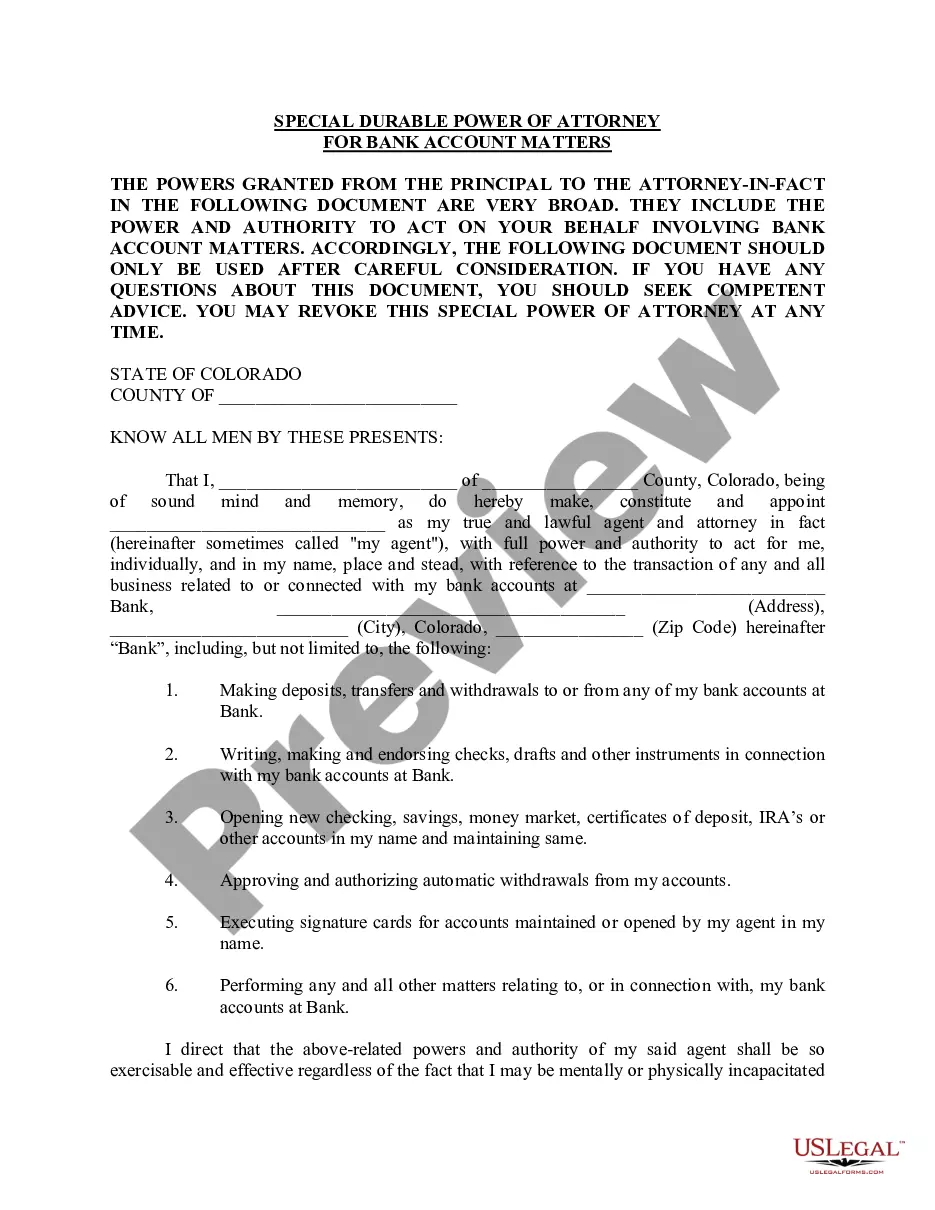

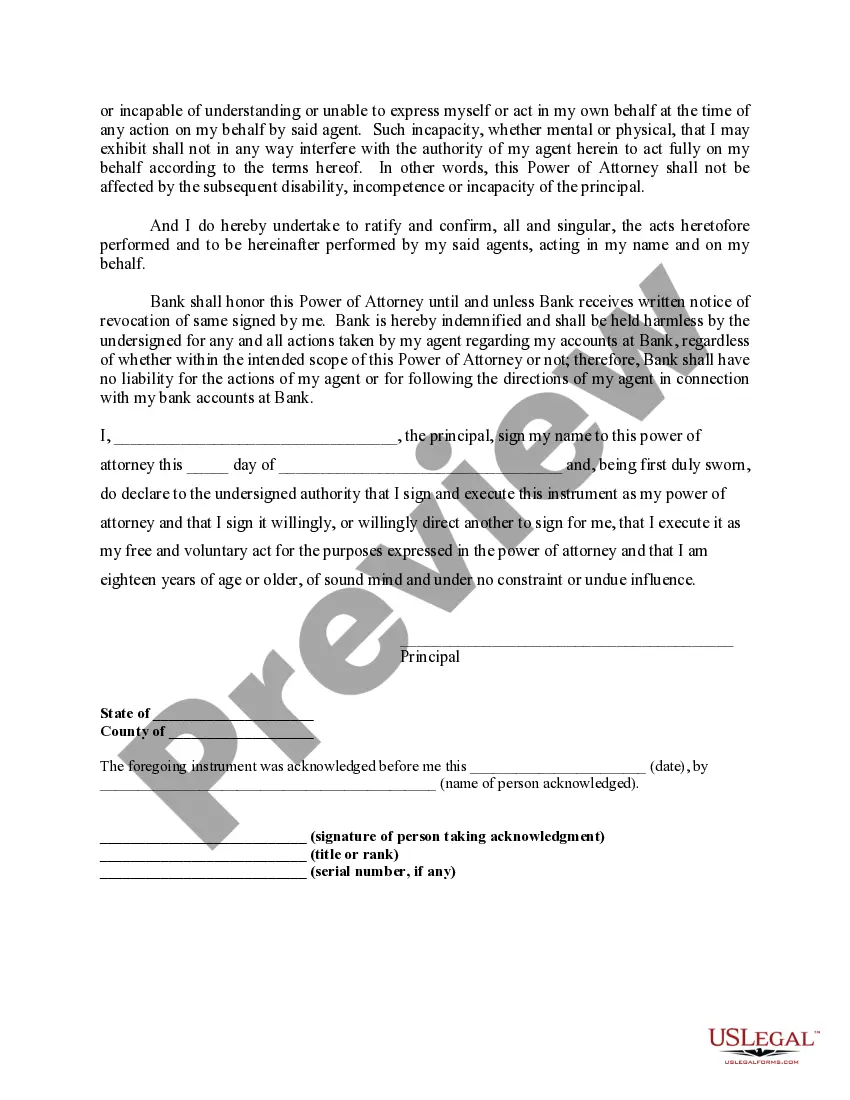

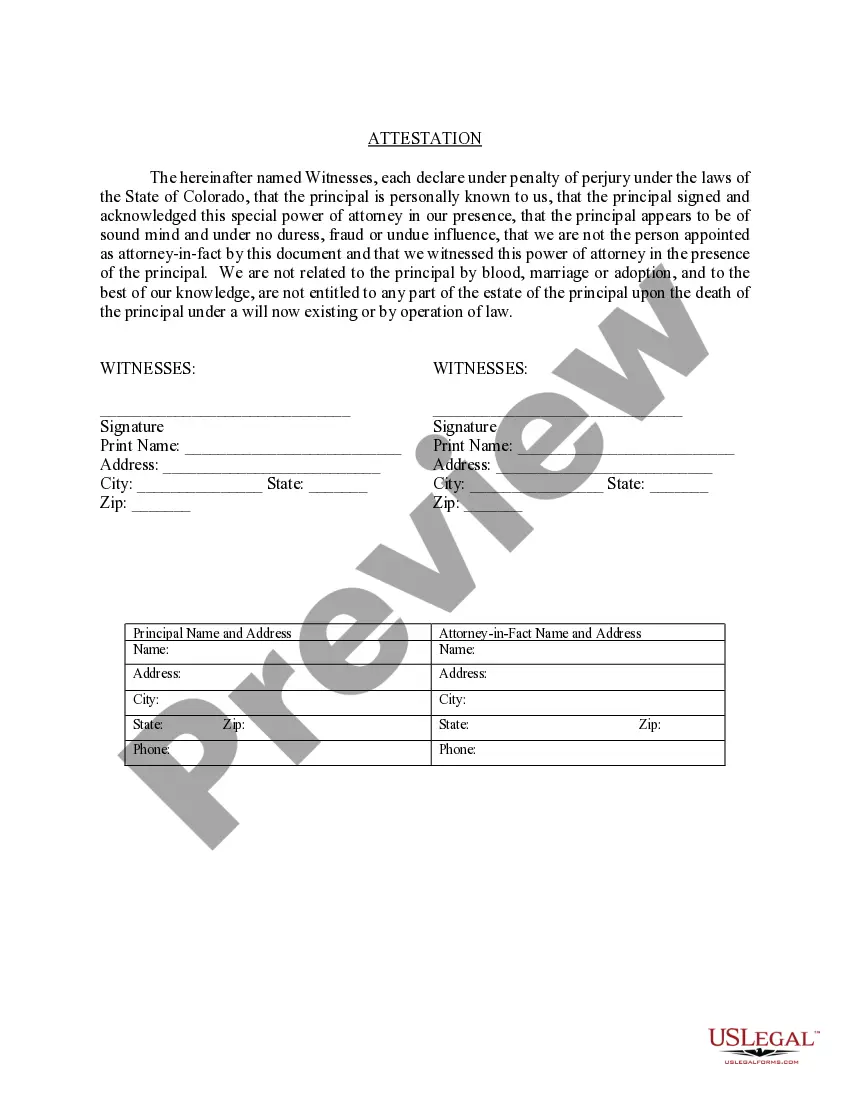

A Lakewood Colorado Special Durable Power of Attorney for Bank Account Matters is a legal document that allows an appointed individual, known as the agent or attorney-in-fact, to manage specific banking affairs on behalf of the principal in Lakewood, Colorado. This power of attorney is a specialized version that focuses solely on bank account matters, giving the agent the authority to act in the principal's best interests regarding their financial transactions, decision-making, and related banking affairs. The Special Durable Power of Attorney for Bank Account Matters provides flexibility and control to the principal, ensuring that their banking affairs are properly handled even if they are unable to manage them personally due to various reasons such as illness, physical incapacity, or absence. It is crucial to note that the durable aspect of this power of attorney means that it remains valid and effective even if the principal becomes incapacitated or mentally incompetent. This document empowers the agent to perform a wide range of specific tasks related to the principal's bank accounts, including but not limited to: 1. Depositing and withdrawing funds: The agent can deposit and withdraw funds on behalf of the principal, ensuring the availability and efficient management of finances. 2. Paying bills and expenses: The agent can pay bills, loans, and other financial obligations using the funds from the principal's bank accounts, ensuring that all financial responsibilities are promptly met. 3. Managing investments: If authorized, the agent can make investment decisions on behalf of the principal, including buying or selling securities or managing investment accounts directly related to the bank accounts. 4. Managing online banking: The agent can access and manage the principal's online banking accounts, including viewing transactions, initiating transfers, and resolving any issues that may arise with online banking services. 5. Opening and closing accounts: The agent may have the power to open or close bank accounts in the principal's name, ensuring the appropriate management and optimization of the principal's banking relationships. It is important to consult an attorney when drafting a Special Durable Power of Attorney for Bank Account Matters in Lakewood, Colorado, as there may be additional requirements or limitations that must be adhered to in accordance with local laws. Different forms or versions of this power of attorney may exist, such as specific powers of attorney only granting limited banking authority or general powers of attorney covering a broader scope of financial matters. By creating a Lakewood Colorado Special Durable Power of Attorney for Bank Account Matters, individuals can secure their financial well-being and ensure that their banking affairs are handled competently and diligently by a trusted agent.

Lakewood Colorado Special Durable Power of Attorney for Bank Account Matters

Description

How to fill out Colorado Special Durable Power Of Attorney For Bank Account Matters?

If you've previously used our service, Log In to your account and download the Lakewood Colorado Special Durable Power of Attorney for Bank Account Matters onto your device by clicking the Download button. Ensure your subscription is active. If not, renew it based on your payment plan.

If this is your initial interaction with our service, follow these straightforward steps to acquire your document.

You have continual access to all the documents you have purchased: you can find it in your profile within the My documents section whenever you need to use it again. Utilize the US Legal Forms service to swiftly find and download any template for your personal or professional requirements!

- Confirm you've found a fitting document. Browse the description and use the Preview feature, if available, to verify if it satisfies your needs. If it’s not what you want, utilize the Search tab above to find the correct one.

- Purchase the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Create an account and process your payment. Enter your credit card information or choose the PayPal option to finalize the transaction.

- Acquire your Lakewood Colorado Special Durable Power of Attorney for Bank Account Matters. Choose the file format for your document and save it onto your device.

- Complete your form. Print it or utilize professional online editors to fill it out and sign it digitally.

Form popularity

FAQ

Yes, a durable power of attorney can cover bank accounts, providing your agent with the authority to manage financial transactions. It’s important to specify banking powers within the document to ensure clarity. With the right wording, your Lakewood Colorado Special Durable Power of Attorney for Bank Account Matters will grant your agent the necessary access.

To obtain a durable power of attorney in Colorado, you can draft the document yourself or use a reliable template from USLegalForms. Make sure it includes the necessary provisions that ensure it remains effective even if you become incapacitated. This will provide your agent with authority, particularly for bank account matters in your Lakewood Colorado Special Durable Power of Attorney.

Banks are particularly cautious about powers of attorney to prevent fraud and protect their customers. They adhere to strict protocols to ensure documents are valid and comply with legal standards. Ensuring your Lakewood Colorado Special Durable Power of Attorney for Bank Account Matters is crafted meticulously can ease concerns and facilitate acceptance.

When presenting your power of attorney to the bank, bring the original document along with a valid ID. It’s beneficial to explain your intentions to the bank representative clearly. Additionally, ensure that your power of attorney is formatted correctly as per the requirements for a Lakewood Colorado Special Durable Power of Attorney for Bank Account Matters to avoid delays.

Yes, a power of attorney can handle bank accounts, allowing the agent to perform transactions on your behalf. This includes managing withdrawals, deposits, and other banking matters. Ensure your power of attorney document specifies these powers clearly to facilitate smooth management of your Lakewood Colorado Special Durable Power of Attorney for Bank Account Matters.

A bank may deny a power of attorney if it lacks specific language or does not meet their internal policies. They may also refuse if the document is outdated or not properly notarized. Understanding the requirements of a Lakewood Colorado Special Durable Power of Attorney for Bank Account Matters can help you avoid potential rejections.

To write a power of attorney letter for a bank, start by clearly stating your intention to grant authority. Include your name, the name of the agent, and the specific banking powers you wish to convey. You should also provide your account details and ensure the document is signed and dated. Utilizing a form from USLegalForms can simplify this process for your Lakewood Colorado Special Durable Power of Attorney for Bank Account Matters.

Yes, a power of attorney can be added to a checking account, allowing your appointed agent to manage the account on your behalf. To do this, provide the bank with the original durable power of attorney document and any required identification. The bank will review the POA to ensure it meets their requirements. For assistance, platforms like US Legal Forms can help you create a compliant POA that includes provisions for checking accounts.

In Colorado, a financial power of attorney, including a Lakewood Colorado Special Durable Power of Attorney for Bank Account Matters, must be signed in the presence of a notary public to be legally binding. This notarization process helps prevent fraud and assures that the document honors your intentions. If you're unsure about the process, using professional services can clarify your obligations and ensure compliance with state laws.

When filling out a check using a power of attorney, ensure that you indicate your agent's name followed by 'acting as agent under a durable power of attorney' for clarity. This informs the bank that your agent has the authority to transact on your behalf. It's vital to keep a copy of the POA on hand, as the bank may request to see it before processing the check. For more tips, you might check out resources on managing POA checks effectively.