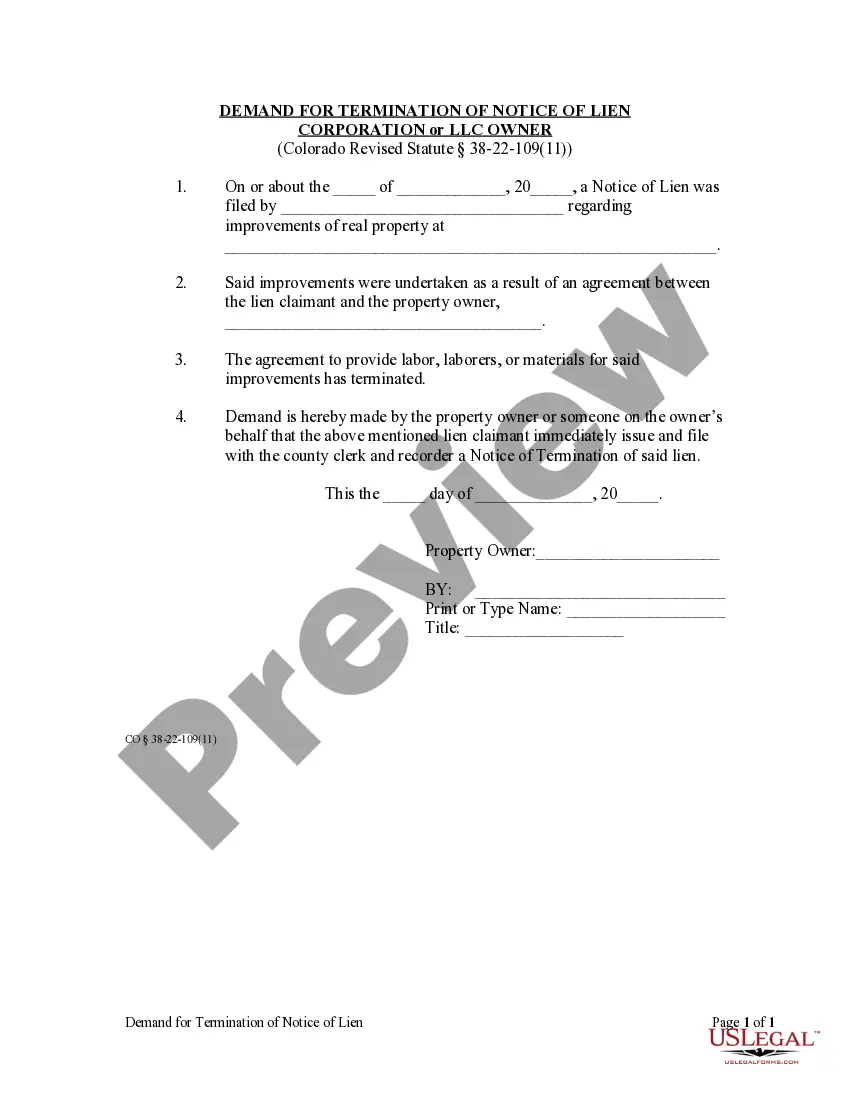

Colorado Demand for Termination of Notice of Lien - Corporation

Colorado Springs Colorado Demand for Termination of Notice of Lien - Corporation

Description

Related forms

Viewed forms

Self-Employed Independent Contractor Agreement for the Sale of Book

Service Contract for Development and Design

Checklist Evaluation of Potential Board Member Nominees

Sample Letter for Letter from Boss Denying Telecommuting

Compilation of Information to Identify an Absconded Spouse

Revocable Trust for Lottery Winnings

How to fill out Colorado Springs Colorado Demand For Termination Of Notice Of Lien - Corporation?

No matter the social or professional status, filling out legal documents is an unfortunate necessity in today’s world. Too often, it’s virtually impossible for someone with no legal background to draft such paperwork from scratch, mainly due to the convoluted terminology and legal nuances they entail. This is where US Legal Forms can save the day. Our service offers a huge library with over 85,000 ready-to-use state-specific documents that work for pretty much any legal situation. US Legal Forms also is an excellent asset for associates or legal counsels who want to to be more efficient time-wise using our DYI forms.

Whether you require the Colorado Springs Colorado Demand for Termination of Notice of Lien - Corporation or LLC or any other document that will be good in your state or area, with US Legal Forms, everything is on hand. Here’s how to get the Colorado Springs Colorado Demand for Termination of Notice of Lien - Corporation or LLC in minutes employing our trusted service. In case you are presently an existing customer, you can go on and log in to your account to get the needed form.

Nevertheless, if you are unfamiliar with our platform, make sure to follow these steps before obtaining the Colorado Springs Colorado Demand for Termination of Notice of Lien - Corporation or LLC:

- Be sure the template you have chosen is suitable for your area because the rules of one state or area do not work for another state or area.

- Review the form and read a brief description (if available) of cases the document can be used for.

- If the one you chosen doesn’t meet your requirements, you can start again and search for the suitable document.

- Click Buy now and pick the subscription plan that suits you the best.

- Access an account {using your login information or create one from scratch.

- Select the payment method and proceed to download the Colorado Springs Colorado Demand for Termination of Notice of Lien - Corporation or LLC once the payment is completed.

You’re all set! Now you can go on and print out the form or fill it out online. In case you have any issues locating your purchased documents, you can easily access them in the My Forms tab.

Whatever case you’re trying to sort out, US Legal Forms has got you covered. Give it a try today and see for yourself.

Form Rating

Form popularity

FAQ

In Colorado, a mechanics lien expires within 6 months of the date the project was completed, or labor or materials were last furnished to the project; whichever is later. The lien claimant must file an action to enforce their lien claim before the deadline or the claim expires and is no longer enforceable.

If contractors and suppliers don't get paid on a construction project in Colorado, they can file a lien to secure payment (even if they were hired by a tenant). A mechanics lien is a legal tool that provides the unpaid party with a security interest in the property.

If the lien on your property is not valid or it is not a legal lien, then you can take legal action. You will want to file what is called a spurious lien action. A spurious lien is an invalid or illegal lien. You must file a spurious lien action in court, and a judge eventually decides whether the lien is valid or not.

Timely File Your Lien: Your mechanics lien in Colorado must be filed within 4 months, or 120 days, of the last date you provided labor and materials for the project. However, if you did not provide materials and only provided labor, you only have 2 months from your last day of providing labor to file your lien.

Restitution liens are effective for 12 years if the amount due is not paid. However, the lien can be extended indefinitely if it is continued every 12 years.

You can remove a mechanics lien only by one of two ways: The contractor records a release of mechanics lien; or. You file a petition with the court to release the mechanics lien.

If the lien on your property is not valid or it is not a legal lien, then you can take legal action. You will want to file what is called a spurious lien action. A spurious lien is an invalid or illegal lien. You must file a spurious lien action in court, and a judge eventually decides whether the lien is valid or not.

Colorado requires all potential lien claimants to serve a Notice of Intent to Lien on the property owner 10 days before filing. General contractors, subcontractors, suppliers, and most others must file a Colorado mechanics lien within 4 months after last providing services or materials.

Steps to file a Colorado mechanics lien Fill out the right Colorado mechanics lien form. Using a mechanics lien form that meets the statutory requirements, fill it out completely and accurately. Send a Notice of Intent to Lien to the property owner.File your lien claim with the Colorado county recorder.

In Colorado, a mechanics lien expires within 6 months of the date the project was completed, or labor or materials were last furnished to the project; whichever is later. The lien claimant must file an action to enforce their lien claim before the deadline or the claim expires and is no longer enforceable.

If contractors and suppliers don't get paid on a construction project in Colorado, they can file a lien to secure payment (even if they were hired by a tenant). A mechanics lien is a legal tool that provides the unpaid party with a security interest in the property.

If the lien on your property is not valid or it is not a legal lien, then you can take legal action. You will want to file what is called a spurious lien action. A spurious lien is an invalid or illegal lien. You must file a spurious lien action in court, and a judge eventually decides whether the lien is valid or not.

Timely File Your Lien: Your mechanics lien in Colorado must be filed within 4 months, or 120 days, of the last date you provided labor and materials for the project. However, if you did not provide materials and only provided labor, you only have 2 months from your last day of providing labor to file your lien.

Restitution liens are effective for 12 years if the amount due is not paid. However, the lien can be extended indefinitely if it is continued every 12 years.

You can remove a mechanics lien only by one of two ways: The contractor records a release of mechanics lien; or. You file a petition with the court to release the mechanics lien.

If the lien on your property is not valid or it is not a legal lien, then you can take legal action. You will want to file what is called a spurious lien action. A spurious lien is an invalid or illegal lien. You must file a spurious lien action in court, and a judge eventually decides whether the lien is valid or not.

Colorado requires all potential lien claimants to serve a Notice of Intent to Lien on the property owner 10 days before filing. General contractors, subcontractors, suppliers, and most others must file a Colorado mechanics lien within 4 months after last providing services or materials.

Steps to file a Colorado mechanics lien Fill out the right Colorado mechanics lien form. Using a mechanics lien form that meets the statutory requirements, fill it out completely and accurately. Send a Notice of Intent to Lien to the property owner.File your lien claim with the Colorado county recorder.

In Colorado, a mechanics lien expires within 6 months of the date the project was completed, or labor or materials were last furnished to the project; whichever is later. The lien claimant must file an action to enforce their lien claim before the deadline or the claim expires and is no longer enforceable.

If contractors and suppliers don't get paid on a construction project in Colorado, they can file a lien to secure payment (even if they were hired by a tenant). A mechanics lien is a legal tool that provides the unpaid party with a security interest in the property.

If the lien on your property is not valid or it is not a legal lien, then you can take legal action. You will want to file what is called a spurious lien action. A spurious lien is an invalid or illegal lien. You must file a spurious lien action in court, and a judge eventually decides whether the lien is valid or not.

Timely File Your Lien: Your mechanics lien in Colorado must be filed within 4 months, or 120 days, of the last date you provided labor and materials for the project. However, if you did not provide materials and only provided labor, you only have 2 months from your last day of providing labor to file your lien.

Restitution liens are effective for 12 years if the amount due is not paid. However, the lien can be extended indefinitely if it is continued every 12 years.

You can remove a mechanics lien only by one of two ways: The contractor records a release of mechanics lien; or. You file a petition with the court to release the mechanics lien.

If the lien on your property is not valid or it is not a legal lien, then you can take legal action. You will want to file what is called a spurious lien action. A spurious lien is an invalid or illegal lien. You must file a spurious lien action in court, and a judge eventually decides whether the lien is valid or not.

Colorado requires all potential lien claimants to serve a Notice of Intent to Lien on the property owner 10 days before filing. General contractors, subcontractors, suppliers, and most others must file a Colorado mechanics lien within 4 months after last providing services or materials.

Steps to file a Colorado mechanics lien Fill out the right Colorado mechanics lien form. Using a mechanics lien form that meets the statutory requirements, fill it out completely and accurately. Send a Notice of Intent to Lien to the property owner.File your lien claim with the Colorado county recorder.

In Colorado, a mechanics lien expires within 6 months of the date the project was completed, or labor or materials were last furnished to the project; whichever is later. The lien claimant must file an action to enforce their lien claim before the deadline or the claim expires and is no longer enforceable.

If contractors and suppliers don't get paid on a construction project in Colorado, they can file a lien to secure payment (even if they were hired by a tenant). A mechanics lien is a legal tool that provides the unpaid party with a security interest in the property.

If the lien on your property is not valid or it is not a legal lien, then you can take legal action. You will want to file what is called a spurious lien action. A spurious lien is an invalid or illegal lien. You must file a spurious lien action in court, and a judge eventually decides whether the lien is valid or not.

Timely File Your Lien: Your mechanics lien in Colorado must be filed within 4 months, or 120 days, of the last date you provided labor and materials for the project. However, if you did not provide materials and only provided labor, you only have 2 months from your last day of providing labor to file your lien.

Restitution liens are effective for 12 years if the amount due is not paid. However, the lien can be extended indefinitely if it is continued every 12 years.

You can remove a mechanics lien only by one of two ways: The contractor records a release of mechanics lien; or. You file a petition with the court to release the mechanics lien.

If the lien on your property is not valid or it is not a legal lien, then you can take legal action. You will want to file what is called a spurious lien action. A spurious lien is an invalid or illegal lien. You must file a spurious lien action in court, and a judge eventually decides whether the lien is valid or not.

Colorado requires all potential lien claimants to serve a Notice of Intent to Lien on the property owner 10 days before filing. General contractors, subcontractors, suppliers, and most others must file a Colorado mechanics lien within 4 months after last providing services or materials.

Steps to file a Colorado mechanics lien Fill out the right Colorado mechanics lien form. Using a mechanics lien form that meets the statutory requirements, fill it out completely and accurately. Send a Notice of Intent to Lien to the property owner.File your lien claim with the Colorado county recorder.

In Colorado, a mechanics lien expires within 6 months of the date the project was completed, or labor or materials were last furnished to the project; whichever is later. The lien claimant must file an action to enforce their lien claim before the deadline or the claim expires and is no longer enforceable.

If contractors and suppliers don't get paid on a construction project in Colorado, they can file a lien to secure payment (even if they were hired by a tenant). A mechanics lien is a legal tool that provides the unpaid party with a security interest in the property.

If the lien on your property is not valid or it is not a legal lien, then you can take legal action. You will want to file what is called a spurious lien action. A spurious lien is an invalid or illegal lien. You must file a spurious lien action in court, and a judge eventually decides whether the lien is valid or not.

Timely File Your Lien: Your mechanics lien in Colorado must be filed within 4 months, or 120 days, of the last date you provided labor and materials for the project. However, if you did not provide materials and only provided labor, you only have 2 months from your last day of providing labor to file your lien.

Restitution liens are effective for 12 years if the amount due is not paid. However, the lien can be extended indefinitely if it is continued every 12 years.

You can remove a mechanics lien only by one of two ways: The contractor records a release of mechanics lien; or. You file a petition with the court to release the mechanics lien.

If the lien on your property is not valid or it is not a legal lien, then you can take legal action. You will want to file what is called a spurious lien action. A spurious lien is an invalid or illegal lien. You must file a spurious lien action in court, and a judge eventually decides whether the lien is valid or not.

Colorado requires all potential lien claimants to serve a Notice of Intent to Lien on the property owner 10 days before filing. General contractors, subcontractors, suppliers, and most others must file a Colorado mechanics lien within 4 months after last providing services or materials.

Steps to file a Colorado mechanics lien Fill out the right Colorado mechanics lien form. Using a mechanics lien form that meets the statutory requirements, fill it out completely and accurately. Send a Notice of Intent to Lien to the property owner.File your lien claim with the Colorado county recorder.

Colorado Springs Colorado Demand for Termination of Notice of Lien - Corporation Related Searches

-

release of lien letter

-

lien release requirements by state

-

colorado lien statute

-

colorado property lien search

-

colorado mechanic lien statute

-

notice of intent to file lien colorado

-

types of liens in colorado

-

how to file a lien in colorado

-

notice of intent to file lien colorado

-

colorado contractor lien

More info

Trusted and secure by over 3 million people of the world’s leading companies

Note: This summary is not intended to be an all-inclusive discussion of Colorado's construction lien laws, but does include basic provisions.

When and By Whom A Lien May Be Filed

Colorado law recognizes that when a person, or corporation, provides labor, materials, or laborers for a construction project or improvement of land, that party shall have the legal authority to assert a lien against the property being improved. Central to properly obtaining a lien is the filing of a construction contract or a memorandum describing the contract with the county recorder prior to the commencement of work. If a memorandum is used, it should describe all of the parties involved in the contract, a description of the property, a description of the work to be done, and the total amount to be paid under the contract and under what terms. Failure to file the contract or memorandum results in the parties providing labor or materials to the construction project being presumed to have a lien for the value of the labor or materials provided. C.R.S.§38-22-101.

Notice of Materials or Labor Furnished

Any party entitled to a lien, except the principal contractor, may at any time give to the owner, or other person responsible for disbursing funds, a written notice advising that the party giving the notice has provided or will provide labor or materials to the project. This written notice serves to advise the party funding the project that the party serving the notice is entitled to be paid and is someone who could potentially file a lien. The notice includes the estimated or agreed value of the labor or materials that have been supplied or will be supplied. Properly served, this notice requires the parties financing the construction project to withhold the amount of value of these labor or materials from the principal contractor to satisfy the claim or lien. C.R.S.§38-22-102.

Filing a Lien Statement

To file a lien, the party claiming the lien, (the lien claimant), must file a lien statement in the office of the county clerk and county recorder. Before a lien statement can be filed the lien claimant must serve the property owner and principal contractor with a notice of intent to file a lien at least ten days before the lien statement is filed. C.R.S.§38-22-109(11).

A lien statement must contain the property owner's name, if known, as well as the name of the lien claimant, and the contractor for whom the lien claimant worked if the lien claimant is a subcontractor. In addition, the notice must contain a property description and a statement of how much the lien claimant is owed. C.R.S.§38-22-109(1).

Timely Filing of Lien Statement

Lien statements claiming payment for labor or work by the day or piece must be filed within two months of the completion of the project. Otherwise, the lien statement must be filed within four months of the day the last work was performed or materials supplied by the lien claimant. C.R.S.§38-22-109(4)

Filing a Notice of Intent to File a Lien

To extend the amount of time within which to file a lien statement, the lien claimant may file with the county clerk a Notice of Intent to File a Lien. This notice contains a property description, the lien claimant's name, address and telephone number and the name of the party the claimant has contracted with. The filing of this notice extends the time the lien claimant may file a lien statement to four months after completion of the project or six months after the filing of the notice, whichever comes first. C.R.S.§38-22-109(4)-(10).

Duration of a Notice of Intent

A Notice of Intent to File a Lien automatically terminates six months after filing. However, if improvements are not yet complete, prior to termination of the notice the claimant may file an amended notice and extend the notice an additional six months from filing or four months from completion of the project. C.R.S.§38-22-109(10).

Duration of a Lien Statement

Regardless of when the lien statement is filed, no lien statement shall remain effective longer than one year from filing unless within thirty (30) days of the one year anniversary of the filing the claimant files with the county recorder an affidavit stating that improvements on the property have not been completed. C.R.S.§38-22-109(9).

Assignment of a Lien or Claim

It is possible for a lien claimant to assign in writing his claim and lien to another party. That party then has all the rights and remedies provided by law of the original lien claimant for the purposes of filing and enforcing the original lien claimant's lien. C.R.S.§ 38-22-117.

Satisfying a lien

After the lien has been filed, the property owner may have the lien removed by paying the amount of the lien together with the costs of filing and recording the lien. After payment, the property owner may demand that the lien claimant file with the county recorder an Acknowledgment of Satisfaction, which attests to the fact that the lien has been satisfied. A lien claimant who does not file an Acknowledgment within ten days of the property owner's request shall forfeit the amount of $10.00 per day. C.R.S.§38-22-118.

Use of a Bond to Prevent the filing of a Lien

The Colorado statute that allows a party who supplies labor or materials to place a lien on the improved property does not apply where the principal contractor and his surety execute a performance bond and a labor and materials bond, each in excess of 150% of the contract price. Parties who would otherwise be entitled to a lien may pursue the contractor and his surety directly, but must file suit within six months of completion of the project. C.R.S.§38-22-129(2).

In order for a bond to prevent the filing of a lien, the principal contractor must file a notice of the bond with the office of the county recorder. The principal contractor should also make copies of the bond available to subcontractors, materialmen, and laborers upon request. C.R.S.§38-22-129(3)

It is possible for a lien claimant to file a lien statement when the principal contractor has a bond in place. If the contractor and surety execute a notice acknowledging the existence of a bond and that the lien claimant is entitled to benefit from that bond, the lien shall be deemed released. Under statute, if the property owner requests that the contractor and surety execute an acknowledgment, they must do so within thirty (30) days. Failure to execute the acknowledgment within thirty (30) days will permit the lien claimant to file his lien as normal. C.R.S.§38-22-129(4).

Note: This summary is not intended to be an all-inclusive discussion of Colorado's construction lien laws, but does include basic provisions.

When and By Whom A Lien May Be Filed

Colorado law recognizes that when a person, or corporation, provides labor, materials, or laborers for a construction project or improvement of land, that party shall have the legal authority to assert a lien against the property being improved. Central to properly obtaining a lien is the filing of a construction contract or a memorandum describing the contract with the county recorder prior to the commencement of work. If a memorandum is used, it should describe all of the parties involved in the contract, a description of the property, a description of the work to be done, and the total amount to be paid under the contract and under what terms. Failure to file the contract or memorandum results in the parties providing labor or materials to the construction project being presumed to have a lien for the value of the labor or materials provided. C.R.S.§38-22-101.

Notice of Materials or Labor Furnished

Any party entitled to a lien, except the principal contractor, may at any time give to the owner, or other person responsible for disbursing funds, a written notice advising that the party giving the notice has provided or will provide labor or materials to the project. This written notice serves to advise the party funding the project that the party serving the notice is entitled to be paid and is someone who could potentially file a lien. The notice includes the estimated or agreed value of the labor or materials that have been supplied or will be supplied. Properly served, this notice requires the parties financing the construction project to withhold the amount of value of these labor or materials from the principal contractor to satisfy the claim or lien. C.R.S.§38-22-102.

Filing a Lien Statement

To file a lien, the party claiming the lien, (the lien claimant), must file a lien statement in the office of the county clerk and county recorder. Before a lien statement can be filed the lien claimant must serve the property owner and principal contractor with a notice of intent to file a lien at least ten days before the lien statement is filed. C.R.S.§38-22-109(11).

A lien statement must contain the property owner's name, if known, as well as the name of the lien claimant, and the contractor for whom the lien claimant worked if the lien claimant is a subcontractor. In addition, the notice must contain a property description and a statement of how much the lien claimant is owed. C.R.S.§38-22-109(1).

Timely Filing of Lien Statement

Lien statements claiming payment for labor or work by the day or piece must be filed within two months of the completion of the project. Otherwise, the lien statement must be filed within four months of the day the last work was performed or materials supplied by the lien claimant. C.R.S.§38-22-109(4)

Filing a Notice of Intent to File a Lien

To extend the amount of time within which to file a lien statement, the lien claimant may file with the county clerk a Notice of Intent to File a Lien. This notice contains a property description, the lien claimant's name, address and telephone number and the name of the party the claimant has contracted with. The filing of this notice extends the time the lien claimant may file a lien statement to four months after completion of the project or six months after the filing of the notice, whichever comes first. C.R.S.§38-22-109(4)-(10).

Duration of a Notice of Intent

A Notice of Intent to File a Lien automatically terminates six months after filing. However, if improvements are not yet complete, prior to termination of the notice the claimant may file an amended notice and extend the notice an additional six months from filing or four months from completion of the project. C.R.S.§38-22-109(10).

Duration of a Lien Statement

Regardless of when the lien statement is filed, no lien statement shall remain effective longer than one year from filing unless within thirty (30) days of the one year anniversary of the filing the claimant files with the county recorder an affidavit stating that improvements on the property have not been completed. C.R.S.§38-22-109(9).

Assignment of a Lien or Claim

It is possible for a lien claimant to assign in writing his claim and lien to another party. That party then has all the rights and remedies provided by law of the original lien claimant for the purposes of filing and enforcing the original lien claimant's lien. C.R.S.§ 38-22-117.

Satisfying a lien

After the lien has been filed, the property owner may have the lien removed by paying the amount of the lien together with the costs of filing and recording the lien. After payment, the property owner may demand that the lien claimant file with the county recorder an Acknowledgment of Satisfaction, which attests to the fact that the lien has been satisfied. A lien claimant who does not file an Acknowledgment within ten days of the property owner's request shall forfeit the amount of $10.00 per day. C.R.S.§38-22-118.

Use of a Bond to Prevent the filing of a Lien

The Colorado statute that allows a party who supplies labor or materials to place a lien on the improved property does not apply where the principal contractor and his surety execute a performance bond and a labor and materials bond, each in excess of 150% of the contract price. Parties who would otherwise be entitled to a lien may pursue the contractor and his surety directly, but must file suit within six months of completion of the project. C.R.S.§38-22-129(2).

In order for a bond to prevent the filing of a lien, the principal contractor must file a notice of the bond with the office of the county recorder. The principal contractor should also make copies of the bond available to subcontractors, materialmen, and laborers upon request. C.R.S.§38-22-129(3)

It is possible for a lien claimant to file a lien statement when the principal contractor has a bond in place. If the contractor and surety execute a notice acknowledging the existence of a bond and that the lien claimant is entitled to benefit from that bond, the lien shall be deemed released. Under statute, if the property owner requests that the contractor and surety execute an acknowledgment, they must do so within thirty (30) days. Failure to execute the acknowledgment within thirty (30) days will permit the lien claimant to file his lien as normal. C.R.S.§38-22-129(4).