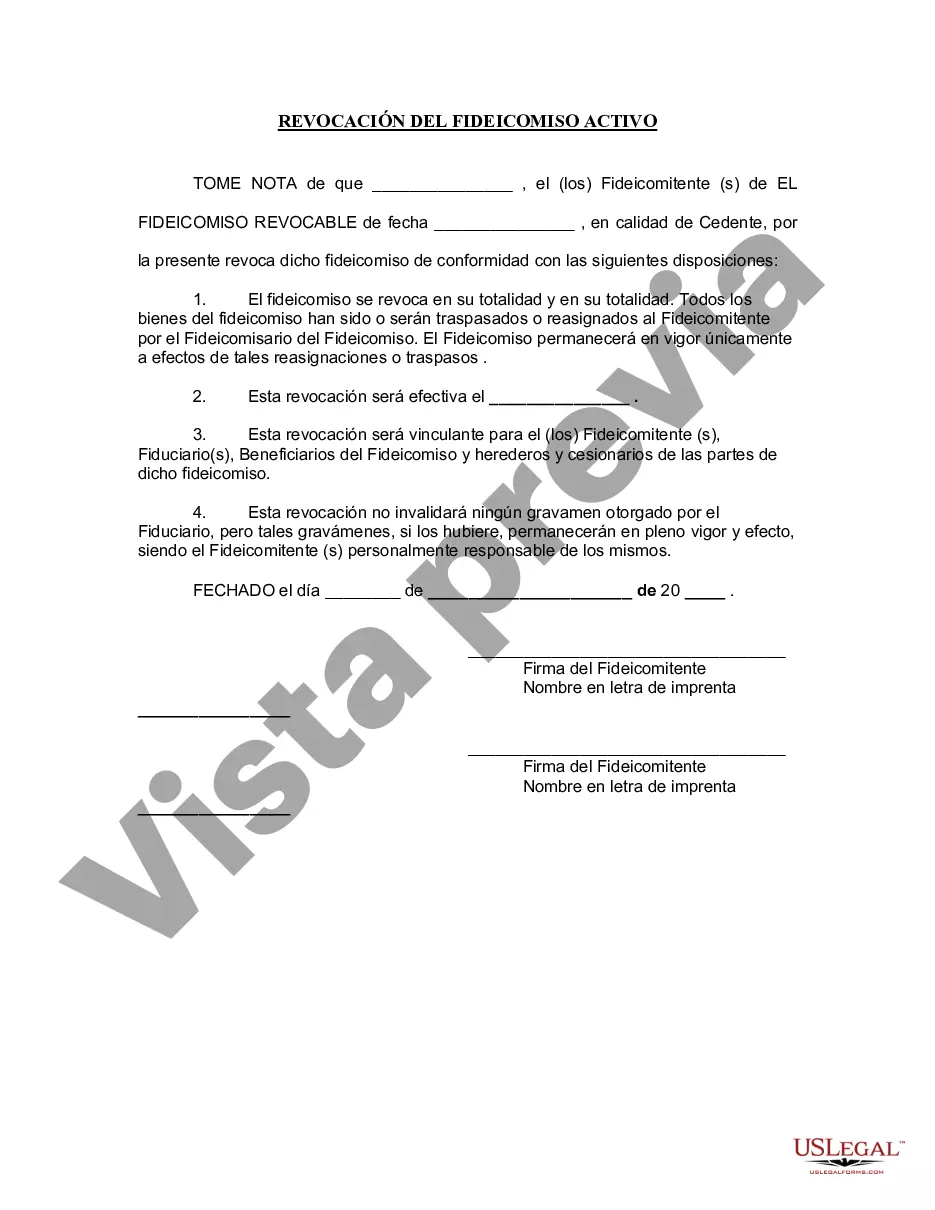

Colorado Springs Colorado Revocation of Living Trust is a legal process that allows individuals in Colorado Springs, Colorado, to revoke or nullify a previously established living trust. A living trust is a legal arrangement that allows individuals to transfer ownership of their assets to a trust during their lifetime, which can then be managed by a designated trustee for the benefit of the trust's beneficiaries. There are several situations in which an individual may choose to revoke their living trust in Colorado Springs, Colorado. Some common reasons for revoking a living trust include changes in personal circumstances, such as marriage, divorce, or the birth or adoption of children, changes in financial situations, or changes in estate planning goals. Additionally, individuals may choose to revoke a living trust if they wish to create a new trust with different terms or if they decide to discontinue the use of a trust altogether. When revoking a living trust in Colorado Springs, Colorado, individuals must follow specific legal procedures to ensure the revocation is valid. It is advisable to consult with an experienced attorney who specializes in estate planning to ensure compliance with all legal requirements. There are different types of Colorado Springs Colorado Revocation of Living Trust, including: 1. Partial Revocation: This type of revocation involves nullifying or modifying specific provisions or assets within the living trust, while leaving the remaining provisions intact. It allows individuals to make specific changes without entirely revoking the trust. 2. Complete Revocation: This type of revocation entails the complete nullification of the living trust. All assets, provisions, and appointees are revoked, and the trust ceases to exist. 3. Amendments: Instead of revoking the entire living trust, individuals may choose to make amendments to certain provisions or terms within the trust. Amendments allow for changes to be made without the need for a complete revocation. 4. Codicil: A codicil is a separate document that can be used to make modifications or updates to the living trust without fully revoking it. It is often used to add or remove beneficiaries, change trustees, or alter distribution instructions. In summary, Colorado Springs Colorado Revocation of Living Trust is a legal process that individuals can undertake to nullify or modify a previously established living trust. Whether through partial revocation, complete revocation, amendments, or a codicil, individuals have various options to revoke or modify their living trust to align with their changing circumstances or estate planning goals. Consulting with a knowledgeable attorney is highly recommended ensuring the proper legal procedures are followed during the revocation process.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Colorado Springs Colorado Revocación de fideicomiso en vida - Colorado Revocation of Living Trust

Description

How to fill out Colorado Springs Colorado Revocación De Fideicomiso En Vida?

We consistently aim to mitigate or avert legal complications when engaging with detailed legal or financial issues.

To achieve this, we seek legal remedies that are typically quite costly.

Nonetheless, not every legal challenge is equally intricate.

The majority of them can be managed independently.

Benefit from US Legal Forms whenever you want to obtain and download the Colorado Springs Colorado Revocation of Living Trust or any other form swiftly and securely. Simply Log In to your account and click the Get button next to it. If you happen to misplace the document, you can always retrieve it again from the My documents section.

- US Legal Forms is an online repository of current DIY legal templates ranging from wills and powers of attorney to incorporation articles and dissolution petitions.

- Our service empowers you to take control of your issues without needing to consult a lawyer.

- We provide access to legal form models that aren't always easily found in public sources.

- Our templates are tailored to state and local specifications, which greatly streamlines the search process.

Form popularity

FAQ

As discussed above, irrevocable trusts are not completely irrevocable; they can be modified or dissolved, but the settlor may not do so unilaterally. The most common mechanisms for modifying or dissolving an irrevocable trust are modification by consent and judicial modification.

You can completely undo the trust if you decide the arrangement isn't working for you after all. But all a revocable trust can do for you is avoid probate of the property it holds when you die. You can name a successor trustee to take over management of the trust for you if you should become incompetent.

(1) An irrevocable trust may be modified or terminated upon consent of the settlor and all beneficiaries, even if the modification or termination is inconsistent with a material noncharitable purpose of the trust. Modification or termination of a charitable trust requires the consent of the attorney general.

An irrevocable trust cannot be revoked or changed. But the difference goes far beyond that fact. Revocable trusts and irrevocable trusts serve very different purposes in estate planning.

Trust agreements usually allow the trustor to remove a trustee, including a successor trustee. This may be done at any time, without the trustee giving reason for the removal. To do so, the trustor executes an amendment to the trust agreement.

Getting consent from all parties Section A provides that so long as the settlor (who made the trust) and all the beneficiaries give consent and that they are all competent to give consent, the trust can be terminated or modified with a simple petition to the relevant probate court.

(a) A noncharitable irrevocable trust may be terminated upon consent of all of the beneficiaries if the court concludes that continuance of the trust is not necessary to achieve any material purpose of the trust.

With living trusts, probate can be avoided and trustees can distribute assets without needing approval from the court. Living trusts offer many other perks, including: Protecting privacy, since living trusts do not become public record. Avoiding the probate process in other states where the individual owns real estate.

The trust is fully valid. It only comes to an end when the settlor fully revokes it.

A will or trust can be contested if the individual who made it lacked the capacity to do so or was unduly influenced by another. It may also be challenged if the signature on the document is invalid.