Fort Collins Colorado Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller In Fort Collins, Colorado, a Bill of Sale is a vital legal document used in the sale of a business by an individual or a corporate seller. It outlines the terms and conditions of the transaction while serving as proof of ownership transfer. This detailed description will explore the purpose and importance of the Fort Collins Colorado Bill of Sale in connection with the sale of a business, highlighting its key components and legal implications. Key Components of a Fort Collins Colorado Bill of Sale: 1. Parties Involved: The Bill of Sale identifies the parties involved in the transaction, including the individual or corporate seller and buyer. Their legal names, contact details, and addresses are mentioned in the document. 2. Business Description: A comprehensive description of the business being sold is included, highlighting its nature, assets involved, intellectual property rights, and any special considerations. 3. Purchase Price and Payment Terms: The agreed-upon purchase price for the business is stated explicitly, along with the payment terms, such as lump sum payment or installment plans. Details regarding down payments, financing, or any other agreed-upon arrangements are documented. 4. Assets Included: The Bill of Sale specifies the assets included in the sale, which may range from physical properties (real estate, inventory, equipment, etc.) to intangible assets (trademarks, patents, customer databases, etc.). Each asset should be described thoroughly to avoid ambiguity. 5. Representations and Warranties: Both the seller and buyer may include representations and warranties in the Bill of Sale, assuring the accuracy of the information provided and guaranteeing the business' condition, legal compliance, and financial status. These representations and warranties protect the parties in case of any misrepresentation or undisclosed liabilities. 6. Liabilities and Indemnification: Any existing liabilities or debts of the business should be outlined in the Bill of Sale. The document may specify whether the seller or the buyer assumes these liabilities and the terms of indemnification. 7. Closing and Transfer: The Bill of Sale should mention the closing date, when the ownership transfer takes effect, and the location where the transfer of assets will occur. Additionally, it may outline the process for transferring licenses, permits, contracts, and leases related to the business. Types of Fort Collins Colorado Bill of Sale in Connection with Sale of Business: 1. Asset Purchase Agreement: This type of Bill of Sale is used when the buyer only intends to acquire specific assets or a portion of the business, rather than the entire entity. It specifies the assets being sold and excludes any liabilities of the business not explicitly mentioned. 2. Stock Purchase Agreement: When the buyer intends to acquire the entire business entity, including all its assets and liabilities, a Stock Purchase Agreement is employed. It involves the transfer of ownership through the sale of shares or stocks held by the existing shareholders or owners. 3. Membership Interest Purchase Agreement: In the case of a Limited Liability Company (LLC) or partnership, a Membership Interest Purchase Agreement is used. This document facilitates the transfer of membership interests, giving the buyer ownership rights in the company. Note: It is crucial to consult with legal professionals or business attorneys to ensure the accuracy and compliance of the Fort Collins Colorado Bill of Sale with state and local laws, as well as to tailor it to the specific needs of the transaction.

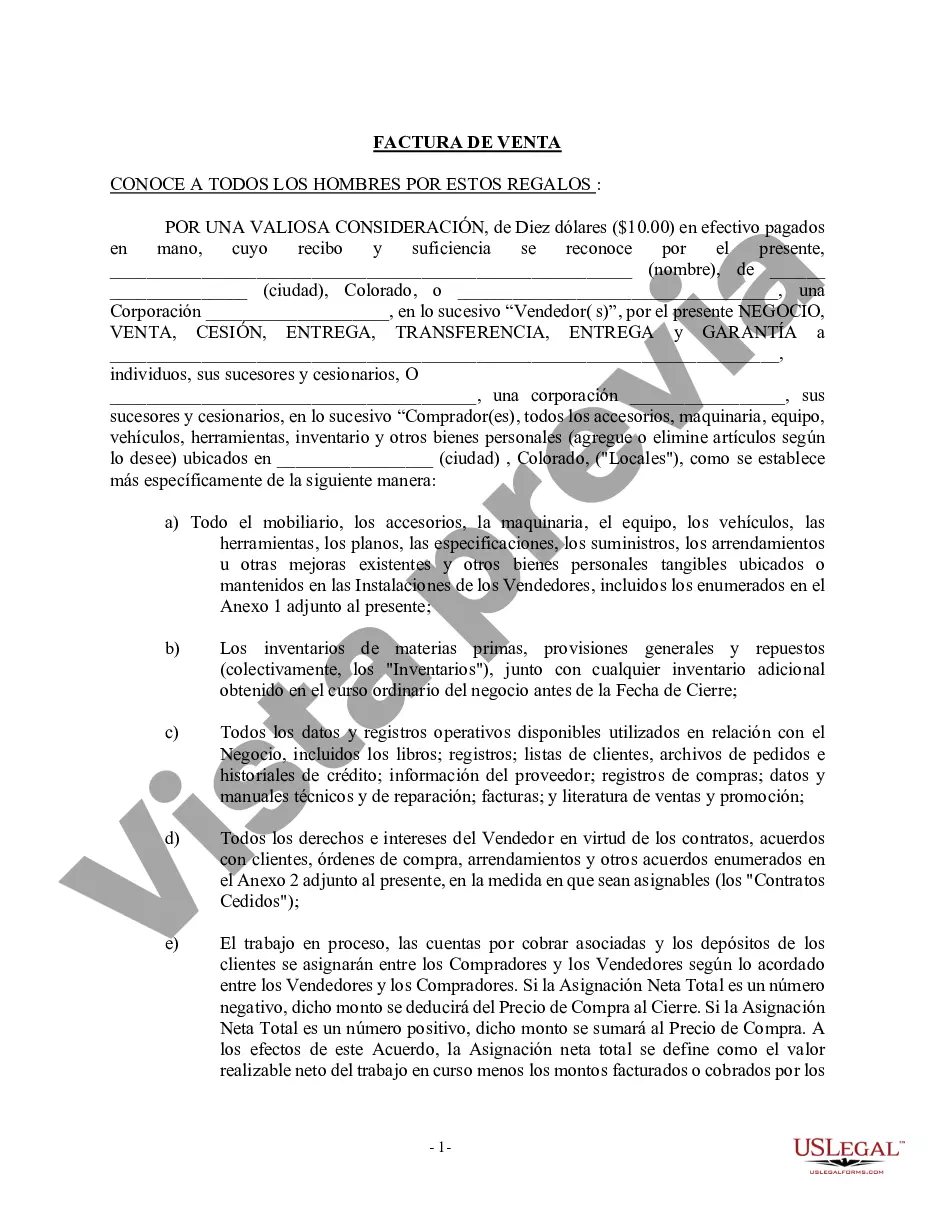

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Fort Collins Colorado Factura de venta en relación con la venta del negocio por parte del vendedor individual o corporativo - Colorado Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller

State:

Colorado

City:

Fort Collins

Control #:

CO-60214

Format:

Word

Instant download

Description

Factura de venta en relación con la venta del negocio - detallada.

Fort Collins Colorado Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller In Fort Collins, Colorado, a Bill of Sale is a vital legal document used in the sale of a business by an individual or a corporate seller. It outlines the terms and conditions of the transaction while serving as proof of ownership transfer. This detailed description will explore the purpose and importance of the Fort Collins Colorado Bill of Sale in connection with the sale of a business, highlighting its key components and legal implications. Key Components of a Fort Collins Colorado Bill of Sale: 1. Parties Involved: The Bill of Sale identifies the parties involved in the transaction, including the individual or corporate seller and buyer. Their legal names, contact details, and addresses are mentioned in the document. 2. Business Description: A comprehensive description of the business being sold is included, highlighting its nature, assets involved, intellectual property rights, and any special considerations. 3. Purchase Price and Payment Terms: The agreed-upon purchase price for the business is stated explicitly, along with the payment terms, such as lump sum payment or installment plans. Details regarding down payments, financing, or any other agreed-upon arrangements are documented. 4. Assets Included: The Bill of Sale specifies the assets included in the sale, which may range from physical properties (real estate, inventory, equipment, etc.) to intangible assets (trademarks, patents, customer databases, etc.). Each asset should be described thoroughly to avoid ambiguity. 5. Representations and Warranties: Both the seller and buyer may include representations and warranties in the Bill of Sale, assuring the accuracy of the information provided and guaranteeing the business' condition, legal compliance, and financial status. These representations and warranties protect the parties in case of any misrepresentation or undisclosed liabilities. 6. Liabilities and Indemnification: Any existing liabilities or debts of the business should be outlined in the Bill of Sale. The document may specify whether the seller or the buyer assumes these liabilities and the terms of indemnification. 7. Closing and Transfer: The Bill of Sale should mention the closing date, when the ownership transfer takes effect, and the location where the transfer of assets will occur. Additionally, it may outline the process for transferring licenses, permits, contracts, and leases related to the business. Types of Fort Collins Colorado Bill of Sale in Connection with Sale of Business: 1. Asset Purchase Agreement: This type of Bill of Sale is used when the buyer only intends to acquire specific assets or a portion of the business, rather than the entire entity. It specifies the assets being sold and excludes any liabilities of the business not explicitly mentioned. 2. Stock Purchase Agreement: When the buyer intends to acquire the entire business entity, including all its assets and liabilities, a Stock Purchase Agreement is employed. It involves the transfer of ownership through the sale of shares or stocks held by the existing shareholders or owners. 3. Membership Interest Purchase Agreement: In the case of a Limited Liability Company (LLC) or partnership, a Membership Interest Purchase Agreement is used. This document facilitates the transfer of membership interests, giving the buyer ownership rights in the company. Note: It is crucial to consult with legal professionals or business attorneys to ensure the accuracy and compliance of the Fort Collins Colorado Bill of Sale with state and local laws, as well as to tailor it to the specific needs of the transaction.

Free preview

How to fill out Fort Collins Colorado Factura De Venta En Relación Con La Venta Del Negocio Por Parte Del Vendedor Individual O Corporativo?

If you’ve already used our service before, log in to your account and save the Fort Collins Colorado Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple steps to obtain your file:

- Ensure you’ve found the right document. Look through the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t fit you, use the Search tab above to get the proper one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Get your Fort Collins Colorado Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller. Opt for the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to each piece of paperwork you have bought: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to rapidly locate and save any template for your personal or professional needs!