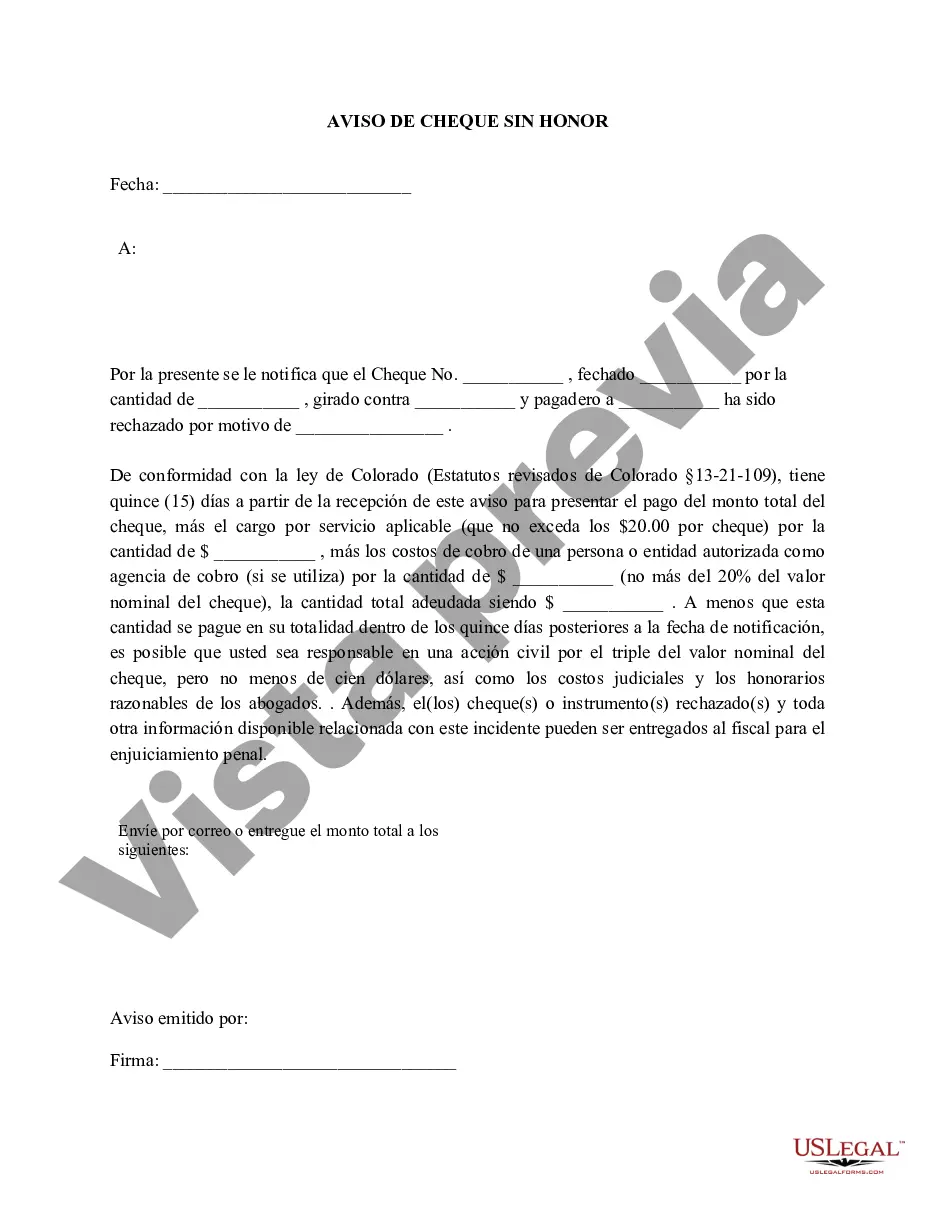

Arvada Colorado Notice of Dishonored Check — Civil: A Comprehensive Overview Keywords: bad check, bounced check, dishonored check, insufficient funds, check fraud, check bouncing, check payment failure. Introduction: The Arvada Colorado Notice of Dishonored Check — Civil serves as a legal communication to individuals or businesses who have issued a check that has been returned by the bank due to insufficient funds or other reasons. This notice is an essential tool for seeking payment, addressing check fraud, and emphasizing the consequences of writing a bad check in Arvada, Colorado. Here, we provide a detailed description to shed light on the different aspects of this document. Types and Reasons for a Dishonored Check: 1. Insufficient Funds: The most common reason for a dishonored check in Arvada is insufficient funds. This occurs when the issuer's bank account balance is not enough to cover the amount stated on the check. 2. Frozen/Blocked Account: Sometimes, an account may be temporarily frozen or blocked by the bank, resulting in a dishonored check. This situation can arise due to various reasons, such as suspected fraudulent activity, account disputes, or court orders. 3. Account Closure: If the account from which the check was drawn has been closed, the check will be dishonored. It is crucial for individuals to ensure their account remains active to avoid complications. 4. Forgery or Alteration: In cases where a check has been forged or altered, often resulting in an unauthorized change of the payee or amount, the bank may reject the check and issue a dishonored check notice. 5. Technological Issues: Occasionally, a dishonored check might occur due to technological issues within the banking system, such as system outages, errors in scanning or processing, or software glitches. Purpose of Arvada Colorado Notice of Dishonored Check — Civil: The primary purpose of this notice is to inform the check issuer about the dishonored status of their payment. By highlighting the dishonored check, it aims to draw attention to the financial and legal consequences associated with this offense. The notice indicates that the recipient (the person or entity to whom the check was issued) has the option to take legal action to recover the funds owed, including potential civil penalties, fees, and additional charges. Consequences of Writing a Bad Check: 1. Civil Penalties: Depending on the amount stated on the check, Colorado law permits the recipient to seek three times the amount of the check or $100, whichever is greater, plus reasonable attorney's fees and damages. 2. Stain on Credit History: Issuing a bad check can damage an individual's credit score and history, making it difficult to obtain credit facilities or loans in the future. 3. Criminal Charges: In some cases, repeated instances of issuing bad checks can lead to criminal charges of check fraud, a serious offense punishable by fines and even incarceration. Conclusion: The Arvada Colorado Notice of Dishonored Check — Civil serves as a formal communication to inform the check issuer about the dishonored status of their payment. Through this legal document, individuals are informed about the consequences of writing a bad check, including the potential for civil penalties, credit damage, and even criminal charges. Understanding these implications can help individuals navigate financial transactions responsibly and avoid the complications associated with dishonored checks in Arvada, Colorado.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Arvada Colorado Aviso de cheque sin fondos - Civil - Palabras clave: cheque sin fondos, cheque sin fondos - Colorado Notice of Dishonored Check - Civil - Keywords: bad check, bounced check

Description

How to fill out Arvada Colorado Aviso De Cheque Sin Fondos - Civil - Palabras Clave: Cheque Sin Fondos, Cheque Sin Fondos?

Locating verified templates specific to your local laws can be challenging unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both personal and professional needs and any real-life scenarios. All the documents are properly categorized by area of usage and jurisdiction areas, so locating the Arvada Colorado Notice of Dishonored Check - Civil - Keywords: bad check, bounced check becomes as quick and easy as ABC.

For everyone already familiar with our service and has used it before, getting the Arvada Colorado Notice of Dishonored Check - Civil - Keywords: bad check, bounced check takes just a few clicks. All you need to do is log in to your account, pick the document, and click Download to save it on your device. This process will take just a couple of additional steps to complete for new users.

Follow the guidelines below to get started with the most extensive online form catalogue:

- Check the Preview mode and form description. Make sure you’ve selected the right one that meets your needs and totally corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you find any inconsistency, utilize the Search tab above to obtain the right one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and select the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the subscription.

- Download the Arvada Colorado Notice of Dishonored Check - Civil - Keywords: bad check, bounced check. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Benefit from the US Legal Forms library to always have essential document templates for any demands just at your hand!