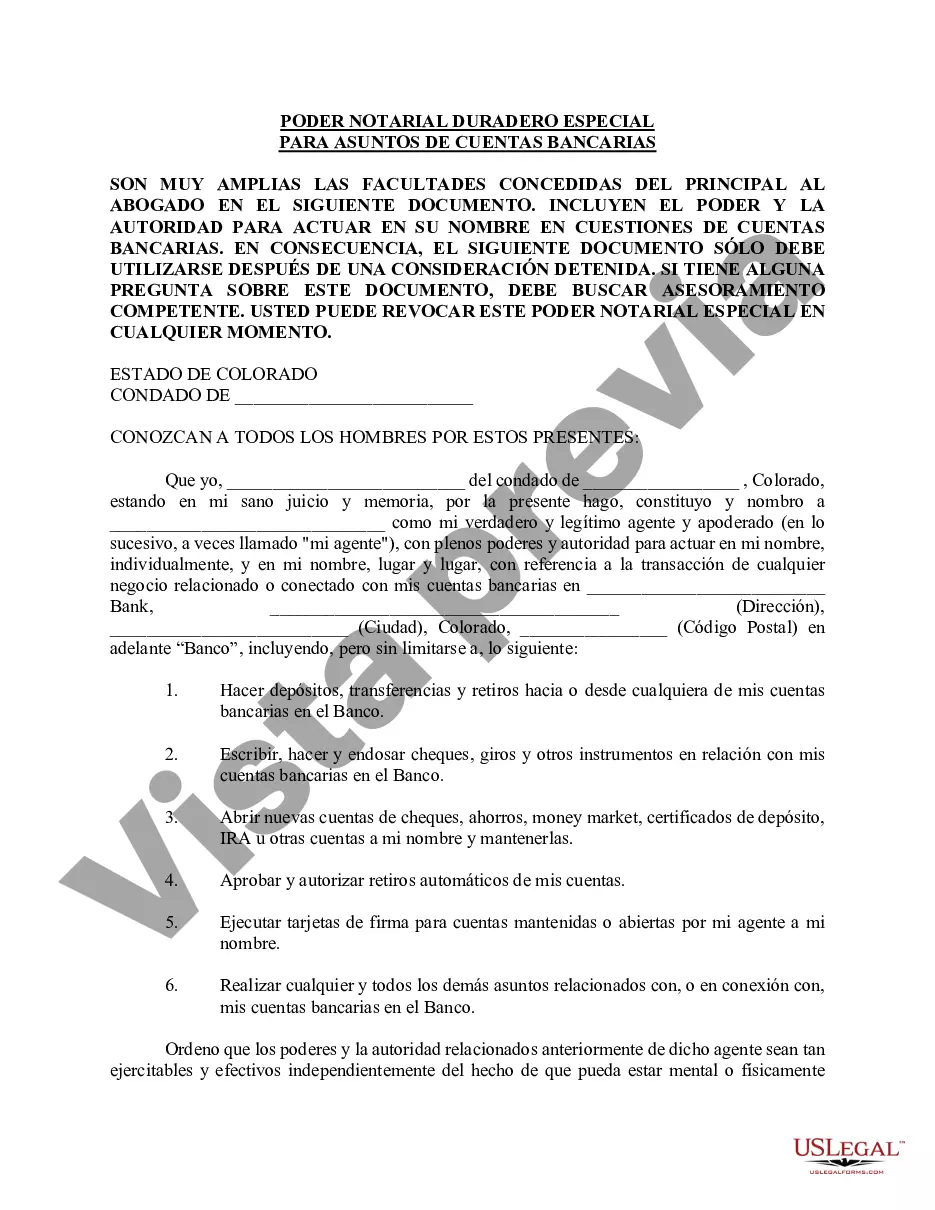

A Colorado Springs Colorado Special Durable Power of Attorney for Bank Account Matters is a legal document that grants authority to a designated person, referred to as the attorney-in-fact or agent, to manage specific banking tasks on behalf of the principal. This type of power of attorney is specifically tailored to handle matters related to bank accounts and financial transactions. It empowers the agent to make decisions and take actions regarding the principal's bank accounts, investments, and other monetary affairs. The agent appointed by the principal gains the ability to perform a range of activities, which may include: 1. Accessing bank accounts: The agent can access the principal's bank accounts, including checking, savings, and money market accounts, to make deposits, withdrawals, and transfers. 2. Paying bills: The agent can pay bills, loans, and other financial obligations on behalf of the principal using funds from their bank accounts. 3. Managing investments: If authorized, the agent can handle investment accounts, which may involve buying or selling stocks, bonds, or other securities. 4. Conducting transactions: The agent can execute financial transactions on behalf of the principal, such as opening or closing accounts, applying for loans, and negotiating terms with financial institutions. 5. Organizing records: The agent may have the authority to maintain and organize financial records, including statements, receipts, and tax-related documents. There are different types of Colorado Springs Colorado Special Durable Power of Attorney for Bank Account Matters that can cater to specific needs. These variations include: 1. Limited Power of Attorney: This allows the agent to handle only specific financial tasks mentioned in the document, such as paying bills or managing investments. 2. General Power of Attorney: This provides the agent with broad authority to manage all banking and financial matters on behalf of the principal. It covers a wide range of tasks and can remain in effect even if the principal becomes incapacitated. 3. Springing Power of Attorney: This type of power of attorney becomes effective only upon the occurrence of a specified event, such as the principal's incapacitation. Until then, the agent does not have any powers. It is important to consult with a qualified attorney to draft a Colorado Springs Colorado Special Durable Power of Attorney for Bank Account Matters that aligns with your specific needs and ensures the legal validity of the document. Keep in mind that laws and requirements regarding powers of attorney may vary across jurisdictions, so it is crucial to obtain local legal advice.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Colorado Springs Colorado Poder especial duradero para asuntos de cuentas bancarias - Colorado Special Durable Power of Attorney for Bank Account Matters

Description

How to fill out Colorado Springs Colorado Poder Especial Duradero Para Asuntos De Cuentas Bancarias?

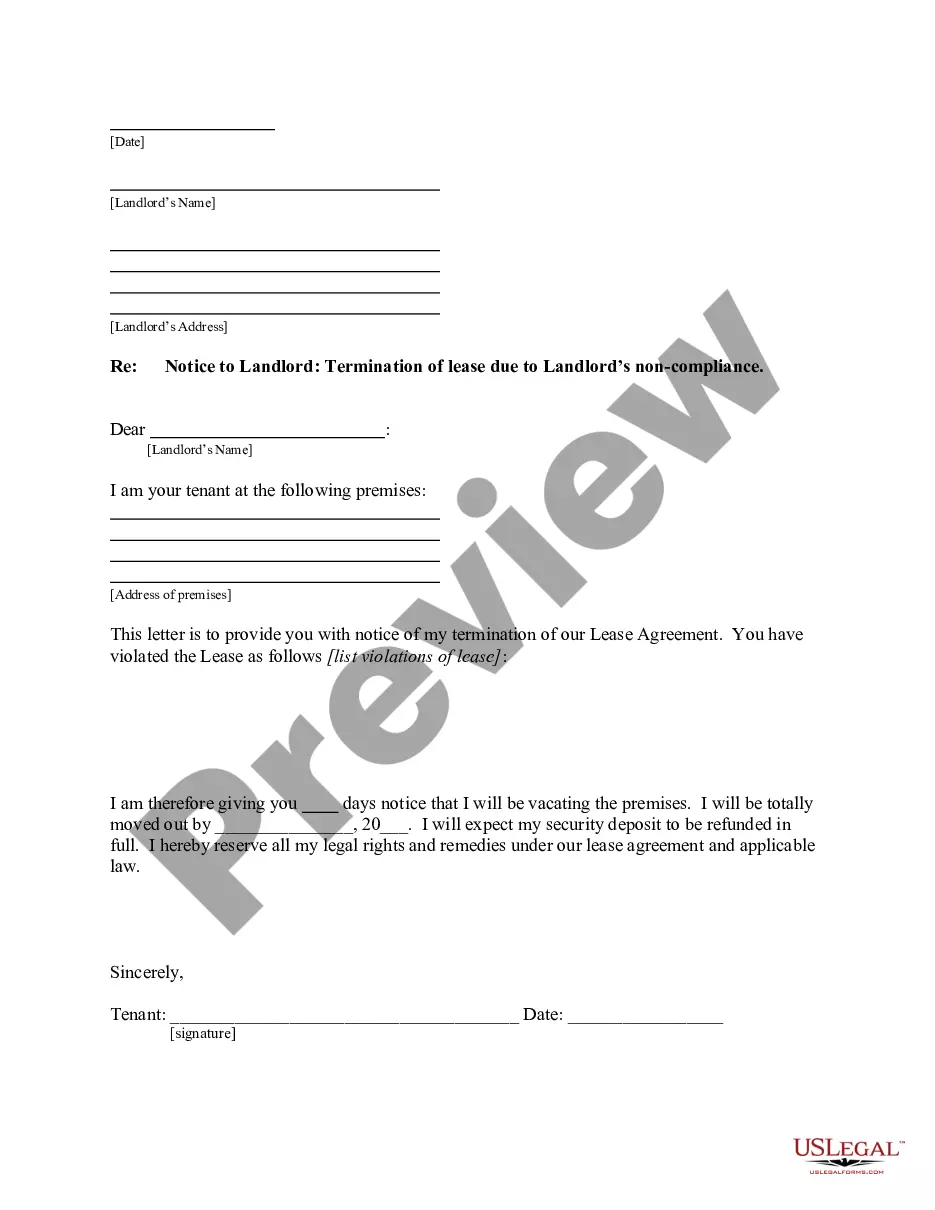

Do you need a trustworthy and inexpensive legal forms supplier to get the Colorado Springs Colorado Special Durable Power of Attorney for Bank Account Matters? US Legal Forms is your go-to solution.

Whether you need a simple arrangement to set rules for cohabitating with your partner or a package of documents to advance your divorce through the court, we got you covered. Our website offers more than 85,000 up-to-date legal document templates for personal and company use. All templates that we offer aren’t generic and frameworked based on the requirements of particular state and area.

To download the form, you need to log in account, locate the needed template, and click the Download button next to it. Please take into account that you can download your previously purchased form templates at any time from the My Forms tab.

Is the first time you visit our platform? No worries. You can create an account in minutes, but before that, make sure to do the following:

- Find out if the Colorado Springs Colorado Special Durable Power of Attorney for Bank Account Matters conforms to the regulations of your state and local area.

- Go through the form’s description (if provided) to learn who and what the form is good for.

- Start the search over in case the template isn’t suitable for your specific scenario.

Now you can register your account. Then select the subscription option and proceed to payment. Once the payment is completed, download the Colorado Springs Colorado Special Durable Power of Attorney for Bank Account Matters in any provided format. You can return to the website at any time and redownload the form free of charge.

Getting up-to-date legal documents has never been easier. Give US Legal Forms a try now, and forget about wasting your valuable time researching legal paperwork online for good.