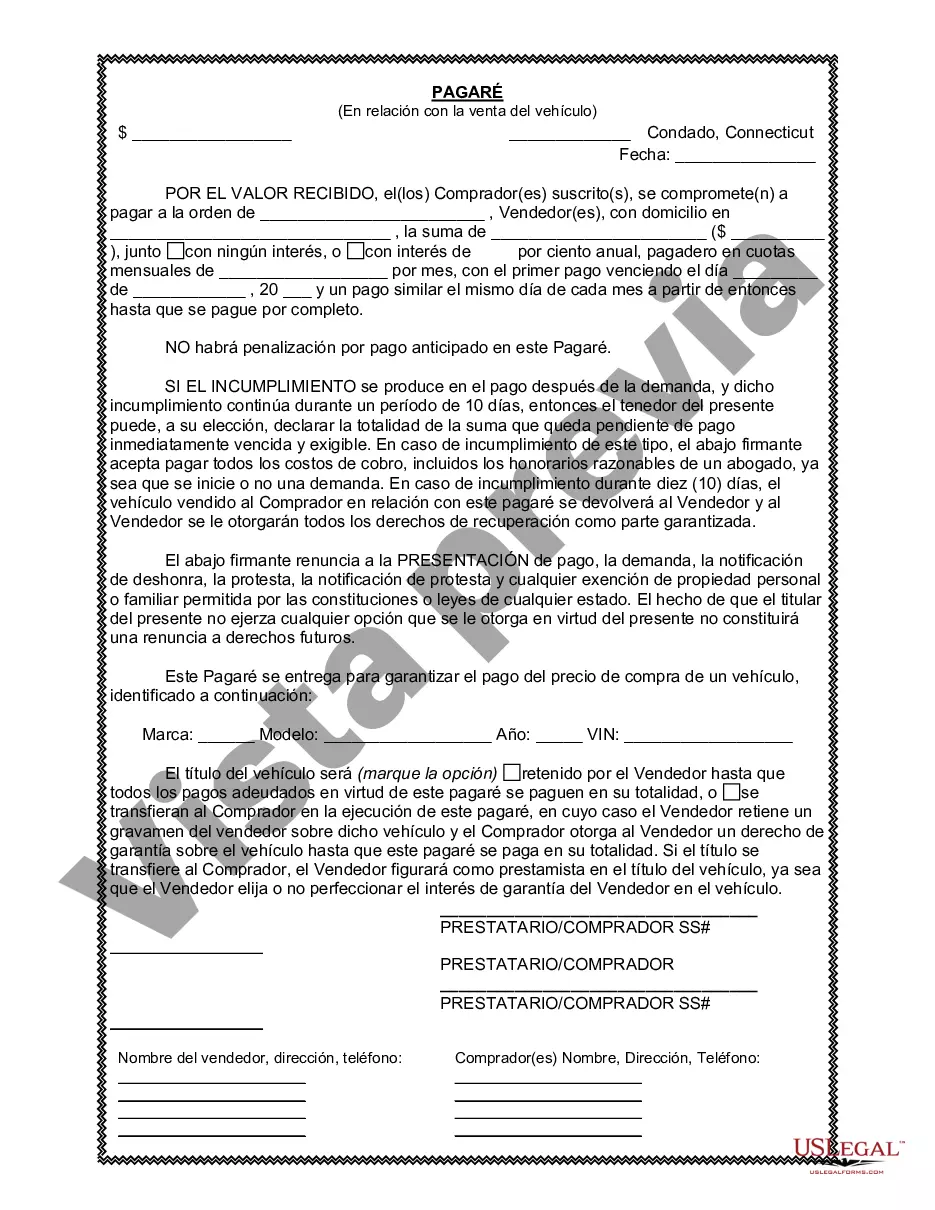

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

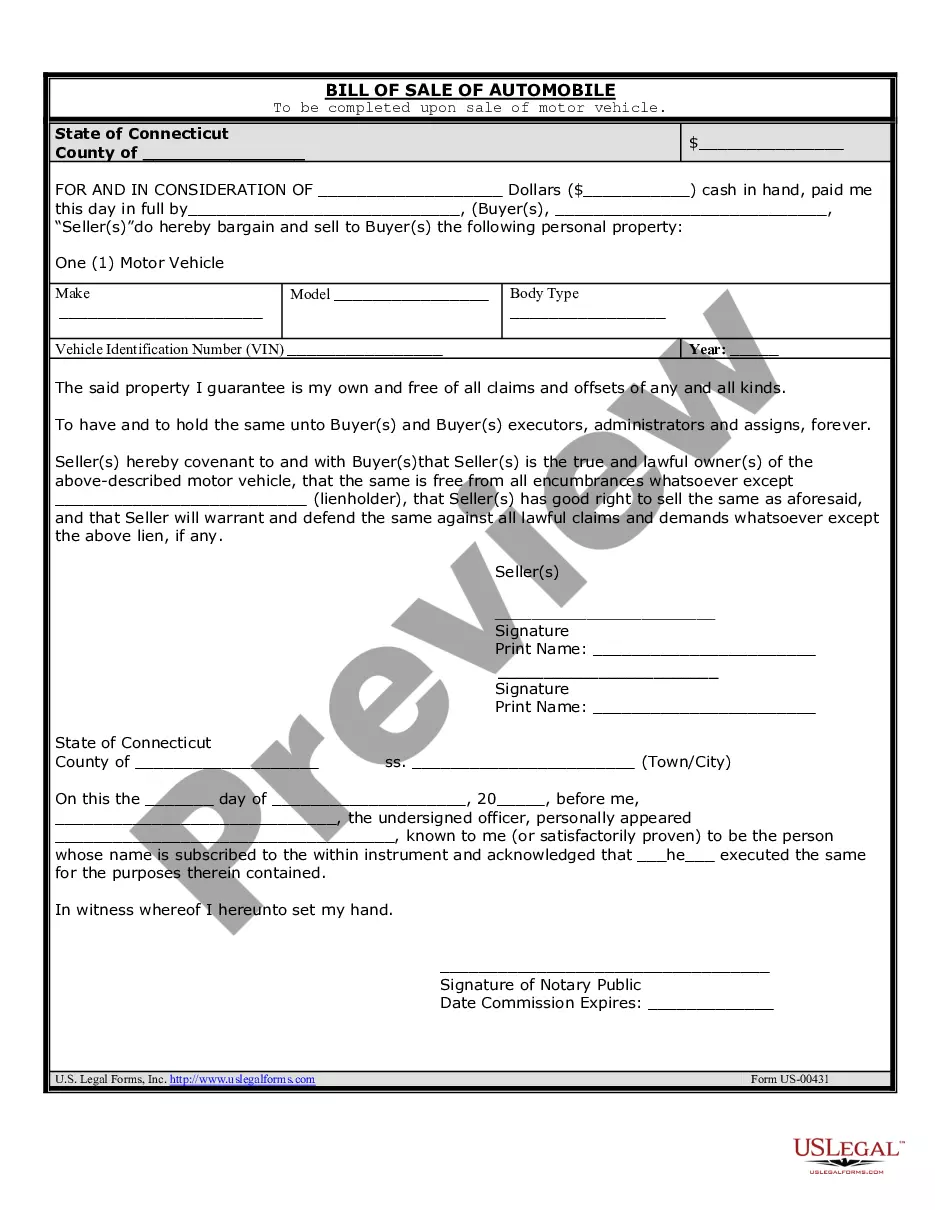

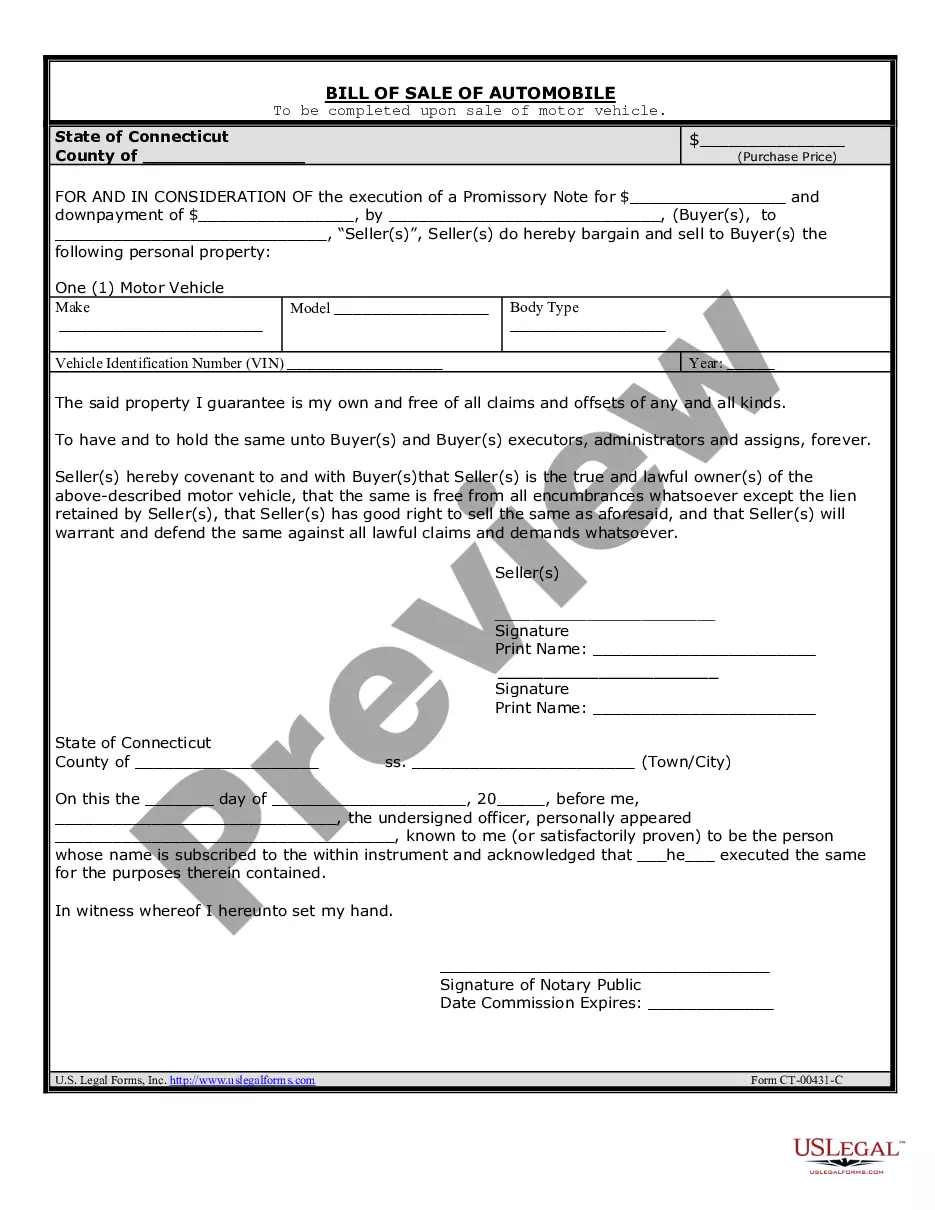

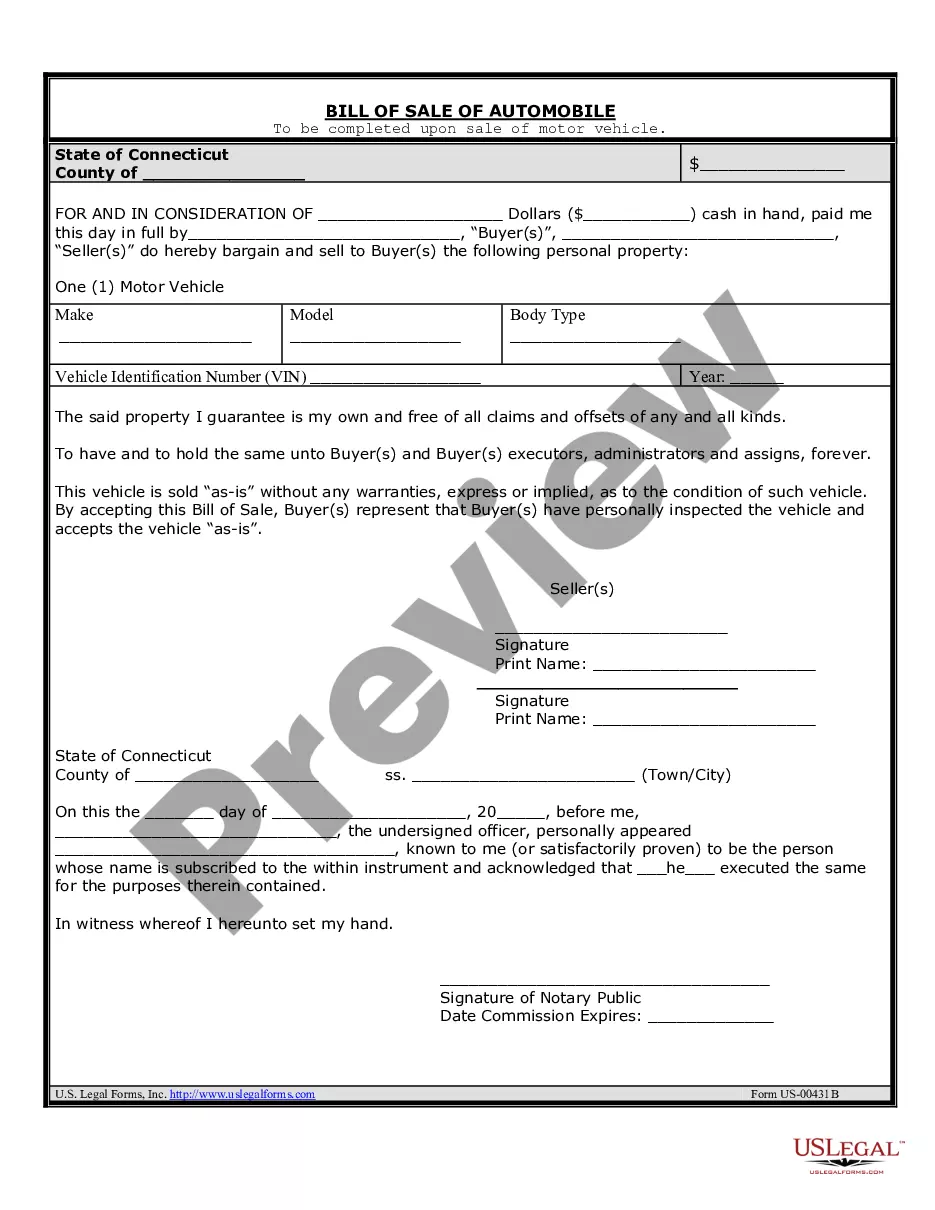

A Stamford Connecticut Promissory Note in connection with the sale of a vehicle or automobile is a legally binding document that outlines the terms and conditions of a loan agreement between a buyer and a seller. It is used when the seller agrees to provide financing to the buyer instead of receiving the full payment upfront. The promissory note serves as proof of the loan and specifies the amount borrowed, the interest rate, the repayment schedule, and any additional terms agreed upon. It ensures that both parties are clear on their obligations and helps prevent misunderstandings or disputes in the future. Various types of Stamford Connecticut Promissory Notes used in connection with the sale of a vehicle or automobile include: 1. Simple Promissory Note: This is the most common type of promissory note, where the buyer promises to repay the loan amount along with interest within a specified period. 2. Installment Promissory Note: This type of promissory note allows the buyer to repay the loan in multiple installments over a specific period. Each installment consists of both principal and interest. 3. Balloon Promissory Note: In this type of promissory note, the buyer agrees to make regular payments of interest and smaller installments of principal, with a large final payment (balloon payment) at the end of the loan term. 4. Secured Promissory Note: This note includes collateral, usually the vehicle being sold, to secure the loan. If the buyer defaults on payments, the seller has the right to repossess the vehicle. 5. Unsecured Promissory Note: Unlike a secured promissory note, this type of note does not require collateral. The seller relies solely on the buyer's promise to repay the loan. It's important for both the buyer and the seller to carefully review and understand the terms of the promissory note before signing. It is advisable to consult with an attorney experienced in Connecticut contract law to ensure the note complies with state regulations and protects the interests of both parties.A Stamford Connecticut Promissory Note in connection with the sale of a vehicle or automobile is a legally binding document that outlines the terms and conditions of a loan agreement between a buyer and a seller. It is used when the seller agrees to provide financing to the buyer instead of receiving the full payment upfront. The promissory note serves as proof of the loan and specifies the amount borrowed, the interest rate, the repayment schedule, and any additional terms agreed upon. It ensures that both parties are clear on their obligations and helps prevent misunderstandings or disputes in the future. Various types of Stamford Connecticut Promissory Notes used in connection with the sale of a vehicle or automobile include: 1. Simple Promissory Note: This is the most common type of promissory note, where the buyer promises to repay the loan amount along with interest within a specified period. 2. Installment Promissory Note: This type of promissory note allows the buyer to repay the loan in multiple installments over a specific period. Each installment consists of both principal and interest. 3. Balloon Promissory Note: In this type of promissory note, the buyer agrees to make regular payments of interest and smaller installments of principal, with a large final payment (balloon payment) at the end of the loan term. 4. Secured Promissory Note: This note includes collateral, usually the vehicle being sold, to secure the loan. If the buyer defaults on payments, the seller has the right to repossess the vehicle. 5. Unsecured Promissory Note: Unlike a secured promissory note, this type of note does not require collateral. The seller relies solely on the buyer's promise to repay the loan. It's important for both the buyer and the seller to carefully review and understand the terms of the promissory note before signing. It is advisable to consult with an attorney experienced in Connecticut contract law to ensure the note complies with state regulations and protects the interests of both parties.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.