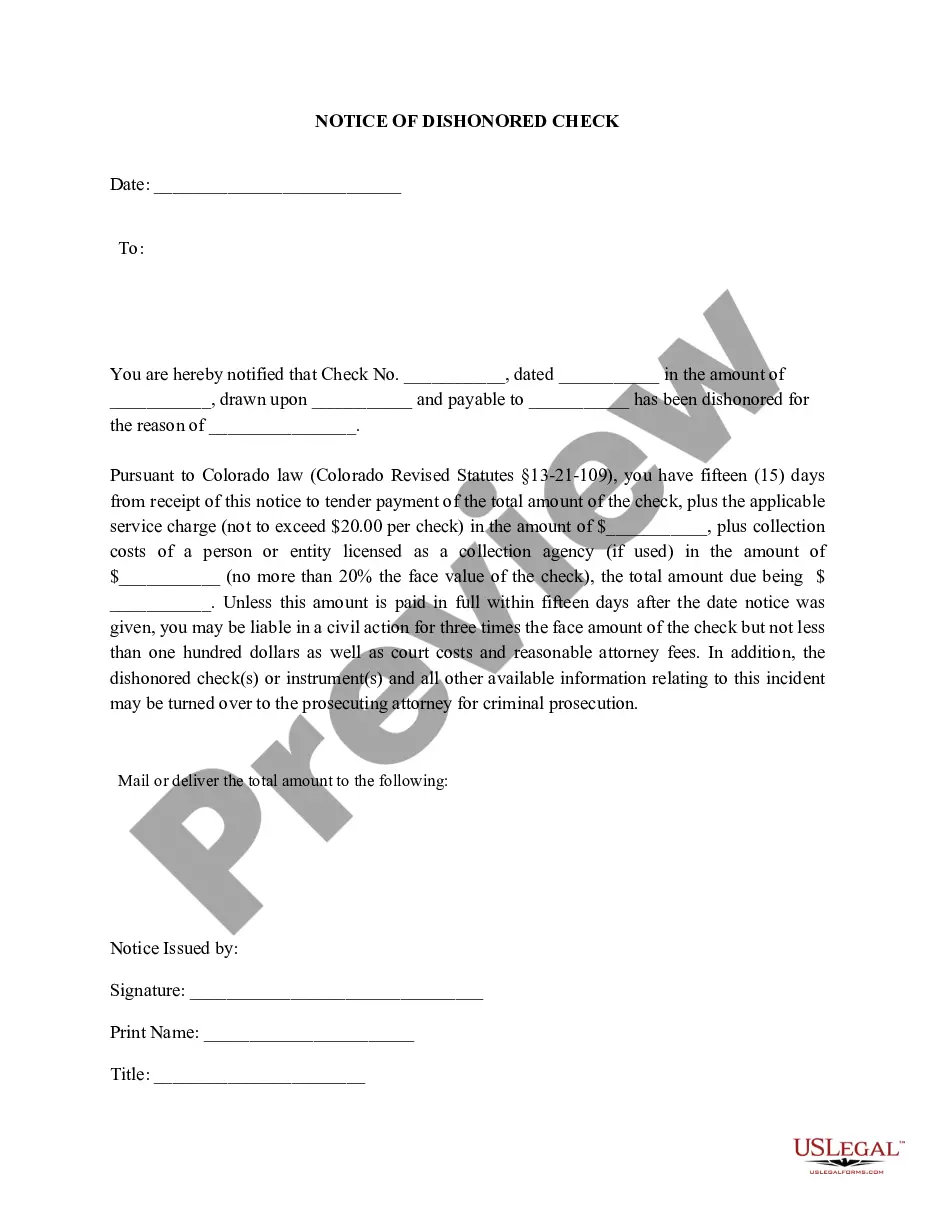

This is a Notice of Dishonored Check - Civil. A "dishonored check" (also known as a "bounced check" or "bad check") is a check which the bank will not pay because there is no such checking account, or there are insufficient funds in the account to pay the check. In order to attempt the greatest possible recovery on a dishonored check, the business owner, or any other person given a dishonored check, may be required by state law to notify the debtor that the check was dishonored.

Lakewood Colorado Notice of Dishonored Check - Civil - Keywords: bad check, bounced check

Description

How to fill out Colorado Notice Of Dishonored Check - Civil - Keywords: Bad Check, Bounced Check?

No matter one's societal or occupational position, completing legal paperwork is an unfortunate requirement in the current professional landscape.

Frequently, it’s nearly impossible for an individual lacking any legal background to create such documents from scratch, largely due to the intricate terminology and legal subtleties they encompass.

This is where US Legal Forms proves to be beneficial.

Ensure the form you found is applicable to your region since the regulations of one state or county do not apply to another state or county.

Review the form and read a brief overview (if available) of the situations for which the document can be utilized.

- Our platform provides an extensive library of more than 85,000 ready-to-use state-specific documents suitable for virtually any legal matter.

- US Legal Forms is also an excellent tool for associates or legal advisors seeking to enhance their time efficiency using our DIY forms.

- Whether you require the Lakewood Colorado Notice of Dishonored Check - Civil - Keywords: bad check, bounced check or any other documentation that is valid in your jurisdiction, with US Legal Forms, everything is readily accessible.

- Here’s the process to obtain the Lakewood Colorado Notice of Dishonored Check - Civil - Keywords: bad check, bounced check within minutes using our trustworthy service.

- If you are an existing customer, simply Log In to your account to obtain the correct form.

- If you are new to our service, make sure to follow these steps before acquiring the Lakewood Colorado Notice of Dishonored Check - Civil - Keywords: bad check, bounced check.

Form popularity

FAQ

Yes, you can dispute a bounced check through your bank, primarily by providing documentation of the transaction. The bank may initiate an investigation to resolve the matter. If the dispute does not lead to a satisfactory resolution, you may need to consider legal action under the Lakewood Colorado Notice of Dishonored Check - Civil laws, which address the consequences of bad checks.

To fight a bounced check, gather evidence that supports your case, such as bank statements and communication with the payer. You can dispute the check through your bank, and consider filing a complaint under the Lakewood Colorado Notice of Dishonored Check - Civil statutes, which handle bad check disputes. Utilizing resources from USLegalForms can provide you with the necessary legal forms and guidance to strengthen your case.

In cases where an employer issues a bad check, you may have grounds to sue for damages, especially if you incurred costs or damage as a result. It is advisable to document all interactions and follow the proper procedures outlined by Lakewood’s civil laws. Consulting a legal professional through platforms like USLegalForms can help you understand your options and navigate the process more effectively.

A bounced check can sometimes be reversed if the payer covers the insufficient funds within a specified time frame. It's important to communicate with your bank promptly to explore your options. However, the Lakewood Colorado Notice of Dishonored Check - Civil laws may apply if the check remains unpaid, potentially exposing the issuer to further legal consequences associated with bad checks.

To write a letter for a bounced check, include key details such as the check number, the amount, and the date it was issued. Clearly explain the situation and request payment or resolution. You can find templates and guidance on US Legal Forms tailored for a Lakewood Colorado Notice of Dishonored Check, simplifying the process for you.

If a company writes you a bad check, first contact them to resolve the issue amicably. If communication fails, you may need to send a formal notification or a demand letter for payment. Tools like US Legal Forms can assist in drafting a letter based on a Lakewood Colorado Notice of Dishonored Check, ensuring you follow the proper legal procedure.

To notify customers of a bounced check, send them a formal letter informing them about the dishonored check. Clearly state the check number, amount, and any fees incurred due to the bounced check. You can utilize US Legal Forms to create a proper notification template that adheres to standards for a Lakewood Colorado Notice of Dishonored Check.

Yes, you can get in trouble for writing a check that bounces. Depending on the circumstances, you may face fees from your bank and potential legal action from the recipient of the bad check. In Lakewood Colorado, it’s important to respond to a Lakewood Colorado Notice of Dishonored Check promptly to manage the consequences effectively.

An example of a bounced check is a check that you write for an amount that exceeds your available bank balance. When the bank attempts to process this check, it refuses payment, leading to the check being marked as a bounced check. In the context of a Lakewood Colorado Notice of Dishonored Check, such situations can have legal implications and may require formal notification.