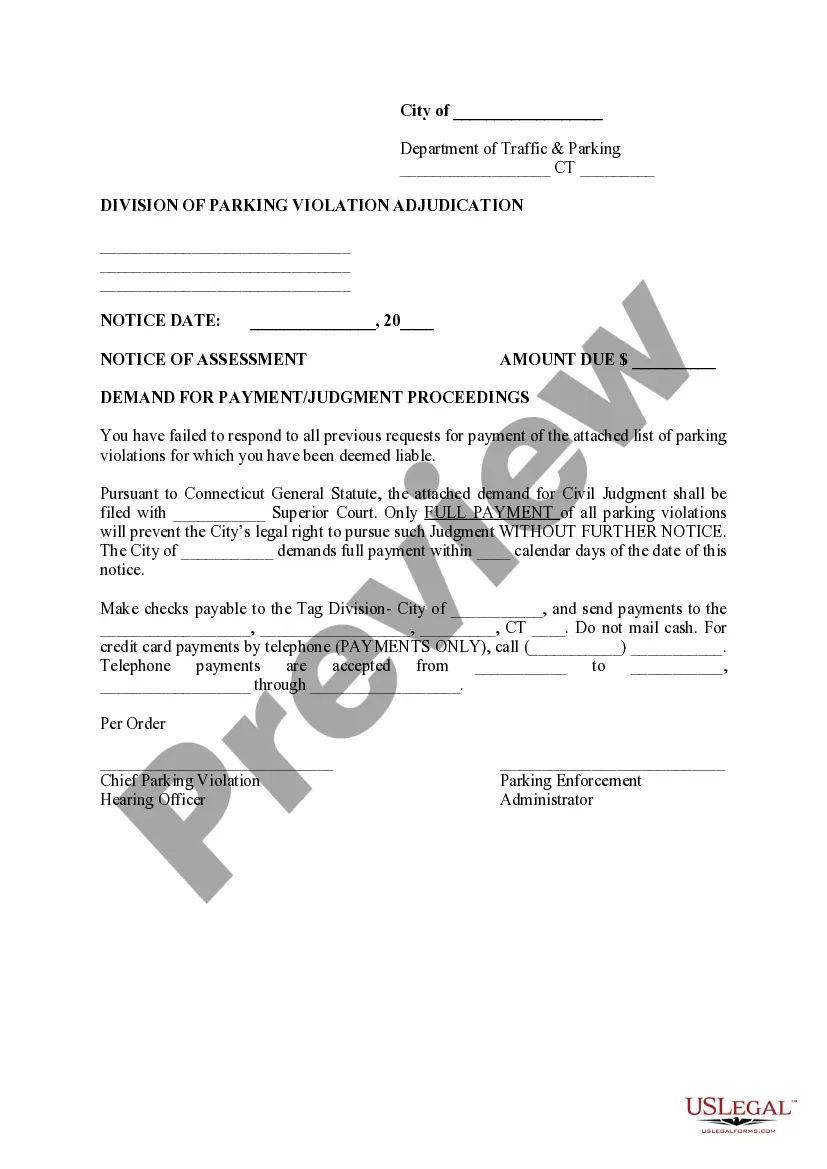

The Bridgeport Connecticut Notice of Assessment/Demand for Payment/Judgment Proceedings serves as an official document that communicates important information to individuals in regard to their tax assessment, outstanding payment dues, and subsequent legal actions. This comprehensive notice outlines the assessment process, payment demands, and potential legal consequences. One type of Bridgeport Connecticut Notice of Assessment/Demand for Payment/Judgment Proceedings is the Tax Assessment Notice. This notice is issued by the Bridgeport Tax Department following a thorough examination of an individual's tax returns. It presents a detailed breakdown of the assessment, including taxable income, deductions, credits, and the resulting tax liability. Taxpayers receive this notice to inform them of their assessed tax dues and the steps they need to take for payment. Another type is the Demand for Payment Notice, which is typically issued after an individual has failed to fulfill their tax obligations within the specified timeframe. This notice serves as a final warning, officially demanding immediate payment of the outstanding tax debt, additional penalties, and interest. It also highlights the potential consequences of non-compliance, such as further legal actions. In certain circumstances, the Bridgeport Connecticut Notice of Assessment/Demand for Payment/Judgment Proceedings might progress to Judgment Proceedings. After repeated attempts to collect unpaid taxes, the Bridgeport Tax Department may initiate legal proceedings, filing a judgment against the delinquent taxpayer. Such proceedings entail court appearances, negotiations, and potential seizure of assets to satisfy the tax debt. It is essential for recipients of these notices to take them seriously and respond promptly. Ignoring or neglecting these notices may lead to severe consequences, including wage garnishment, bank account levies, property liens, or other legal actions. In the case of Judgment Proceedings, ignoring the notice might result in adverse impacts on credit scores and legal standing. Individuals who receive a Bridgeport Connecticut Notice of Assessment/Demand for Payment/Judgment Proceedings should carefully review it, ensuring accuracy and completeness. If there are any discrepancies or concerns, contacting the Bridgeport Tax Department immediately is crucial. Open communication and timely payment or resolution can often prevent the escalation of legal actions and associated financial implications. Overall, the Bridgeport Connecticut Notice of Assessment/Demand for Payment/Judgment Proceedings is a vital document that plays a significant role in ensuring tax compliance. It serves as a formal communication tool that ensures taxpayers have a clear understanding of their tax liabilities, outlines the steps for payment, and warns of potential legal consequences if obligations are not met.

Bridgeport Connecticut Notice of Assessment/Demand for Payment/Judgment Proceedings

Description

How to fill out Bridgeport Connecticut Notice Of Assessment/Demand For Payment/Judgment Proceedings?

No matter what social or professional status, filling out legal forms is an unfortunate necessity in today’s professional environment. Very often, it’s virtually impossible for someone without any legal background to create such papers cfrom the ground up, mainly due to the convoluted jargon and legal subtleties they involve. This is where US Legal Forms comes to the rescue. Our platform offers a huge collection with over 85,000 ready-to-use state-specific forms that work for pretty much any legal case. US Legal Forms also is an excellent resource for associates or legal counsels who want to to be more efficient time-wise using our DYI tpapers.

No matter if you need the Bridgeport Connecticut Notice of Assessment/Demand for Payment/Judgment Proceedings or any other paperwork that will be valid in your state or area, with US Legal Forms, everything is on hand. Here’s how you can get the Bridgeport Connecticut Notice of Assessment/Demand for Payment/Judgment Proceedings quickly using our trustworthy platform. If you are presently a subscriber, you can proceed to log in to your account to get the appropriate form.

However, in case you are a novice to our library, ensure that you follow these steps prior to downloading the Bridgeport Connecticut Notice of Assessment/Demand for Payment/Judgment Proceedings:

- Be sure the form you have found is suitable for your location because the rules of one state or area do not work for another state or area.

- Preview the document and go through a brief description (if provided) of cases the paper can be used for.

- If the form you selected doesn’t suit your needs, you can start over and search for the needed form.

- Click Buy now and pick the subscription option you prefer the best.

- utilizing your login information or register for one from scratch.

- Select the payment gateway and proceed to download the Bridgeport Connecticut Notice of Assessment/Demand for Payment/Judgment Proceedings as soon as the payment is through.

You’re all set! Now you can proceed to print the document or complete it online. In case you have any issues locating your purchased forms, you can easily access them in the My Forms tab.

Regardless of what situation you’re trying to solve, US Legal Forms has got you covered. Try it out today and see for yourself.