Title: Aurora Colorado Living Trust for Individuals: Single, Divorced, or Widow/Widower with Children Introduction: Aurora, Colorado offers its residents a variety of legal tools to safeguard their assets and ensure the smooth transfer of wealth to their loved ones. One such instrument is a living trust, which can benefit individuals who are single, divorced, widowed, or widowers with children. In this article, we will discuss the concept of living trusts and explore different types available in Aurora, Colorado, specifically tailored to the unique circumstances of these individuals. 1. What is a Living Trust? A living trust is a legal document that allows individuals to place their assets, such as property, investments, and other valuable possessions, into a trust for their own benefit during their lifetime and for the benefit of their beneficiaries upon their passing. It provides flexibility, control, and avoids the need for probate, ensuring a smooth transfer of assets to loved ones. 2. Living Trust Types for Single Individuals: a. Revocable Living Trust: This type of trust allows single individuals to retain control and ownership of their assets during their lifetime, but designates beneficiaries who will receive the assets upon their death. It can be modified or revoked at any time. b. Irrevocable Living Trust: Irrevocable trusts transfer ownership of assets permanently, which may provide tax benefits and asset protection in specific circumstances. However, single individuals should carefully consider this option as it limits their ability to modify the trust. 3. Living Trust Types for Divorced Individuals: Divorce can significantly impact an individual's estate distribution plans. Two common living trust options for divorced individuals are: a. Testamentary Living Trust: This trust is established through a will, which outlines how assets will be distributed upon the individual's death. It provides flexibility to make changes as personal circumstances evolve. b. Discretionary Trust: Divorced individuals with minor children can establish a discretionary trust, creating a framework for managing assets for the children's benefit after their death. Trustees have control over asset distribution based on predetermined conditions or beneficiaries' needs. 4. Living Trust Types for Widows/Widowers: a. Bypass Trust: Also known as an "A-B trust," it allows widows/widowers to ensure their assets pass smoothly to their children while preserving certain tax benefits by utilizing both spouses' estate tax exemptions. b. Generation-Skipping Trust: This trust may be beneficial for widows/widowers who want to transfer assets to grandchildren or future generations while minimizing estate taxes and protecting assets from creditors. Conclusion: Living trusts provide invaluable estate planning tools for individuals in Aurora, Colorado, who are single, divorced, or widowed with children. Whether establishing a revocable living trust, discretionary trust, or selecting from other trust options, it is crucial to consult with an experienced estate planning attorney to tailor the trust to your specific circumstances. Properly executed living trusts can offer peace of mind, protect assets, and efficiently transfer wealth to beneficiaries, ensuring a secure future for your loved ones.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Aurora Colorado Fideicomiso en vida para persona soltera, divorciada o viuda o viuda con hijos - Colorado Living Trust for individual, Who is Single, Divorced or Widow or Widower with Children

Description

How to fill out Aurora Colorado Fideicomiso En Vida Para Persona Soltera, Divorciada O Viuda O Viuda Con Hijos?

We always want to reduce or avoid legal issues when dealing with nuanced legal or financial affairs. To do so, we sign up for attorney solutions that, usually, are extremely costly. Nevertheless, not all legal matters are equally complex. Most of them can be dealt with by ourselves.

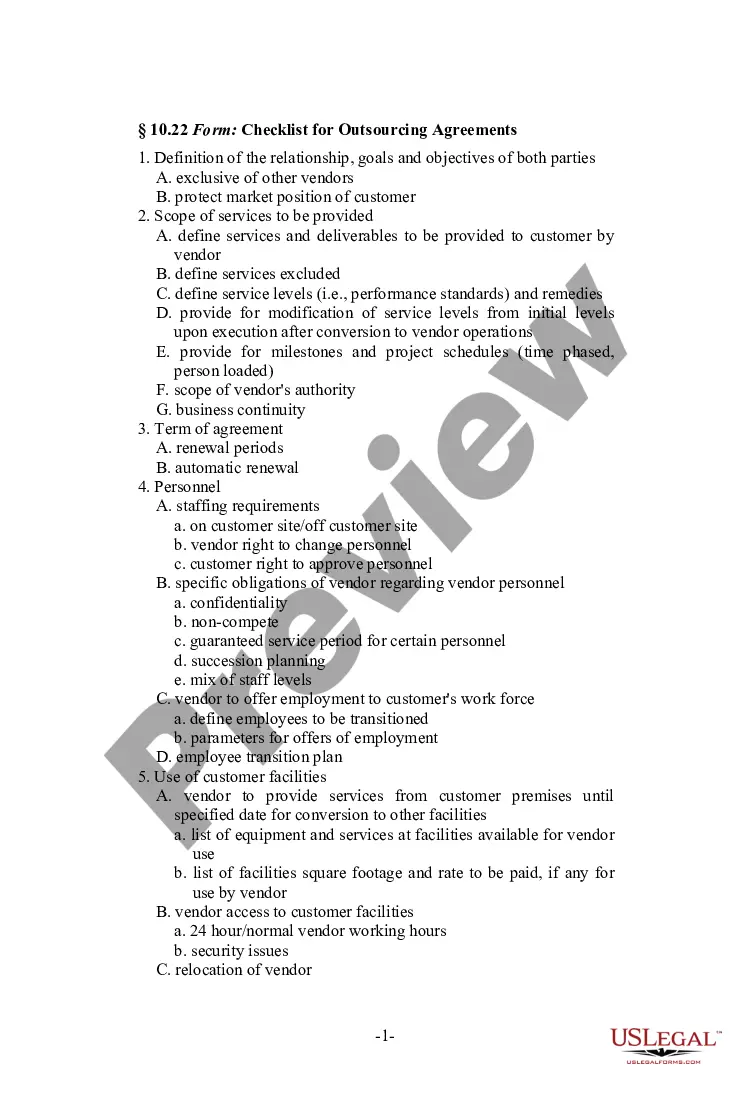

US Legal Forms is a web-based library of updated DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your affairs into your own hands without using services of legal counsel. We provide access to legal document templates that aren’t always openly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the Aurora Colorado Living Trust for individual, Who is Single, Divorced or Widow or Widower with Children or any other document quickly and safely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always download it again from within the My Forms tab.

The process is equally effortless if you’re new to the platform! You can create your account within minutes.

- Make sure to check if the Aurora Colorado Living Trust for individual, Who is Single, Divorced or Widow or Widower with Children adheres to the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s description (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve ensured that the Aurora Colorado Living Trust for individual, Who is Single, Divorced or Widow or Widower with Children would work for your case, you can choose the subscription plan and make a payment.

- Then you can download the form in any suitable format.

For more than 24 years of our existence, we’ve served millions of people by providing ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save time and resources!