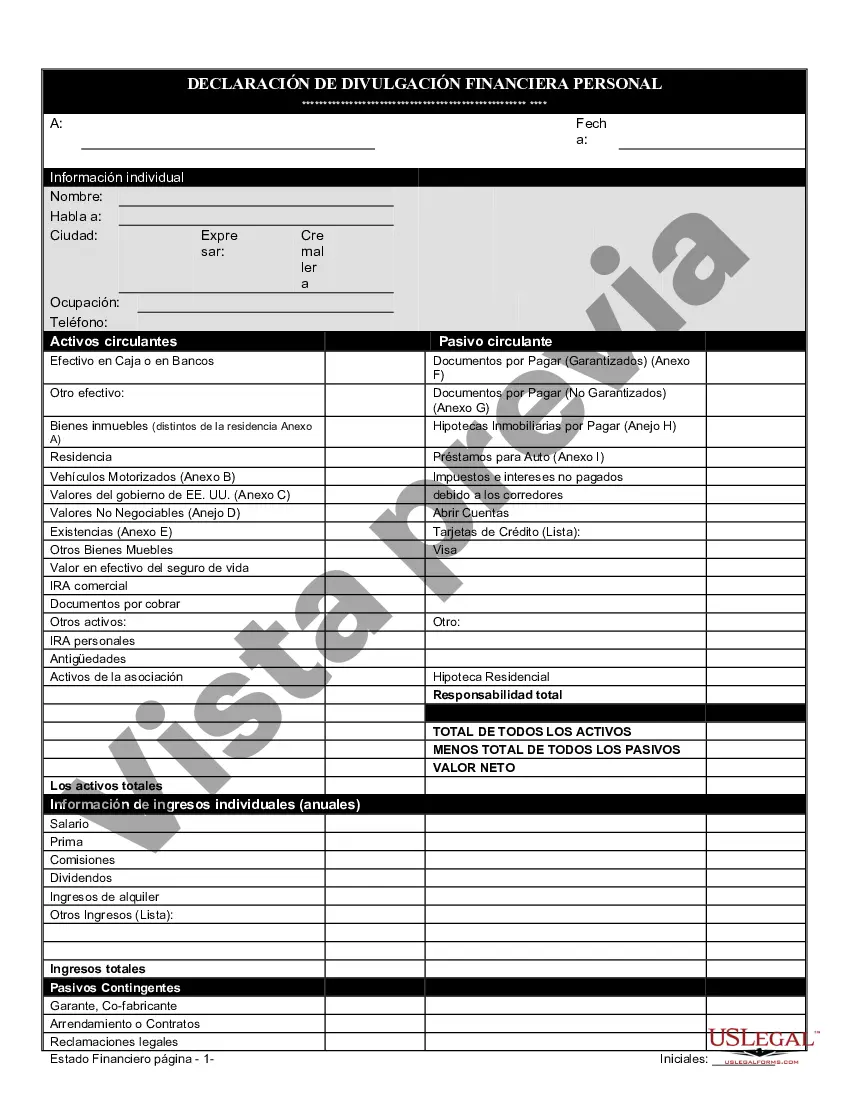

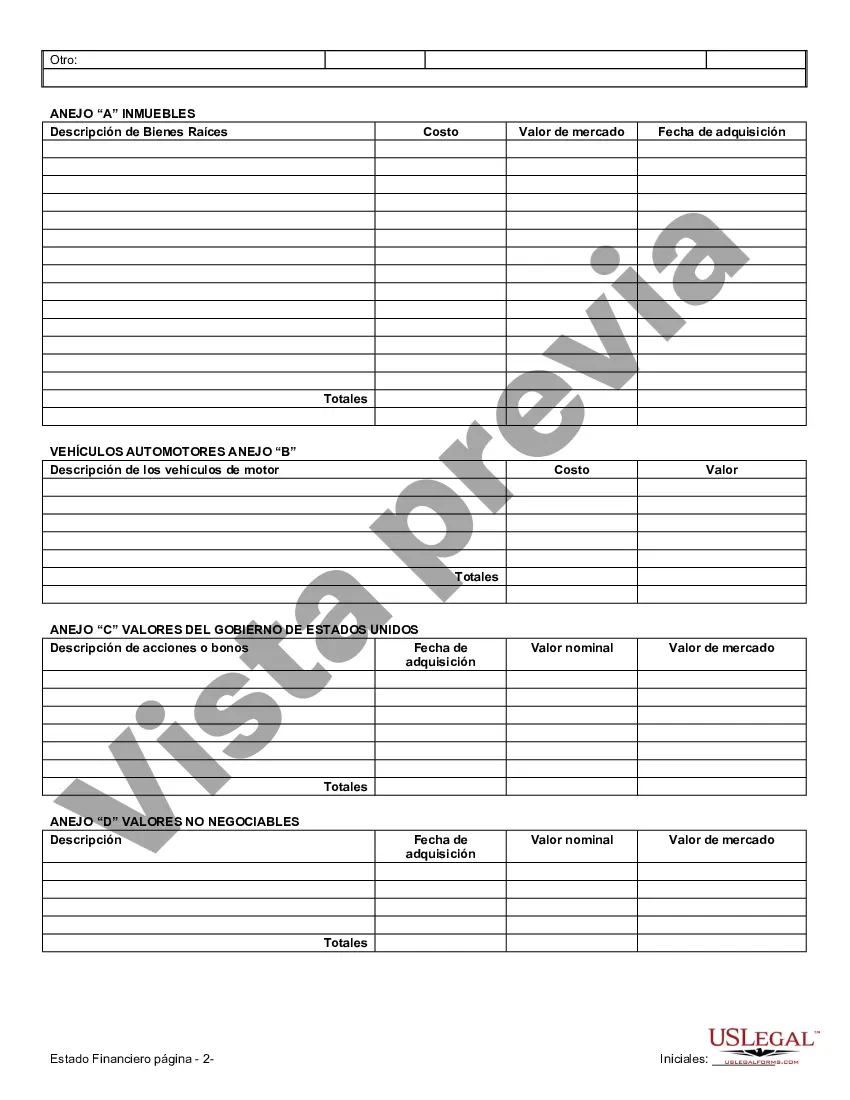

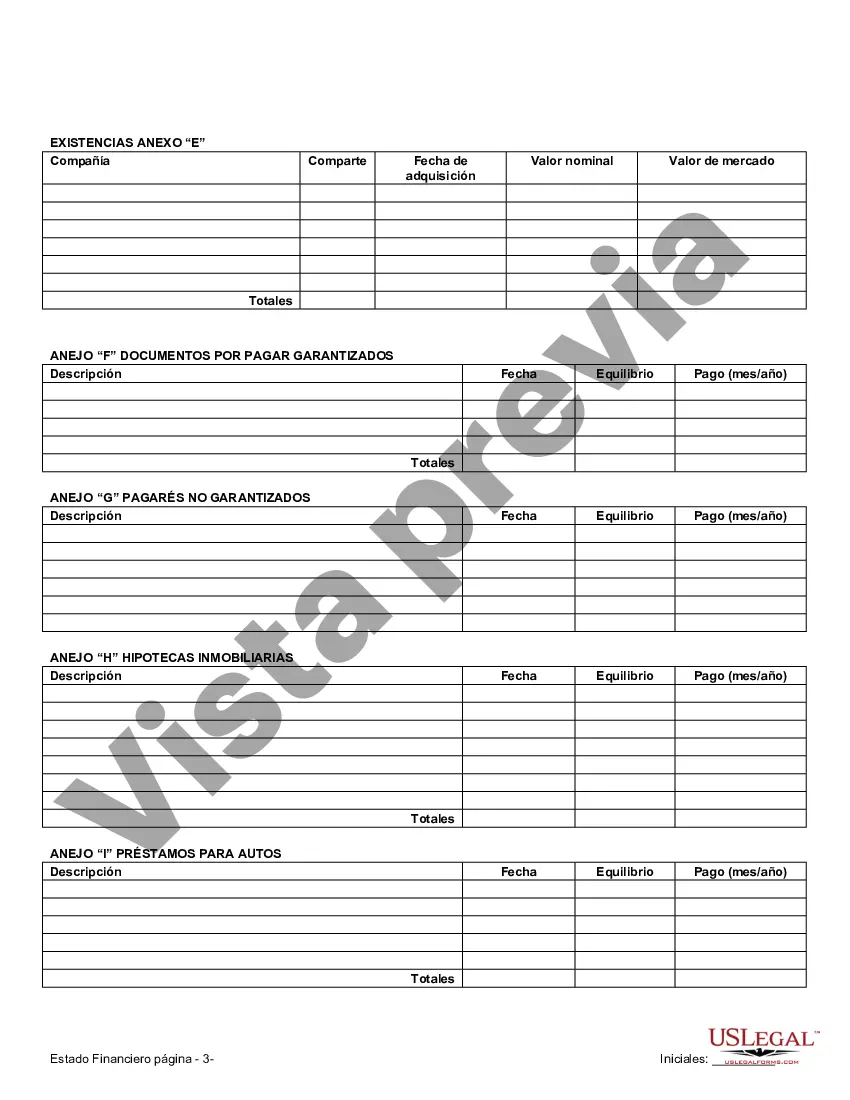

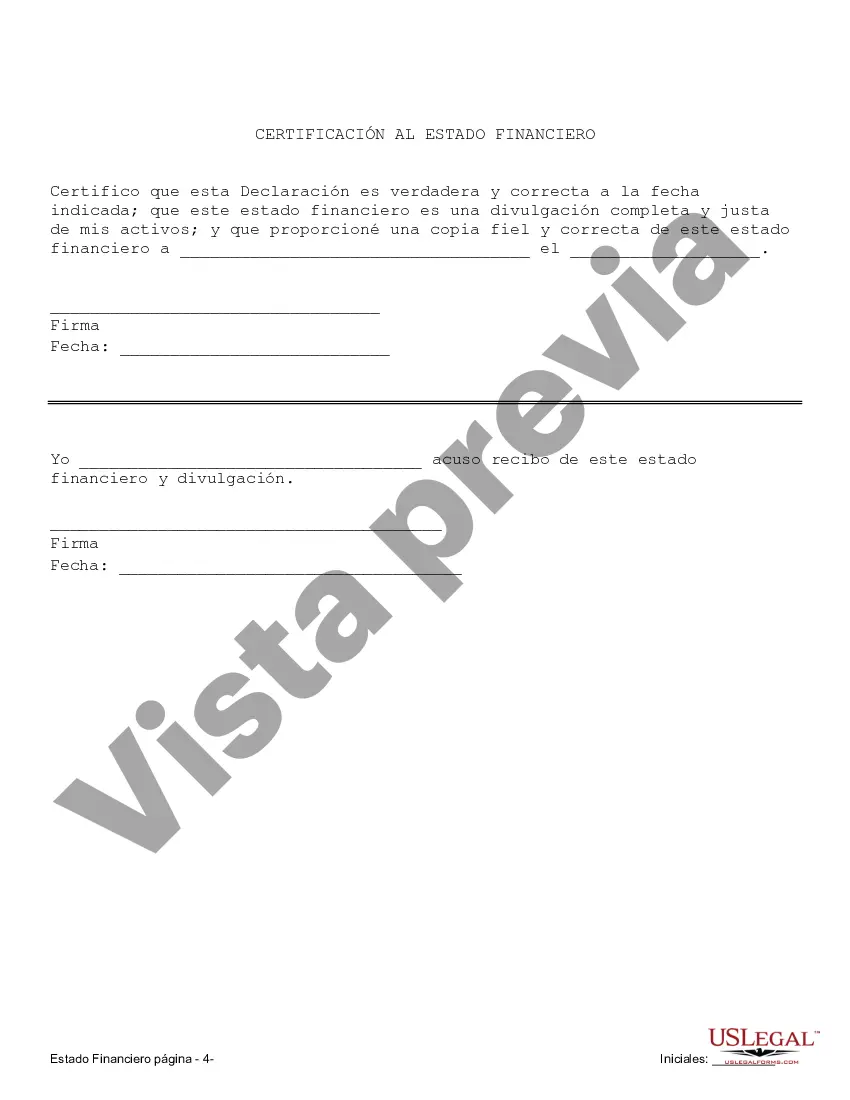

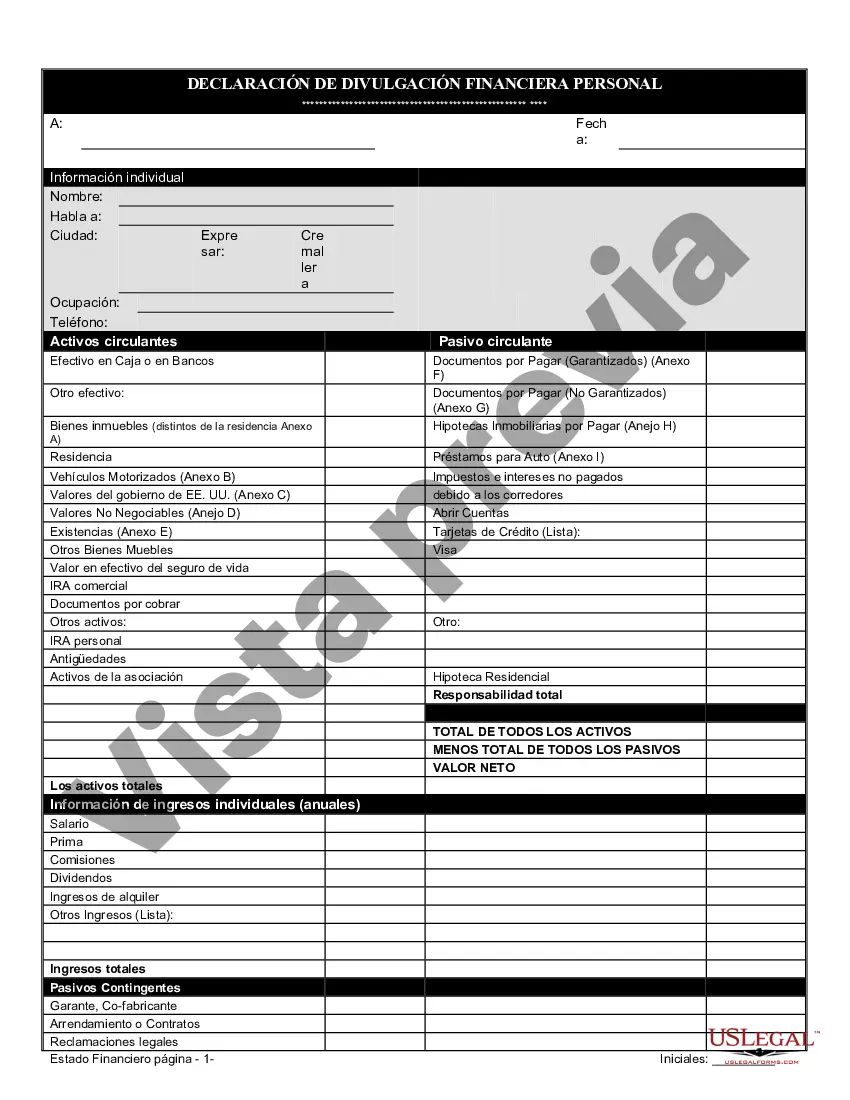

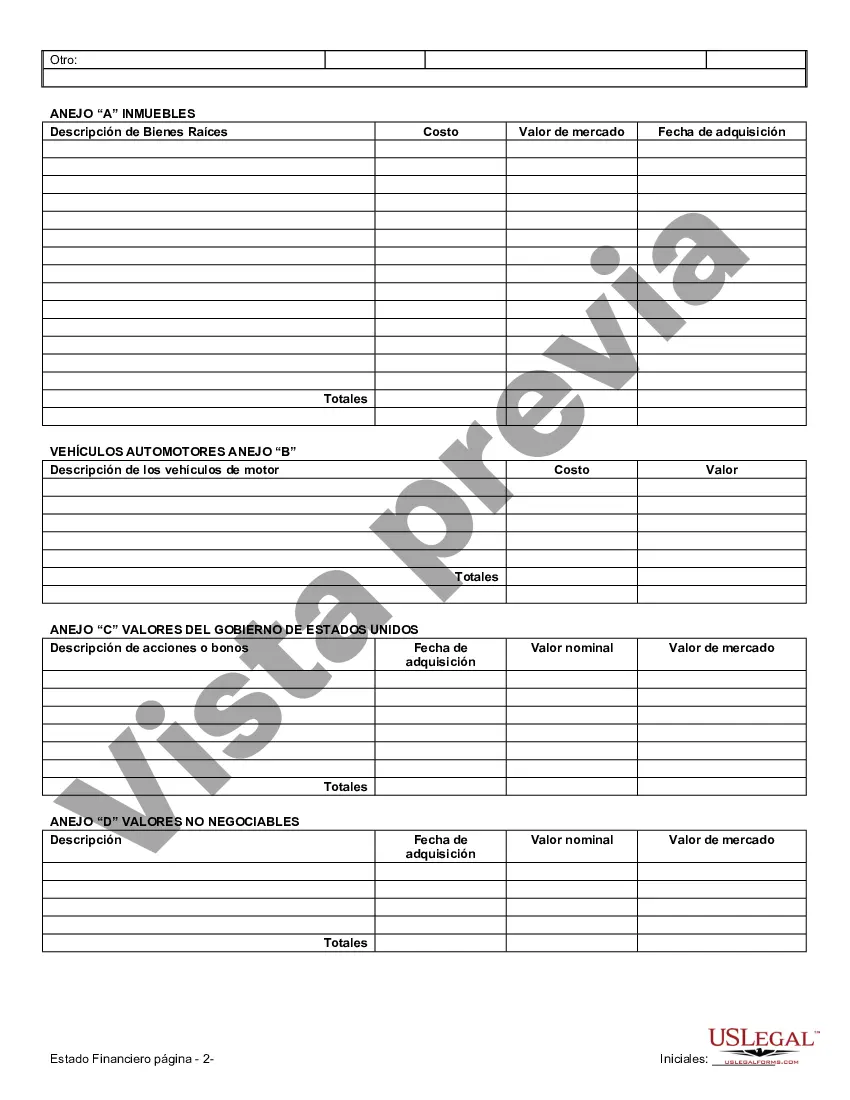

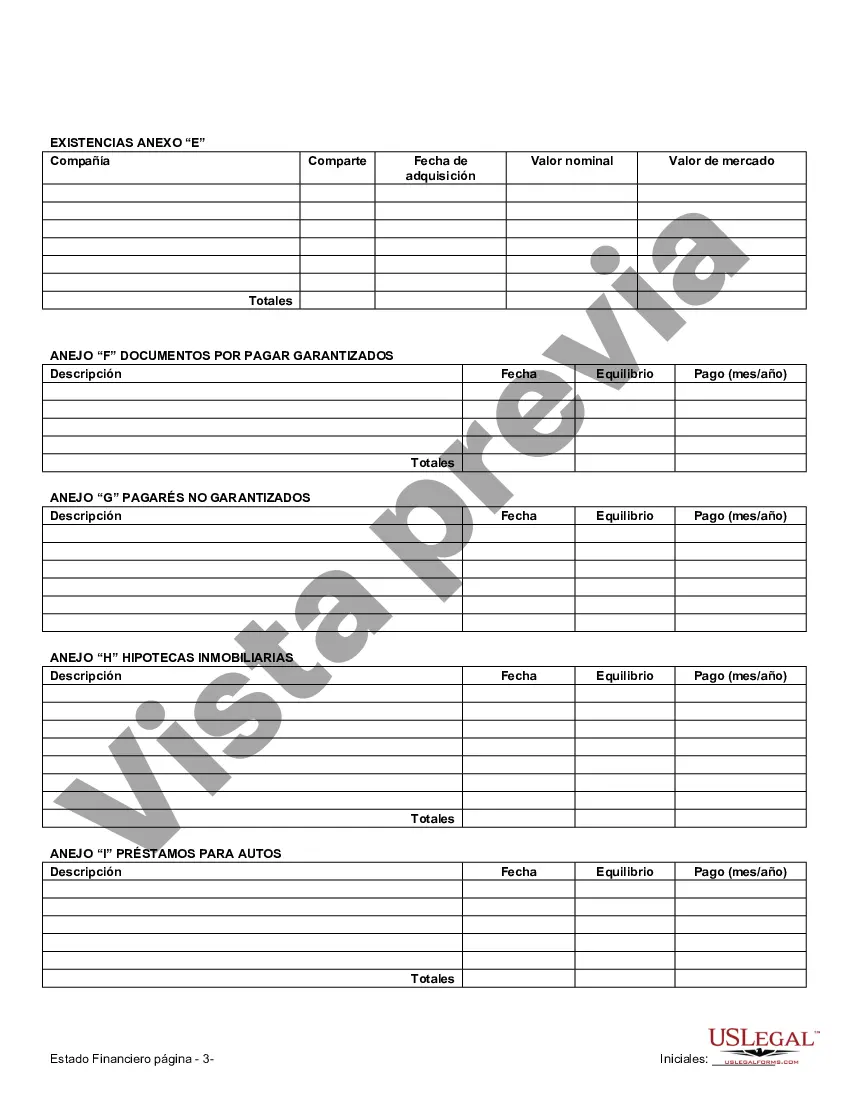

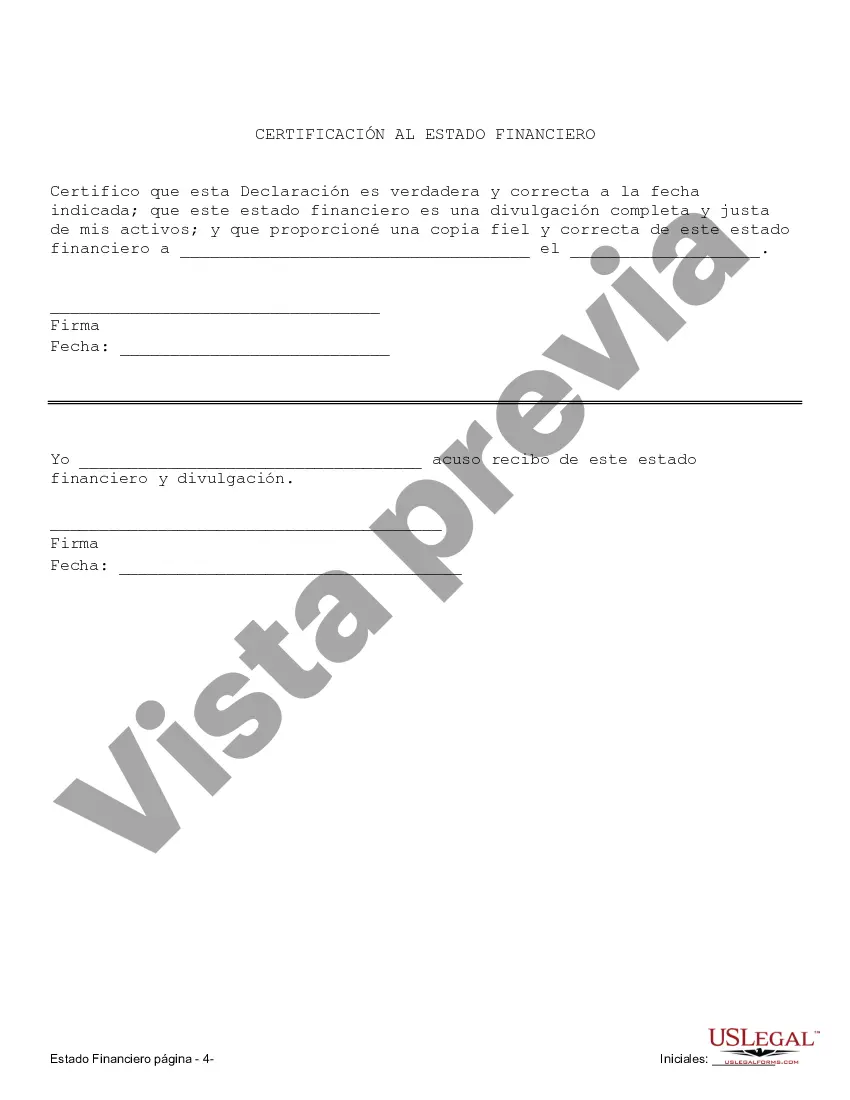

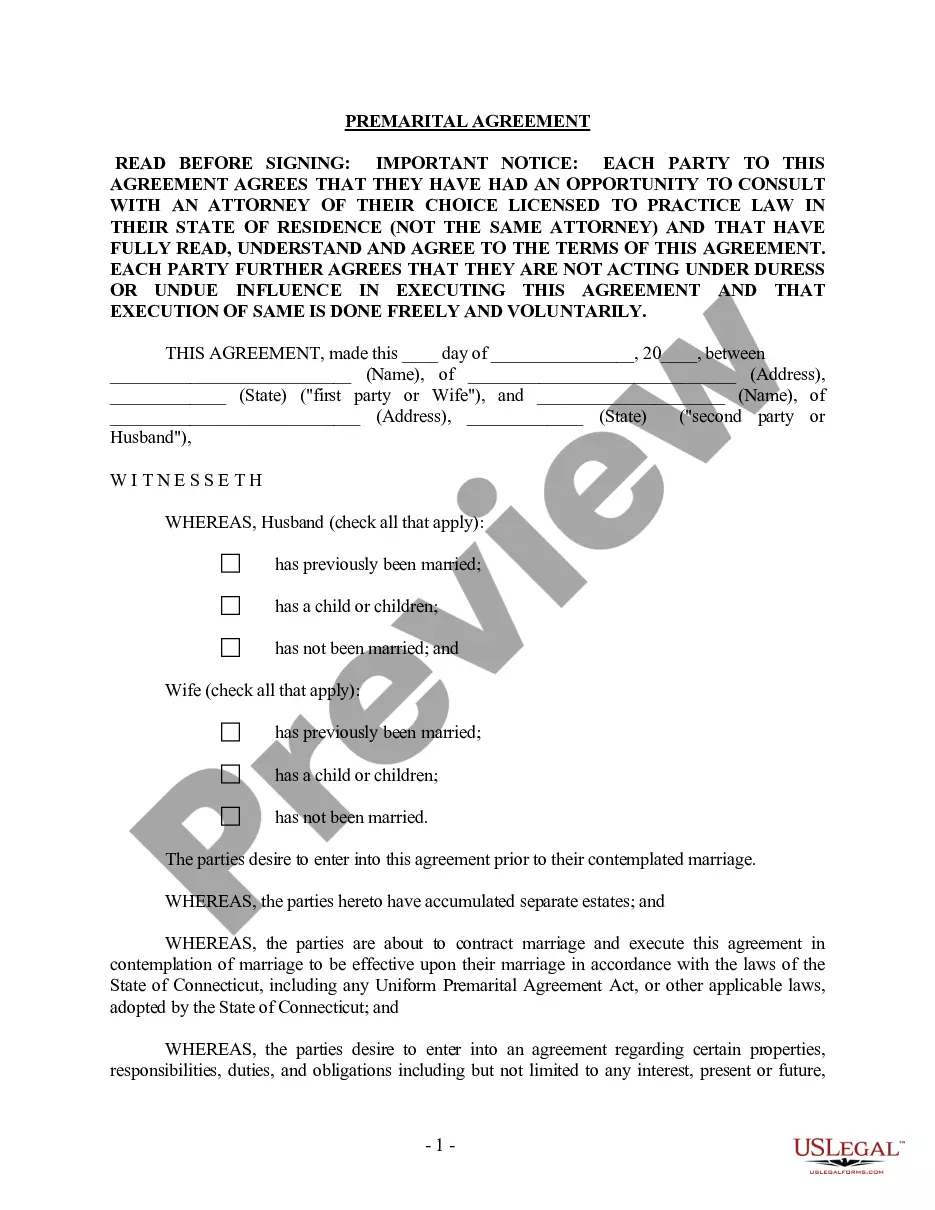

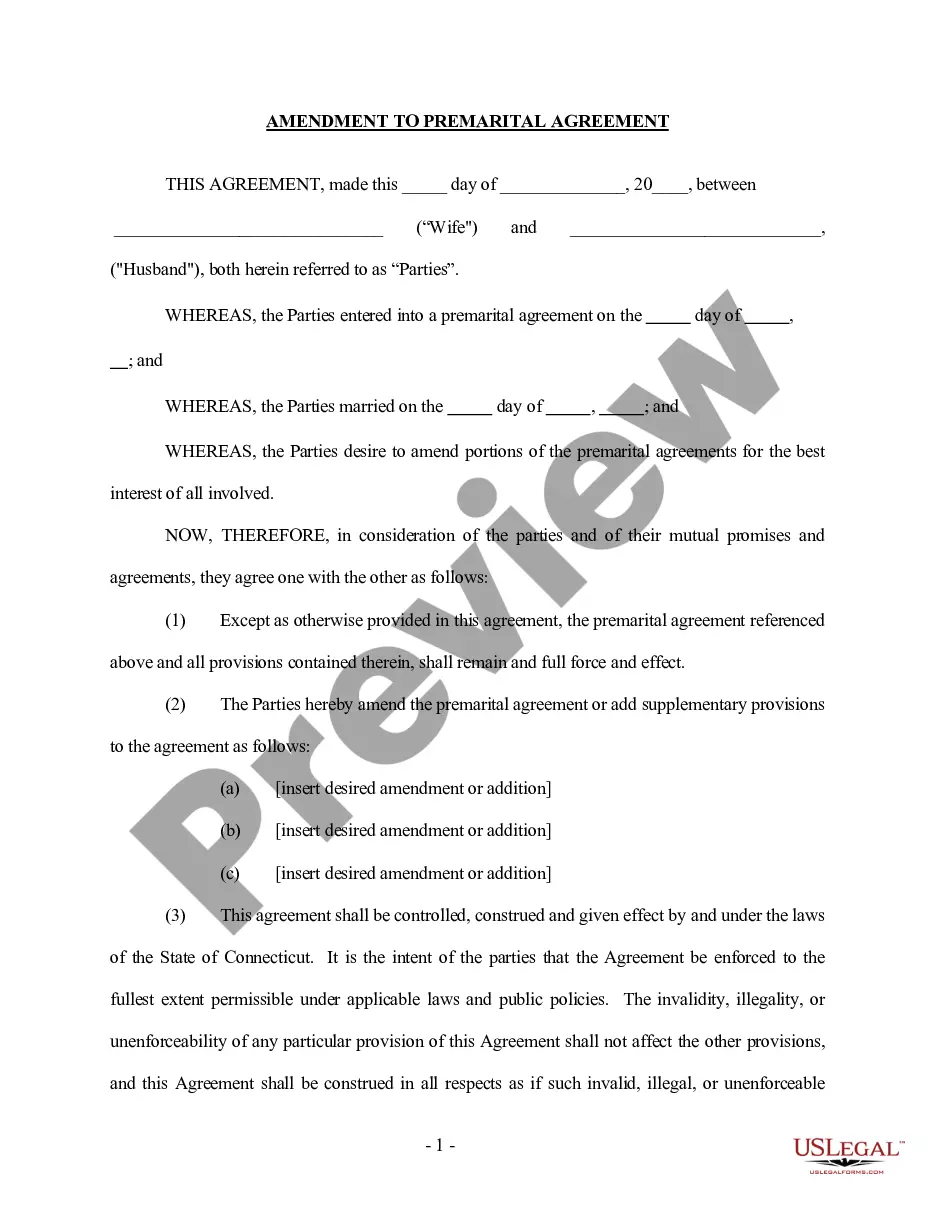

Stamford Connecticut Financial Statements in Connection with Prenuptial Premarital Agreement When it comes to entering into a prenuptial or premarital agreement in Stamford, Connecticut, the inclusion of financial statements is of paramount importance. Financial statements serve as crucial documents that disclose the financial standing of both parties involved in the agreement. They provide a comprehensive and detailed overview of each individual's financial health, assets, liabilities, and income. Stamford Connecticut recognizes the significance of financial statements as they ensure transparency, fairness, and informed decision-making during the creation of a prenuptial or premarital agreement. These statements are meticulously prepared and must adhere to the legal framework of the state. Types of Stamford Connecticut Financial Statements in Connection with Prenuptial Premarital Agreement: 1. Personal Balance Sheets: This type of financial statement outlines an individual's assets, liabilities, and net worth. It includes information about real estate properties, vehicles, investments, bank accounts, debts, and other financial obligations. 2. Income Statements: Income statements provide a detailed breakdown of an individual's income from various sources such as employment, investments, rent, or other revenue streams. This statement helps evaluate the earning capacity of each party and assess potential alimony or spousal support considerations. 3. Tax Returns: Tax returns serve as a critical component of the financial statement, revealing details about an individual's tax obligations, income sources, deductions, and other financial aspects related to their taxes. This information assists in ensuring accuracy and verifying the financial information provided in other statements. 4. Bank Statements: Bank statements offer a comprehensive overview of an individual's financial transactions, including deposits, withdrawals, and account balances. They aid in verifying the accuracy of the personal balance sheet, providing insights into spending habits, and identifying individual financial patterns. 5. Investment Statements: These statements provide a breakdown of an individual's investment portfolio, including stocks, bonds, mutual funds, real estate, and any other investment assets. Investment statements are essential in understanding the value, growth, and potential risks associated with an individual's financial assets. 6. Retirement Account Statements: Stamford Connecticut financial statements for prenuptial or premarital agreements often require disclosure of retirement account statements. These statements provide details about contributions, vested amounts, and potential future benefits associated with retirement plans such as 401(k)s, IRAs, or pension plans. Including these various types of financial statements ensures that parties involved in a Stamford Connecticut prenuptial or premarital agreement have a comprehensive understanding of each other's financial situation. By disclosing assets, liabilities, income, and financial obligations, these statements enable both parties to make informed decisions that protect their rights and assets. It is crucial to work with experienced professionals such as attorneys and financial advisors who are well-versed in Stamford Connecticut family law to ensure accuracy, compliance, and fairness in the preparation and inclusion of financial statements within the prenuptial or premarital agreement.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Stamford Connecticut Estados financieros solo en relación con el acuerdo prematrimonial prenupcial - Connecticut Financial Statements only in Connection with Prenuptial Premarital Agreement

Description

How to fill out Stamford Connecticut Estados Financieros Solo En Relación Con El Acuerdo Prematrimonial Prenupcial?

No matter what social or professional status, completing legal forms is an unfortunate necessity in today’s professional environment. Too often, it’s practically impossible for someone with no legal education to draft such paperwork cfrom the ground up, mainly due to the convoluted terminology and legal subtleties they entail. This is where US Legal Forms comes in handy. Our platform provides a huge collection with over 85,000 ready-to-use state-specific forms that work for almost any legal situation. US Legal Forms also serves as a great resource for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI tpapers.

No matter if you require the Stamford Connecticut Financial Statements only in Connection with Prenuptial Premarital Agreement or any other document that will be good in your state or county, with US Legal Forms, everything is on hand. Here’s how to get the Stamford Connecticut Financial Statements only in Connection with Prenuptial Premarital Agreement in minutes using our trusted platform. In case you are already an existing customer, you can go ahead and log in to your account to download the needed form.

However, in case you are new to our platform, make sure to follow these steps prior to obtaining the Stamford Connecticut Financial Statements only in Connection with Prenuptial Premarital Agreement:

- Be sure the template you have found is suitable for your location since the rules of one state or county do not work for another state or county.

- Preview the form and go through a short description (if available) of cases the paper can be used for.

- If the one you picked doesn’t meet your needs, you can start over and search for the necessary document.

- Click Buy now and pick the subscription plan that suits you the best.

- with your login information or register for one from scratch.

- Choose the payment gateway and proceed to download the Stamford Connecticut Financial Statements only in Connection with Prenuptial Premarital Agreement once the payment is done.

You’re good to go! Now you can go ahead and print the form or complete it online. In case you have any problems locating your purchased forms, you can easily access them in the My Forms tab.

Whatever case you’re trying to sort out, US Legal Forms has got you covered. Try it out today and see for yourself.