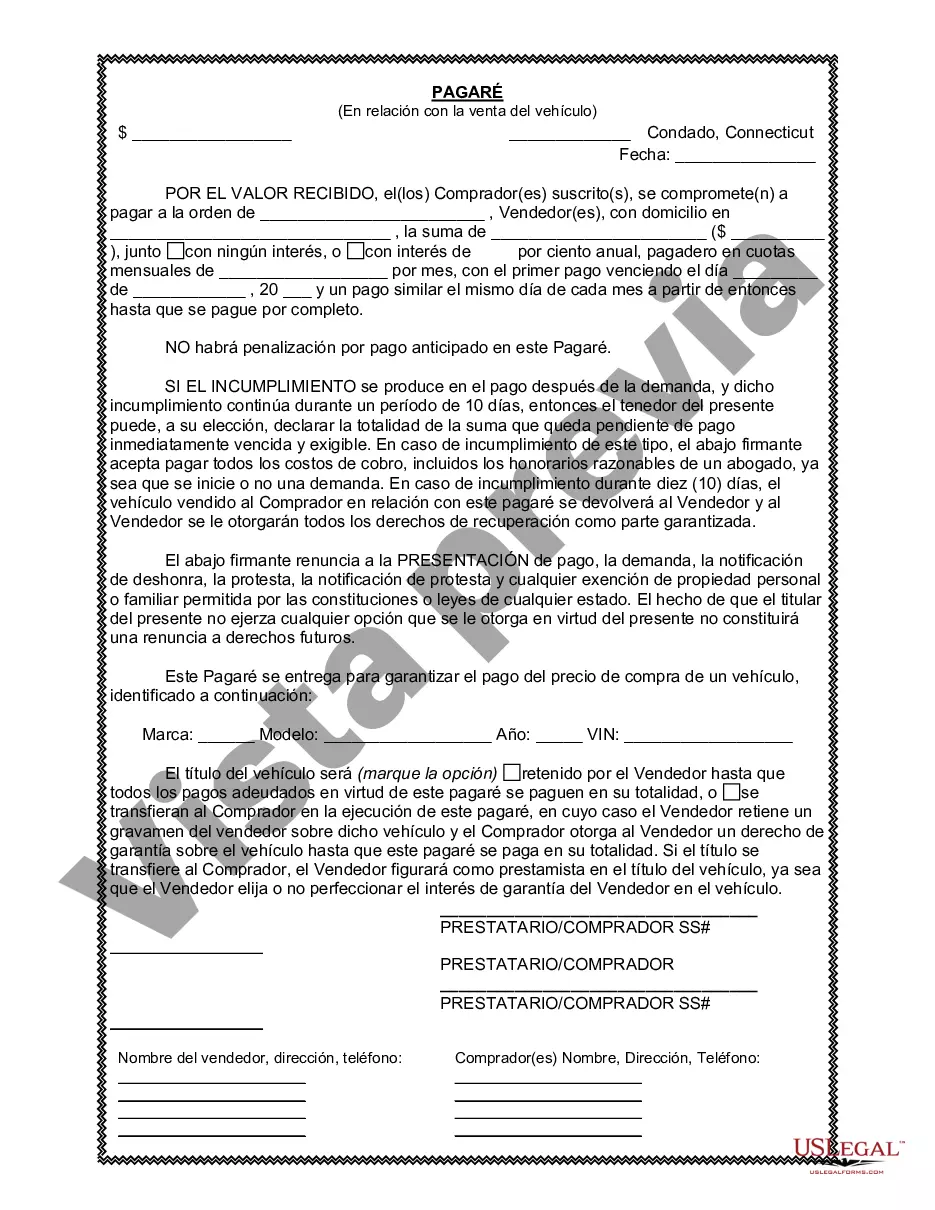

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

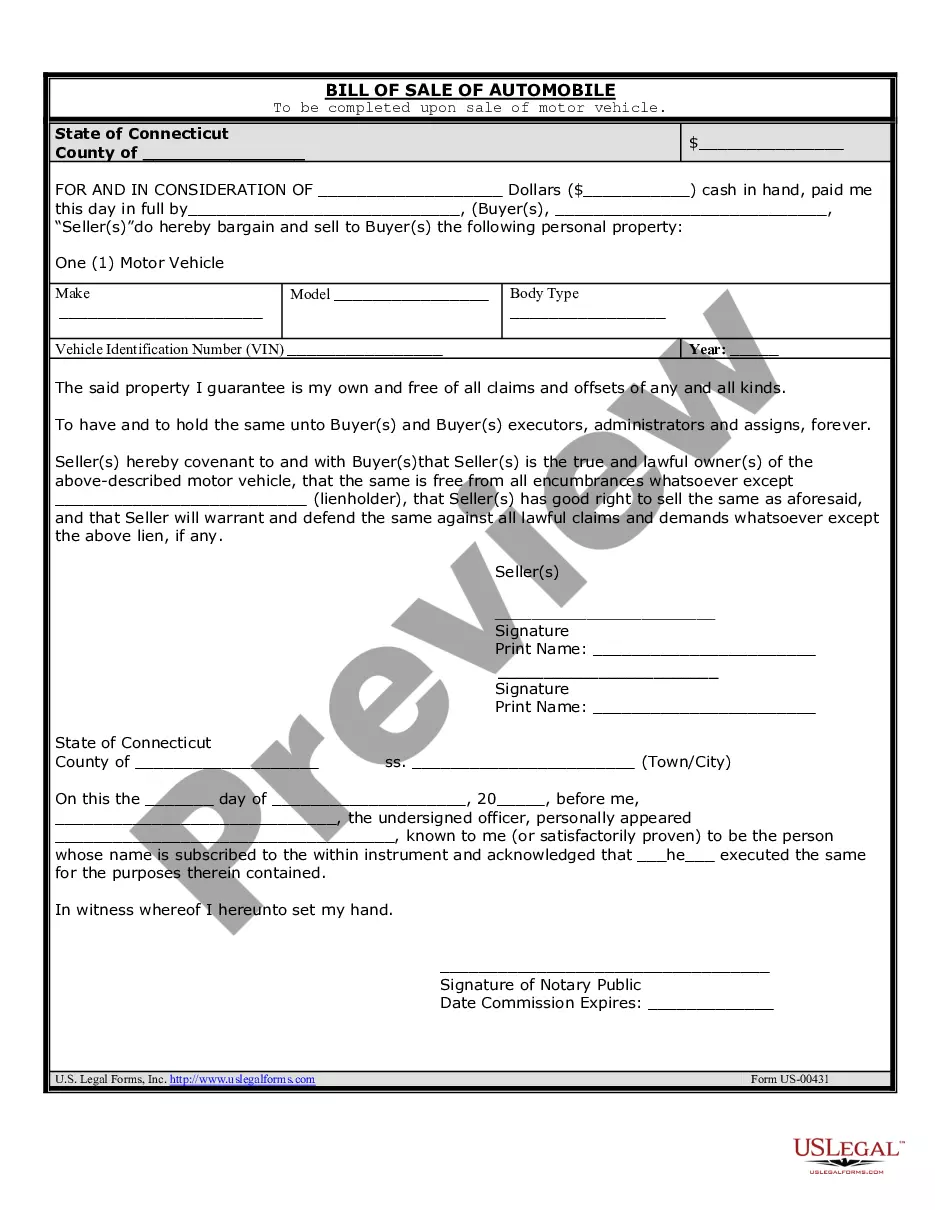

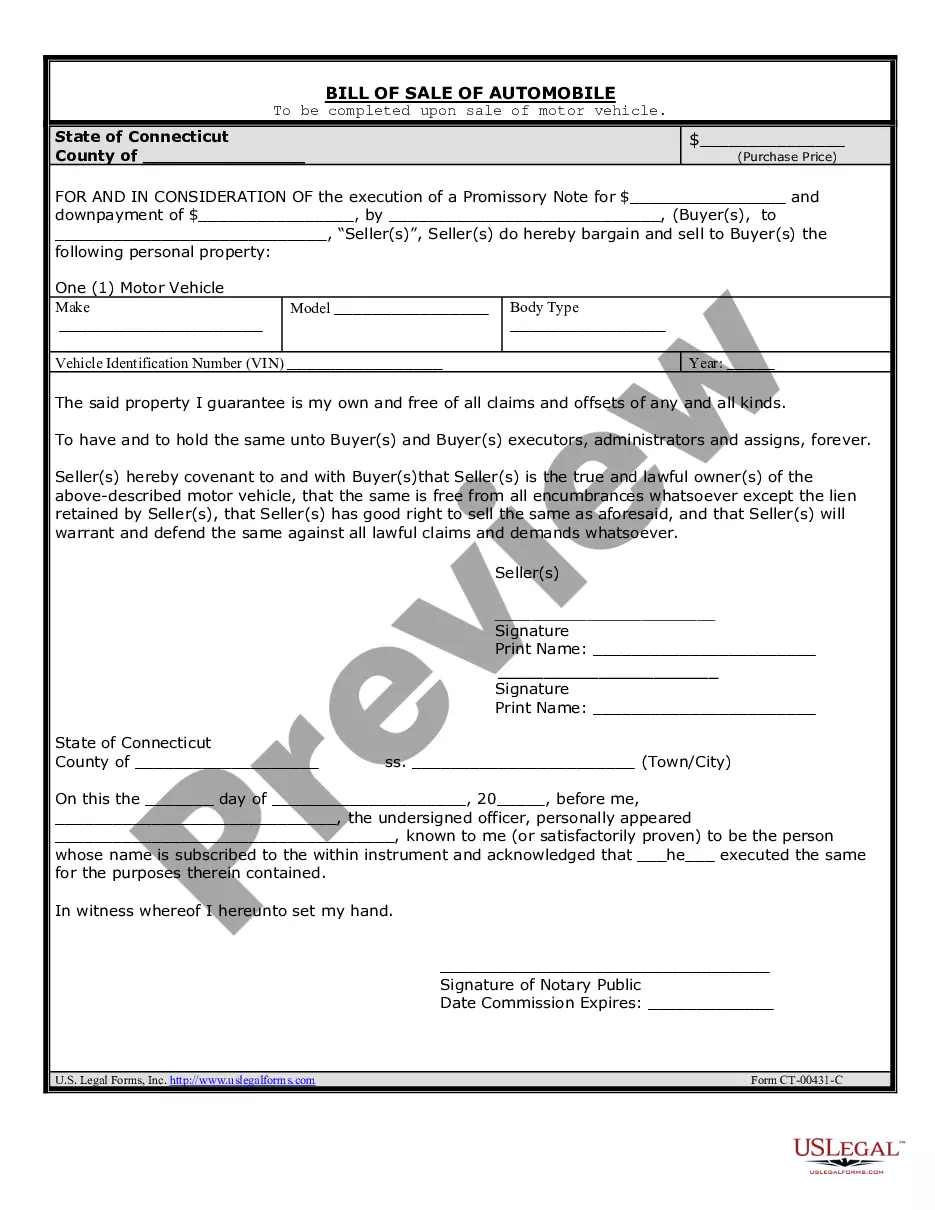

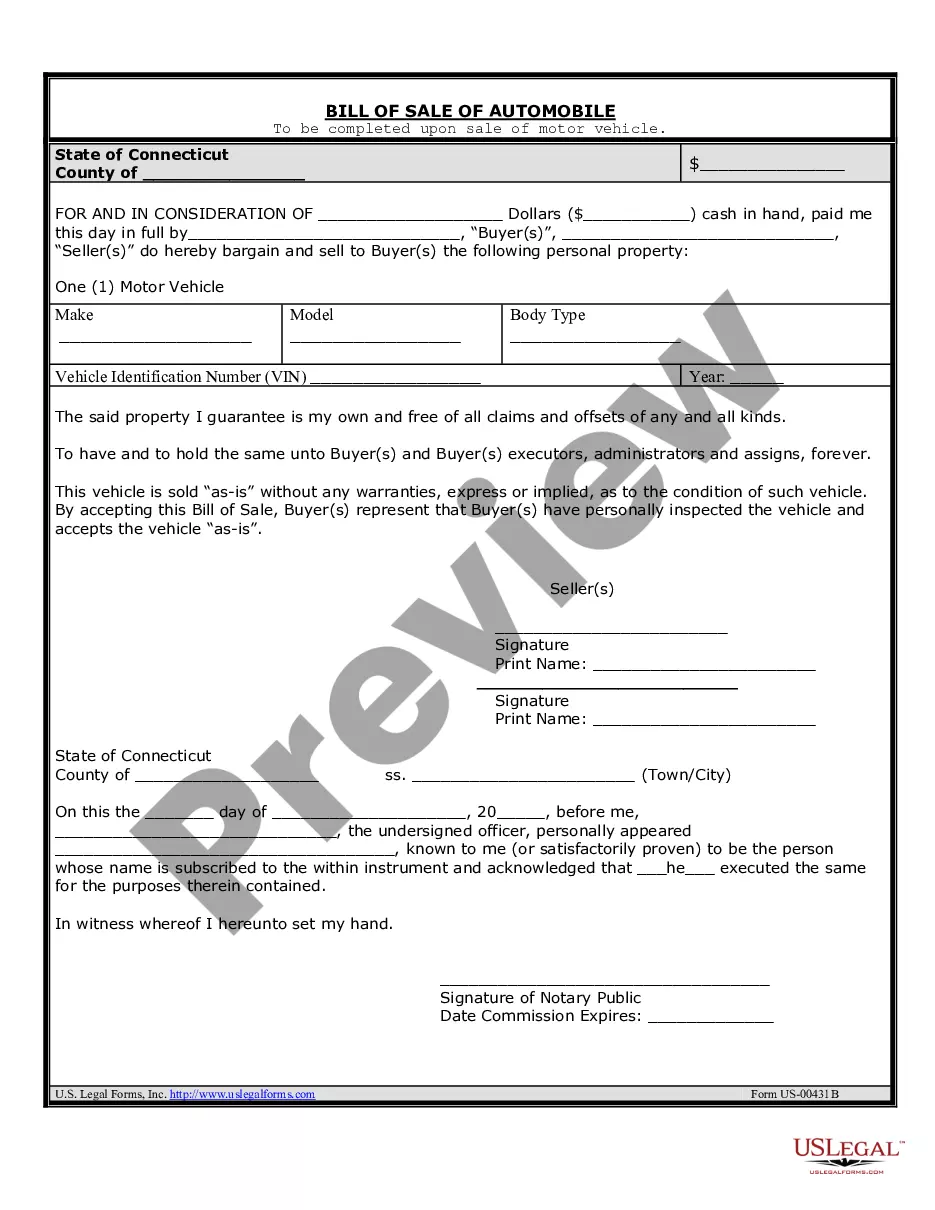

A Bridgeport Connecticut Promissory Note in Connection with the Sale of a Vehicle or Automobile is a legally binding agreement that outlines the terms and conditions of a loan provided by a seller to a buyer for the purchase of a vehicle. It serves as a promissory document, ensuring that the buyer promises to repay the loan amount along with any agreed-upon interest within a specified timeframe. Keywords: Bridgeport Connecticut, Promissory Note, Sale of Vehicle, Sale of Automobile There are two primary types of Bridgeport Connecticut Promissory Notes in connection with the Sale of a Vehicle or Automobile: 1. Installment Promissory Note: This type of promissory note divides the total purchase price into equal installments, which the buyer agrees to pay over a set period. The note typically includes the loan amount, interest rate (if any), the number of installments, the due date of each installment, and any penalties for late payments or default. 2. Balloon Promissory Note: This type of promissory note involves smaller periodic payments over the loan term, but with one large "balloon payment" due at the end of the term. The balloon payment covers the outstanding loan balance and is often employed when the buyer can't afford higher monthly installments. In both types of promissory notes, there are essential components that should be included: 1. Parties Involved: Clearly state the names and contact information of both the buyer (borrower) and seller (lender) involved in the agreement. 2. Vehicle Details: Mention the make, model, year, Vehicle Identification Number (VIN), and any other relevant information to identify the purchased vehicle accurately. 3. Loan Amount: Specify the total loan amount provided by the seller to the buyer to facilitate the vehicle purchase. 4. Interest Rate: If applicable, clearly state the interest rate charged on the loan. Alternatively, if there's no interest charged, mention that the loan is interest-free. 5. Payment Terms: Outline the repayment plan, including the number of installments and their respective due dates. If it's a balloon note, describe the periodic payments, the date of the balloon payment, and the payment's composition. 6. Late Payment Penalties: Clearly specify any penalties or fees that the buyer will be subjected to if they fail to make timely payments, highlighting the consequences of default. 7. Collateral: State whether the vehicle itself serves as collateral, providing rights to the seller in case of default or other breaches by the buyer. 8. Signatures: Provide space for both parties to sign and date the promissory note, indicating their agreement and commitment to its terms. It is crucial to note that a Bridgeport Connecticut Promissory Note in Connection with the Sale of a Vehicle or Automobile should comply with the applicable state laws and regulations to ensure its enforceability in case of any disputes or legal consequences. It is always recommended consulting an attorney for specific guidance and to tailor the promissory note to individual circumstances.A Bridgeport Connecticut Promissory Note in Connection with the Sale of a Vehicle or Automobile is a legally binding agreement that outlines the terms and conditions of a loan provided by a seller to a buyer for the purchase of a vehicle. It serves as a promissory document, ensuring that the buyer promises to repay the loan amount along with any agreed-upon interest within a specified timeframe. Keywords: Bridgeport Connecticut, Promissory Note, Sale of Vehicle, Sale of Automobile There are two primary types of Bridgeport Connecticut Promissory Notes in connection with the Sale of a Vehicle or Automobile: 1. Installment Promissory Note: This type of promissory note divides the total purchase price into equal installments, which the buyer agrees to pay over a set period. The note typically includes the loan amount, interest rate (if any), the number of installments, the due date of each installment, and any penalties for late payments or default. 2. Balloon Promissory Note: This type of promissory note involves smaller periodic payments over the loan term, but with one large "balloon payment" due at the end of the term. The balloon payment covers the outstanding loan balance and is often employed when the buyer can't afford higher monthly installments. In both types of promissory notes, there are essential components that should be included: 1. Parties Involved: Clearly state the names and contact information of both the buyer (borrower) and seller (lender) involved in the agreement. 2. Vehicle Details: Mention the make, model, year, Vehicle Identification Number (VIN), and any other relevant information to identify the purchased vehicle accurately. 3. Loan Amount: Specify the total loan amount provided by the seller to the buyer to facilitate the vehicle purchase. 4. Interest Rate: If applicable, clearly state the interest rate charged on the loan. Alternatively, if there's no interest charged, mention that the loan is interest-free. 5. Payment Terms: Outline the repayment plan, including the number of installments and their respective due dates. If it's a balloon note, describe the periodic payments, the date of the balloon payment, and the payment's composition. 6. Late Payment Penalties: Clearly specify any penalties or fees that the buyer will be subjected to if they fail to make timely payments, highlighting the consequences of default. 7. Collateral: State whether the vehicle itself serves as collateral, providing rights to the seller in case of default or other breaches by the buyer. 8. Signatures: Provide space for both parties to sign and date the promissory note, indicating their agreement and commitment to its terms. It is crucial to note that a Bridgeport Connecticut Promissory Note in Connection with the Sale of a Vehicle or Automobile should comply with the applicable state laws and regulations to ensure its enforceability in case of any disputes or legal consequences. It is always recommended consulting an attorney for specific guidance and to tailor the promissory note to individual circumstances.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.