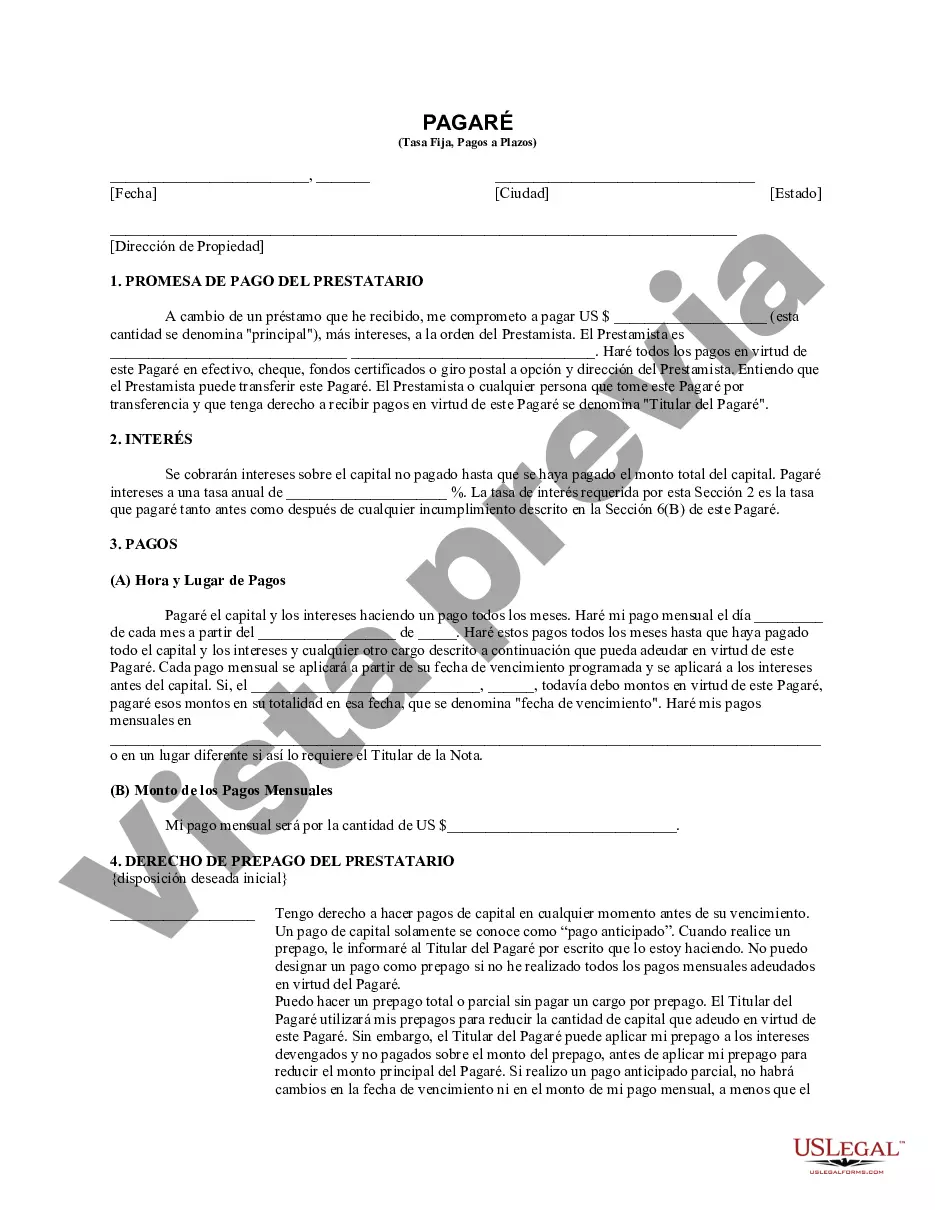

Lakewood Colorado Installments Fixed Rate Promissory Note Secured by Residential Real Estate is a legal document that outlines the terms of a loan agreement between a lender and borrower in the city of Lakewood, Colorado. This promissory note is specifically used in the context of residential real estate transactions and serves as a binding agreement that ensures repayment of the loan amount. The note includes various important clauses, such as the interest rate, installment payment schedule, and the method of securing the loan with residential real estate. In Lakewood, Colorado, there are several types of Installments Fixed Rate Promissory Notes that can be secured by residential real estate: 1. Single-Family Home Promissory Note: This type of promissory note is designed for loans secured by a single-family residential property in Lakewood, Colorado. It clearly defines the terms of the loan, including the fixed interest rate, repayment installments, and the specific residential property used as collateral. 2. Condominium Promissory Note: For loans secured by a condominium unit in Lakewood, Colorado, this type of promissory note is used. It incorporates all the necessary details related to the loan, such as the fixed interest rate, repayment structure, and the specific condominium unit being pledged as collateral. 3. Townhouse Promissory Note: When a loan is secured by a townhouse property in Lakewood, Colorado, this type of promissory note is utilized. It specifies the terms and conditions of the loan, including the fixed interest rate, installment payments, and the townhouse property used as collateral to secure the loan. 4. Multi-Unit Residential Promissory Note: This type of promissory note is relevant for loans secured by multi-unit residential properties, such as duplexes, triplexes, or apartment buildings, in Lakewood, Colorado. It clarifies the key elements of the loan agreement, including the fixed interest rate, repayment terms, and the specific multi-unit residential property that serves as collateral. In summary, the Lakewood Colorado Installments Fixed Rate Promissory Note Secured by Residential Real Estate is a comprehensive legal document that ensures the loan agreement's clarity and enforceability. Whether it is a single-family home, condominium, townhouse, or multi-unit residential property, this promissory note helps protect both parties' interests and provides a clear roadmap for loan repayment.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Lakewood Pagaré de tasa fija a plazos de Colorado garantizado por bienes raíces residenciales - Colorado Installments Fixed Rate Promissory Note Secured by Residential Real Estate

Description

How to fill out Lakewood Pagaré De Tasa Fija A Plazos De Colorado Garantizado Por Bienes Raíces Residenciales?

We always strive to minimize or avoid legal damage when dealing with nuanced legal or financial matters. To accomplish this, we apply for attorney services that, as a rule, are very costly. Nevertheless, not all legal issues are equally complex. Most of them can be dealt with by ourselves.

US Legal Forms is a web-based library of up-to-date DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your matters into your own hands without the need of using services of an attorney. We provide access to legal form templates that aren’t always publicly available. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the Lakewood Colorado Installments Fixed Rate Promissory Note Secured by Residential Real Estate or any other form quickly and securely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always re-download it in the My Forms tab.

The process is just as easy if you’re new to the website! You can create your account within minutes.

- Make sure to check if the Lakewood Colorado Installments Fixed Rate Promissory Note Secured by Residential Real Estate complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s description (if available), and if you notice any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve made sure that the Lakewood Colorado Installments Fixed Rate Promissory Note Secured by Residential Real Estate is proper for your case, you can select the subscription option and make a payment.

- Then you can download the document in any suitable file format.

For more than 24 years of our presence on the market, we’ve helped millions of people by providing ready to customize and up-to-date legal documents. Take advantage of US Legal Forms now to save efforts and resources!