Centennial Colorado Special Durable Power of Attorney for Bank Account Matters is a legal document that grants a designated person, known as the agent or attorney-in-fact, the authority to act on behalf of another person, referred to as the principal, specifically in matters concerning their bank accounts. This type of power of attorney is specially designed to ensure that an individual's financial affairs are properly managed, even if they become incapacitated or unavailable. The Centennial Colorado Special Durable Power of Attorney for Bank Account Matters provides comprehensive authorization to the agent, allowing them to conduct a wide range of activities related to the principal's bank accounts. Such activities may include but are not limited to, depositing and withdrawing funds, managing investments, paying bills, transferring funds between accounts, negotiating loans, accessing safe deposit boxes, and engaging in online banking transactions. It is important to note that the "durable" aspect of this power of attorney implies that it remains valid and in effect, even if the principal becomes incapacitated, unless otherwise specified. This ensures that the agent can continue to manage the principal's finances seamlessly, avoiding potential disruptions. In the Centennial Colorado area, there may be various types of Special Durable Power of Attorney for Bank Account Matters available. Some of these variants may include: 1. Limited Special Durable Power of Attorney for Bank Account Matters: This type of power of attorney grants specific and limited powers to the agent, confining their authority to only certain aspects of bank account management, as detailed in the document. This option could be suitable for principals who want to delegate control over specific financial matters while retaining control over others. 2. Full Special Durable Power of Attorney for Bank Account Matters: This variant provides the agent with comprehensive authority to handle all aspects of the principal's bank accounts, as mentioned earlier. It covers a wide range of financial activities and allows the agent to act on the principal's behalf in any bank account-related matter. 3. Conditional Special Durable Power of Attorney for Bank Account Matters: In some cases, a power of attorney may come into effect only under specific conditions outlined by the principal. For example, it may activate upon the principal's incapacitation or upon reaching a certain age. This type of power of attorney ensures that the agent's authority is invoked only when the specified conditions are met. In conclusion, the Centennial Colorado Special Durable Power of Attorney for Bank Account Matters is a crucial legal instrument that empowers an agent to manage all or specific aspects of a principal's bank accounts, ensuring smooth financial management in case of incapacity. Whether through a limited, full, or conditional arrangement, this type of power of attorney offers peace of mind and safeguards an individual's financial well-being.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Centennial Colorado Poder especial duradero para asuntos de cuentas bancarias - Colorado Special Durable Power of Attorney for Bank Account Matters

State:

Colorado

City:

Centennial

Control #:

CO-P099H

Format:

Word

Instant download

Description

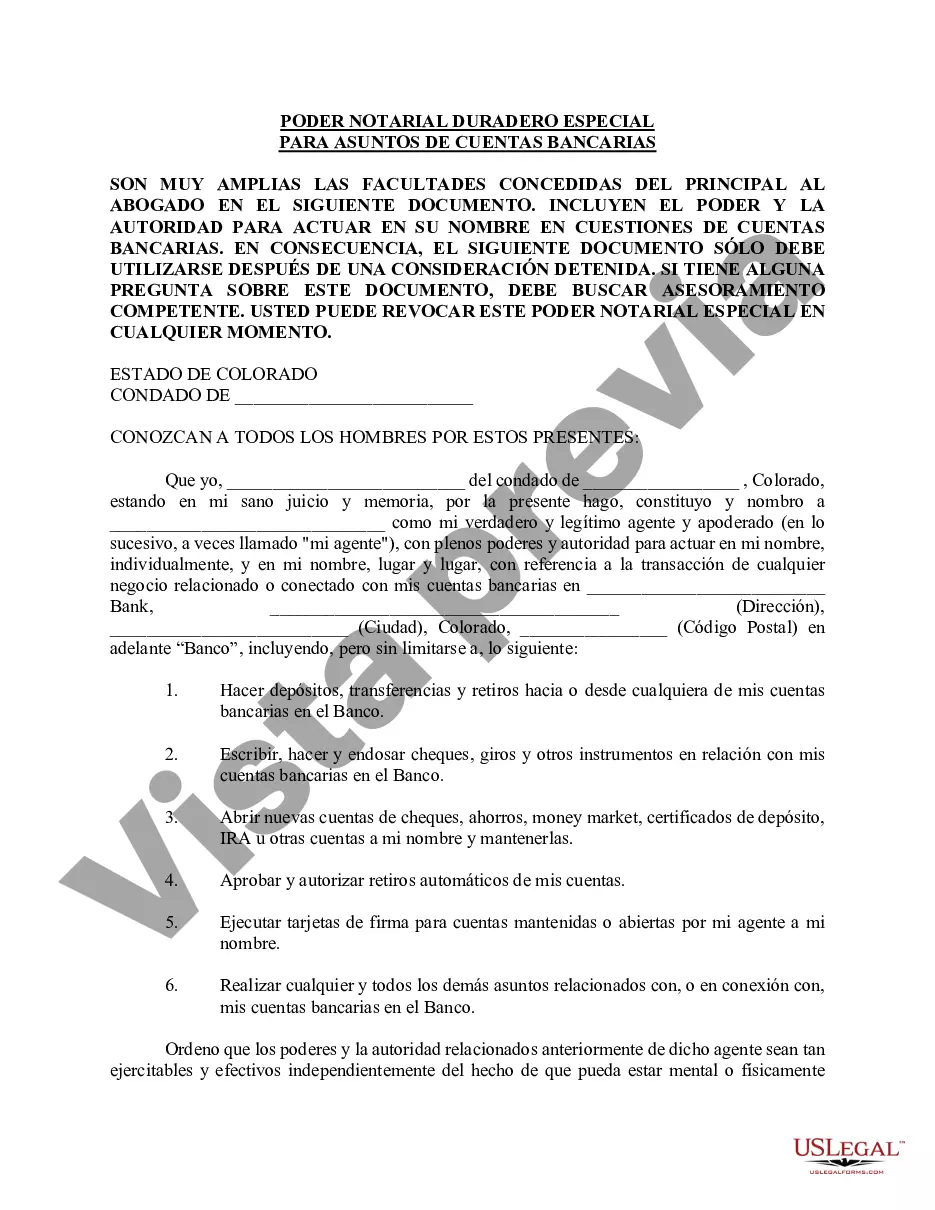

This special or limited power of attorney is for your agent to handle bank account matters for you, including, making deposits, writing checks, opening accounts, etc. A limited power of attorney allows the principal to give only specific powers to the agent. The limited power of attorney is used to allow the agent to handle specific matters when the principal is unavailable or unable to do so.

Centennial Colorado Special Durable Power of Attorney for Bank Account Matters is a legal document that grants a designated person, known as the agent or attorney-in-fact, the authority to act on behalf of another person, referred to as the principal, specifically in matters concerning their bank accounts. This type of power of attorney is specially designed to ensure that an individual's financial affairs are properly managed, even if they become incapacitated or unavailable. The Centennial Colorado Special Durable Power of Attorney for Bank Account Matters provides comprehensive authorization to the agent, allowing them to conduct a wide range of activities related to the principal's bank accounts. Such activities may include but are not limited to, depositing and withdrawing funds, managing investments, paying bills, transferring funds between accounts, negotiating loans, accessing safe deposit boxes, and engaging in online banking transactions. It is important to note that the "durable" aspect of this power of attorney implies that it remains valid and in effect, even if the principal becomes incapacitated, unless otherwise specified. This ensures that the agent can continue to manage the principal's finances seamlessly, avoiding potential disruptions. In the Centennial Colorado area, there may be various types of Special Durable Power of Attorney for Bank Account Matters available. Some of these variants may include: 1. Limited Special Durable Power of Attorney for Bank Account Matters: This type of power of attorney grants specific and limited powers to the agent, confining their authority to only certain aspects of bank account management, as detailed in the document. This option could be suitable for principals who want to delegate control over specific financial matters while retaining control over others. 2. Full Special Durable Power of Attorney for Bank Account Matters: This variant provides the agent with comprehensive authority to handle all aspects of the principal's bank accounts, as mentioned earlier. It covers a wide range of financial activities and allows the agent to act on the principal's behalf in any bank account-related matter. 3. Conditional Special Durable Power of Attorney for Bank Account Matters: In some cases, a power of attorney may come into effect only under specific conditions outlined by the principal. For example, it may activate upon the principal's incapacitation or upon reaching a certain age. This type of power of attorney ensures that the agent's authority is invoked only when the specified conditions are met. In conclusion, the Centennial Colorado Special Durable Power of Attorney for Bank Account Matters is a crucial legal instrument that empowers an agent to manage all or specific aspects of a principal's bank accounts, ensuring smooth financial management in case of incapacity. Whether through a limited, full, or conditional arrangement, this type of power of attorney offers peace of mind and safeguards an individual's financial well-being.

Free preview

How to fill out Centennial Colorado Poder Especial Duradero Para Asuntos De Cuentas Bancarias?

If you’ve already used our service before, log in to your account and download the Centennial Colorado Special Durable Power of Attorney for Bank Account Matters on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple actions to obtain your file:

- Make sure you’ve located the right document. Look through the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t fit you, utilize the Search tab above to get the proper one.

- Buy the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Obtain your Centennial Colorado Special Durable Power of Attorney for Bank Account Matters. Opt for the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to every piece of paperwork you have bought: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly locate and save any template for your individual or professional needs!