Title: Understanding Thornton Colorado Financial Account Transfer to Living Trust: Types and Procedures Explained Introduction: In Thornton, Colorado, financial account transfer to a living trust provides individuals with an effective means of managing their assets and ensuring a smooth transfer of wealth upon their passing. This comprehensive guide outlines the key aspects of a financial account transfer to a living trust, including the various types available, processes involved, and the importance of seeking professional guidance. 1. What is a Living Trust? A living trust is a legal document that allows individuals (trustees) to transfer their assets, including financial accounts, into a trust during their lifetime for the benefit of themselves or their designated beneficiaries. A living trust enables the smooth management and distribution of assets, avoiding probate and ensuring privacy. 2. Types of Thornton Colorado Financial Account Transfer to Living Trust: a) Revocable Living Trust: This type of trust allows trustees to maintain control and make changes to the trust during their lifetime, including adding or removing assets. b) Irrevocable Living Trust: Unlike revocable trusts, an irrevocable trust cannot be changed once established. It provides greater asset protection and potential tax benefits but requires careful consideration due to limited flexibility. 3. The Process: a) Establishing the Living Trust: Consult with an experienced attorney to draft the living trust document, ensuring it complies with Colorado state laws and accurately reflects your intentions. b) Funding the Trust: Transfer ownership of financial accounts to the trust by completing appropriate forms provided by the financial institutions. This may involve visiting your bank, brokerage, or other financial institutions to complete the required paperwork. c) Updating Beneficiary Designations: Review and update the beneficiaries of your financial accounts to reflect the living trust as the primary beneficiary. d) Ongoing Management: Once the financial accounts are transferred to the living trust, consistent management and periodic review of the trust are essential to ensure it aligns with your changing financial circumstances and goals. 4. Advantages of Thornton Colorado Financial Account Transfer to Living Trust: a) Avoidance of Probate: Transferring assets to a living trust helps bypass the probate process, which can be time-consuming, costly, and expose sensitive financial details to the public. b) Privacy: Probate records are public, whereas living trusts maintain privacy and keep financial matters confidential. c) Efficient Wealth Transfer: Living trusts enable the smooth transition of assets to beneficiaries, avoiding delays and legal complexities associated with probate. d) Asset Protection: Irrevocable living trusts offer an added layer of protection by separating assets from personal liabilities and potential creditors. Conclusion: Thornton, Colorado residents looking to establish a Financial Account Transfer to Living Trust have various options available to protect their assets and streamline estate administration. By understanding the different types of living trusts and following the necessary procedures, individuals can ensure their wealth is efficiently transferred to their chosen beneficiaries while maintaining privacy and avoiding probate. It is advisable to consult with an experienced attorney specializing in estate planning to draft an appropriate trust document and guide you through the entire process.

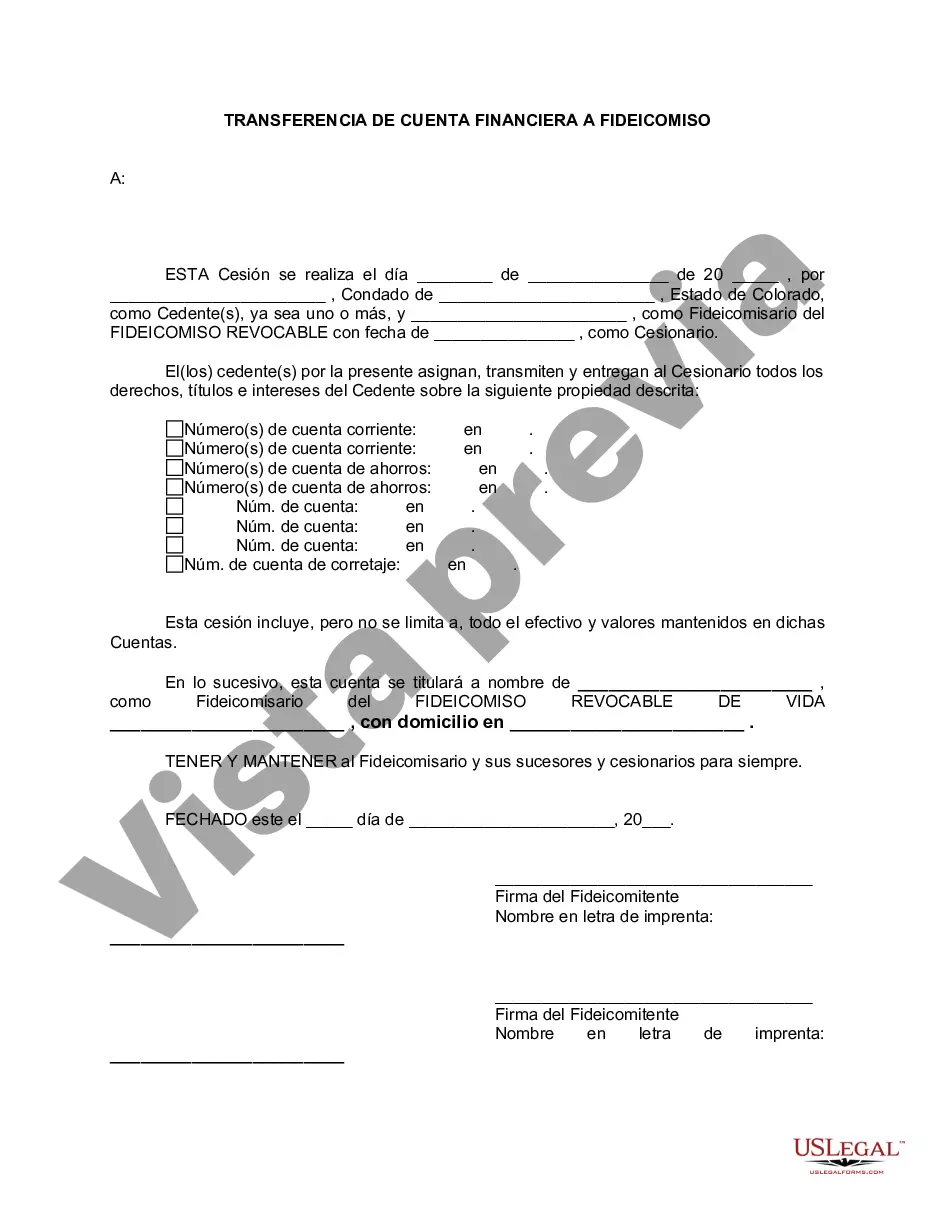

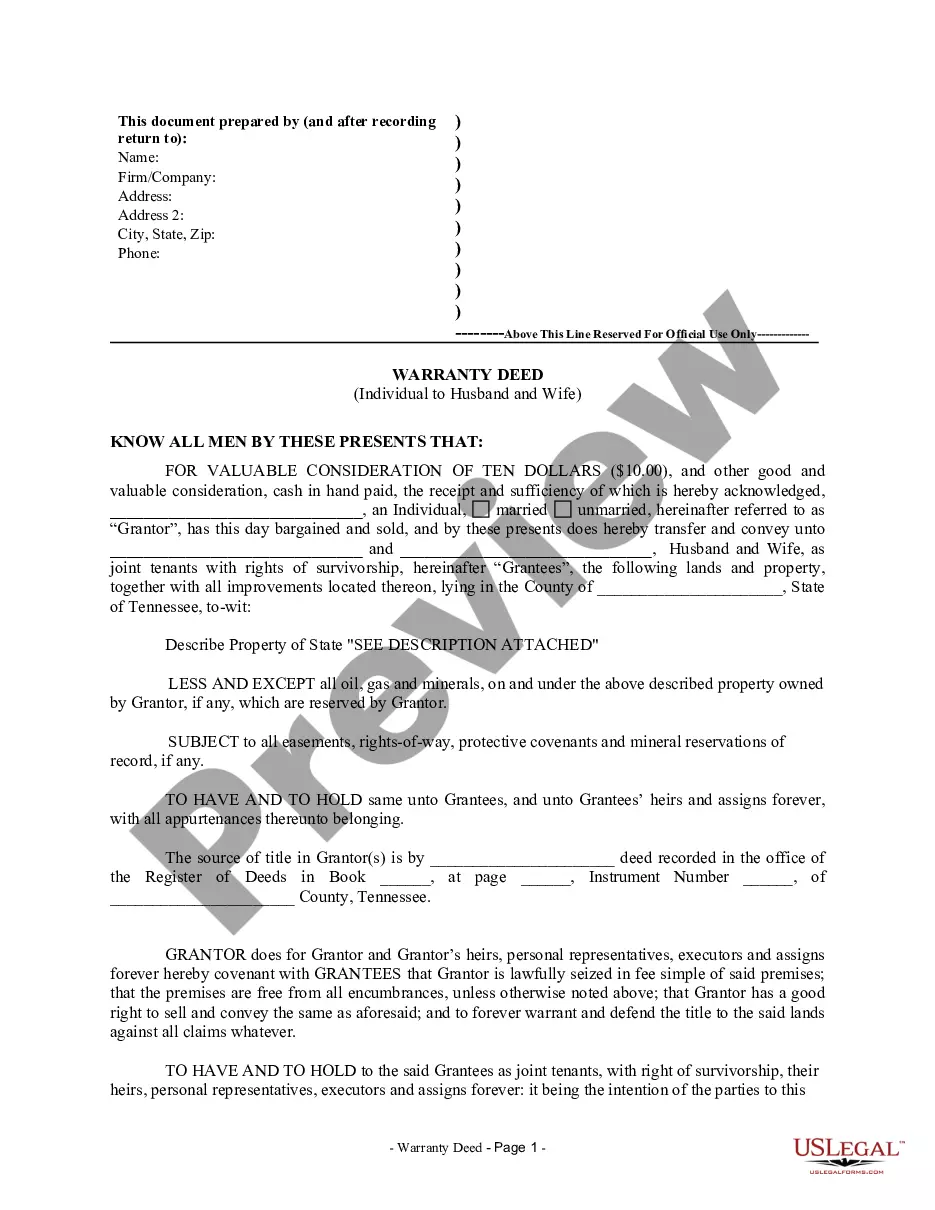

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Thornton Colorado Transferencia de cuenta financiera a fideicomiso en vida - Colorado Financial Account Transfer to Living Trust

Description

How to fill out Thornton Colorado Transferencia De Cuenta Financiera A Fideicomiso En Vida?

Utilize the US Legal Forms and gain immediate access to any document you desire.

Our advantageous website with a vast array of document templates enables you to locate and obtain nearly any document sample you need.

You can save, complete, and sign the Thornton Colorado Financial Account Transfer to Living Trust in just a few minutes, rather than spending countless hours searching the internet for a suitable template.

Using our collection is an excellent method to enhance the security of your form submissions. Our experienced attorneys frequently review all documents to ensure that the templates are suitable for a specific state and adhere to current laws and regulations.

Initiate the saving process. Select Buy Now and choose your preferred pricing plan. Then, register for an account and complete your order using a credit card or PayPal.

Store the document. Choose the format to receive the Thornton Colorado Financial Account Transfer to Living Trust and modify and fill it, or sign it according to your preferences.

- How can you acquire the Thornton Colorado Financial Account Transfer to Living Trust.

- If you possess a subscription, simply Log Into your account. The Download option will be activated for all documents you examine.

- Additionally, you can access all previously saved files in the My documents section.

- If you have not yet created an account, follow the directions below.

- Locate the template you require. Ensure that it is the template you were looking for: verify its title and description, and use the Preview feature if available. Otherwise, use the Search bar to find the correct one.