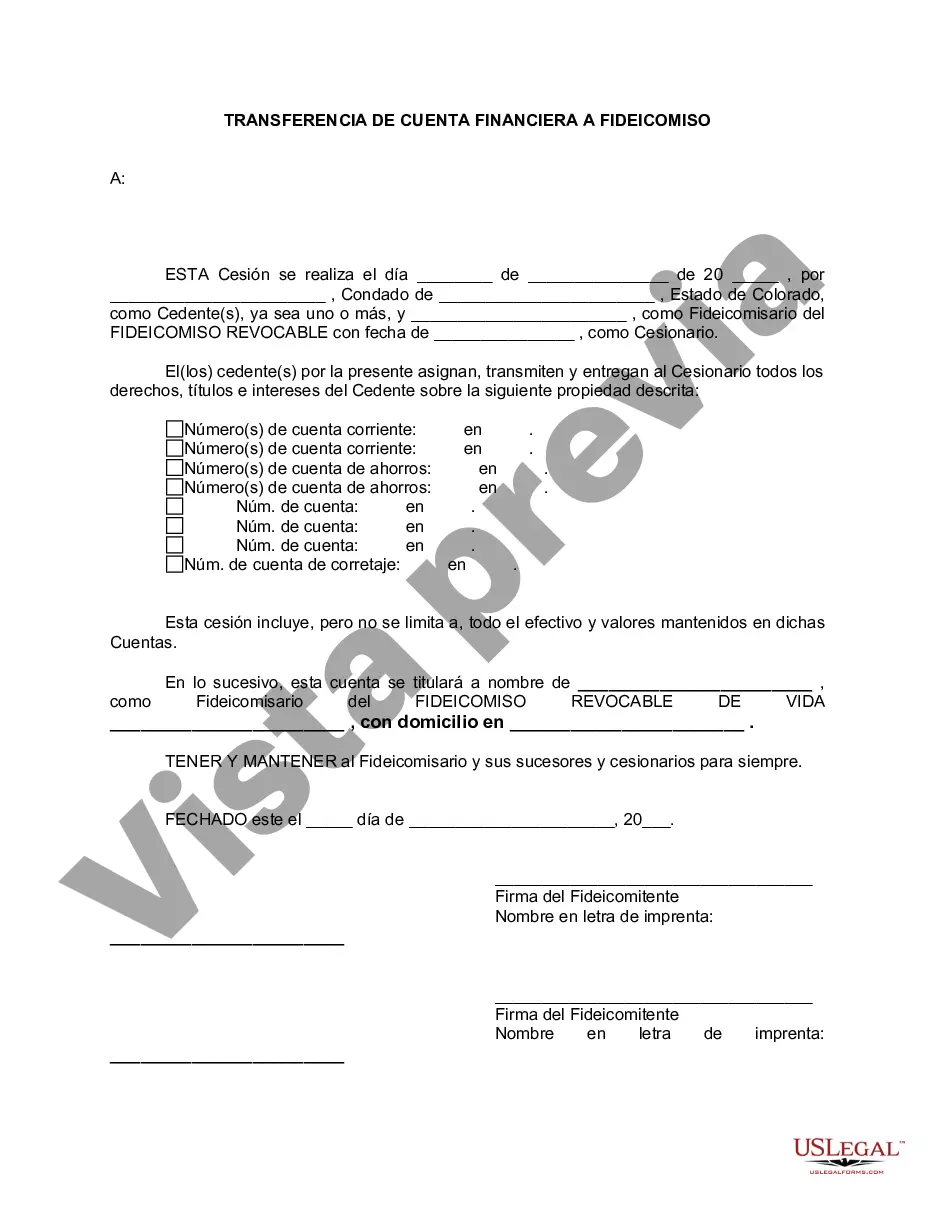

Westminster Colorado Financial Account Transfer to Living Trust involves the process of moving one's financial accounts into a living trust for better estate planning and asset protection. A living trust is a legal entity created during one's lifetime to hold assets for the benefit of the trust creator (granter) and designated beneficiaries. The process of Westminster Colorado Financial Account Transfer to Living Trust begins by identifying the financial accounts one wishes to include in the trust. These may include bank accounts, brokerage accounts, retirement accounts, stocks, bonds, or real estate properties. To initiate the transfer, the account holder must contact the respective financial institutions where the accounts are held and inform them of their intention to transfer the accounts into their living trust. The necessary transfer documentation and forms will be provided by the financial institution, which need to be completed accurately. It's important to note that different types of Westminster Colorado Financial Account Transfer to Living Trust could be categorized based on the type of financial account being transferred. For example: 1. Bank Account Transfer to Living Trust: This type of transfer involves transferring savings accounts, checking accounts, certificates of deposit (CDs), or money market accounts into a living trust. The account holder will work directly with the bank to complete the transfer process. 2. Investment Account Transfer to Living Trust: This type of transfer includes brokerage accounts and investment portfolios. The account holder needs to consult their financial advisor or brokerage firm to initiate the transfer process and ensure compliance with any specific requirements. 3. Retirement Account Transfer to Living Trust: This category includes Individual Retirement Accounts (IRAs), 401(k)s, or other employer-sponsored retirement accounts. The account holder must consult with their retirement account custodian or plan administrator to understand any restrictions or tax implications associated with transferring these accounts to a living trust. 4. Real Estate Transfer to Living Trust: In this scenario, the account holder transfers ownership of any real estate properties, such as residential homes or commercial properties, into their living trust. Working with a real estate attorney or title company is often necessary to complete the necessary documentation and ensure a valid transfer. Regardless of the specific financial account type, the account holder should consult with an estate planning attorney or trusted financial advisor who specializes in living trusts to ensure the transfer process is executed correctly, compliantly, and in line with their overall estate planning objectives.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Westminster Colorado Transferencia de cuenta financiera a fideicomiso en vida - Colorado Financial Account Transfer to Living Trust

Description

How to fill out Westminster Colorado Transferencia De Cuenta Financiera A Fideicomiso En Vida?

If you are looking for a relevant form, it’s impossible to choose a better place than the US Legal Forms site – one of the most considerable online libraries. Here you can get a large number of form samples for company and individual purposes by types and regions, or key phrases. Using our high-quality search function, finding the latest Westminster Colorado Financial Account Transfer to Living Trust is as easy as 1-2-3. Additionally, the relevance of each and every record is proved by a group of expert lawyers that on a regular basis review the templates on our website and update them in accordance with the latest state and county laws.

If you already know about our system and have an account, all you should do to receive the Westminster Colorado Financial Account Transfer to Living Trust is to log in to your account and click the Download button.

If you utilize US Legal Forms the very first time, just follow the instructions listed below:

- Make sure you have opened the sample you need. Read its information and use the Preview option (if available) to explore its content. If it doesn’t meet your needs, utilize the Search option at the top of the screen to discover the appropriate file.

- Confirm your choice. Choose the Buy now button. Next, choose your preferred pricing plan and provide credentials to register an account.

- Make the purchase. Use your credit card or PayPal account to finish the registration procedure.

- Receive the form. Select the format and download it on your device.

- Make modifications. Fill out, edit, print, and sign the received Westminster Colorado Financial Account Transfer to Living Trust.

Each form you add to your account does not have an expiration date and is yours forever. You can easily access them using the My Forms menu, so if you want to have an extra duplicate for modifying or creating a hard copy, you may come back and export it again at any time.

Take advantage of the US Legal Forms extensive catalogue to gain access to the Westminster Colorado Financial Account Transfer to Living Trust you were seeking and a large number of other professional and state-specific samples in a single place!