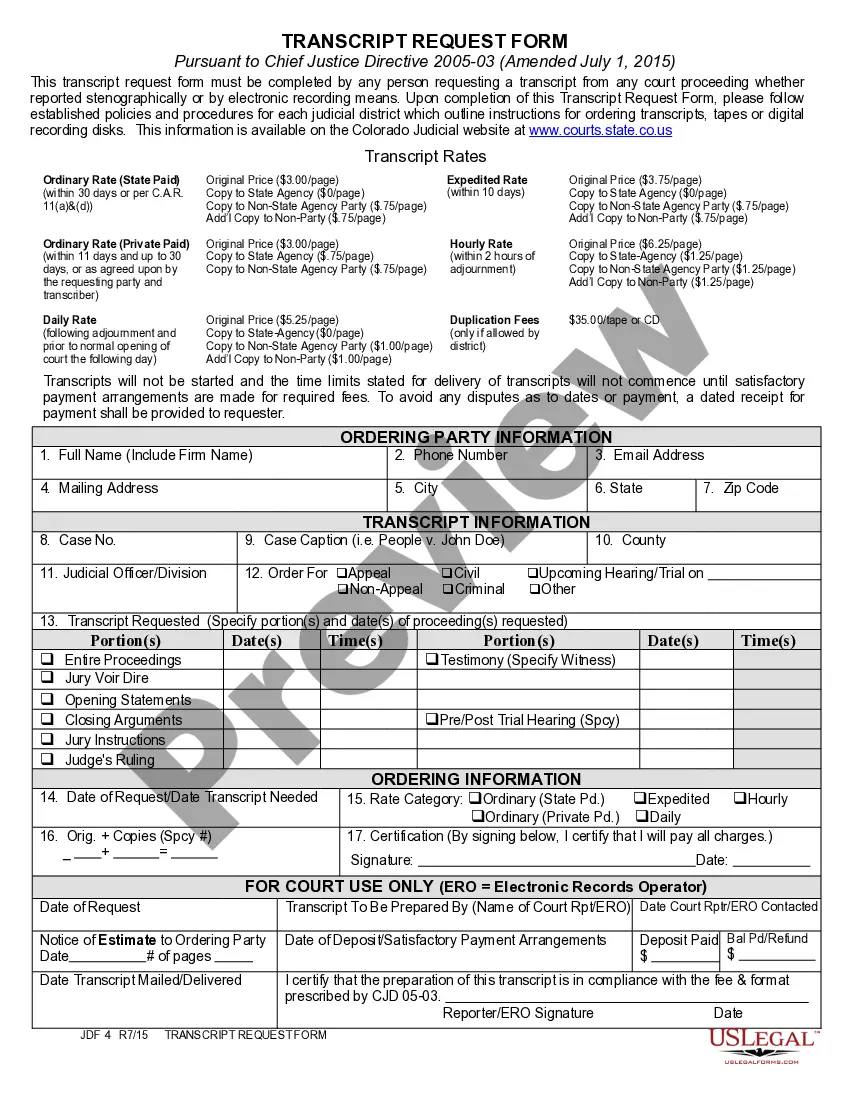

This is an official form from the Colorado State Judicial Branch, which complies with all applicable laws and statutes. USLF amends and updates the forms as is required by Colorado statutes and law.

Title: Aurora Colorado Instructions For Appealing Property Tax Assessments With The District Court Introduction: In Aurora, Colorado, property tax assessments play a crucial role in determining the amount of taxes owed by property owners. However, there may be instances where property owners feel their tax assessments are inaccurately high. In such cases, the Aurora Colorado District Court offers a process for property owners to appeal their property tax assessments. This comprehensive guide will outline the steps and pertinent information related to appealing property tax assessments in Aurora, Colorado. 1. Understanding the Property Tax Appeal Process: — Overview of how property tax assessments are determined in Aurora, Colorado — Explanation of the reasons for disputing property tax assessments — Importance of understanding the timeline for property tax appeals 2. Initial Steps to Take: — Contacting the Aurora County Assessor’s Office to gatheinformationio— - Collecting necessary documents and evidence for the appeal — Understanding the assessment review period and the deadline to file appeals 3. Filing the Appeal: — Overview of the required forms and documents for the appeal — Step-by-step instructions on completing the appeal forms accurately — Providing supporting evidence and documentation to strengthen the appeal 4. Presenting the Case: — Understanding the appeals hearing process with the Aurora Colorado District Court — Tips for preparing a strong case and presenting evidence effectively — Importance of seeking professional assistance or legal representation, if needed 5. Appealing the District Court's Decision: — Explanation of the options available if dissatisfied with the District Court's decision — Overview of how to file an appeal with the Colorado Court of Appeals or the Colorado Supreme Court 6. Additional Resources and Support: — Listing relevant online resources, guides, and publications on property tax assessments — Contact information for the Aurora Colorado District Court and related authorities — Recommendations for seeking professional advice from tax consultants or attorneys Types of Aurora Colorado Instructions For Appealing Property Tax Assessments With The District Court: 1. Residential Property Tax Appeal Instructions: — Specific instructions tailored to residential property owners in Aurora, Colorado — Guidelines for gathering evidence relevant to residential properties — Addressing common concerns specific to residential property assessments 2. Commercial Property Tax Appeal Instructions: — Specific instructions tailored to commercial property owners in Aurora, Colorado — Guidance for compiling documentation and evidence specific to commercial properties — Addressing unique challenges faced in appealing commercial property tax assessments 3. Agricultural Property Tax Appeal Instructions: — Specific instructions tailored to agricultural property owners in Aurora, Colorado — Explaining the unique procedures and supporting documentation required for agricultural properties — Addressing common concerns specific to agricultural property assessments Conclusion: Understanding the process of appealing property tax assessments with the Aurora Colorado District Court is essential for property owners seeking resolution regarding inaccurate tax assessments. By following the outlined instructions and gathering the appropriate evidence, property owners can present strong cases and increase the chances of a successful appeal. Additionally, seeking professional assistance and utilizing available resources can provide valuable guidance throughout the appeal process.Title: Aurora Colorado Instructions For Appealing Property Tax Assessments With The District Court Introduction: In Aurora, Colorado, property tax assessments play a crucial role in determining the amount of taxes owed by property owners. However, there may be instances where property owners feel their tax assessments are inaccurately high. In such cases, the Aurora Colorado District Court offers a process for property owners to appeal their property tax assessments. This comprehensive guide will outline the steps and pertinent information related to appealing property tax assessments in Aurora, Colorado. 1. Understanding the Property Tax Appeal Process: — Overview of how property tax assessments are determined in Aurora, Colorado — Explanation of the reasons for disputing property tax assessments — Importance of understanding the timeline for property tax appeals 2. Initial Steps to Take: — Contacting the Aurora County Assessor’s Office to gatheinformationio— - Collecting necessary documents and evidence for the appeal — Understanding the assessment review period and the deadline to file appeals 3. Filing the Appeal: — Overview of the required forms and documents for the appeal — Step-by-step instructions on completing the appeal forms accurately — Providing supporting evidence and documentation to strengthen the appeal 4. Presenting the Case: — Understanding the appeals hearing process with the Aurora Colorado District Court — Tips for preparing a strong case and presenting evidence effectively — Importance of seeking professional assistance or legal representation, if needed 5. Appealing the District Court's Decision: — Explanation of the options available if dissatisfied with the District Court's decision — Overview of how to file an appeal with the Colorado Court of Appeals or the Colorado Supreme Court 6. Additional Resources and Support: — Listing relevant online resources, guides, and publications on property tax assessments — Contact information for the Aurora Colorado District Court and related authorities — Recommendations for seeking professional advice from tax consultants or attorneys Types of Aurora Colorado Instructions For Appealing Property Tax Assessments With The District Court: 1. Residential Property Tax Appeal Instructions: — Specific instructions tailored to residential property owners in Aurora, Colorado — Guidelines for gathering evidence relevant to residential properties — Addressing common concerns specific to residential property assessments 2. Commercial Property Tax Appeal Instructions: — Specific instructions tailored to commercial property owners in Aurora, Colorado — Guidance for compiling documentation and evidence specific to commercial properties — Addressing unique challenges faced in appealing commercial property tax assessments 3. Agricultural Property Tax Appeal Instructions: — Specific instructions tailored to agricultural property owners in Aurora, Colorado — Explaining the unique procedures and supporting documentation required for agricultural properties — Addressing common concerns specific to agricultural property assessments Conclusion: Understanding the process of appealing property tax assessments with the Aurora Colorado District Court is essential for property owners seeking resolution regarding inaccurate tax assessments. By following the outlined instructions and gathering the appropriate evidence, property owners can present strong cases and increase the chances of a successful appeal. Additionally, seeking professional assistance and utilizing available resources can provide valuable guidance throughout the appeal process.